A thread 🧵 about $AAPL Covered Call that didn’t work out as I had hoped

There are risks with selling options that need to be understood

As they say “No Free Lunch”

But…

Even trades that go against you can be managed and maneuvered

👇👇👇

#OptionsTrading #Optionselling

There are risks with selling options that need to be understood

As they say “No Free Lunch”

But…

Even trades that go against you can be managed and maneuvered

👇👇👇

#OptionsTrading #Optionselling

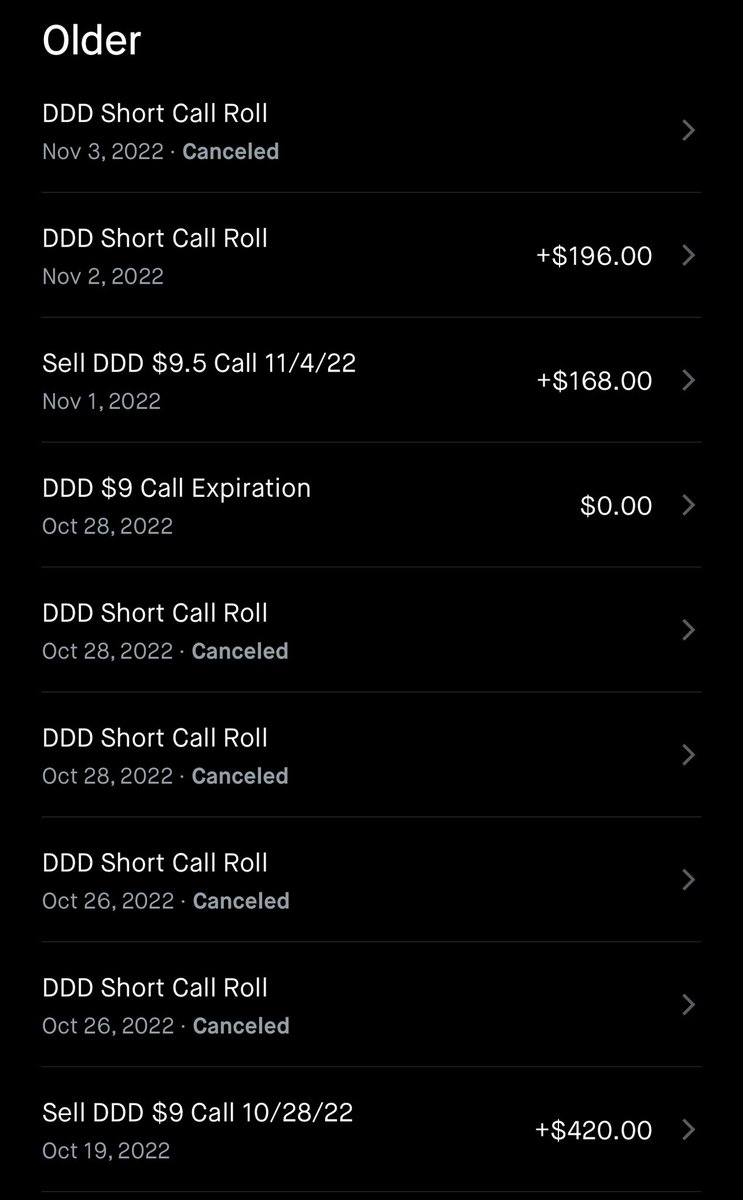

I sold an $AAPL Covered Call on 4/10:

- 4/14 $162.5C

- Premium: $115

$AAPL was around $159 at that time so this was a higher than usual risk that I took by selecting an aggressive strike price

- 4/14 $162.5C

- Premium: $115

$AAPL was around $159 at that time so this was a higher than usual risk that I took by selecting an aggressive strike price

The risk materialized and $AAPL reached ~ $165.2 by expiry

I rolled over the call to 4/21 just prior to close on 4/14

Same strike price

Premium: $95

It was a risk by rolling over in the money but I was willing to be patient

I rolled over the call to 4/21 just prior to close on 4/14

Same strike price

Premium: $95

It was a risk by rolling over in the money but I was willing to be patient

The $AAPL price kept moving up

On 4/19 $AAPL was $168

My call option was almost $6 in the money

But on 4/20 and 4/21 $AAPL retreated by $3 and was around $165 again

But still above my strike so I rolled it to 4/28 $162.5 on 4/21

Premium: $109

On 4/19 $AAPL was $168

My call option was almost $6 in the money

But on 4/20 and 4/21 $AAPL retreated by $3 and was around $165 again

But still above my strike so I rolled it to 4/28 $162.5 on 4/21

Premium: $109

The call is still about $2.5 in the money

The current value of this option is $3.55

Altogether I have made $319 in premiums in 11 days

If $AAPL closes below $162.5 by 4/28 the call will expire worthless

If it doesn’t then I will keep playing this rollover game

The current value of this option is $3.55

Altogether I have made $319 in premiums in 11 days

If $AAPL closes below $162.5 by 4/28 the call will expire worthless

If it doesn’t then I will keep playing this rollover game

$AAPL has had 25% run in 3 months so I am okay remaining patient

I will keep collecting premiums and wait until one week the call expires

If $AAPL heads higher to $170+ then I might move the call out by 2+ weeks increasing the strike price by $1-2

I will keep collecting premiums and wait until one week the call expires

If $AAPL heads higher to $170+ then I might move the call out by 2+ weeks increasing the strike price by $1-2

To summarize:

- Covered Calls are profitable

- Covered Calls have RISKS

- The risks can be managed

- You can buy more time

- Theta Decay is option seller’s friend

- Trades will go against you sometimes

- Covered Calls are profitable

- Covered Calls have RISKS

- The risks can be managed

- You can buy more time

- Theta Decay is option seller’s friend

- Trades will go against you sometimes

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter