#Hindenburg strikes again!

This time against the legendary Carl Icahn.

We know reading 7000 words can be too much for you.

So we have read every word of it and summarized it for you.

No ChatGPT involved :)

A 🧵

Let's go!

This time against the legendary Carl Icahn.

We know reading 7000 words can be too much for you.

So we have read every word of it and summarized it for you.

No ChatGPT involved :)

A 🧵

Let's go!

Carl operates his money through a publicly-listed holding company. He holds an 85% stake.

This #hindenburgresearch report is a masterclass on how to assess a Holdco.

We are not in it for knowing whether its short attempt will be another success or not.

Top 7 insights👇

This #hindenburgresearch report is a masterclass on how to assess a Holdco.

We are not in it for knowing whether its short attempt will be another success or not.

Top 7 insights👇

1. Always check the actual value of the reported investment

Hindenburg says Icahn overstated the value of his holdings by 22% Vs its current NAV.

CMP implies a 218% premium to NAV.🤯

Hindenburg says Icahn overstated the value of his holdings by 22% Vs its current NAV.

CMP implies a 218% premium to NAV.🤯

2. Never trust brokerages

Takes a shot against Jefferies, the only i-bank having a 'buy' rating.

"Jefferies is luring in retail investors under the guise of IEP’s ‘safe’ dividend, while also selling Bn in IEP units through its i-banking arm to support the very same dividend"

Takes a shot against Jefferies, the only i-bank having a 'buy' rating.

"Jefferies is luring in retail investors under the guise of IEP’s ‘safe’ dividend, while also selling Bn in IEP units through its i-banking arm to support the very same dividend"

3. Sustenance of Earnings & Dividends?

'Collect A 15.8% Dividend Yield While Investing Alongside Legendary Corporate Raider Carl Icahn"

That's the story being sold.

Reality: Where are the cashflows?

'Collect A 15.8% Dividend Yield While Investing Alongside Legendary Corporate Raider Carl Icahn"

That's the story being sold.

Reality: Where are the cashflows?

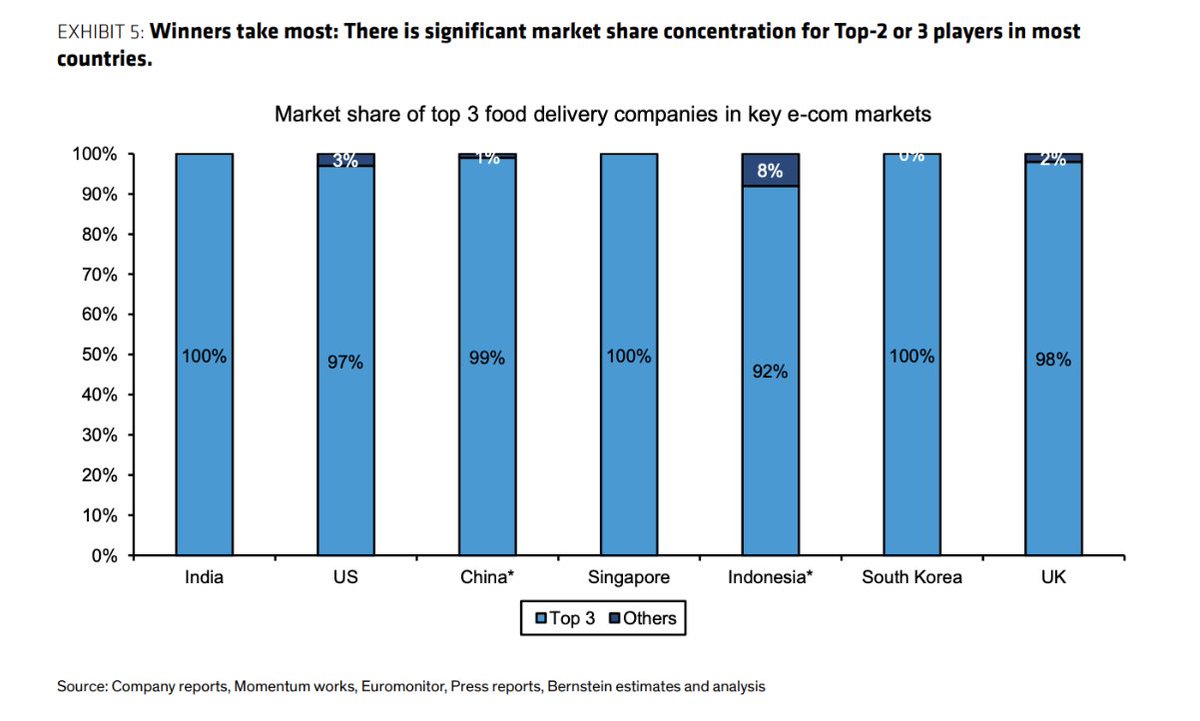

4. Valuation Vs the peers?

While the peers are trading at par or some even at a discount of their NAV.

The list includes Icahn's long-time rival Bill Ackman of the perishing square that is trading at a 34% discount!

Icahn is trading at a whopping 218% premium.

While the peers are trading at par or some even at a discount of their NAV.

The list includes Icahn's long-time rival Bill Ackman of the perishing square that is trading at a 34% discount!

Icahn is trading at a whopping 218% premium.

5. Leverage is a double-edged sword

Debt 5Bn dollars

Annual debt repayments for 3-4 years; 1 Bn Dollars

Current Market Cap 18 Bn Dollars!

The only way to sustain these high dividends is to take up more debt.

But for how long?

And what does the end game look like?

Debt 5Bn dollars

Annual debt repayments for 3-4 years; 1 Bn Dollars

Current Market Cap 18 Bn Dollars!

The only way to sustain these high dividends is to take up more debt.

But for how long?

And what does the end game look like?

6. Promoter's financial muscle

Contrary to popular views, Icahn seems to be under serious financial strain.

Icahn has pledged close to 60% of his holdings.

How will he bail out his Holdco?

Contrary to popular views, Icahn seems to be under serious financial strain.

Icahn has pledged close to 60% of his holdings.

How will he bail out his Holdco?

7. Being a contrarian needs "Courage" more than anything else.

Hindenburg's past record highlights the superlative record one can attain by being a contrarian.

Hindenburg's past record highlights the superlative record one can attain by being a contrarian.

Most of us were glued to the #HindenburgReport on #AdaniEnterprises only because that directly impacted our market.

You cannot ignore these reports as who knows the same pattern may repeat in an Indian company too.

Learning from this report can save you from a landmine.

You cannot ignore these reports as who knows the same pattern may repeat in an Indian company too.

Learning from this report can save you from a landmine.

Here's the link to the full report in case you wish to read it in full just as we did.

hindenburgresearch.com/icahn/

hindenburgresearch.com/icahn/

• • •

Missing some Tweet in this thread? You can try to

force a refresh