Speculators are extremely short on the SP500

Similar to 2020, 2015, 2011 and 2007

A short thread 🧵

Similar to 2020, 2015, 2011 and 2007

A short thread 🧵

2/ Net positioning in the futures market is often a good contrarian indicator

But there's a crucial caveat often overlooked by investors

But there's a crucial caveat often overlooked by investors

3/ Bulls point out that high levels of net short positioning successfully predicted market bottoms in:

- 2020

- 2015

- 2011

- 2020

- 2015

- 2011

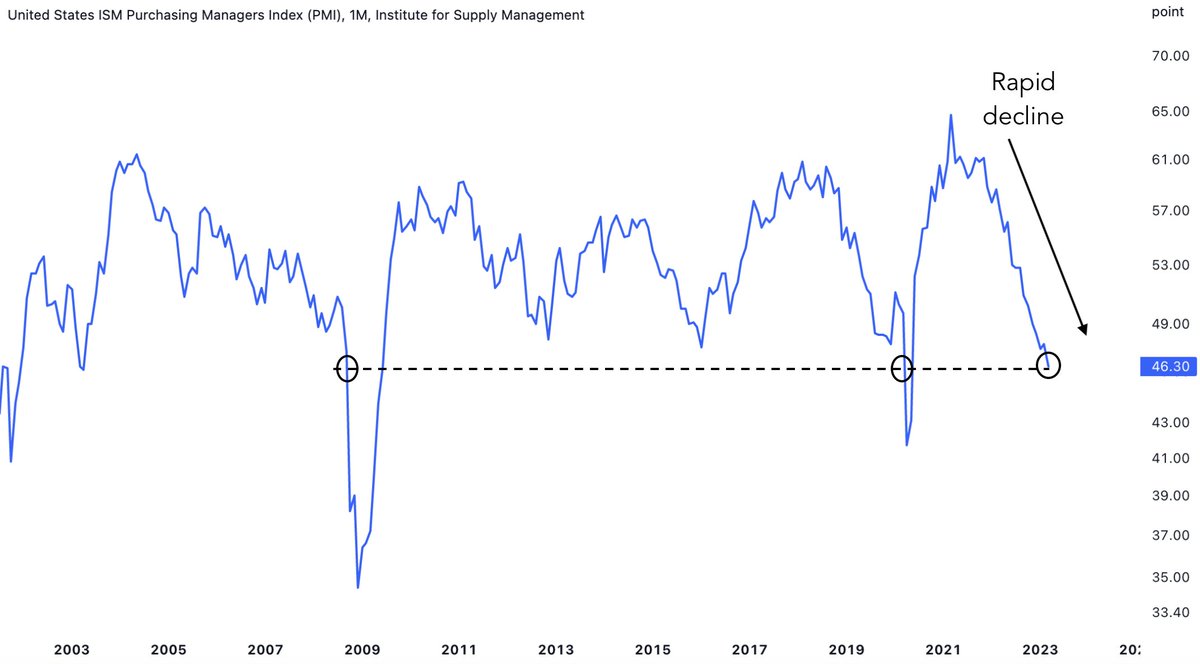

4/ However, similar net short levels also preceded the 2007 top

Which eventually led to the Financial Crisis

Which eventually led to the Financial Crisis

5/ Extreme short positioning isn't always a reliable contrarian indicator

The key difference lies in the monetary policy environment

The key difference lies in the monetary policy environment

6/ In 2011 and 2015, a steep 10y-2y yield curve signaled easy monetary policy

An accommodative Fed combined with net short positioning, marked market bottoms in both cases

An accommodative Fed combined with net short positioning, marked market bottoms in both cases

7/ In 2020, massive stimulus flooded the system with liquidity

Which caught short positions off guard following C19

Which caught short positions off guard following C19

8/ In contrast, in 2007, the Fed was tightening monetary policy with rate hikes

Causing the 10y-2y yield curve to invert and leading to a recession and rapid market decline

Causing the 10y-2y yield curve to invert and leading to a recession and rapid market decline

9/ High net short positioning during easy monetary policy increases the likelihood of a market bottom

But when it occurs amid tight monetary policy, shorts often prove accurate

But when it occurs amid tight monetary policy, shorts often prove accurate

10/ Since 2022, the Fed has been aggressively hiking rates, and the 10y-2y yield curve is the most inverted since the 1980s

This suggests that speculators may be making the right call by going short

This suggests that speculators may be making the right call by going short

11/ Investors must consider the monetary policy context when interpreting net short positioning

As of now, the Fed's policy indicates that caution is warranted for those betting on a quick market rebound

As of now, the Fed's policy indicates that caution is warranted for those betting on a quick market rebound

12/ Thanks for reading!

If you found this thread valuable, please ❤️ and 🔁 the first tweet below

And follow @GameofTrades_ for more market insights, finance and investment strategies

If you found this thread valuable, please ❤️ and 🔁 the first tweet below

And follow @GameofTrades_ for more market insights, finance and investment strategies

https://twitter.com/GameofTrades_/status/1652009913256935424

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter