I know a trader that makes $10,000+ every month

He only uses ONE system

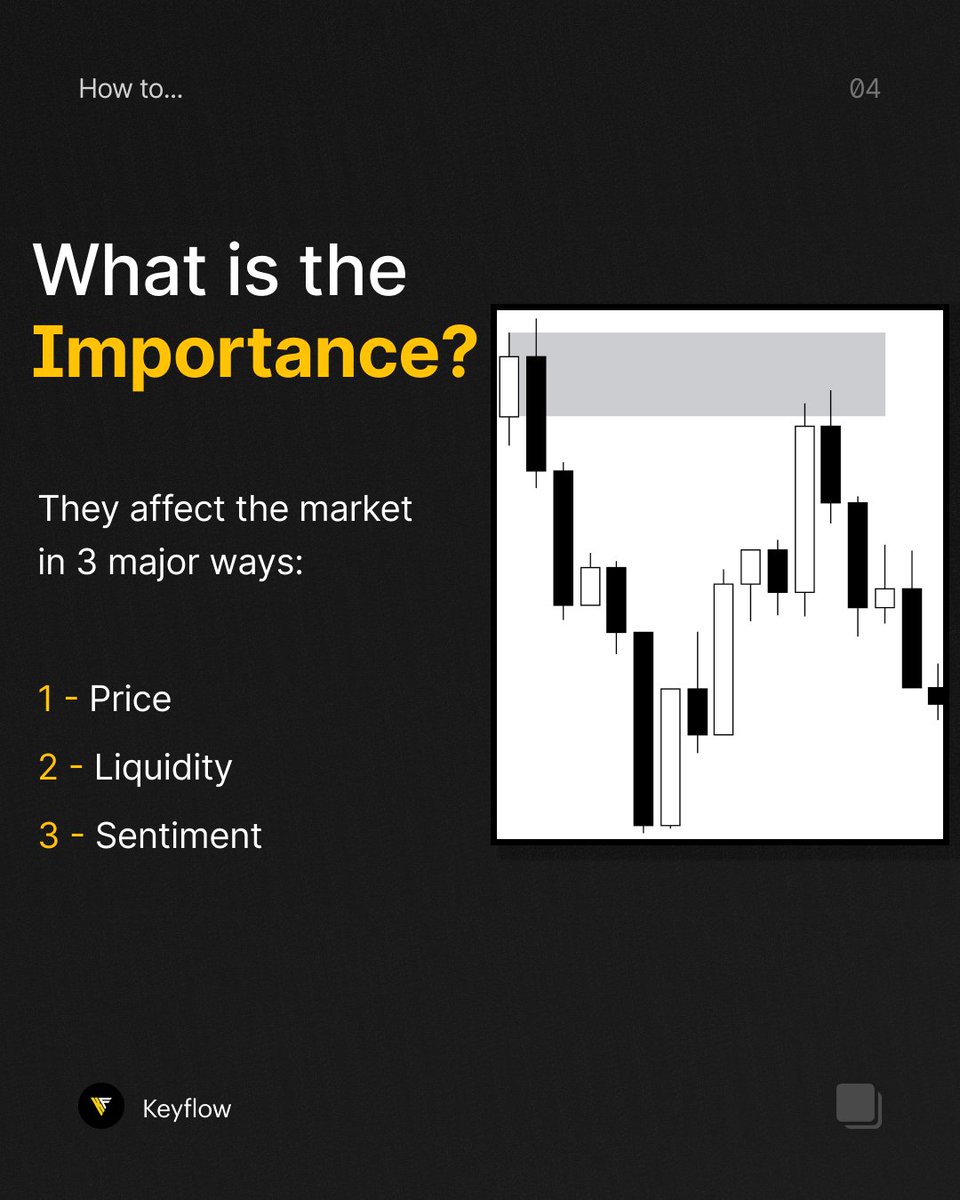

