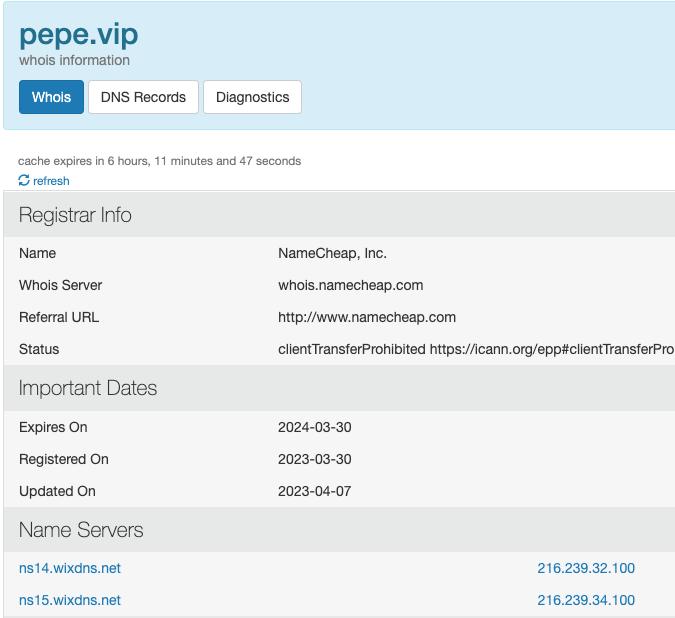

I got curious about the $PEPE project and how it was born.

So I did some investigations.

Here is what I found.

So I did some investigations.

Here is what I found.

2. On 4th of April, the Twitter account pepecoineth was created.

After a first tweet, no activity for 10 days.

After a first tweet, no activity for 10 days.

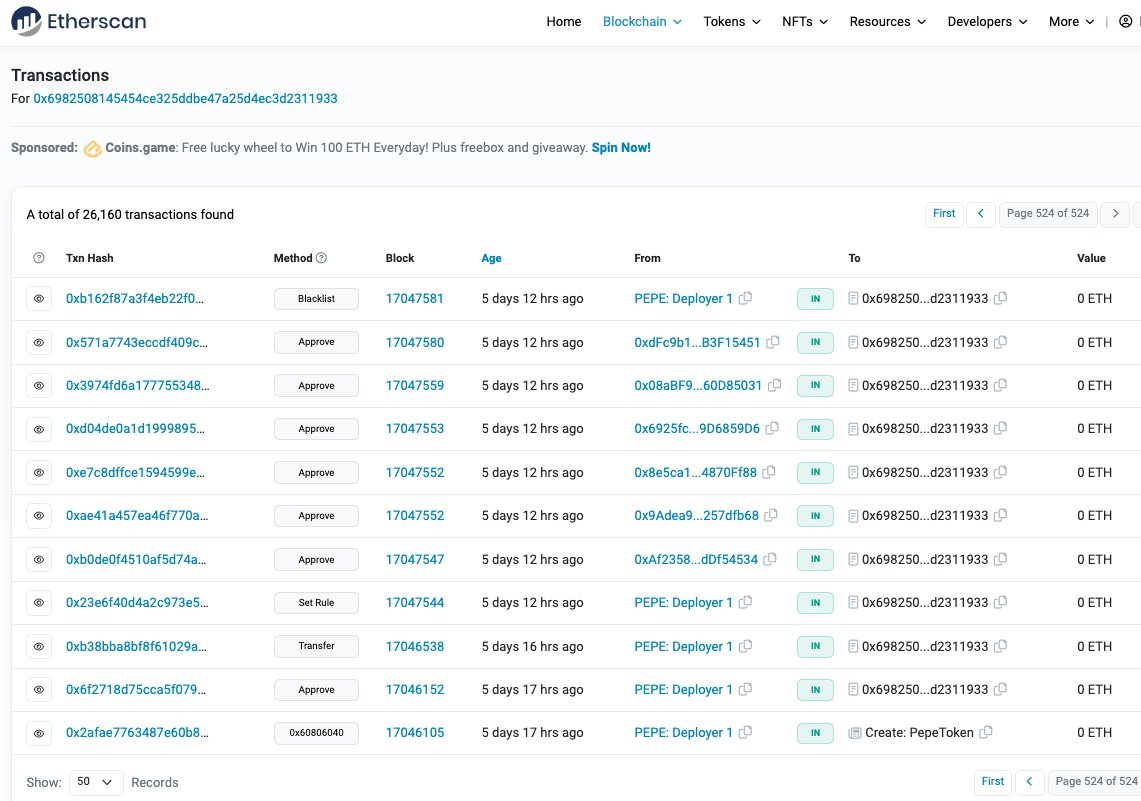

3. Then on 14th of April, creation of Telegram group and the $PEPE is created and it's listed on dextools.io.

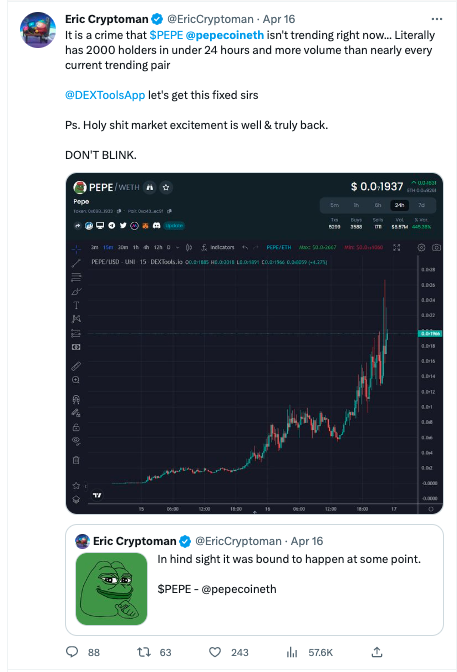

4. In crypto, everything happens on Twitter. So here are the first mentions of $PEPE from influencers. On 16th of April, two days after it was listed (You need to let 2 days for insiders to buy).

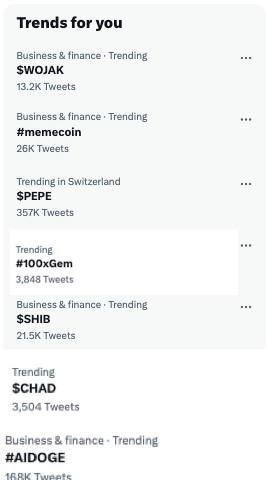

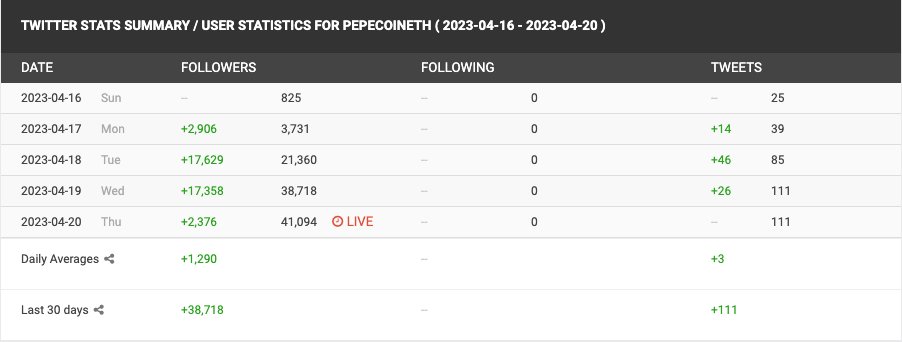

5. The shilling continues, until two days ago, it became trendy on Twitter.

Bringing around 35k followers to the account in just 2 days.

Bringing around 35k followers to the account in just 2 days.

6. Naturally, the price started to pump (a lot) as soon as it spread on Twitter. With retail fomoing

7. Here are, in order, the 20 first wallets with ENS domains that bought $PEPE shortly after it was listed:

complainooor.eth

squigs.eth

zerich.eth

dimethyltryptamine.eth

irresponsible.eth

*🍐🍐🍐.eth

dousan.eth

stevespurrier.eth

sendboobs.eth

grooove.eth

cybergenesis621.eth

complainooor.eth

squigs.eth

zerich.eth

dimethyltryptamine.eth

irresponsible.eth

*🍐🍐🍐.eth

dousan.eth

stevespurrier.eth

sendboobs.eth

grooove.eth

cybergenesis621.eth

*مرحبابالعالم.eth

betdeeznuts.eth

it4i.eth

mazo.eth

zaybles.eth

yeeticus.eth

rootslashbin.eth

sauropoda.eth

gaksplat.eth

betdeeznuts.eth

it4i.eth

mazo.eth

zaybles.eth

yeeticus.eth

rootslashbin.eth

sauropoda.eth

gaksplat.eth

8. Regarding it's future potential, it actually reminds me of $BONK, the Solana memecoin that trended for one week last December. And here is its PA.

I expect a similar pattern for $PEPE

I expect a similar pattern for $PEPE

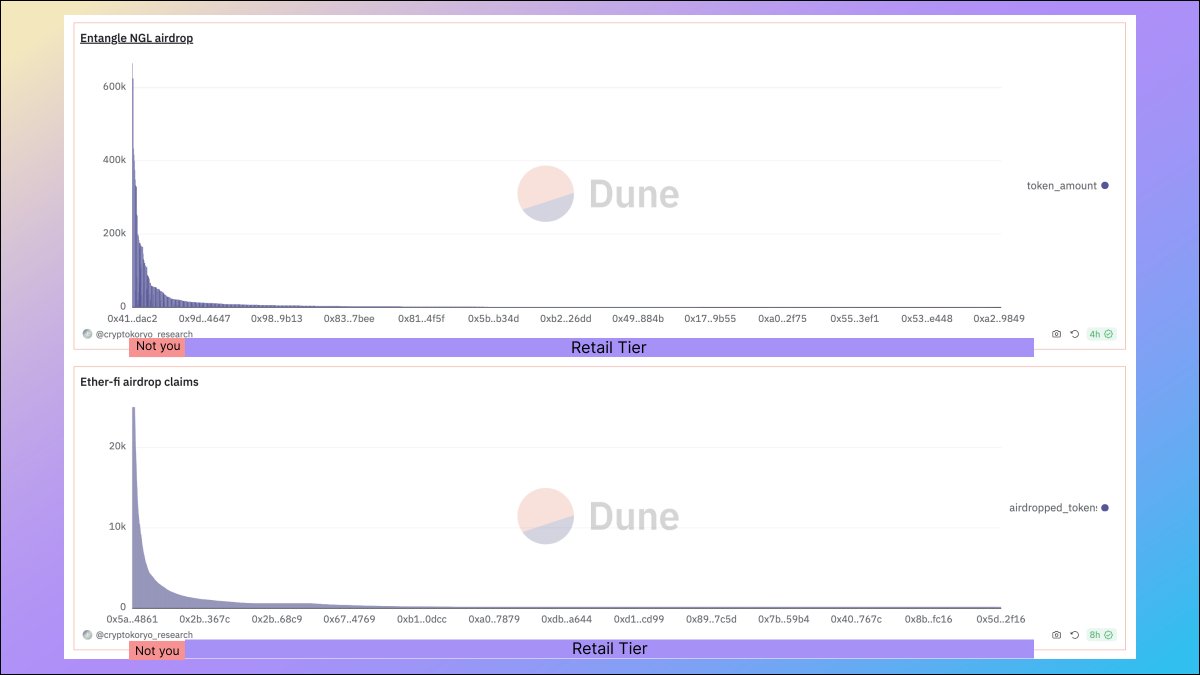

9. To conclude, remember insiders own 10% of the supply on that illiquid shitcoin.

They are already millionaires, up 1000x out of thin air. They could dump at any point.

I wouldn't touch it personally at this point.

They are already millionaires, up 1000x out of thin air. They could dump at any point.

I wouldn't touch it personally at this point.

Thanks for reading.

Give me a follow @CryptoKoryo for more.

If you enjoyed, make sure to like and retweet the first tweet linked below.

Give me a follow @CryptoKoryo for more.

If you enjoyed, make sure to like and retweet the first tweet linked below.

https://twitter.com/CryptoKoryo/status/1648979943764762626

• • •

Missing some Tweet in this thread? You can try to

force a refresh