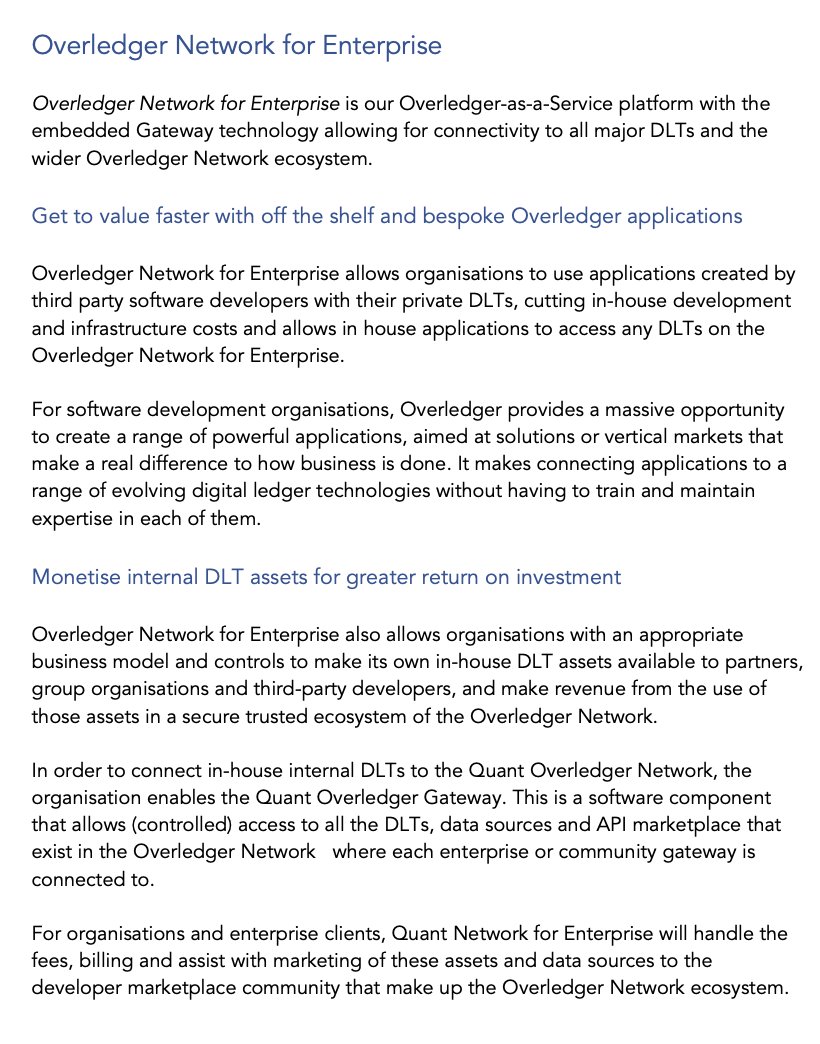

Overledger Network for Enterprise

- Get to value faster with off the shelf and bespoke Overledger applications

- Monetise internal DLT assets for greater return on investment

$QNT

- Get to value faster with off the shelf and bespoke Overledger applications

- Monetise internal DLT assets for greater return on investment

$QNT

• • •

Missing some Tweet in this thread? You can try to

force a refresh