1/x

robert.p.balan (PAM)

Apr 18, 2023 10:03 AM

EUROPEAN SESSION BRIEF

DXY WEAKENING AHEAD OF THE 10YR YIELD, PAM GOES GOLD LONG OVERHEDGE; WAITING FOR SIGNAL FOR A 10YR YIELD TOP TO PUT IN THE TN LONG OVERHEDGERS; TAKING PROFITS ON LONG EQUITY INDEX SCALPERS DURING EUROPE… twitter.com/i/web/status/1…

robert.p.balan (PAM)

Apr 18, 2023 10:03 AM

EUROPEAN SESSION BRIEF

DXY WEAKENING AHEAD OF THE 10YR YIELD, PAM GOES GOLD LONG OVERHEDGE; WAITING FOR SIGNAL FOR A 10YR YIELD TOP TO PUT IN THE TN LONG OVERHEDGERS; TAKING PROFITS ON LONG EQUITY INDEX SCALPERS DURING EUROPE… twitter.com/i/web/status/1…

2/X

robert.p.balan

Apr 18, 2023 10:05 AM

We initiate long Gold GCM3 overhedgers for gold positioning. twitter.com/i/web/status/1…

robert.p.balan

Apr 18, 2023 10:05 AM

We initiate long Gold GCM3 overhedgers for gold positioning. twitter.com/i/web/status/1…

3/X

robert.p.balan (PAM)

Apr 18, 2023 10:28 AM

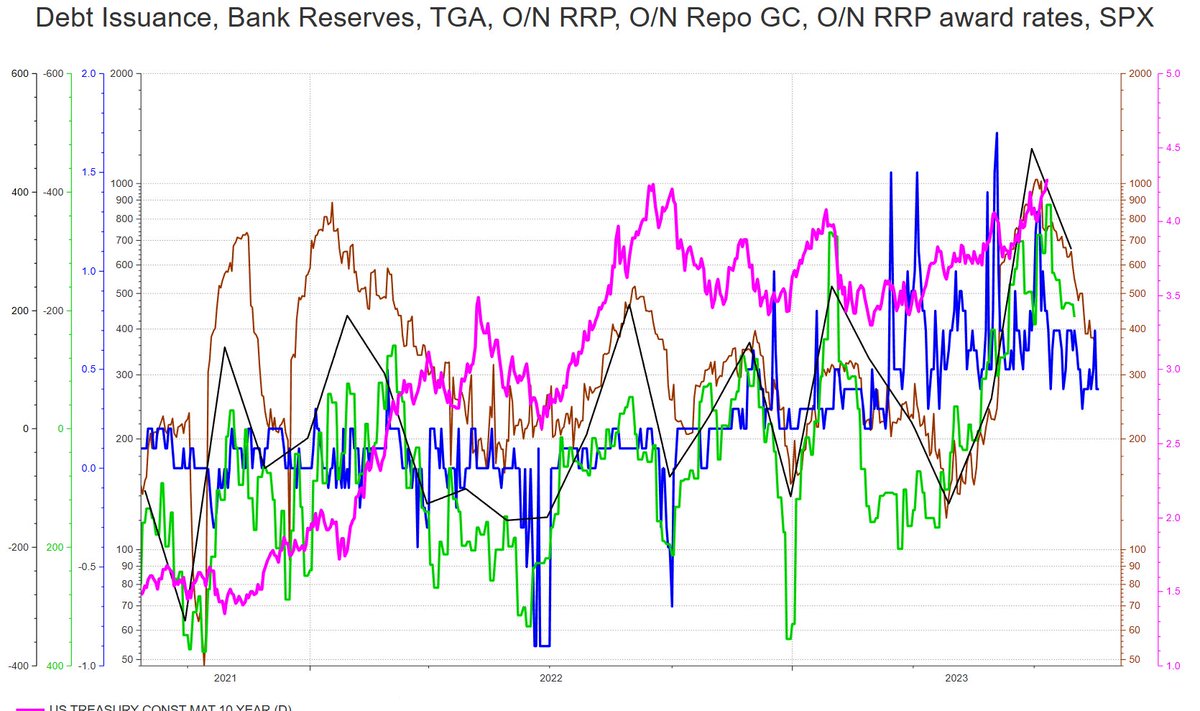

The falling DXY and sideways course of the 10Yr Yield kick-started an NQ and ES rally (as well as Gold's).

The longer the Yield stays on pause, and the farther the DXY falls, the higher NQ and ES (and Gold) should go.