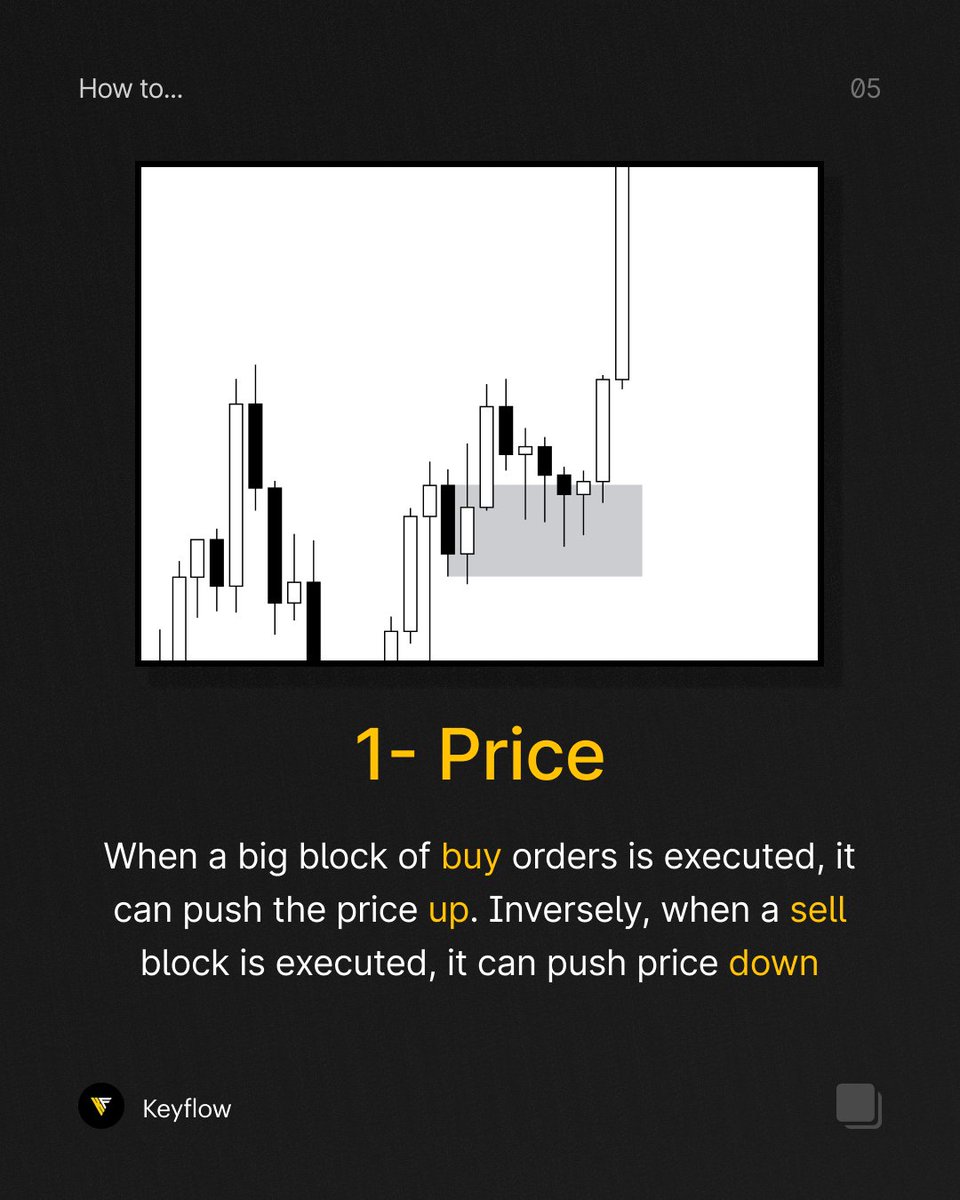

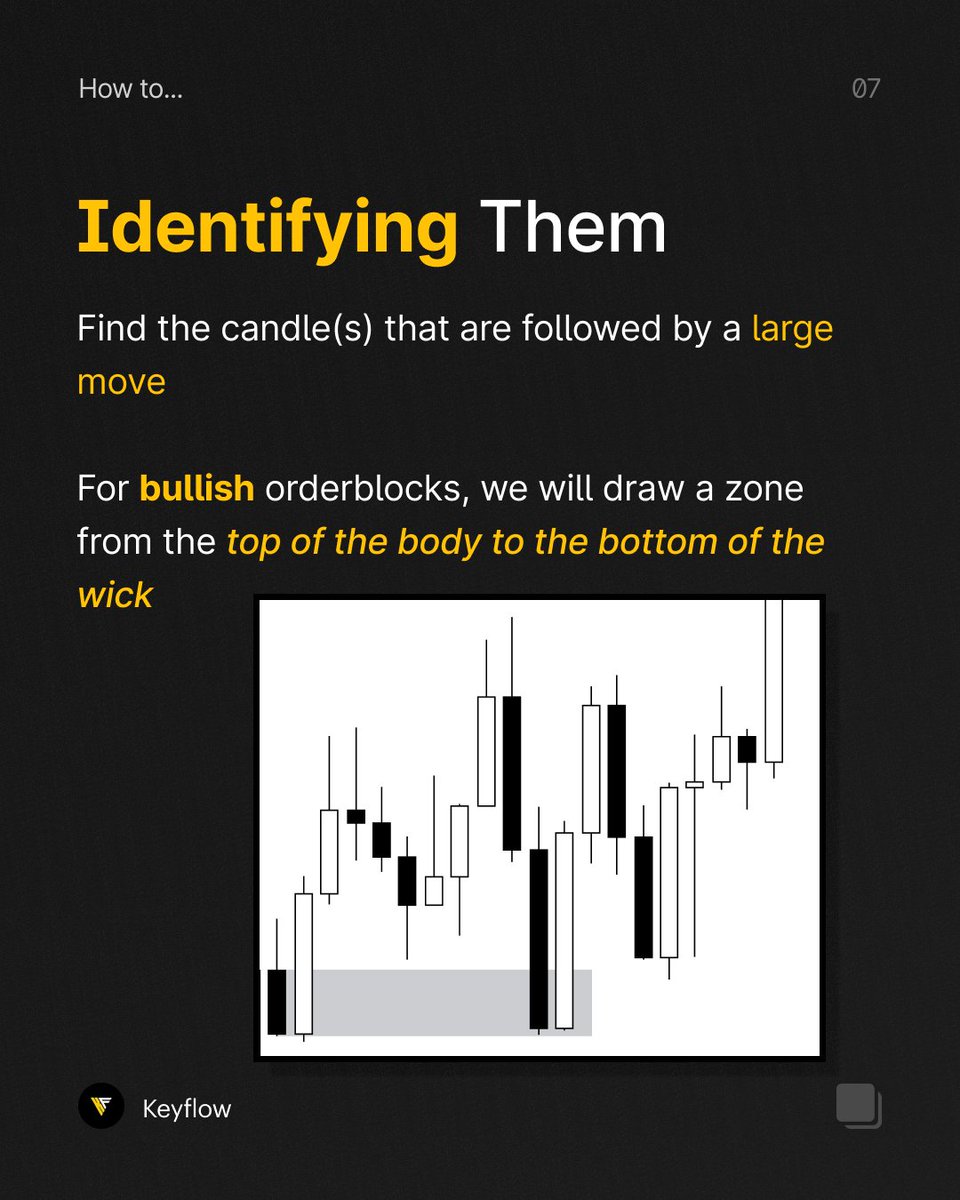

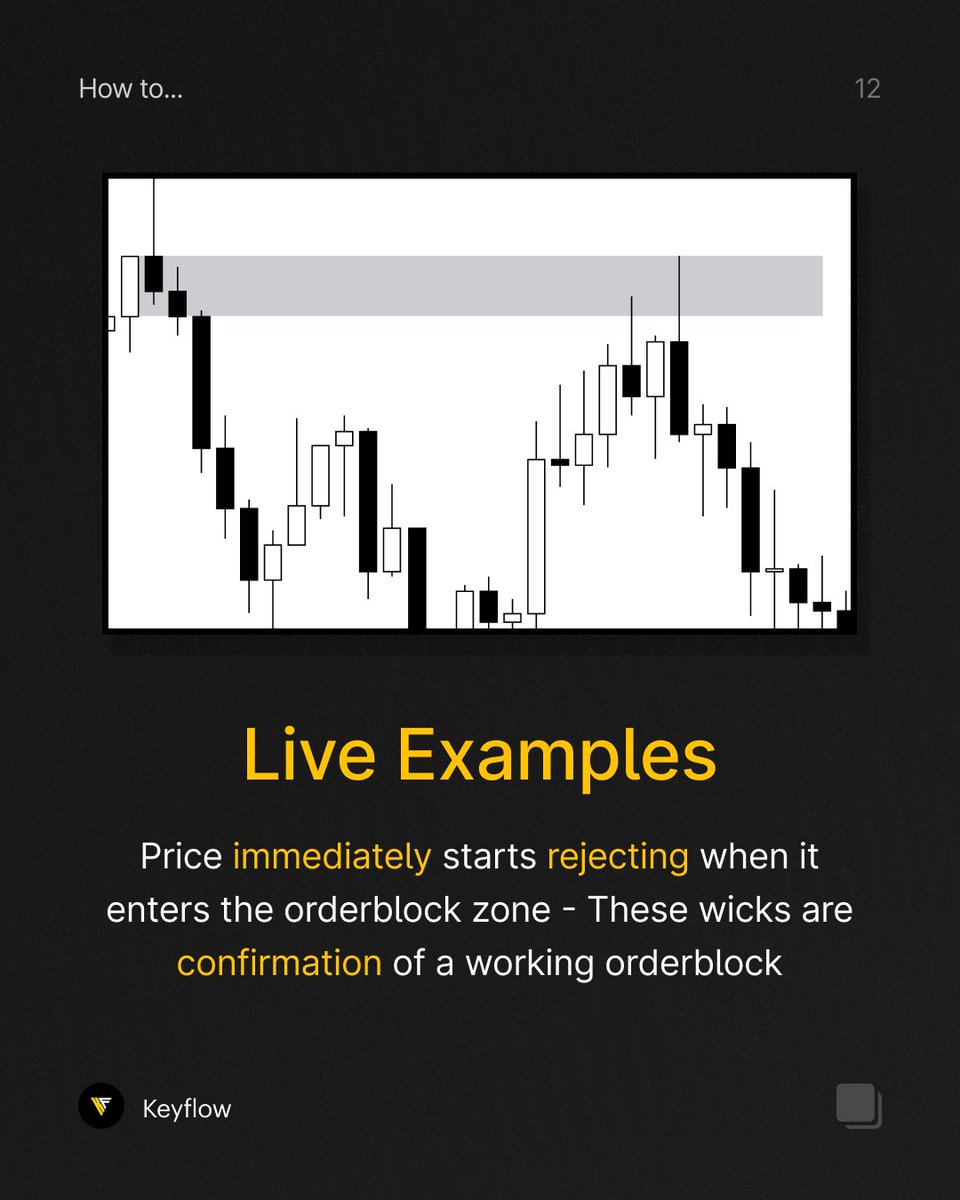

Orderblocks.

Let's get into them 👇

He only uses ONE system

Orderblocks.

Let's get into them 👇

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter