Francois Rochon is a fantastic Quality Investor who has Compounded his Capital by more than 15% annually for almost 30 years🧵📈

Let's take a look at Francois' Investing Strategy and Philosophy so we can learn his Methods and Mental Models 📊

=THREAD=

Let's take a look at Francois' Investing Strategy and Philosophy so we can learn his Methods and Mental Models 📊

=THREAD=

Investment Philosophy 📈

•Time in the market beats timing the market

•The stock market is not efficient in the short term

•Only buy companies with a competitive advantage

•Stocks are the best asset class for long-term investment

•Time in the market beats timing the market

•The stock market is not efficient in the short term

•Only buy companies with a competitive advantage

•Stocks are the best asset class for long-term investment

•Focus on companies with steady margins and high returns on capital

•Good long-term prospects and a dedicated management team are crucial

•If you are right about the business, you’ll eventually be right about the stock

•Good long-term prospects and a dedicated management team are crucial

•If you are right about the business, you’ll eventually be right about the stock

Rochon's Business Analysis Framework 📊

•Outlook - Secular growth

•Valuation - 5-year valuation model

•Financials - High ROC, growth, and low debt

•Business model - Moat, market leader, low cyclicality

•Management quality - Ownership, Capital allocation

•Outlook - Secular growth

•Valuation - 5-year valuation model

•Financials - High ROC, growth, and low debt

•Business model - Moat, market leader, low cyclicality

•Management quality - Ownership, Capital allocation

Competitive advantages are essential 🏰

Not only will a moat protect the cash flows from a business

It will also hedge against inflation, which is an inherent part of our economic system

A business should be able to rise prices in inflationary environments

Not only will a moat protect the cash flows from a business

It will also hedge against inflation, which is an inherent part of our economic system

A business should be able to rise prices in inflationary environments

Rochon's rules for managing expectations 1️⃣/3️⃣

•1/3 years the stock market falls a minimum of 10%

•1/3 stocks we buy will disappoint

•1/3 years we will underperform the index

These rules are great tools to manage your own expectations when things don't go your way.

•1/3 years the stock market falls a minimum of 10%

•1/3 stocks we buy will disappoint

•1/3 years we will underperform the index

These rules are great tools to manage your own expectations when things don't go your way.

Focus on businesses, ignore macroeconomics 📚

Part of Rochon's strategy is to identify quality businesses with a moat

Rochon wants to buy these businesses at a reasonable price (Sounds familiar?)

And he wants to pay as little attention to geopolitics/macro as possible

Part of Rochon's strategy is to identify quality businesses with a moat

Rochon wants to buy these businesses at a reasonable price (Sounds familiar?)

And he wants to pay as little attention to geopolitics/macro as possible

Owners earnings 💰

In the short term, stock prices may fluctuate, but in the long term, they follow the intrinsic value of the company.

Rochon tracks the intrinsic value of a company through its owners' earnings.

Owner earnings is also a metric Buffett uses :

In the short term, stock prices may fluctuate, but in the long term, they follow the intrinsic value of the company.

Rochon tracks the intrinsic value of a company through its owners' earnings.

Owner earnings is also a metric Buffett uses :

Share your mistakes ⛔

Rochon has a tradition of sharing mistakes he has made over the years

From his 2022 letter, we can read about his mistake of not buying LVMH when it was trading at a PE of 16

Rubbing your nose in your mistakes will force you to learn from them

Rochon has a tradition of sharing mistakes he has made over the years

From his 2022 letter, we can read about his mistake of not buying LVMH when it was trading at a PE of 16

Rubbing your nose in your mistakes will force you to learn from them

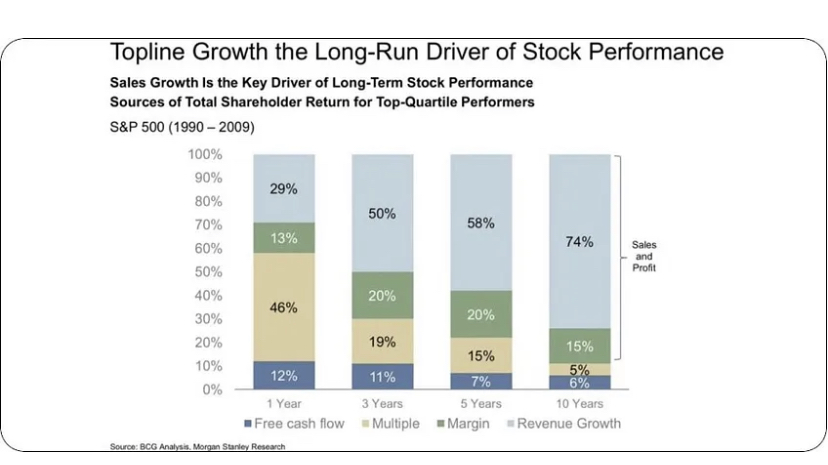

Multiple contraction and expansion 📊

In the short term, the stock market is a voting machine, in the long term, it's a weighing machine.

Stocks will eventually follow the fundamentals. Rochon follows the owner's earnings and ignores the noise.

In the short term, the stock market is a voting machine, in the long term, it's a weighing machine.

Stocks will eventually follow the fundamentals. Rochon follows the owner's earnings and ignores the noise.

3 Essential Traits for a Successful Investor 🧠

1. Patience: It can take several years before the market recognizes the true value of a business

2. Rationality: i) Ignore fads, ii) Ignore short-term noise iii) focus on what you can control

3. Humilty: Continuous improvement

1. Patience: It can take several years before the market recognizes the true value of a business

2. Rationality: i) Ignore fads, ii) Ignore short-term noise iii) focus on what you can control

3. Humilty: Continuous improvement

Patience is a virtue for investors 👴

One important trait for all investors that both Rochon and Munger talk about, is the ability to defer gratification.

The same applies to patience after investing in a business, let the story play out before you react.

One important trait for all investors that both Rochon and Munger talk about, is the ability to defer gratification.

The same applies to patience after investing in a business, let the story play out before you react.

Don't cut the flowers and water the weeds 💐

Oftentimes, your biggest mistake in the markets will be selling a stock too early.

One should aim to be long-term in stocks, as there is an edge to having a long-term view. Rochon prefers a holding period of +6 years.

Oftentimes, your biggest mistake in the markets will be selling a stock too early.

One should aim to be long-term in stocks, as there is an edge to having a long-term view. Rochon prefers a holding period of +6 years.

Rochon has great mental models and frameworks that make him a brilliant investor 🧠

His philosophy emphasizes:

- Focus on intrinsic value and quality

- Great management

- Business Outlook

- Owner earnings

- Long-term

- Patience

Simple, not easy.

His philosophy emphasizes:

- Focus on intrinsic value and quality

- Great management

- Business Outlook

- Owner earnings

- Long-term

- Patience

Simple, not easy.

If you enjoyed this thread, please:

1. Follow me (@InvestInAssets) for more

2. Retweet the 1st tweet below to share this thread

I write about my journey as a private investor focusing on high-quality businesses

1. Follow me (@InvestInAssets) for more

2. Retweet the 1st tweet below to share this thread

I write about my journey as a private investor focusing on high-quality businesses

https://twitter.com/InvestInAssets/status/1652605242419351552

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter