1/ $LOTUS is taking off

It claims to be "a proof of concept designed to test the limits of a token generation event, where incentives are aligned and risks are transparent among all participants."

Here's what that means and how it works👇

It claims to be "a proof of concept designed to test the limits of a token generation event, where incentives are aligned and risks are transparent among all participants."

Here's what that means and how it works👇

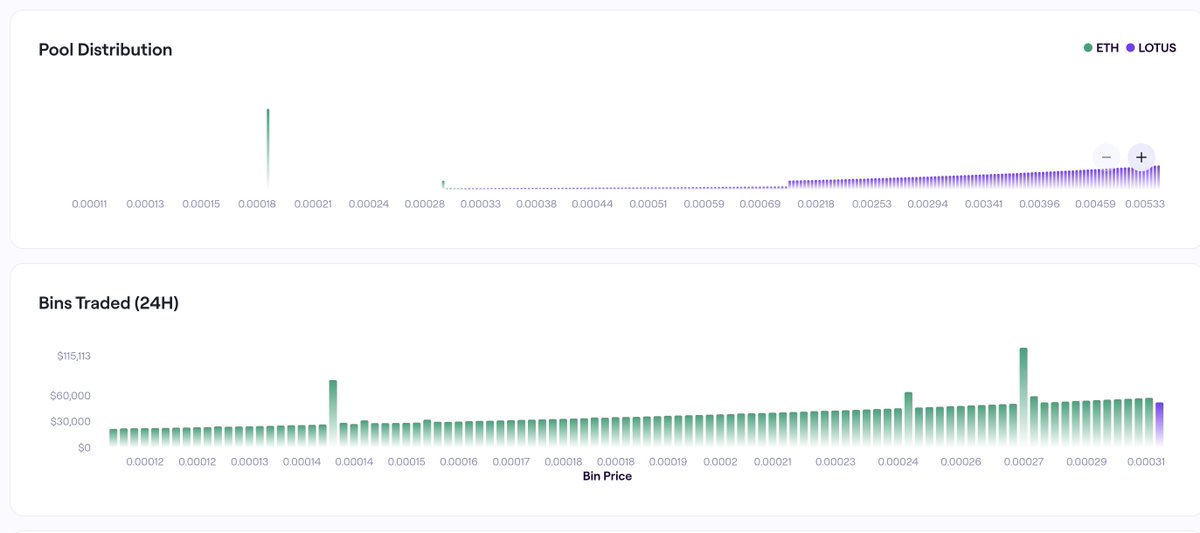

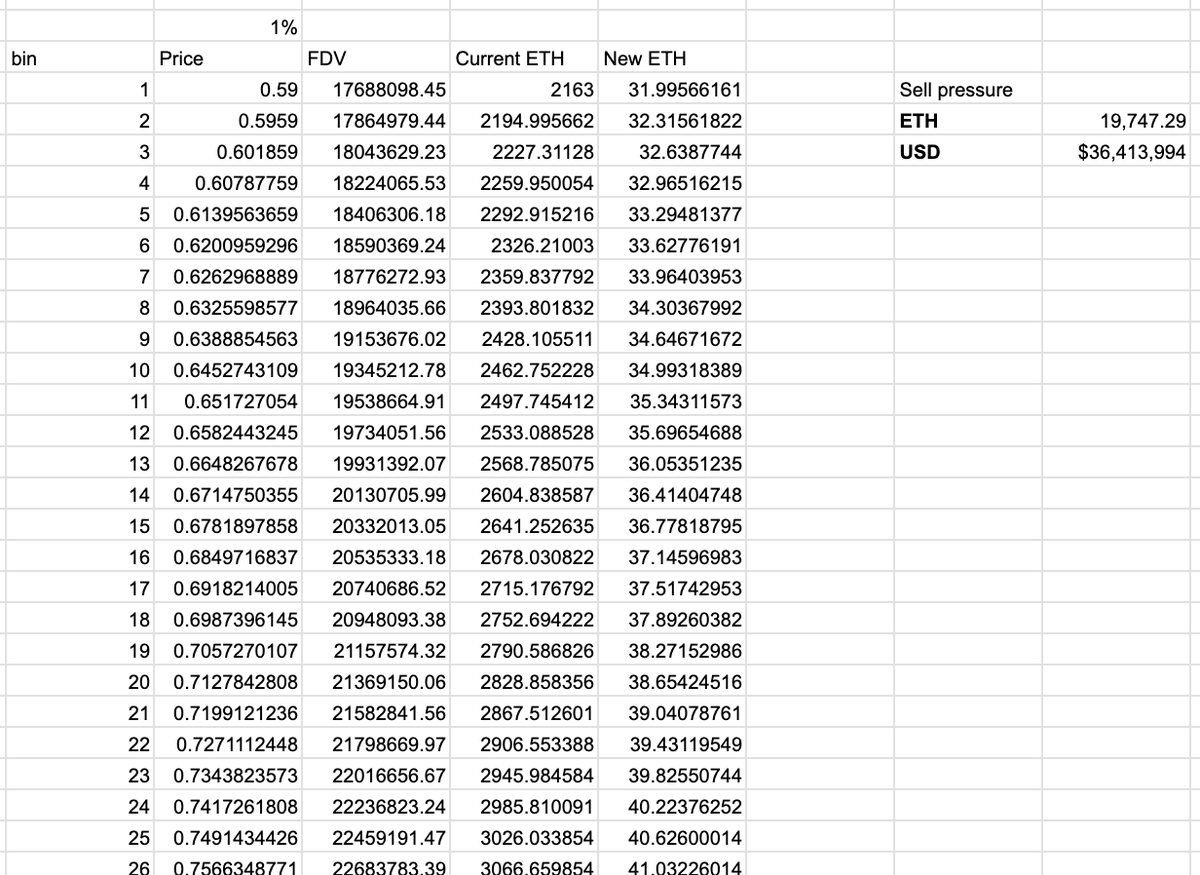

2/ Lotus is an experiment with @traderjoe_xyz "liquidity book"

There is a set amnt of lotus at each price "bin" and once everything sells at that price it goes up another bin, 100,000 lotus per bin, increasing in price roughly 1% each bin

There is a set amnt of lotus at each price "bin" and once everything sells at that price it goes up another bin, 100,000 lotus per bin, increasing in price roughly 1% each bin

3/ This mean the pool is collecting a ton of ETH as people buy

Collecting because you cant exactly sell

Collecting because you cant exactly sell

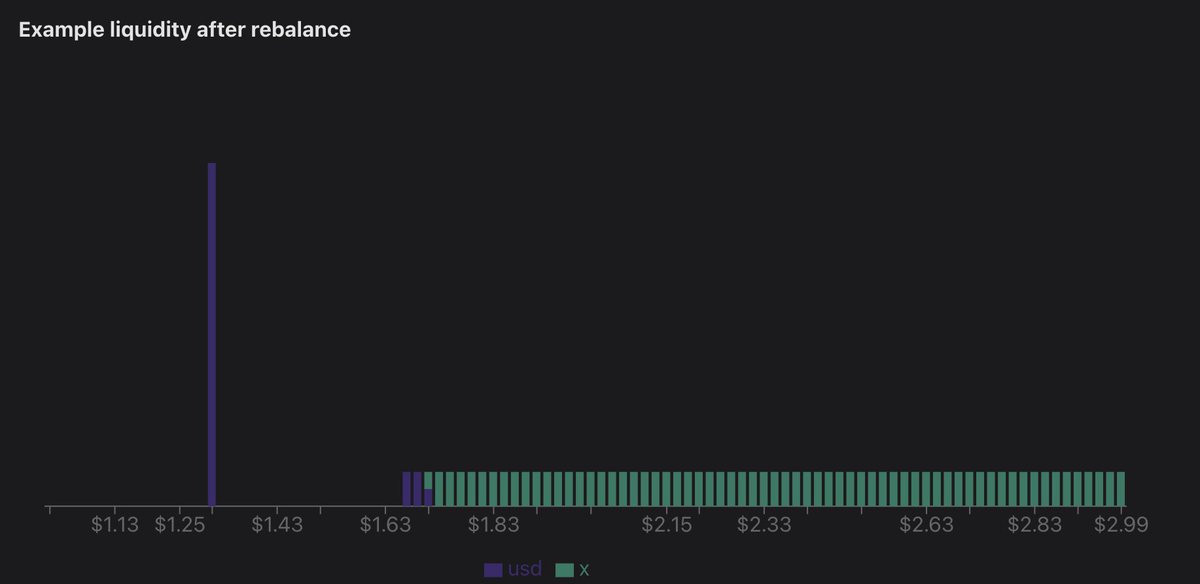

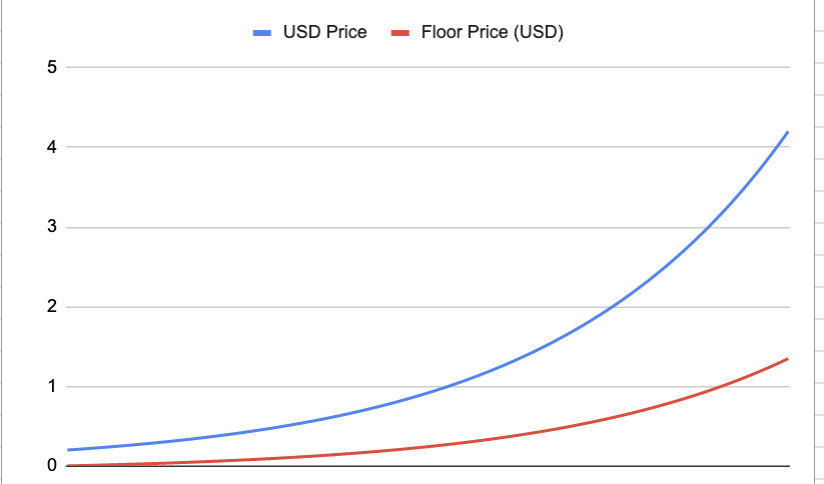

4/ Every 5 bins the liquidity is redistributed where a small chunk is within a reasonable bid from the current bin price and the rest moves to the "floor"

The floor is the RFV for the token, is it priced by dividing all the ETH in the pool by the total circulating supply

The floor is the RFV for the token, is it priced by dividing all the ETH in the pool by the total circulating supply

5/ You can see where the floor is in real time on the Trader Joe pool here:

traderjoexyz.com/arbitrum/pool/…

traderjoexyz.com/arbitrum/pool/…

6/ As more people buy the spot price starts to deviate more from the floor price

This assumes constant token supply however!

This assumes constant token supply however!

7/ The supply will shrink overtime since every sell is taxed at 10%

8% is burned permanently

2% goes to stakers

The contract cannot mint any new tokens

8% is burned permanently

2% goes to stakers

The contract cannot mint any new tokens

