Entry Models are worthless without knowing the draw on liquidity. Use these narratives to find the draw on liquidity.

https://twitter.com/Dangstrat/status/1654458625035739137?s=20

There are more entry models but here are 6 entry models that I use:

1. FVG

2. BRK

3. OB

4. BPR

5. MSS

6. Turtle Soup

When you have multiple entry models in alignment this is the "Unicorn" entry which means it's higher probability.

1. FVG

2. BRK

3. OB

4. BPR

5. MSS

6. Turtle Soup

When you have multiple entry models in alignment this is the "Unicorn" entry which means it's higher probability.

1. Fair Value Gaps (FVG)

https://twitter.com/dangstrat/status/1646094745796583424?s=46&t=L2ac2_4DeGqw31-SAbhe6Q

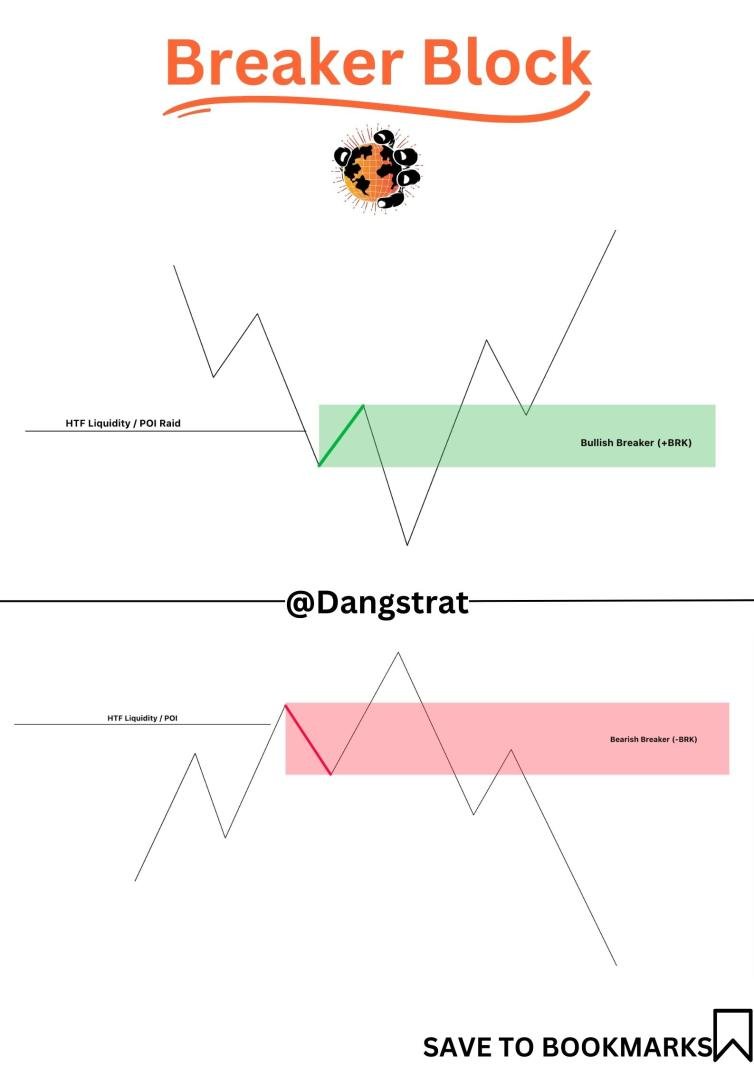

2. Breaker Blocks (BRK)

https://twitter.com/Dangstrat/status/1647911678397366272?s=20

3. Orderblocks (OB)

https://twitter.com/Dangstrat/status/1646820503082999809?s=20

4. Balanced Price Range (BPR)

https://twitter.com/Dangstrat/status/1652352608269418499?s=20

5. Market Structure Shift (MSS)

https://twitter.com/Dangstrat/status/1640750954524934165?s=20

The most common entry models for me are FVGs, BRKs, OBs, BPRs. The entry comes after liquidity raids & market structure shifts when there is a clear draw on liquidity and narrative.

The least common entry models for me are market orders after MSS & Turtle Soups.

FVG/BRK/OB/BPR are all retracement entries for better Risk/Reward after market structure shift. When MSS happens the only time I enter on a market order is if the risk/reward is still good.

FVG/BRK/OB/BPR are all retracement entries for better Risk/Reward after market structure shift. When MSS happens the only time I enter on a market order is if the risk/reward is still good.

The 'fu' on my charts are Turtle Soups which are smart money reversals. For successful turtle soup entries you need a HTF PD Array / POI to back up the high/low liquidity raid. You're expecting price to sweep liquidity and reject the PD Array/POI for a reversal.

Here is a link to join my Discord! Sign up for my Lifetime Membership to get live access to my real time trade signals. whop.com/dangstrat

Here is my Notion link to access more free educational content from me. ossified-ground-684.notion.site/Dangstrat-Trad…

I spend hours just to make one thread so if this thread helped, please like and retweet for more educational content and for others to see! Thank you for your support🧡

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter