1/ This thread shows there are deep connections between NFTs/crypto, Goldman Sachs, controversial financiers/investors, and some of the major FIAT frauds and financial scandals over the last years (e.g. Wirecard, 1MDB) that cannot be explained by mere coincidence. A thread. 🧵

2/ The sale of RTFKT (CloneX) to Nike at the end of 2021, which some estimate to be over $1 billion, was a great ROI for the VCs involved as their investment was only $8 million. One of the investors was Galaxy Digital from Mike Novogratz. His brother works for NFT company Candy.

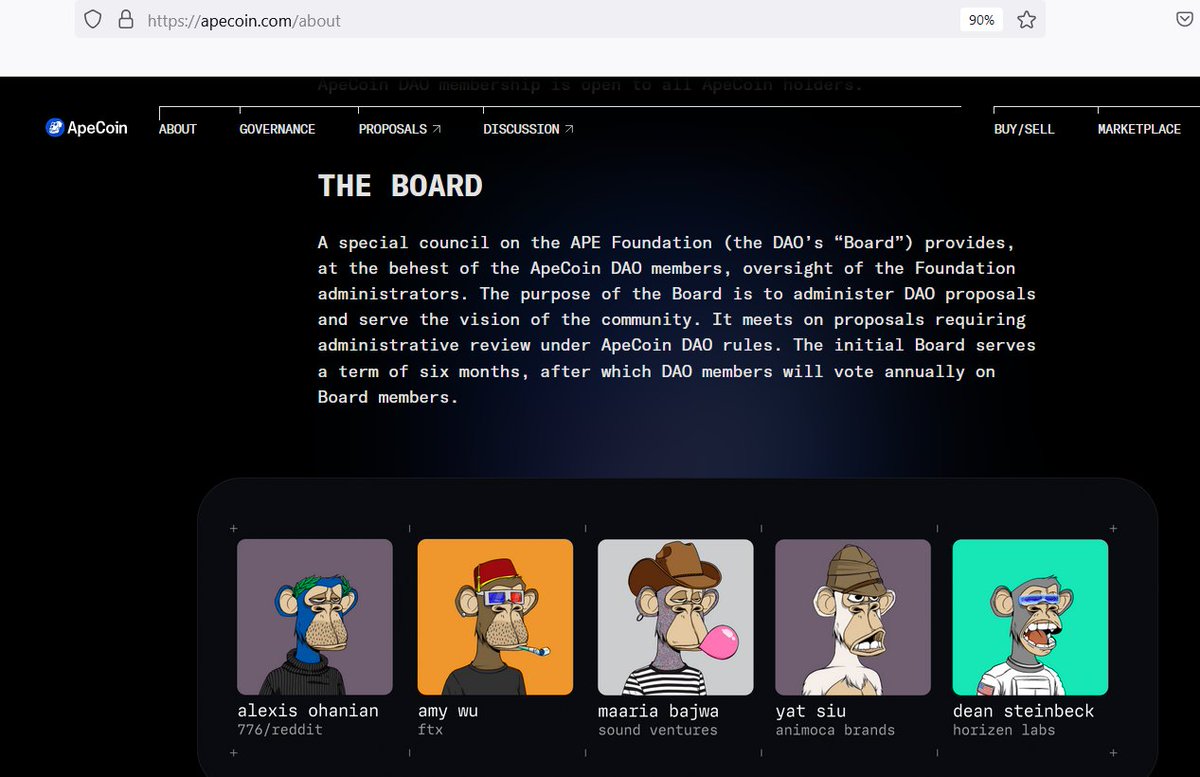

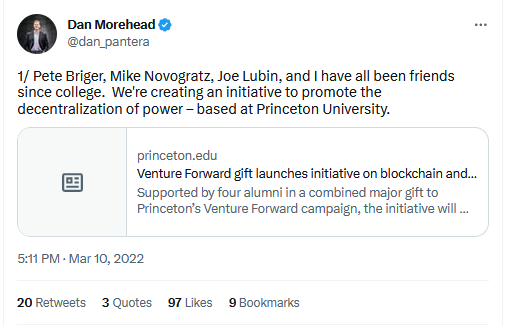

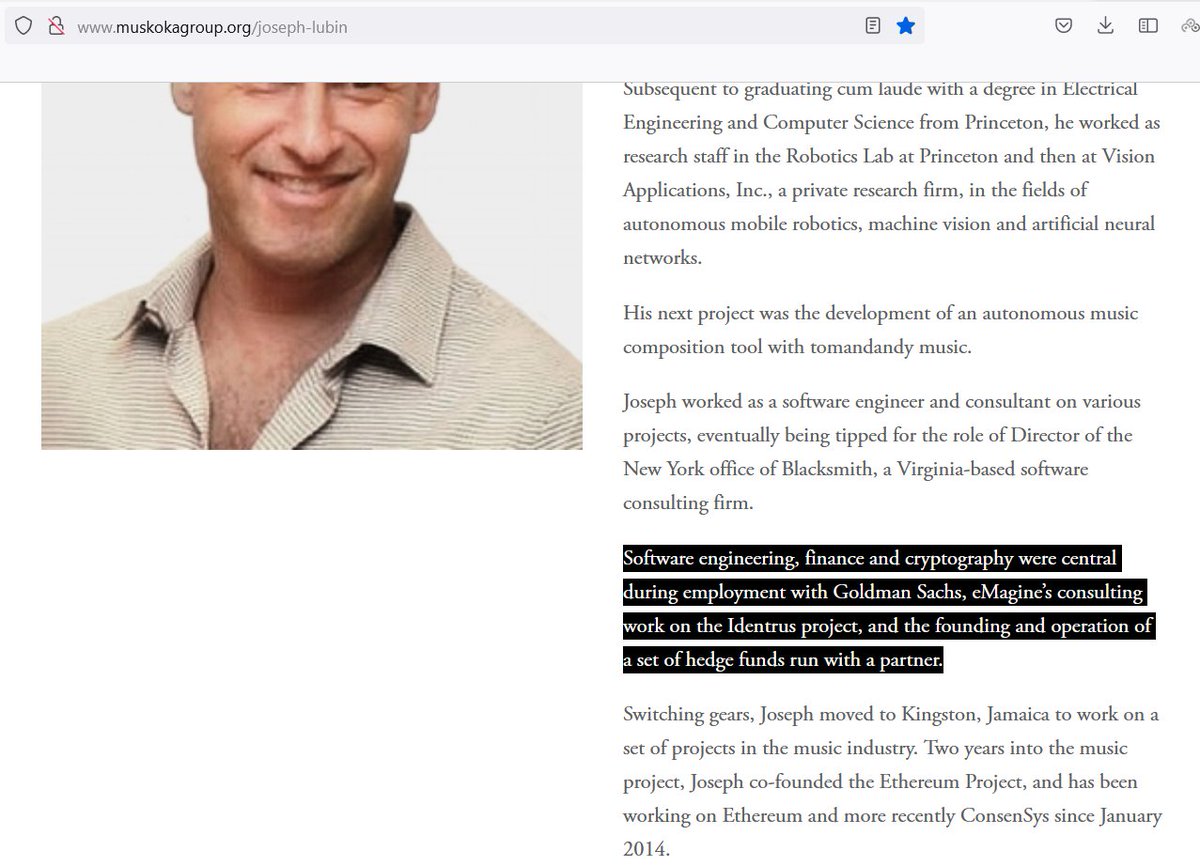

3/ Novogratz was a college roommate of Joseph Lubin, the co-founder of Ethereum, and was able to buy 500.000 ETH for less than $500k from Vitalik Buterin. Novogratz, Lubin, but also Dan Morehead (Pantera Capital) and Pete Briger (Fortress) are very early crypto crypto investors.

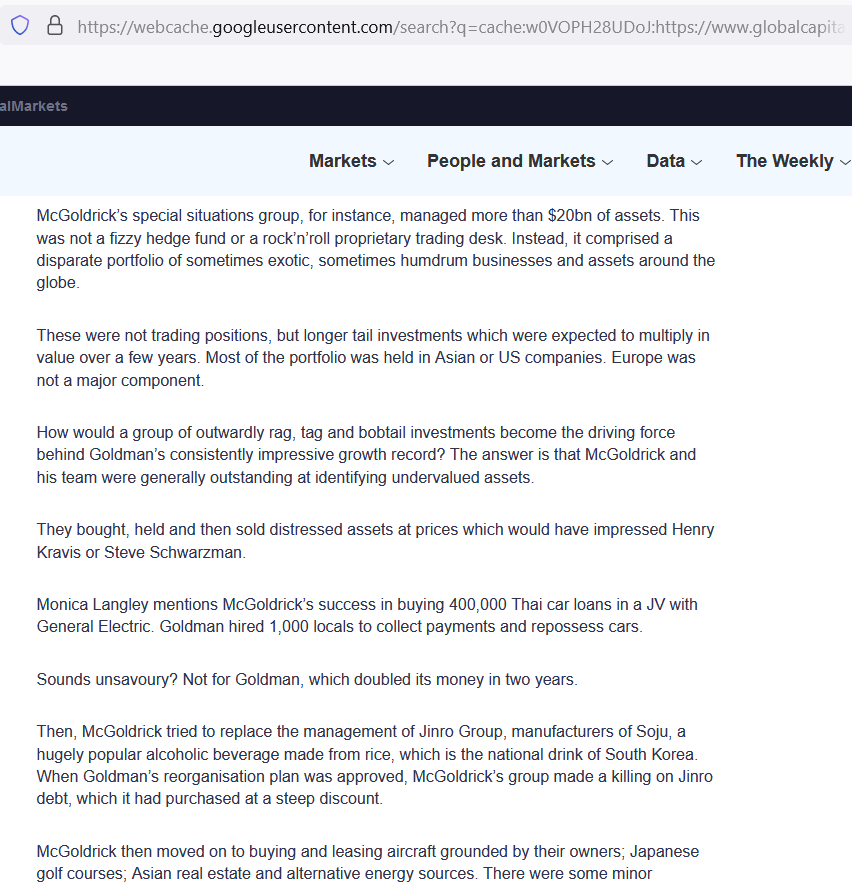

4/ They go way back to their Goldman Sachs days and Briger, who purchased $20 million BTC in 2013 with Fortress, co-founded Goldman’s secretive & very profitable Special Situations Group. Vitalik confirmed in an interview that 2 Ethereum team members had a Goldman background.

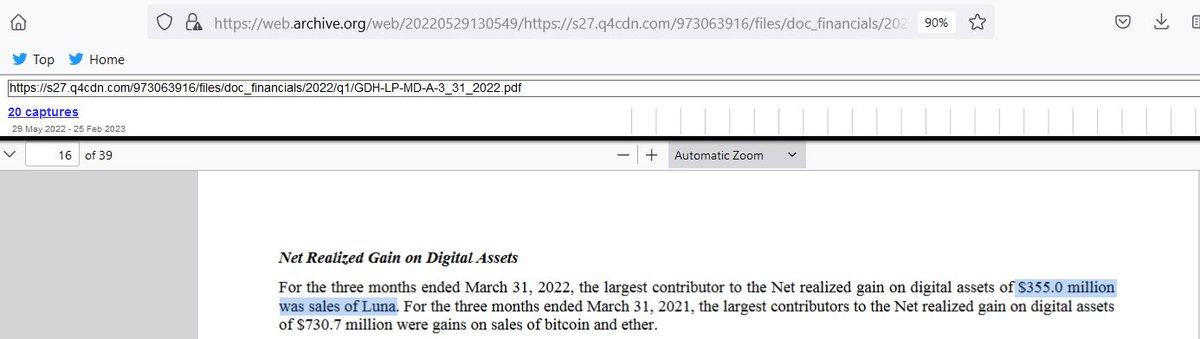

5/ In the press it was suggested that Galaxy lost a lot of money during the Terra LUNA collapse, but that was not the case at all. They made a significant profit off of Terra LUNA in Q1 2022 ($355 million), just like Pantera Capital that made a $170 million profit from Terra LUNA

6/ Around the same time Peter Thiel sold all of his crypto making a profit of $1.8 billion (and returned $13bn to investors). Thiel is connected with Novogratz via investments such as BlockOne/Bullish ($9 billion SPAC), but also via the controversial investor Christian Angermayer

7/ Angermayer is Thiel’s business partner via Elevat3 & a business partner of Novogratz with Cryptology Asset Group (recently renamed to Samara). Already in 2012 a big article appeared detailing Angermayer’s checkered history, involving unpaid bills, pump & dump & angry investors

8/ Nothing seems to have changed. Angermayer brokered the deal between Softbank and Wirecard, one of the largest financial frauds in recent history. He was in direct contact with Jan Marsalek, the main suspect with 6 passports who used BTC to move funds from Dubai to Russia.

9/ But that is only the tip of the iceberg. The whole ICO of BlockOne is surrounded by fraudulent transactions, but BlockOne also invested in Northern Data (also via Angermayer's FinLab), which is fraught with insider trading via Novogratz, Angermayer & Co ningiresearch.com/2022/03/03/sho…

10/ The stock prices of various IPOs associated with Angermayer have declined by over 87%. Shareholders of these stocks are generally entities of Angermayer or his business partners, including Florian Brand, a kitchen appliance specialist and an actor, Marco Beckmann.

11/ FTX invested in a Angermayer’s pharma company called Rejuveron (why?), together with multiple entities associated with Angermayer: re:Mind, Apeiron, Presight and Korify. There are many more examples like this. Atai Life claims it made hundreds of millions of losses.

12/ Via LinkedIn we can see that Angermayer knows another controversial German, Lars Windhorst, a “financier with nine lives” whose business career is even more disturbing. Windhorst introduced Goldman Sachs to Falcon Private Bank, which is the bank involved in the big 1MBD fraud

13/ According to a KPMG report, Windhorst was in personal contact with the main suspect Khadem al-Qubaisi since 2013, who is now jailed for 15 years. Falcon Bank was one of the first crypto banks and after the its collapse, the execs went to work for their partner Bitcoin Suisse.

14/ The UK branche was acquired by Dolfin Financial, whose owner is Roman Joukovski, financial adviser to oligarchs & the family of the President of Kazakhstan. Dolfin also got shut down as it was involved in a Golden Visa scheme fraud for wealthy Chinese/Russians/etc.

15/ Dolfin was the main investor in the crypto Waves Platform by Sasha Ivanov and involved in a fraud case regarding crypto platform Vostok. But back again to Windhorst, who knows Mike Novogratz via their connection with the football club Hertha BSC. Novogratz grew up in Germany.

16/ In 2021 Michael Daffey became the chairman of Novogratz’s Galaxy and was paid over $35 million in that year alone. Daffey was high up at Goldman Sachs with many important connections and ALSO an early Bitcoin investor: he allegedly made more with BTC than at Goldman Sachs.

17/ Only through a lawsuit we know that Daffey/Goldman Sachs was close to Windhorst and did multiple deals together. The records of the exclusive/secretive Beaverbrook golf club show that Windhorst, Daffey & other GS execs are all shareholders: Gary Cohn, M. Sherwood, Jörg Kukies

18/ Windhorst is connected to the Adler fraud, the Ethad Airlines debacle and the H2O Asset management collapse, and Goldman Sachs was often deeply involved. There are also crypto connections, e.g. via Sora Bank/Bank Alpinum and ADS Securities (ADSS).

19/ The Adler case shows again a spiderweb of insider trading as exposed by Viceroy Research. There are even direct connections with 17 Black, a Dubai company owned by Yorgen Fenech, who is charged with organizing/financing the murder of Maltese journalist Daphne Caruana Galizia.

20/ Windhorst is a business partner of ‘billionaire’ Rob Hersov, who is big into crypto/NFTs (and ex Goldman Sachs). Originating from a wealthy family, he has, again, a checkered history and is close with Sanjeev Gupta, a main figure in the Greensill scandal.

21/ Hersov is a long-term business partner of Jean Chalopin, the founder of Deltec & Moonstone Bank (and also deeply involved in “pharma”). They invested in different projects decades ago, were part of a UK company called The NOD and Hersov served as the chairman of Deltec Int.

22/ Deltec, the bank of BitFinex (Tether), used to work closely with FTX, both located at the Bahamas. FTX was one of the largest recipients of Tether & FTX’s largest investment was in Genesis Digital, co-founded by Marco Streng, who is also closely associated with Angermayer.

23/ Streng is a business partner of Christopher Harborne, a BitFinex shareholder and implicated in falsifying documents. One of the other founders of Genesis is Abdumalik Mirakhmedov. He used to work with BSI, which was the other bank that was implicated in the 1MDB scandal.

24/ Goldman Sachs is known for secretly betting against their own clients, which they consider “muppets” (the screenshot is from the book "Why I Left Goldman Sachs: A Wall Street Story" by Greg Smith. There are many examples of this.

25/ We believe this network of seemingly isolated cases of fraud are actually more connected and deserve more scrutiny, including the role that crypto could have played to potentially launder/siphon off profits from (seemingly) legitimate companies and pump & dump certain stocks.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter