A DeFi strategy that u can sleep at night while depolying 80% of ur capital in.

its not sexy but it works

🔥 Battle tested Smart contract

🔥 Blue Chip crypto only exposure

🔥 Real non ponzi yield

🔥 prefect DCA product with Yield

its not sexy but it works

🔥 Battle tested Smart contract

🔥 Blue Chip crypto only exposure

🔥 Real non ponzi yield

🔥 prefect DCA product with Yield

Introducing TriCrypto on @CurveFinance

18.45%apr on @arbitrum

13.17%apr on #Etherum

25.15%apr on @avax

35.81%apr on @FantomFDN

In this thread

1️⃣ What is TriCrypto

2️⃣ Why is TriCrypto something i can recommend frens

3️⃣ When should u enter

4️⃣ Tutorial

18.45%apr on @arbitrum

13.17%apr on #Etherum

25.15%apr on @avax

35.81%apr on @FantomFDN

In this thread

1️⃣ What is TriCrypto

2️⃣ Why is TriCrypto something i can recommend frens

3️⃣ When should u enter

4️⃣ Tutorial

1️⃣ What is TriCrypto

It is a Curve's v2 liquidity pool with

- stablecoin ( which stables depends on chain)

- BTC

- ETH

with 33% of each asset each.

Its yield is from trading fees & incentivized emission yield from curve

It is a Curve's v2 liquidity pool with

- stablecoin ( which stables depends on chain)

- BTC

- ETH

with 33% of each asset each.

Its yield is from trading fees & incentivized emission yield from curve

2️⃣ Why is TriCrypto something i can recommend frens

The TriCrypto pool targets to keep 33% of each asset in most time.

Meaning, each 10 usd of tricrypto u hold u are technically holding 3.3 btc, 3.3 eth and 3.3 usd.

The TriCrypto pool targets to keep 33% of each asset in most time.

Meaning, each 10 usd of tricrypto u hold u are technically holding 3.3 btc, 3.3 eth and 3.3 usd.

If btc & eth goes down in price, because the pool targets to keep at 33% essentially u will be buying the dip.

u will have more number of tokens in btc & eth

If btc & eth goes up in price, tricrypto will essenitally sell some of the eth btc to keep the 33% balance

u will have more number of tokens in btc & eth

If btc & eth goes up in price, tricrypto will essenitally sell some of the eth btc to keep the 33% balance

Why is it good?

🔥 Battle tested smart contract

🔥 66% exposure in btc & eth with auto rebalancing + yield is something you can comfortablely depoly large amount of capital

🔥 if someone wants stress free exposure to crypto with some yield, this is what i recommend

🔥 Battle tested smart contract

🔥 66% exposure in btc & eth with auto rebalancing + yield is something you can comfortablely depoly large amount of capital

🔥 if someone wants stress free exposure to crypto with some yield, this is what i recommend

3️⃣ When should u enter

Because it still has 66% delta exposure in btc n eth. ideally u want to enter when u think

🔹 the market is near bottom for a rebound

🔹 market will be sideways for a while

Because it still has 66% delta exposure in btc n eth. ideally u want to enter when u think

🔹 the market is near bottom for a rebound

🔹 market will be sideways for a while

If u are a god tier trader n can time the market

🔹 enter near low

🔹 sideways a bit so u have time to accumulate yield

🔹 as the market picks up u unwind the position into BTC & ETH only so it doesn't sell ur upside

🔹 enter near low

🔹 sideways a bit so u have time to accumulate yield

🔹 as the market picks up u unwind the position into BTC & ETH only so it doesn't sell ur upside

4️⃣ Tutorial

Go to @CurveFinance & to their site

depending on which chain u want to join

(will be using arbitrum for tutorial purpose)

Go to @CurveFinance & to their site

depending on which chain u want to join

(will be using arbitrum for tutorial purpose)

Enter the pool with ur prefered asset.

Do take note on slippage Loss or bonus

when they pool is imbalance, u will get more or less LP token

Also if u are supply BTC ETH, u are essentially selling 33% into stable

and if u are buying with stable u are essentially buy 66% btc,eth

Do take note on slippage Loss or bonus

when they pool is imbalance, u will get more or less LP token

Also if u are supply BTC ETH, u are essentially selling 33% into stable

and if u are buying with stable u are essentially buy 66% btc,eth

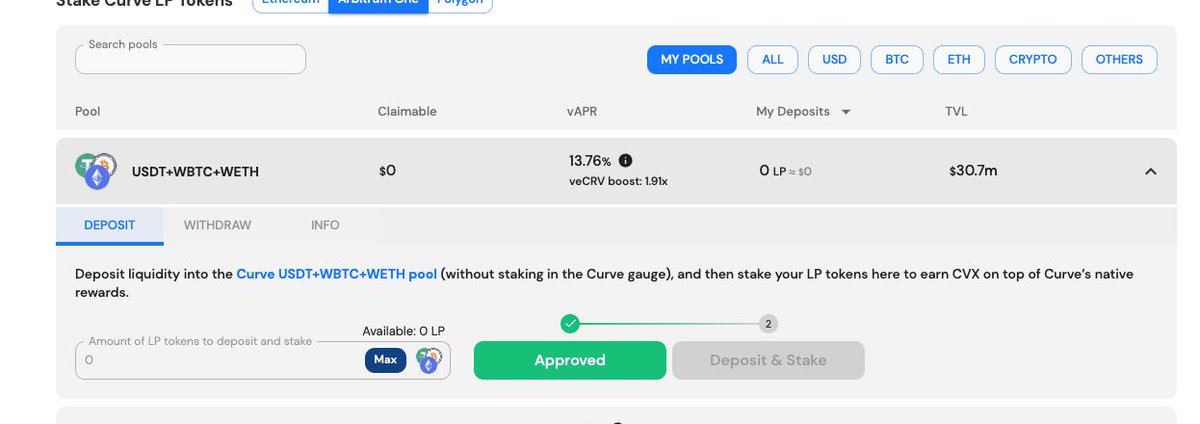

Go to @ConvexFinance for the boosted yield

Select the right chain

deposit ur LP

Claim ur yield time to time

Select the right chain

deposit ur LP

Claim ur yield time to time

@CurveFinance is old but gold, the typically kol will just shill u the newest thing, i shill things that work.

Face it, market is going stale if people are still talking u into idos either the project is really good or they are not ur friend.

Sometimes boring is what works

Face it, market is going stale if people are still talking u into idos either the project is really good or they are not ur friend.

Sometimes boring is what works

Old strategy thats works n u can sleep at night

@milesdeutscher

@CJCJCJCJ_

@DAdvisoor

@CryptoKoryo

@alpha_pls

@0xTindorr

@Chinchillah_

@defi_mochi

@CryptoShiro_

@CryptoDragonite

@rickawsb

@rektdiomedes

@thelearningpill

@0xJamesXXX

@crypto_linn

@DeFi_Cheetah

@crypthoem

@milesdeutscher

@CJCJCJCJ_

@DAdvisoor

@CryptoKoryo

@alpha_pls

@0xTindorr

@Chinchillah_

@defi_mochi

@CryptoShiro_

@CryptoDragonite

@rickawsb

@rektdiomedes

@thelearningpill

@0xJamesXXX

@crypto_linn

@DeFi_Cheetah

@crypthoem

Old strategy thats works n u can sleep at night

@TechFlowPost

@Alvin0617

@arndxt_xo

@defitrader_

@0xsurferboy

@Louround_

@ChadCaff

@ThorHartvigsen

@0xSalazar

@WinterSoldierxz

@schizoxbt

@ViktorDefi

@poopmandefi

@Slappjakke

@CurveCap

@mrblocktw

@TechFlowPost

@Alvin0617

@arndxt_xo

@defitrader_

@0xsurferboy

@Louround_

@ChadCaff

@ThorHartvigsen

@0xSalazar

@WinterSoldierxz

@schizoxbt

@ViktorDefi

@poopmandefi

@Slappjakke

@CurveCap

@mrblocktw

• • •

Missing some Tweet in this thread? You can try to

force a refresh