8/ Lotus stakers receive this 2% proportionally to their pool contribution

Unstaking takes 24hrs however

Unstaking takes 24hrs however

9/ The staking page is not live yet but is supposed to come in the next few hours

There does not appear to be a Twitter for the project either

There does not appear to be a Twitter for the project either

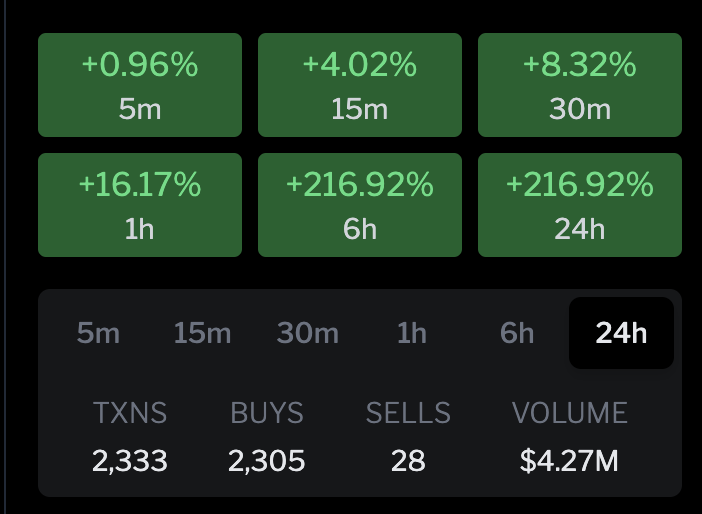

11/ It's only a few hour old but the contract has already accrued almost $4M of ETH

It will take nearly $40M of ETH to fill all the bins

It will take nearly $40M of ETH to fill all the bins

https://twitter.com/Brentsketit/status/1655792021964210178?s=20

12/ So in summary its a new ponzi with a novel mech

Lots of pumpanomics at play but you know always know what the token is backed by and what you can sell it for

Lots of pumpanomics at play but you know always know what the token is backed by and what you can sell it for

13/ Will take a huge push to sell out and let the real (3,3) games begin but its already received a ton of hype in a few hours and even bitboy is talking abt it

Have fun!

Have fun!

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter