Did you know that some people make millions from airdrops by farming them with hundreds or even thousands of accounts?

I’m probably going to get hate for revealing these secrets...

...but here you go 🧵👇

I’m probably going to get hate for revealing these secrets...

...but here you go 🧵👇

Disclaimer: I do not condone nor encourage Sybil attacks. The following information is provided for educational purposes only to understand how it happens.

I interviewed a pro - let's call him Marlon - and this is what he said 👇

1/

I will reveal all my secrets:

We'll cover everything from on-chain preparations and advanced wallet management, to distributing assets without looking like a Sybil.

Plus, essential tools and tips that'll save you time and keep you from making costly mistakes.

I will reveal all my secrets:

We'll cover everything from on-chain preparations and advanced wallet management, to distributing assets without looking like a Sybil.

Plus, essential tools and tips that'll save you time and keep you from making costly mistakes.

2/

Airdrops involve distributing free tokens for various actions during a project's early stages as a way to reward early supporters.

There are two primary reasons for giving away free tokens:

• Gaining attention

• Addressing legal issues

Airdrops involve distributing free tokens for various actions during a project's early stages as a way to reward early supporters.

There are two primary reasons for giving away free tokens:

• Gaining attention

• Addressing legal issues

3/

Airdrops bring hype, liquidity and value justification to crypto projects.

Many projects are avoiding SEC interference by ditching token sales for giveaways. Aptos rewarded users for passing KYC, testnet participation and minting special NFTs.

Airdrops bring hype, liquidity and value justification to crypto projects.

Many projects are avoiding SEC interference by ditching token sales for giveaways. Aptos rewarded users for passing KYC, testnet participation and minting special NFTs.

4/

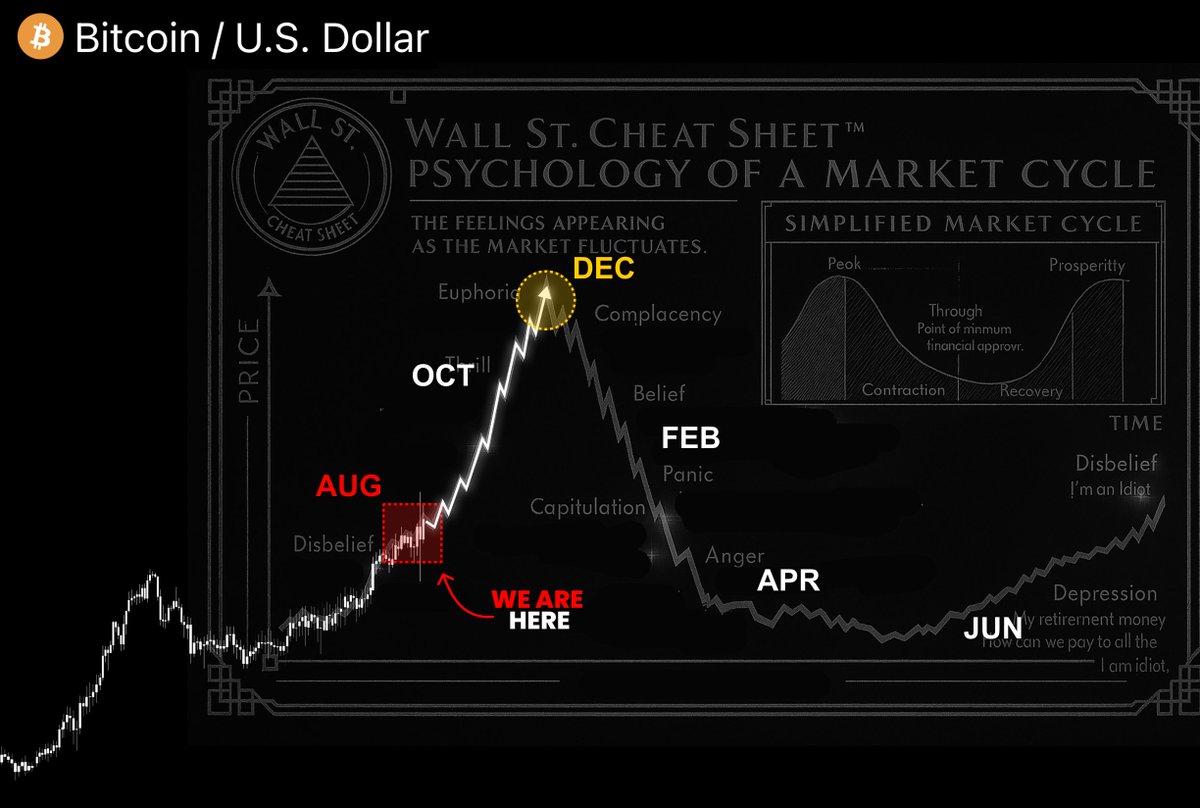

Potential earnings from airdrops:

