There is a discussion on upgrading

the OSMO to OSMO 2.0 🧪🧪

@osmosiszone

Here's how this upcoming upgrade will affect OSMO tokenomics 🪙

#TokenUnlocks #OSMO

1/15

the OSMO to OSMO 2.0 🧪🧪

@osmosiszone

Here's how this upcoming upgrade will affect OSMO tokenomics 🪙

#TokenUnlocks #OSMO

1/15

Here's a topic that will be covered 📝;

• $OSMO Tokenomics Problem 📌

• Prop #1 Extending emission schedule

• Prop #2 - Adjusting the emission ratio

• Prop #3 - Reducing the super fluid risk factor

• Sum-up 🖋️

2/15

• $OSMO Tokenomics Problem 📌

• Prop #1 Extending emission schedule

• Prop #2 - Adjusting the emission ratio

• Prop #3 - Reducing the super fluid risk factor

• Sum-up 🖋️

2/15

$OSMO Tokenomics Problem 📌

- Inflation is higher than staking return

- Inflation is higher than LP incentives

- Community Pool received redirected incentives for the last 10 months

- Superfluid staking is underutilized

3/15

- Inflation is higher than staking return

- Inflation is higher than LP incentives

- Community Pool received redirected incentives for the last 10 months

- Superfluid staking is underutilized

3/15

Proposal 🔖

The upcoming upgrade will consist of 3 proposals, each with a focus on a different area:

Prop #1 - Extending $OSMO emission schedule

Prop #2 - Adjusting the emission ratio

Prop #3 - Reducing the super fluid risk factor to 25%

Ref: commonwealth.im/osmosis/discus…

4/15

The upcoming upgrade will consist of 3 proposals, each with a focus on a different area:

Prop #1 - Extending $OSMO emission schedule

Prop #2 - Adjusting the emission ratio

Prop #3 - Reducing the super fluid risk factor to 25%

Ref: commonwealth.im/osmosis/discus…

4/15

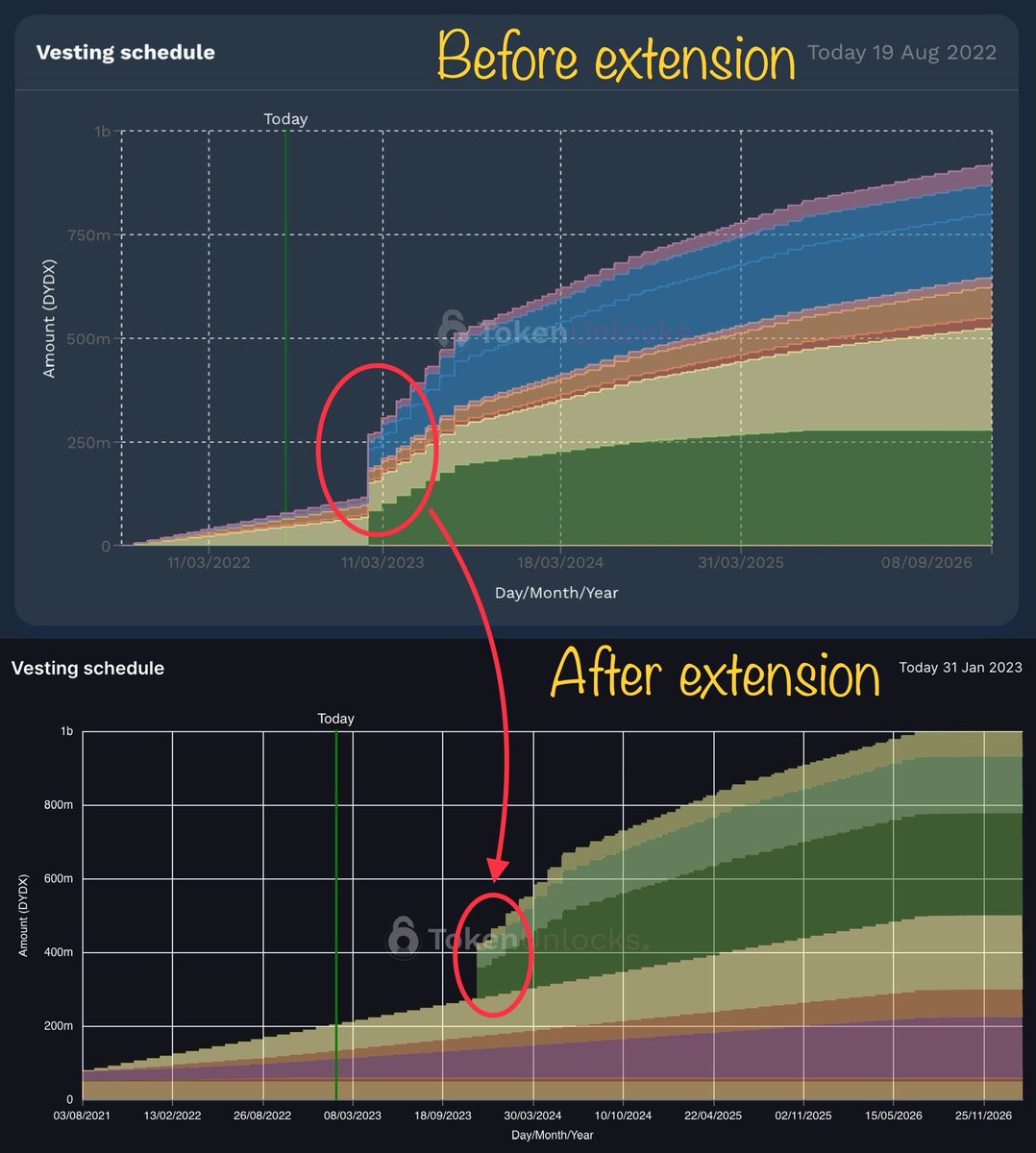

Prop #1 - Extending $OSMO emission schedule

This proposal aims to reduce $OSMO's daily emissions by 50% with the next software upgrade.

However, if the emission reduction is the only change made, the maximum supply will not reach 1bn, but will instead be around 780m $OSMO

5/15

This proposal aims to reduce $OSMO's daily emissions by 50% with the next software upgrade.

However, if the emission reduction is the only change made, the maximum supply will not reach 1bn, but will instead be around 780m $OSMO

5/15

To retain the maximum supply of 1bn, the duration of the thirdening would have to be extended in a future governance proposal

But, this would result in a slightly lower maximum supply of around 980m rather than 1bn.

6/15

But, this would result in a slightly lower maximum supply of around 980m rather than 1bn.

6/15

Prop #1 Outcome

The emission reduction of 50% will affect every party

- Stakers

- Liquidity Providers

- Community Pool

- Developers

resulting in a significant decrease in rewards

Therefore, it needs to combine this proposal with two other proposals to mitigate the impact.

7/15

The emission reduction of 50% will affect every party

- Stakers

- Liquidity Providers

- Community Pool

- Developers

resulting in a significant decrease in rewards

Therefore, it needs to combine this proposal with two other proposals to mitigate the impact.

7/15

Prop #2 - Adjusting the emission ratio

This proposal aims to adjust the emission ratio and minimize the impact of Prop #1

Here are the changes in ratio:

- Staking: 25% ⬆️ 50%

- Pool Incentives: 13.5% ⬆️ 20%

- Community Pool: 36.5% ⬇️ 5%

- Developer Rewards: 25% ➡️ 25%

8/15

This proposal aims to adjust the emission ratio and minimize the impact of Prop #1

Here are the changes in ratio:

- Staking: 25% ⬆️ 50%

- Pool Incentives: 13.5% ⬆️ 20%

- Community Pool: 36.5% ⬇️ 5%

- Developer Rewards: 25% ➡️ 25%

8/15

Prop #2 Outcome

The adjusted emission scheme has resulted in increased Staking and Pool incentives, leading to a significant rise in net yield (return - inflation)

- Staking Rewards net yield: -4.1% ⬆️ 21.8%

- Liquidity Rewards net yield: 9.2% ⬆️ 26.7%

9/15

The adjusted emission scheme has resulted in increased Staking and Pool incentives, leading to a significant rise in net yield (return - inflation)

- Staking Rewards net yield: -4.1% ⬆️ 21.8%

- Liquidity Rewards net yield: 9.2% ⬆️ 26.7%

9/15

Prop #3 - Reducing the Superfluid risk factor to 25%

Superfluid staking enables $OSMO tokens locked in LP to contribute to network security and participate in voting

This proposal will permitting 75% of $OSMO locked in Superfluid pools to be used for staking

10/15

Superfluid staking enables $OSMO tokens locked in LP to contribute to network security and participate in voting

This proposal will permitting 75% of $OSMO locked in Superfluid pools to be used for staking

10/15

Prop #3 Outcome

This change would boost Superfluid pools' APR by ~2%, while lowering Staking APR by ~1.4%, considering the current $OSMO in Superfluid pools

11/15

This change would boost Superfluid pools' APR by ~2%, while lowering Staking APR by ~1.4%, considering the current $OSMO in Superfluid pools

11/15

Sum-up 🖋️

After the 3 proposals are implemented,the daily $OSMO emission will be:

- Staking Rewards: 137,986 (Δ = 0%)

- Liquidity Rewards: 54,795 (from 73,973, Δ = -26%)

- Community Pool: 13,699 (from 200,000, Δ = -93%)

- Developer Rewards: 68,493 (from 136,986, Δ = -50%)

12/15

After the 3 proposals are implemented,the daily $OSMO emission will be:

- Staking Rewards: 137,986 (Δ = 0%)

- Liquidity Rewards: 54,795 (from 73,973, Δ = -26%)

- Community Pool: 13,699 (from 200,000, Δ = -93%)

- Developer Rewards: 68,493 (from 136,986, Δ = -50%)

12/15

This will significantly improve tokenomics by reducing inflation by 50% while maintaining the same $OSMO emissions for Staking Rewards ✅

This is particularly important as the current high inflation still results in net inflation for $OSMO stakers 🔑🏦

13/15

This is particularly important as the current high inflation still results in net inflation for $OSMO stakers 🔑🏦

13/15

With an additional 25% of $OSMO in superfluid pools being staked, the overall APR (weighted average) will decrease slightly due to the drop in Liquidity Rewards but it's still higher than adjusted inflationƒ

14/15

14/15

Want to understand OSMO 2.0 tokenomics upcoming upgrade? This article's got you covered! 🧪✨

If you're into analytics, retweet and stay tuned for more articles coming your way!🔍

15/15

If you're into analytics, retweet and stay tuned for more articles coming your way!🔍

15/15

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter