HOW TO FIND THE DRAW ON LIQUIDITY 🧲 #ICT

this mini thread will go over the key basics to understanding where the market is likely to go (1/3)

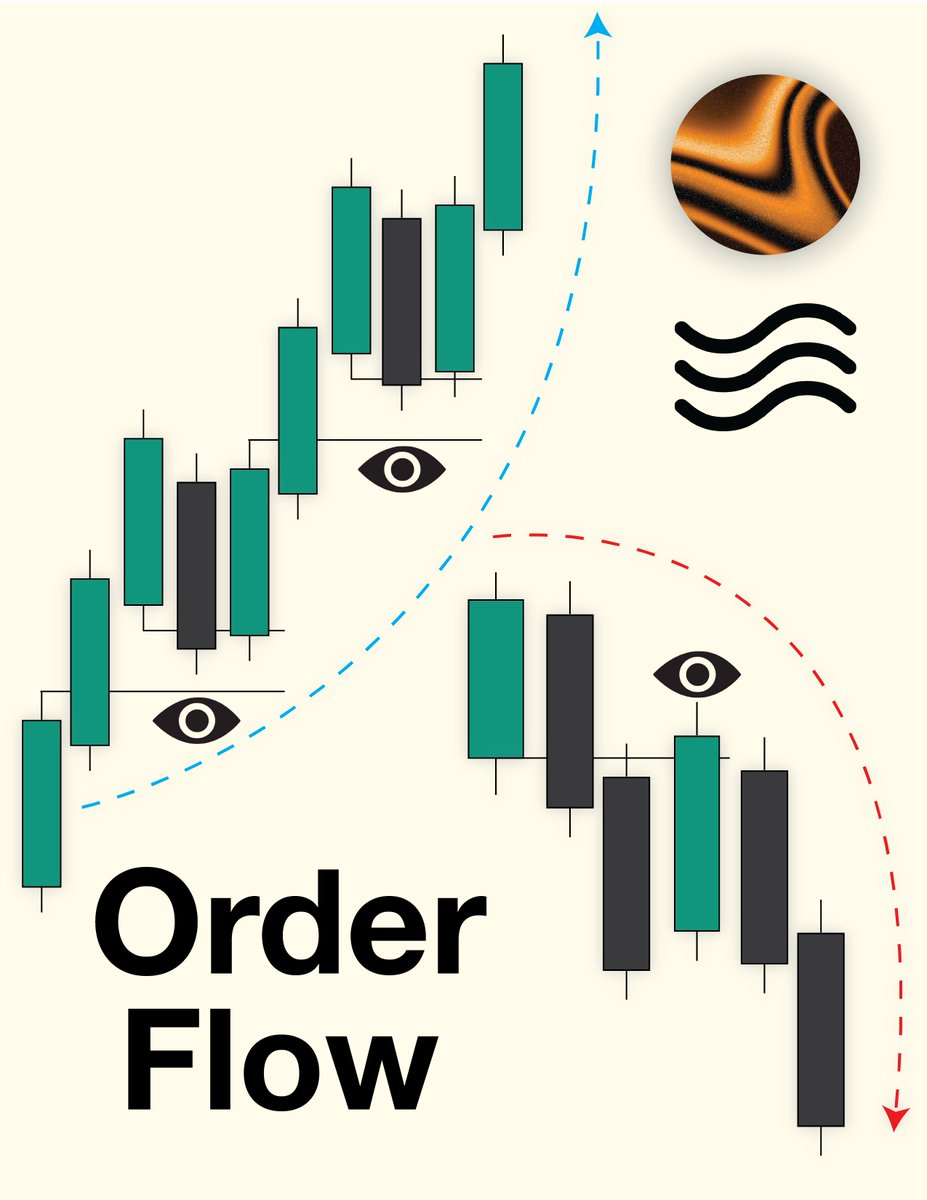

Key components to DOL

- Equal Highs (eqh)

- Support Levels

- Resistance levels

[ $ES 1H]

this mini thread will go over the key basics to understanding where the market is likely to go (1/3)

Key components to DOL

- Equal Highs (eqh)

- Support Levels

- Resistance levels

[ $ES 1H]

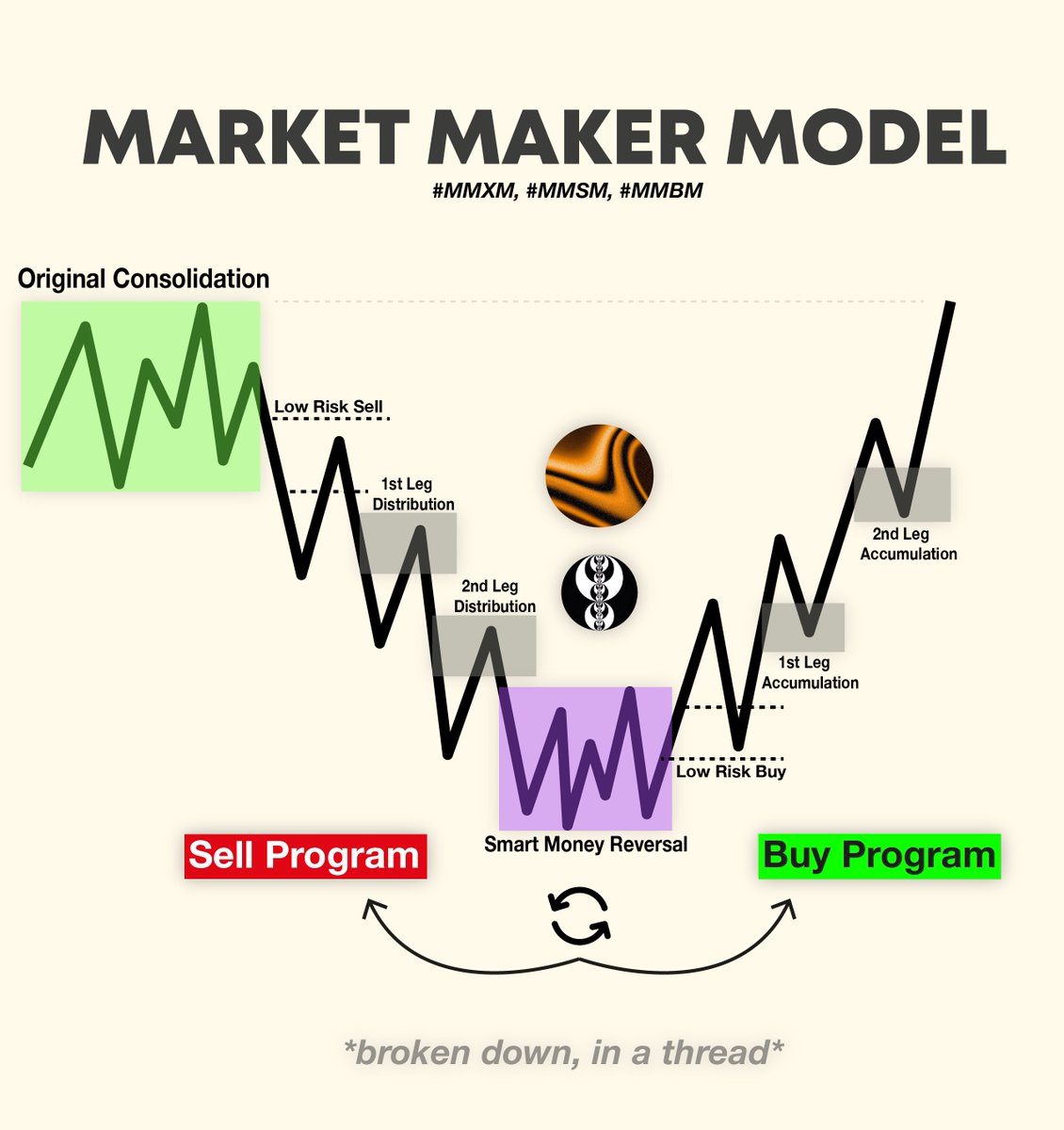

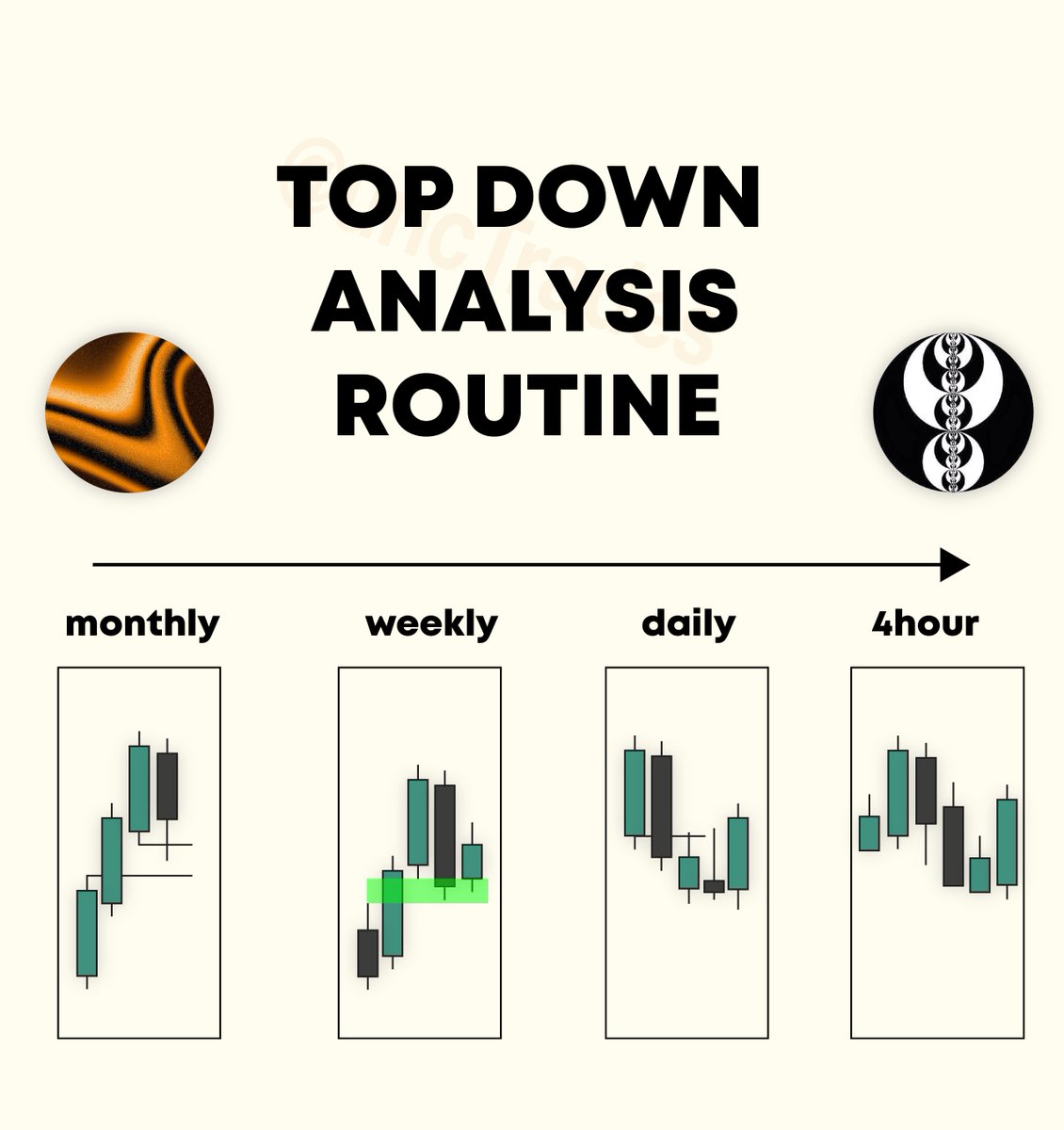

First off, for anyone new to ICT / SMC

the DOL is simply HTF highs & lows,

The first thing you should be asking your self before trading is "Where is the market drawing to"

take this for example 👇

Price takes the low & as you would expect, price began to reverse. (2/3)

the DOL is simply HTF highs & lows,

The first thing you should be asking your self before trading is "Where is the market drawing to"

take this for example 👇

Price takes the low & as you would expect, price began to reverse. (2/3)