Two years of focusing on airdrop activities with a small deposit could have earned you at least six figures on these projects 👇

2021:

• ENS (~1k-15k$)

• DYDX (~5k-100k$)

• Biconomy (~8k-25k$)

• Paraswap (~5k-15k$)

Potential earnings from airdrops:

Two years of focusing on airdrop activities with a small deposit could have earned you at least six figures on these projects 👇

2021:

• ENS (~1k-15k$)

• DYDX (~5k-100k$)

• Biconomy (~8k-25k$)

• Paraswap (~5k-15k$)

5/

2022:

• Goldfinch (~1k-20k$)

• Project Galaxy (~1k-15k$)

• Optimism (~1k-40k$)

• Hashflow (~1k-100k$)

• Aptos (~1k-3k$)

• Blur (~1k-100k)

• Arbitrum (~1k-15k)

2022:

• Goldfinch (~1k-20k$)

• Project Galaxy (~1k-15k$)

• Optimism (~1k-40k$)

• Hashflow (~1k-100k$)

• Aptos (~1k-3k$)

• Blur (~1k-100k)

• Arbitrum (~1k-15k)

6/

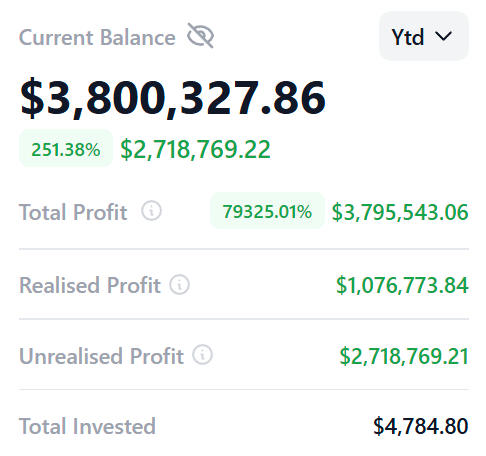

This is just one wallet participating.

Think bigger: Imagine dozens of wallets. That's how you win in this competition and earn six or more figures.

This is just one wallet participating.

Think bigger: Imagine dozens of wallets. That's how you win in this competition and earn six or more figures.

7/

First, you need to create wallets. The easiest way to do this is using CoinTool's batch generator.

• cointool.app/createWallet/e…

Once created, you can export wallets with one click.

First, you need to create wallets. The easiest way to do this is using CoinTool's batch generator.

• cointool.app/createWallet/e…

Once created, you can export wallets with one click.

8/

After creating wallets, download an anti-detect browser.

An antidetect browser is a web-browsing app that uses data spoofing to protect privacy. Its unique digital fingerprint and browser header are often used to manage multiple accounts or enhance online privacy.

After creating wallets, download an anti-detect browser.

An antidetect browser is a web-browsing app that uses data spoofing to protect privacy. Its unique digital fingerprint and browser header are often used to manage multiple accounts or enhance online privacy.

9/

Marlon recommended using Dolphin Anty. It offers the best value for your money.

• anty.dolphin.ru.com/a/10176

Marlon recommended using Dolphin Anty. It offers the best value for your money.

• anty.dolphin.ru.com/a/10176

10/

Create an account, download the application for your OS, and click "pay."

They offer a 3-day trial for up to 10 profiles, but I suggest picking a plan based on how many accounts you'll be managing.

Create an account, download the application for your OS, and click "pay."

They offer a 3-day trial for up to 10 profiles, but I suggest picking a plan based on how many accounts you'll be managing.

11/

Marlon handles 100 accounts, so he use the "base" plan. But if you're just starting out, pick the "free" option with 10 profiles for only $10 a month.

Btw, there is payment in crypto.

Marlon handles 100 accounts, so he use the "base" plan. But if you're just starting out, pick the "free" option with 10 profiles for only $10 a month.

Btw, there is payment in crypto.

12/

Next step: Get proxies for each profile you plan to run.

Visit proxys.io/en?refid=63213 and purchase your proxy.

Choose "Individual IPv4 (foreign)" and select any country *except* those that are sanctioned - they're off-limits for tokenseals participation, etc.

Next step: Get proxies for each profile you plan to run.

Visit proxys.io/en?refid=63213 and purchase your proxy.

Choose "Individual IPv4 (foreign)" and select any country *except* those that are sanctioned - they're off-limits for tokenseals participation, etc.

15/

Add the MetaMask extension from the Google Web Store.

• Go to the "Extensions" tab.

• Click on "Create".

• Add this link:

chrome.google.com/webstore/detai…

Add the MetaMask extension from the Google Web Store.

• Go to the "Extensions" tab.

• Click on "Create".

• Add this link:

chrome.google.com/webstore/detai…

16/

Create all the profiles you'll be working with and click "Start".

Import wallets created using CoinTool.

One profile - one wallet.

Create all the profiles you'll be working with and click "Start".

Import wallets created using CoinTool.

One profile - one wallet.

17/

Once you've imported the wallets, it's time to strategically refill them.

Avoid being flagged as a Sybil by funding from multiple addresses and avoiding any overlap between them.

Once you've imported the wallets, it's time to strategically refill them.

Avoid being flagged as a Sybil by funding from multiple addresses and avoiding any overlap between them.

18/

Marlon recommends using the Bitget exchange. No KYC needed and they have sub-accounts.

• partner.bitget.com/bg/Y23XF9

Marlon recommends using the Bitget exchange. No KYC needed and they have sub-accounts.

• partner.bitget.com/bg/Y23XF9

20/

Now you can switch between subaccounts. Each subaccount now has a unique address.

Withdrawals can be made from one exchange account, but deposits must go to different addresses to avoid overlap - this is crucial!

Now you can switch between subaccounts. Each subaccount now has a unique address.

Withdrawals can be made from one exchange account, but deposits must go to different addresses to avoid overlap - this is crucial!

21/

Create up to 50 addresses on each subaccount. That’s a total of 100 addresses with two subaccounts.

Create up to 50 addresses on each subaccount. That’s a total of 100 addresses with two subaccounts.

22/

Tracking wallet balances manually is a tedious and time-consuming task.

This spreadsheet reveals the balance and value of native coins, along with the priciest ERC-20 token on wallets across major networks:

• docs.google.com/spreadsheets/d…

Tracking wallet balances manually is a tedious and time-consuming task.

This spreadsheet reveals the balance and value of native coins, along with the priciest ERC-20 token on wallets across major networks:

• docs.google.com/spreadsheets/d…

23/

Just make a copy and add your addresses and you will no longer need to go to each wallet separately.

This spreadsheet runs on scripts, takes information from blockchain scans. It has the ability to hide balances in individual networks to save parsing resources.

Just make a copy and add your addresses and you will no longer need to go to each wallet separately.

This spreadsheet runs on scripts, takes information from blockchain scans. It has the ability to hide balances in individual networks to save parsing resources.

24/

Time for on-chain action.

The most important goal? Conceal any connection between your on-chain addresses.

Time for on-chain action.

The most important goal? Conceal any connection between your on-chain addresses.

25/

The part below was inspired by @Auri_0x

Tips for appearing like a real user:

• Withdraw random amounts at different times

• Use old wallets with transaction history (without overlap)

• If you don't have old wallets, create new ones

The part below was inspired by @Auri_0x

Tips for appearing like a real user:

• Withdraw random amounts at different times

• Use old wallets with transaction history (without overlap)

• If you don't have old wallets, create new ones

26/

Spread your tokens across multiple networks. Aim for a total balance of at least $100.

Check wallet overlaps here:

• breadcrumbs.app

• ethtective.com

Spread your tokens across multiple networks. Aim for a total balance of at least $100.

Check wallet overlaps here:

• breadcrumbs.app

• ethtective.com

27/

When interacting with relatively unpopular contracts, make sure there are other addresses' transactions in-between yours. Do not allow the same interaction pattern.

When interacting with relatively unpopular contracts, make sure there are other addresses' transactions in-between yours. Do not allow the same interaction pattern.

28/

The sequence of actions and interactions must make sense.

If you're bridging to different chains only to bounce back, then you're definitely sybilling.

If Twitter cuts off this thread, don't worry - just click on this tweet and all will be revealed.

The sequence of actions and interactions must make sense.

If you're bridging to different chains only to bounce back, then you're definitely sybilling.

If Twitter cuts off this thread, don't worry - just click on this tweet and all will be revealed.

29/

If you find yourself performing the same actions across hundreds of addresses on a DEX, like swapping, sending, and providing liquidity, it's crucial to mix them up and randomize your approach.

If you find yourself performing the same actions across hundreds of addresses on a DEX, like swapping, sending, and providing liquidity, it's crucial to mix them up and randomize your approach.

30/

Frequency matters. The more, the better - but don't raise suspicion by going overboard.

And for volumes? You don't need thousands to farm. Start with 10-20 bucks and avoid dealing with cents.

Frequency matters. The more, the better - but don't raise suspicion by going overboard.

