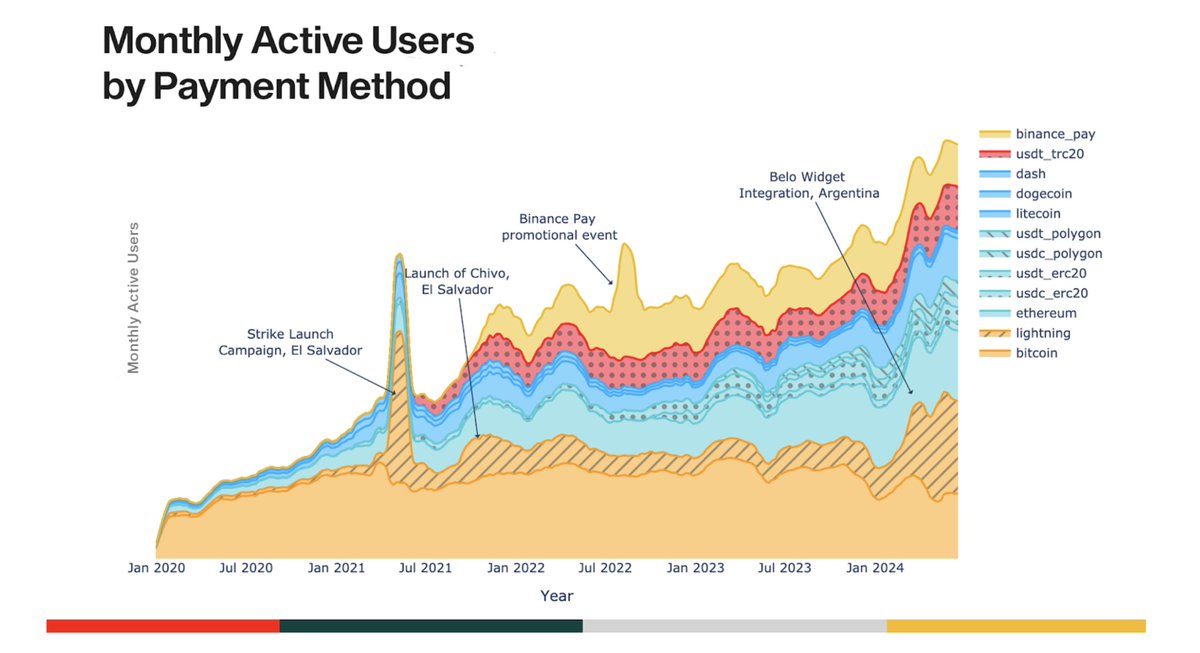

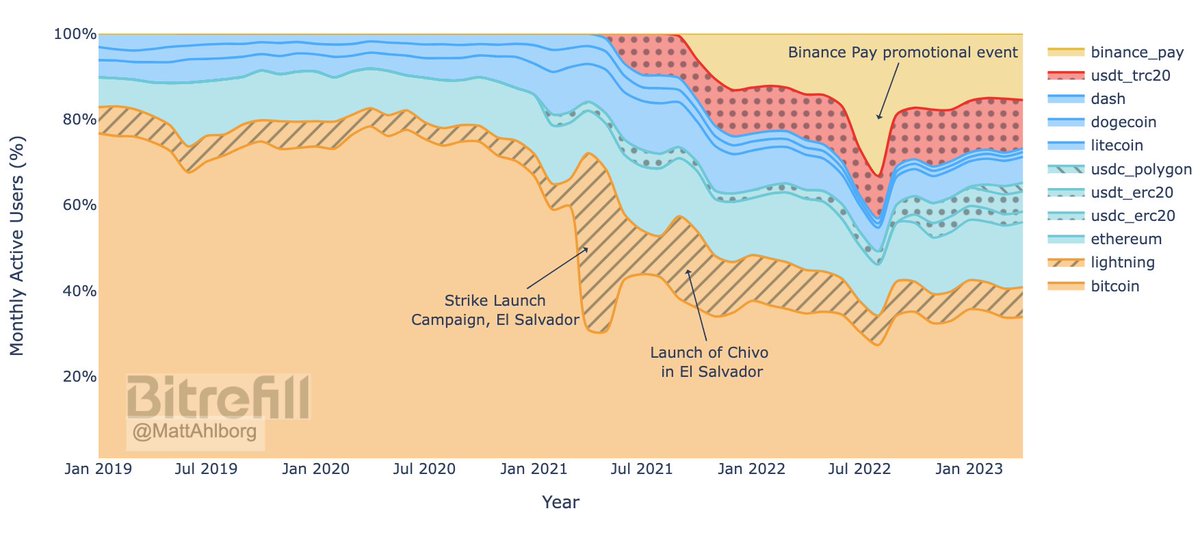

1/25 🧵 @bitrefill believes it the largest commerce platform in the space. As such, I wanted to share some deep thoughts on payment method (PM) popularity over time in the hope of pushing the industry forward. This first chart shows monthly active users for each PM since 2019:

2/25 In the chart above:

- Solid colors indicate crypto assets,

- Dotted texture represents stablecoin tokens,

- Backslashes represent layer 2 crypto assets (BTC on Lightning),

- Forward slashes represent layer 2/sidechain stablecoins (USDC on Polygon).

- Solid colors indicate crypto assets,

- Dotted texture represents stablecoin tokens,

- Backslashes represent layer 2 crypto assets (BTC on Lightning),

- Forward slashes represent layer 2/sidechain stablecoins (USDC on Polygon).

3/25 In summary, the chart above shows the Bitcoin ecosystem ceding ground to other PM’s over the last four years. There is much nuance to this phenomenon, however, so let’s get into the latent factors influencing each PM over time:

4/25 Ethereum Ecosystem:

ETH users have the highest average purchase value among all of our users. There is a large amount of monetary value in this ecosystem beyond the market cap of ETH alone, with many ICO, NFT, and DeFi projects ultimately returning value...

ETH users have the highest average purchase value among all of our users. There is a large amount of monetary value in this ecosystem beyond the market cap of ETH alone, with many ICO, NFT, and DeFi projects ultimately returning value...

5/25 …to the base token ETH which users then spend with us. Additionally, this ecosystem benefits from the stablecoins USDT and USDC riding upon it, further expanding circular-economy-like use cases for participants in the system.

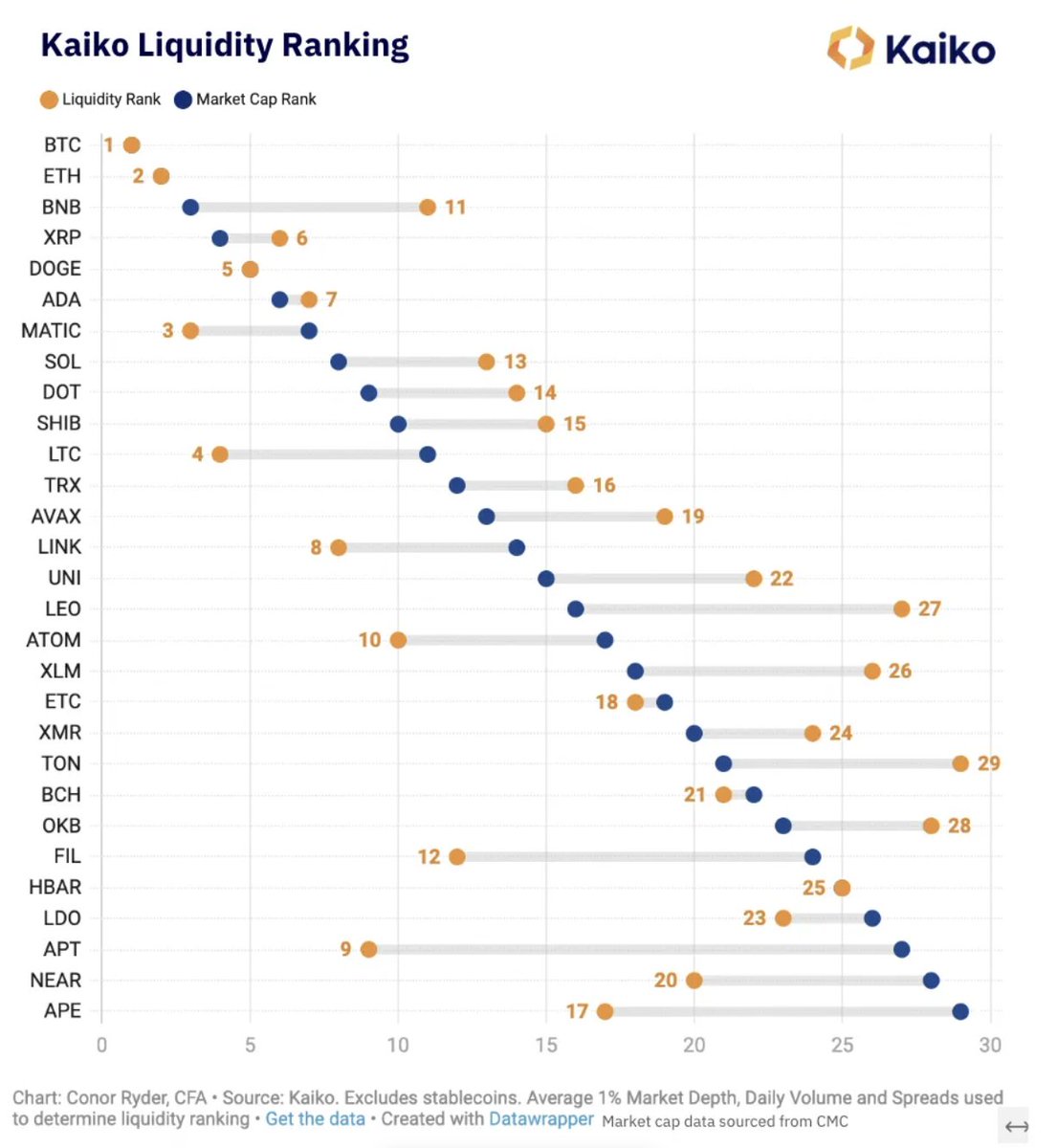

6/25 Next, LTC, DOGE, and DASH are a set of PM’s I refer to as “legacy coins”. Legacy coins are often an afterthought in the space, but have actually built up substantial network effects over the years by simply being listed on so many exchanges and wallets so early in time.

7/25 These coins enjoy high volume, low trading spreads, and good market depth, which are important if using them as a medium of exchange. A recent @KaikoData report backs this up by showing that LTC and DOGE rank 4th and 5th among all coins in terms of overall ‘liquidity’:

8/25 Anecdotally, these coins are not being held by LTC, DOGE, or DASH “hodlers” and “believers”, but rather are being used as a mediums of exchange to make payments from popular exchanges/wallets.

9/25 For example, when a user who holds a smattering of altcoins or stablecoins on an exchange and wants to make a purchase with us, they often trade those coins for LTC and immediately send that LTC to us to make payment.

10/25 For them, LTC is cheaper than paying BTC on-chain fees, and works just as well. Additionally, during periods of high fees, many payments which normally come to us via BTC will spillover to legacy coins instead:

11/25 This is a good time to transition to the #LightningNetwork. Lightning payments have steadily grown over time but perhaps less than Bitcoiners would have hoped. To this day, Lightning still struggles beating Litecoin in daily pmnts. Why is this? IMO, Lightning still lacks…

12/25 ...the wallet and exchange integrations necessary for "normie" user growth. Adding LN to the previous chart, we can see that when on-chain fees got expensive during the bull run of 21', Lightning’s share did increase, but less so than legacy coins during the same time:

13/25 Note: I removed Lightning transactions coming from El Salvador on this chart to reduce the noise related to the Bitcoin law and all of the growth there unrelated to fee pressure.

14/25 In summary, even as Lightning made progress in 21', it still lost out to legacy coins as the preferred substitute payment method to us during periods of high fees. It will be exciting to see if this changes as we enter higher fees periods again!

15/25 Next is Tether on Tron. USDT_TRC20 has gained substantial traction with its attractive combination of speed, low fees, stability, and exchange/wallet interoperability. Over time, I see it continuing to gain ground provided it maintains these qualities.

16/25 Binance Pay: @binance is the largest exchange in the world and we have customers from all around the globe making payments through this service. For these customers and others paying from custodial exchanges, convenience and user-friendliness trumps sovereignty.

17/25 Taking a look at payment method popularity on a map illuminates some really interesting trends as well:

18/25 Insights:

- Binance is very popular in emerging markets (EM),

- USDT on Tron is also quite popular in EM, esp Asia,

- Bitcoin ecosystem payments are generally quite Western, but it has made inroads into EM,

- Ethereum is extremely Western, and has made few inroads in EM.

- Binance is very popular in emerging markets (EM),

- USDT on Tron is also quite popular in EM, esp Asia,

- Bitcoin ecosystem payments are generally quite Western, but it has made inroads into EM,

- Ethereum is extremely Western, and has made few inroads in EM.

19/25 To note:

- VPN usage can muddy the waters of analysis, but we probably have a bit less Western users and a bit more EM users than shown here,

- Latin America’s pie not including Bitcoinized El Salvador would lean heavily towards Binance.

- VPN usage can muddy the waters of analysis, but we probably have a bit less Western users and a bit more EM users than shown here,

- Latin America’s pie not including Bitcoinized El Salvador would lean heavily towards Binance.

20/25 To be clear, nearly every PM we offer is still on the rise in terms of absolute numbers. We decided to hold off on releasing those numbers for now, but may in time.

In closing, where does all this leave the Bitcoin ecosystem with regards to its future in payments?

In closing, where does all this leave the Bitcoin ecosystem with regards to its future in payments?

21/25 On the one hand, Bitcoin has been attacked on all sides over the years because:

1) Stablecoins allow users to escape volatility,

2) Legacy coins allow users to escape fees,

3) Exchanges and smart contract chains let users “do more” with their coins on “DeFi/Web3” stuff.

1) Stablecoins allow users to escape volatility,

2) Legacy coins allow users to escape fees,

3) Exchanges and smart contract chains let users “do more” with their coins on “DeFi/Web3” stuff.

22/25 On the other hand, over the longer term, my gut says that these more centralized PM’s and their ecosystems will undergo various forms of attack, particularly by regulatory agencies/governments.

23/25 This would turn the tide back towards Bitcoin just as its own, ostensibly more censorship-resistant versions of stablecoins, “DeFi”, and “Web3” come into their own.

24/25 But the data stands on its own and I hope it generates a lot of interesting discussion in the space.

What does everyone else think?

What does everyone else think?

25/25 One last disclaimer:

All of these thoughts are my opinions based on Bitrefill data and not the opinion of Bitrefill the company!

All of these thoughts are my opinions based on Bitrefill data and not the opinion of Bitrefill the company!

• • •

Missing some Tweet in this thread? You can try to

force a refresh