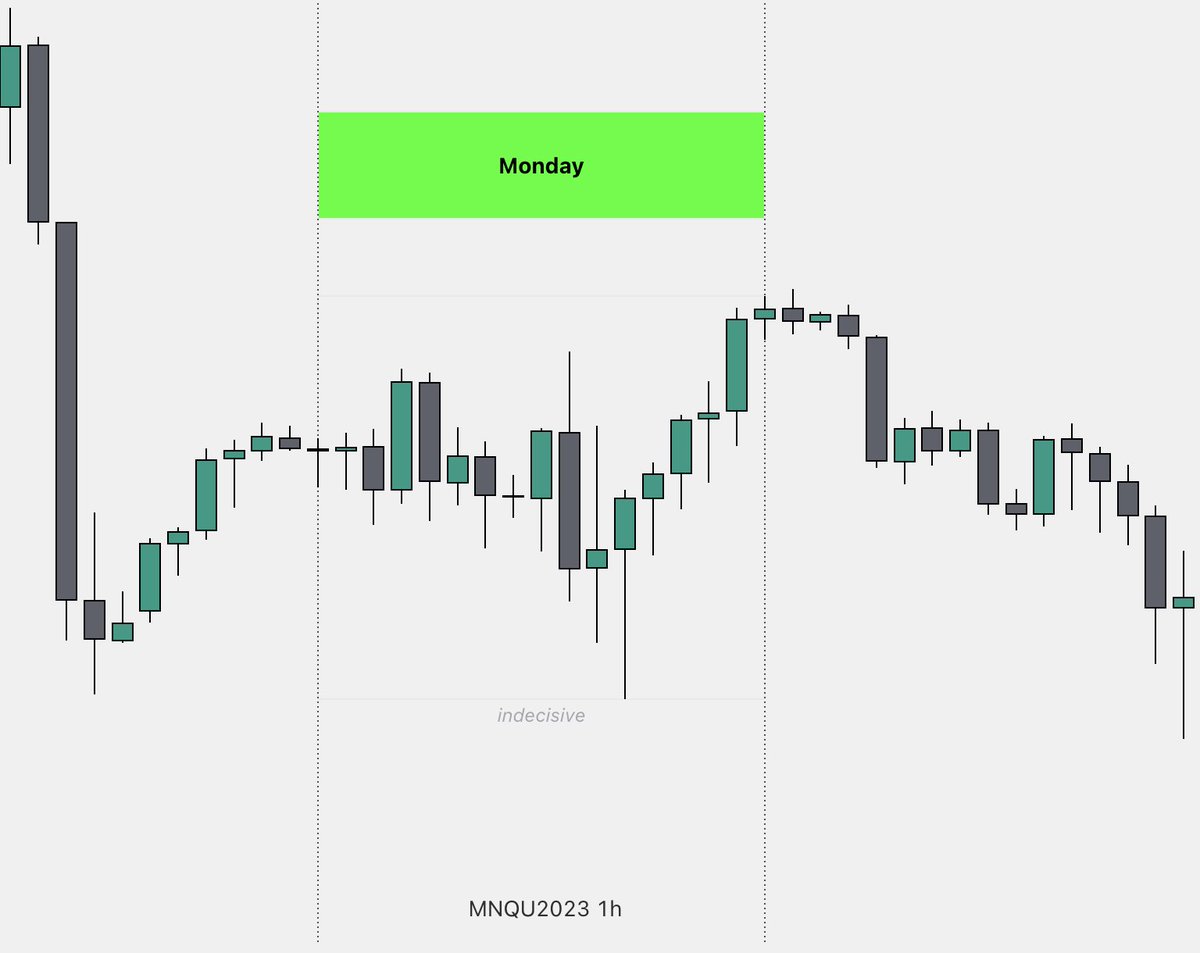

Not always will price go from A - B

Usually a short term swing low / high or EQH / EQH will be created in the process

if you automatically assume your bullish after SSL gets taken you're most likely going to lose a trade

Usually a short term swing low / high or EQH / EQH will be created in the process

if you automatically assume your bullish after SSL gets taken you're most likely going to lose a trade

Your draw on liquidity doesn't even have to be a side of liquidity, it could be any imbalance like..

FVG, OB, VI, Liquidity Void

Chart below is $ES [Weekly]

FVG, OB, VI, Liquidity Void

Chart below is $ES [Weekly]

To summarize this thread:

Your main focus should be figuring out WHERE DOL rest and WHEN will we get there 😉

if you take enough notes you will notice there is specific times when price will rush towards the liquidity

FEEL FREE TO DM ME ANYTHING I ALWAYS READ IT

Your main focus should be figuring out WHERE DOL rest and WHEN will we get there 😉

if you take enough notes you will notice there is specific times when price will rush towards the liquidity

FEEL FREE TO DM ME ANYTHING I ALWAYS READ IT

FORGOT TO ADD

I do have a server for anyone to join! If you want more tips / questions JOIN

not the biggest server one of the best i promise you 🤞

discord.gg/QFmUz6ja3A

I do have a server for anyone to join! If you want more tips / questions JOIN

not the biggest server one of the best i promise you 🤞

discord.gg/QFmUz6ja3A

• • •

Missing some Tweet in this thread? You can try to

force a refresh