I also… twitter.com/i/web/status/1…

robert.p.balan (PAM)

Apr 18, 2023 10:28 AM

The falling DXY and sideways course of the 10Yr Yield kick-started an NQ and ES rally (as well as Gold's).

The longer the Yield stays on pause, and the farther the DXY falls, the higher NQ and ES (and Gold) should go.

I also… twitter.com/i/web/status/1…

4/X

robert.p.balan (PAM)

Apr 18, 2023 11:23 AM

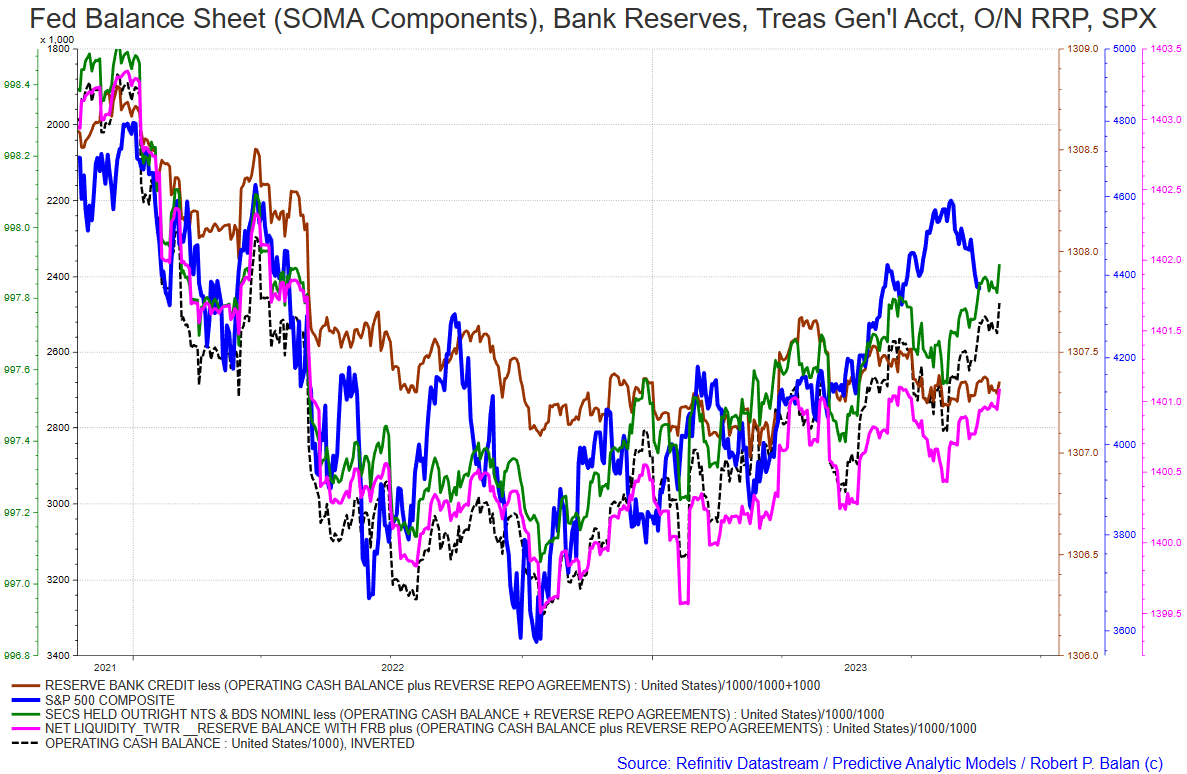

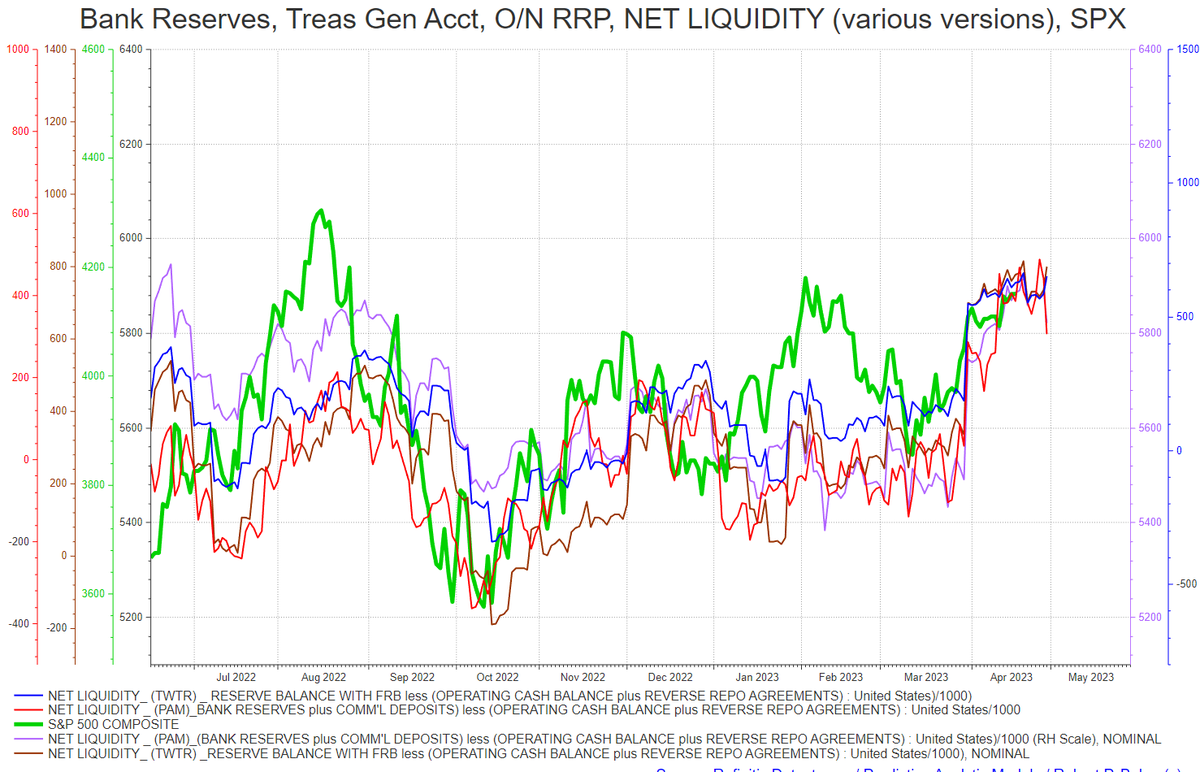

This is how the models look like today.

The Net Liquidity models are showing still friendly environment for a day (probably even two). Then a topping process begins.

Bearish traders are arguing for a red day today on account of… twitter.com/i/web/status/1…

robert.p.balan (PAM)

Apr 18, 2023 11:23 AM

This is how the models look like today.

The Net Liquidity models are showing still friendly environment for a day (probably even two). Then a topping process begins.

Bearish traders are arguing for a red day today on account of… twitter.com/i/web/status/1…

5/X

robert.p.balan (PAM)

Apr 18, 2023 11:54 AM

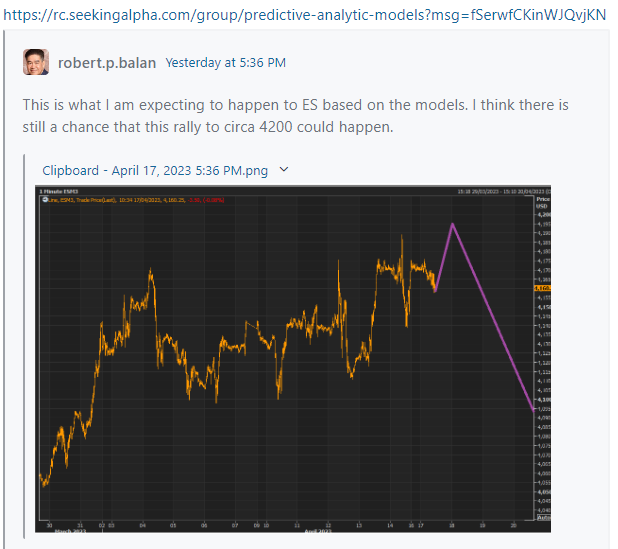

This post yesterday is ageing very well, indeed -- we are on the way to circa 4200. twitter.com/i/web/status/1…

robert.p.balan (PAM)

Apr 18, 2023 11:54 AM

This post yesterday is ageing very well, indeed -- we are on the way to circa 4200. twitter.com/i/web/status/1…

6/X

robert.p.balan (PAM)

Apr 18, 2023 12:12 PM

We add to the gold long overhedge, if we get the desired GCM3 level. The DXY is starting to recover somehow, and that might get us a lower GCM3 level. twitter.com/i/web/status/1…

robert.p.balan (PAM)

Apr 18, 2023 12:12 PM

We add to the gold long overhedge, if we get the desired GCM3 level. The DXY is starting to recover somehow, and that might get us a lower GCM3 level. twitter.com/i/web/status/1…

7/X

robert.p.balan PAM)

Apr 18, 2023 12:41 PM

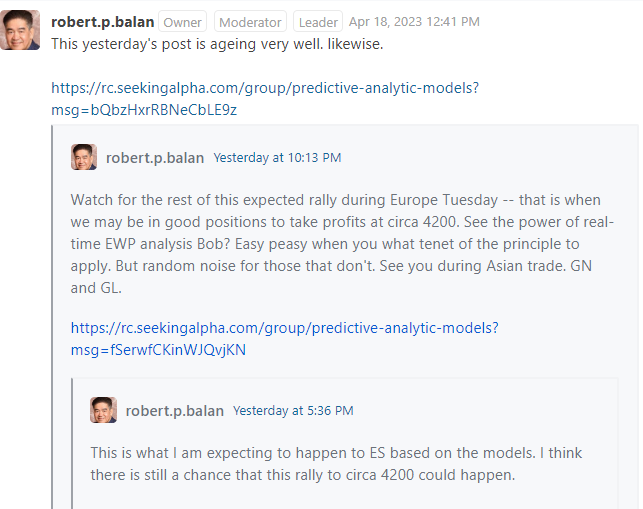

This yesterday's post is ageing very well, likewise. twitter.com/i/web/status/1…

robert.p.balan PAM)

Apr 18, 2023 12:41 PM

This yesterday's post is ageing very well, likewise. twitter.com/i/web/status/1…

8/x

robert.p.balan (PAM)

Apr 18, 2023 1:12 PM

Here is the question I am asking myself -- if ESM3 breaches 4200, ES will go higher further. But there is also a chance that it won't.

NQ nonetheless still looks due for another 0DTE run-up by the time NY trade opens, on the other… twitter.com/i/web/status/1…

robert.p.balan (PAM)

Apr 18, 2023 1:12 PM

Here is the question I am asking myself -- if ESM3 breaches 4200, ES will go higher further. But there is also a chance that it won't.

NQ nonetheless still looks due for another 0DTE run-up by the time NY trade opens, on the other… twitter.com/i/web/status/1…

9/X

robert.p.balan (PAM)

Apr 18, 2023 1:34 PM

Oh boy! on the other hand it, our hads are being forced -- looks like the Yield may be headed lower now, which I did not expect at this juncture.

It might just pull the equities lower. Prudence over valor, gals and guys. Were out,… twitter.com/i/web/status/1…

robert.p.balan (PAM)

Apr 18, 2023 1:34 PM

Oh boy! on the other hand it, our hads are being forced -- looks like the Yield may be headed lower now, which I did not expect at this juncture.

It might just pull the equities lower. Prudence over valor, gals and guys. Were out,… twitter.com/i/web/status/1…

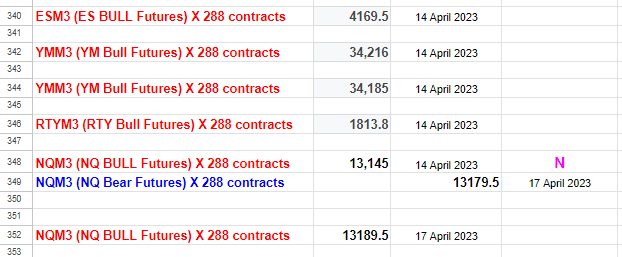

10/X

robert.p.balan

Apr 18, 2023 1:42 PM

Long scalpers of April 14, are all offloaded. twitter.com/i/web/status/1…

robert.p.balan

Apr 18, 2023 1:42 PM

Long scalpers of April 14, are all offloaded. twitter.com/i/web/status/1…

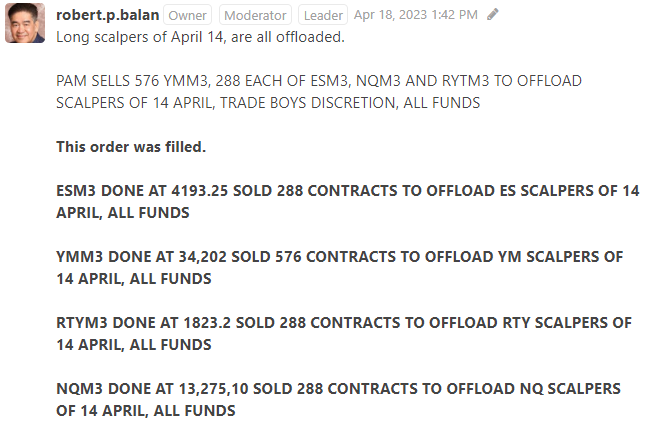

11/X

robert.p.balan (PAM)

Apr 18, 2023 1:48 PM

We now do the initial tranche of the long TN overhedge. twitter.com/i/web/status/1…

robert.p.balan (PAM)

Apr 18, 2023 1:48 PM

We now do the initial tranche of the long TN overhedge. twitter.com/i/web/status/1…

12/X

robert.p.balan (PAM)

LeaderApr 18, 2023 2:24 PM

The DXY will not rebound that high, and it looks like the 10Yr Yield is now on a topping out process. We do the second tranche of the long Gold overhedgers. twitter.com/i/web/status/1…

robert.p.balan (PAM)

LeaderApr 18, 2023 2:24 PM

The DXY will not rebound that high, and it looks like the 10Yr Yield is now on a topping out process. We do the second tranche of the long Gold overhedgers. twitter.com/i/web/status/1…

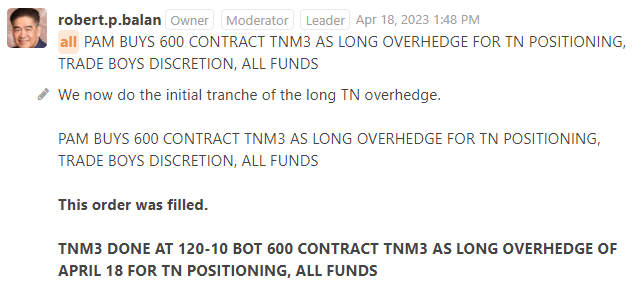

13/X

Some reaction from the PAM community with regards to that "improbable long trade, ahead of the income tax payment"

Some reaction from the PAM community with regards to that "improbable long trade, ahead of the income tax payment"

14/X

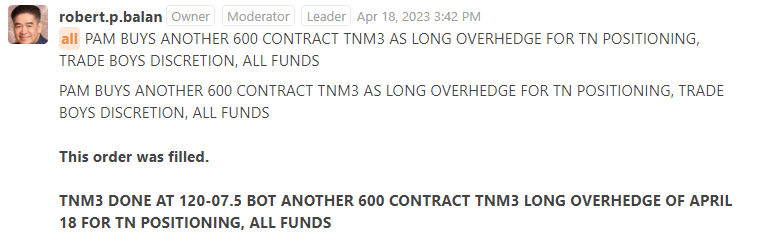

robert.p.balan (PAM)

Apr 18, 2023 3:42 PM

We do another tranche of the long TN long overhedge. twitter.com/i/web/status/1…

robert.p.balan (PAM)

Apr 18, 2023 3:42 PM

We do another tranche of the long TN long overhedge. twitter.com/i/web/status/1…

15/X

robert.p.balan (PAM)

Apr 18, 2023 3:51 PM

Yields and equity futurres are back at POSITIVE covar _sentiment turned negative. twitter.com/i/web/status/1…

robert.p.balan (PAM)

Apr 18, 2023 3:51 PM

Yields and equity futurres are back at POSITIVE covar _sentiment turned negative. twitter.com/i/web/status/1…

16/X

robert.p.balan

Apr 18, 2023 6:19 PM

I leave for 2 hours for a client meeting, and the market did diligent work on the EWP illustration we posted yesterday 😃

Our ESM3 illustration missed the actual market top by just 2.75 bps. How's that for "random walk"?

Now, lets see… twitter.com/i/web/status/1…

robert.p.balan

Apr 18, 2023 6:19 PM

I leave for 2 hours for a client meeting, and the market did diligent work on the EWP illustration we posted yesterday 😃

Our ESM3 illustration missed the actual market top by just 2.75 bps. How's that for "random walk"?

Now, lets see… twitter.com/i/web/status/1…

17/X

robert.p.balan (PAM)

Apr 18, 2023 6:29 PM

As we have been hammering since the opening of PAM in May 2018, there is no need or room for FOMO, if you know the natural tendency of price movements (e.g. action, reaction), and you can actually wait and plan for your entry and… twitter.com/i/web/status/1…

robert.p.balan (PAM)

Apr 18, 2023 6:29 PM

As we have been hammering since the opening of PAM in May 2018, there is no need or room for FOMO, if you know the natural tendency of price movements (e.g. action, reaction), and you can actually wait and plan for your entry and… twitter.com/i/web/status/1…

• • •

Missing some Tweet in this thread? You can try to

force a refresh