And for volumes? You don't need thousands to farm. Start with 10-20 bucks and avoid dealing with cents.

31/

Use @Dune dashboards to differentiate yourself from the 80%+ and scale up smart.

E.g., bridging 0.1 ETH to zkSync beats out over 70% of users.

Always aim to come out on top across all metrics.

Use @Dune dashboards to differentiate yourself from the 80%+ and scale up smart.

E.g., bridging 0.1 ETH to zkSync beats out over 70% of users.

Always aim to come out on top across all metrics.

32/

Scored a big airdrop? Marlon recommends reinvesting it in your team and scaling up! Rent an office and hire acquaintances to help you out.

Scored a big airdrop? Marlon recommends reinvesting it in your team and scaling up! Rent an office and hire acquaintances to help you out.

33/

Don't waste your time on weak projects. Focus only on the solid ones and aim to maximize your accounts (e.g. LayerZero, ZkSync, Starknet)

Don't waste your time on weak projects. Focus only on the solid ones and aim to maximize your accounts (e.g. LayerZero, ZkSync, Starknet)

34/

By investing just $15 in Arbitrum transactions, you could have earned over $1,000.

For 100 accounts, you would have spent $1,500 and made more than $100,000.

By investing just $15 in Arbitrum transactions, you could have earned over $1,000.

For 100 accounts, you would have spent $1,500 and made more than $100,000.

35/

Here’s how Sui case went down:

To get tokensale allocations, you needed a Discord account. But to avoid getting banned for having too many accounts, you had to use antidetect and proxies to simulate individual users – just like on other social platforms and forms.

Here’s how Sui case went down:

To get tokensale allocations, you needed a Discord account. But to avoid getting banned for having too many accounts, you had to use antidetect and proxies to simulate individual users – just like on other social platforms and forms.

36/

If you had joined Sui Discord with 100 accounts before February 1st, you would have received about 50 allocations.

Now, picture this: for just $2,250, you could buy back those allocations and earn around $100,000.

If you had joined Sui Discord with 100 accounts before February 1st, you would have received about 50 allocations.

Now, picture this: for just $2,250, you could buy back those allocations and earn around $100,000.

37/

"Where do I get 50 exchange accounts?" you ask.

Trading other people's data is illegal, so why not offer your friends a cut of the profits for their help?

Don't have many acquaintances? A trusted source can provide assistance for a small fee: t.me/wwwever

"Where do I get 50 exchange accounts?" you ask.

Trading other people's data is illegal, so why not offer your friends a cut of the profits for their help?

Don't have many acquaintances? A trusted source can provide assistance for a small fee: t.me/wwwever

38/

To avoid getting banned, warm up your antidetect after launch. Visit top sites like Amazon and Facebook, and do random actions to get cookies as a real user.

The sites track organic activity, so don't skip this crucial step.

To avoid getting banned, warm up your antidetect after launch. Visit top sites like Amazon and Facebook, and do random actions to get cookies as a real user.

The sites track organic activity, so don't skip this crucial step.

39/

After that, you can begin creating your social profiles.

Once created, don't immediately rush to join and follow too many projects. Start by setting up your own Discord server and writing something there. When it comes to social networks, upload a geotagged iPhone photo.

After that, you can begin creating your social profiles.

Once created, don't immediately rush to join and follow too many projects. Start by setting up your own Discord server and writing something there. When it comes to social networks, upload a geotagged iPhone photo.

40/

Smooth is key. No sudden follow/unfollow moves.

Need a phone number for your social profiles? Rent a virtual one here: ardizor.notion.site/Virtual-number…

Smooth is key. No sudden follow/unfollow moves.

Need a phone number for your social profiles? Rent a virtual one here: ardizor.notion.site/Virtual-number…

41/

Sybil Hunters can't touch you now.

In conclusion, mastering the art of airdrop farming can change your life.

But let's circle back to the start of this thread. The knowledge I've shared comes with great responsibility. Please note: This information is for reference only.

Sybil Hunters can't touch you now.

In conclusion, mastering the art of airdrop farming can change your life.

But let's circle back to the start of this thread. The knowledge I've shared comes with great responsibility. Please note: This information is for reference only.

Shout-out to the amazing folks who helped make this thread possible!

Be sure to follow:

@cryptocrushmia

@MacnBTC

Be sure to follow:

@cryptocrushmia

@MacnBTC

I hope you've found this thread helpful.

Follow me @ardizor for more.

Like/Retweet the first tweet below if you can:

Follow me @ardizor for more.

Like/Retweet the first tweet below if you can:

https://twitter.com/ardizor/status/1655587394412765195

• • •

Missing some Tweet in this thread? You can try to

force a refresh