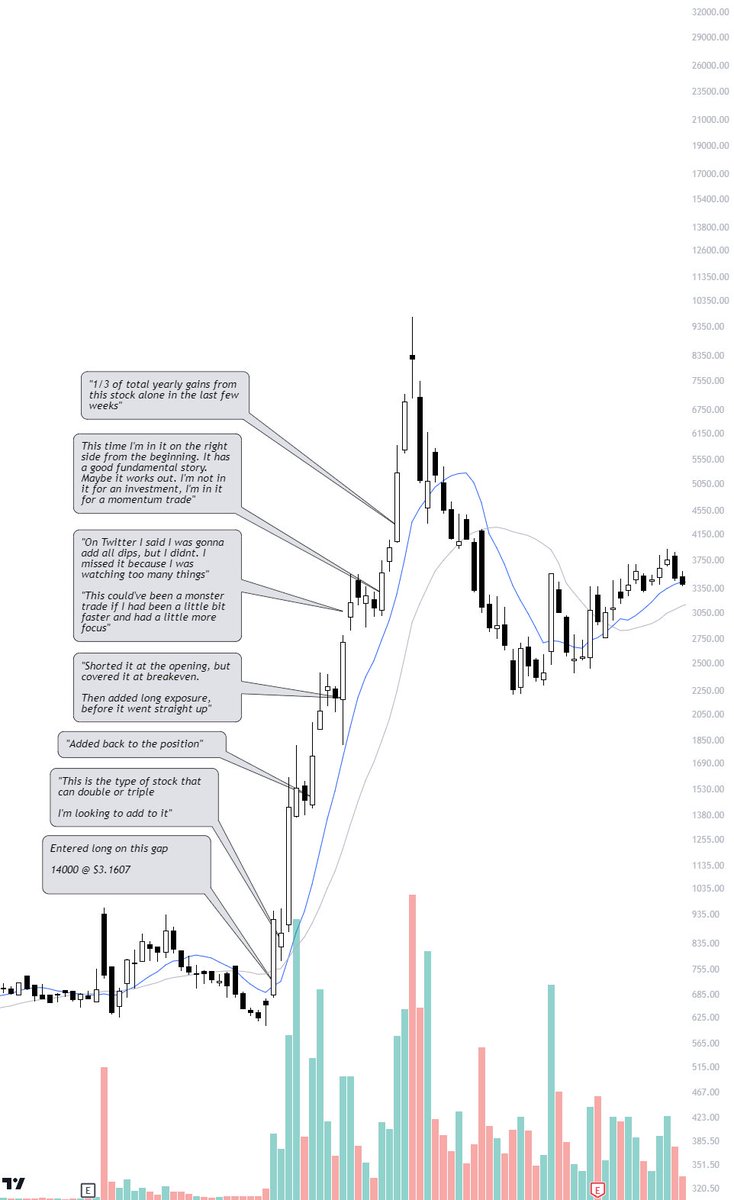

HMNY was one of Qullamaggies best trades in 2017

He made $200,000 on the long side, and $100,000 on the short side

Here's 17 lessons I learned studying this trade

👇

PS: His own review is at the end

He made $200,000 on the long side, and $100,000 on the short side

Here's 17 lessons I learned studying this trade

👇

PS: His own review is at the end

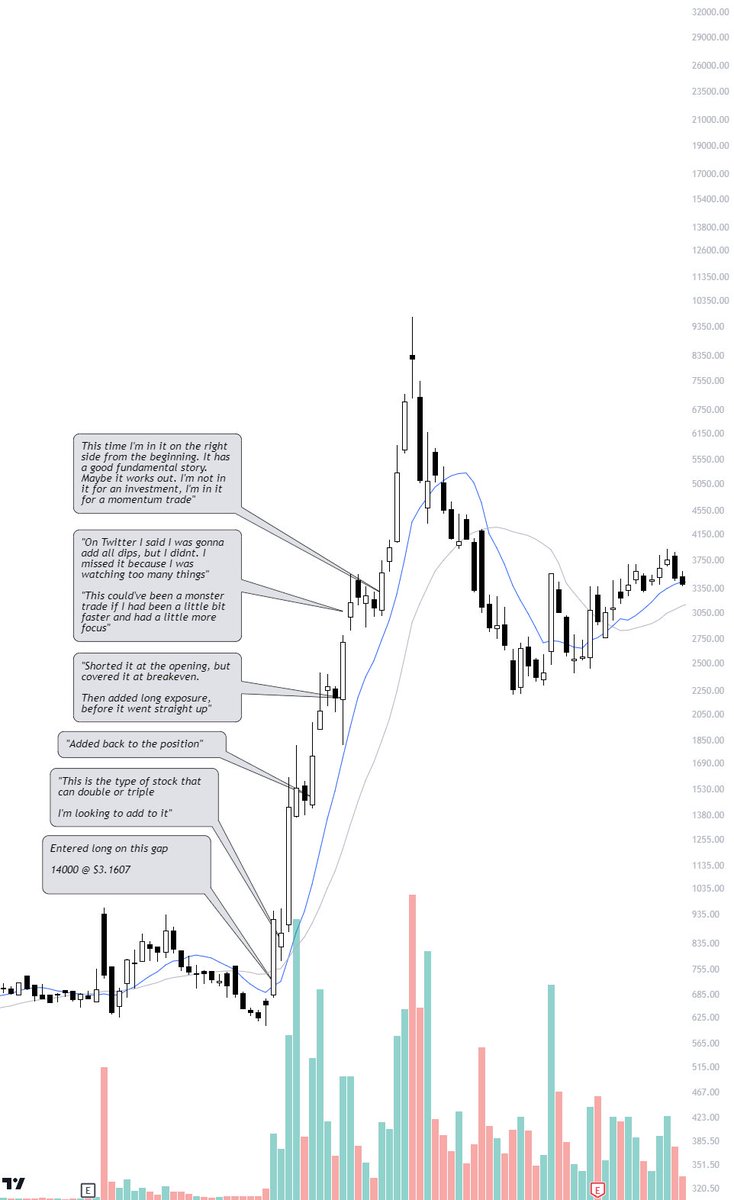

LESSON #1:

Chart patterns doesnt have to be perfect to enter 🌟

Qullamaggie entered this trade on a fundamental story and positive price action intraday📈

Chart patterns doesnt have to be perfect to enter 🌟

Qullamaggie entered this trade on a fundamental story and positive price action intraday📈

LESSON #3

Just because you have sold into strength doesnt mean you can't add back if you find a good buy point

Qullamaggie sold and added to his core several times 🔁

Just because you have sold into strength doesnt mean you can't add back if you find a good buy point

Qullamaggie sold and added to his core several times 🔁

#LESSON 4

Don't be afraid to change your opionon

You have to be flexible and let the market tell you what to do. Not the other way around 🐟

Don't be afraid to change your opionon

You have to be flexible and let the market tell you what to do. Not the other way around 🐟

#LESSON 5

Dont split your attention on too many things

"This could've been a monster trade if I had been a little faster and had a little more focus"

Dont split your attention on too many things

"This could've been a monster trade if I had been a little faster and had a little more focus"

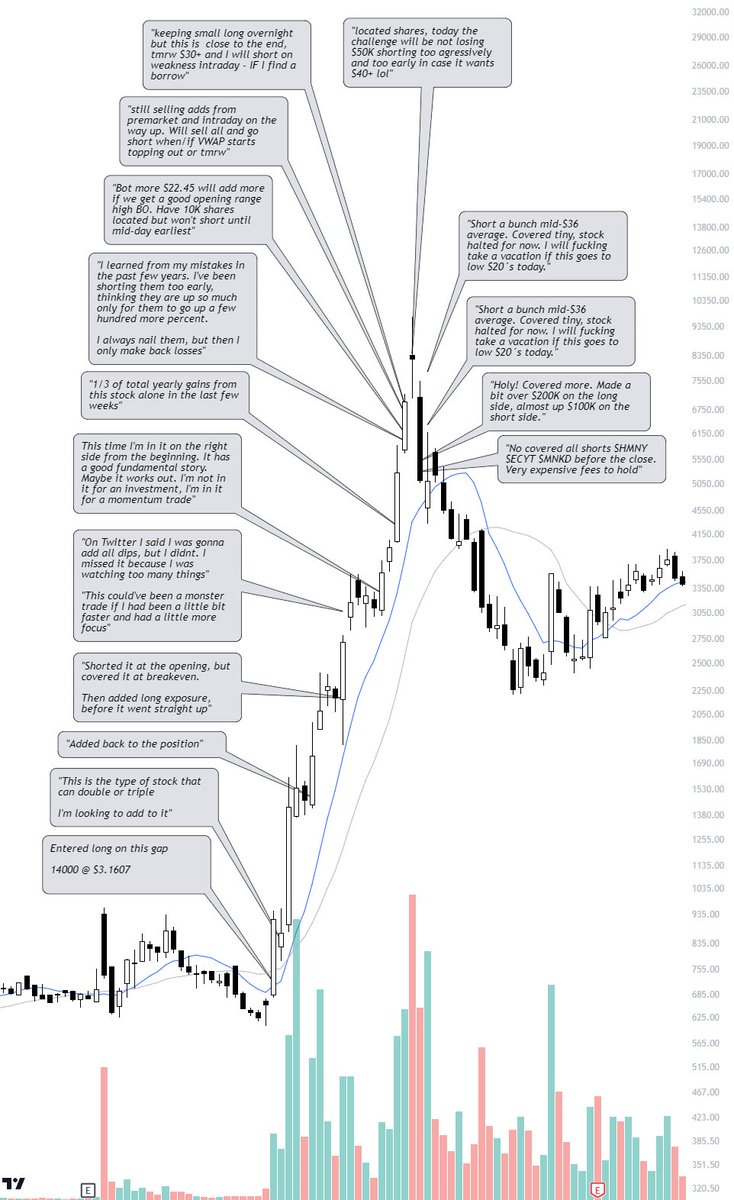

LESSON #7

One trade wont make your year. But it sure as hell can help

But you never know which trade it's gonna be. 👨🎓

One trade wont make your year. But it sure as hell can help

But you never know which trade it's gonna be. 👨🎓

Hey! We are half way through!

Who said learning couldnt be fun? 🥳

Who said learning couldnt be fun? 🥳

LESSON #12

Don't let the excitement for a home run get the best of you

Qullamaggie had 10,000 shares located, but never shorted more than 6,500

Don't let the excitement for a home run get the best of you

Qullamaggie had 10,000 shares located, but never shorted more than 6,500

LESSON #14

Long trades has unlimited upside, and limited downside

Short trades has unlimited downside and limited upside

Long trades has unlimited upside, and limited downside

Short trades has unlimited downside and limited upside

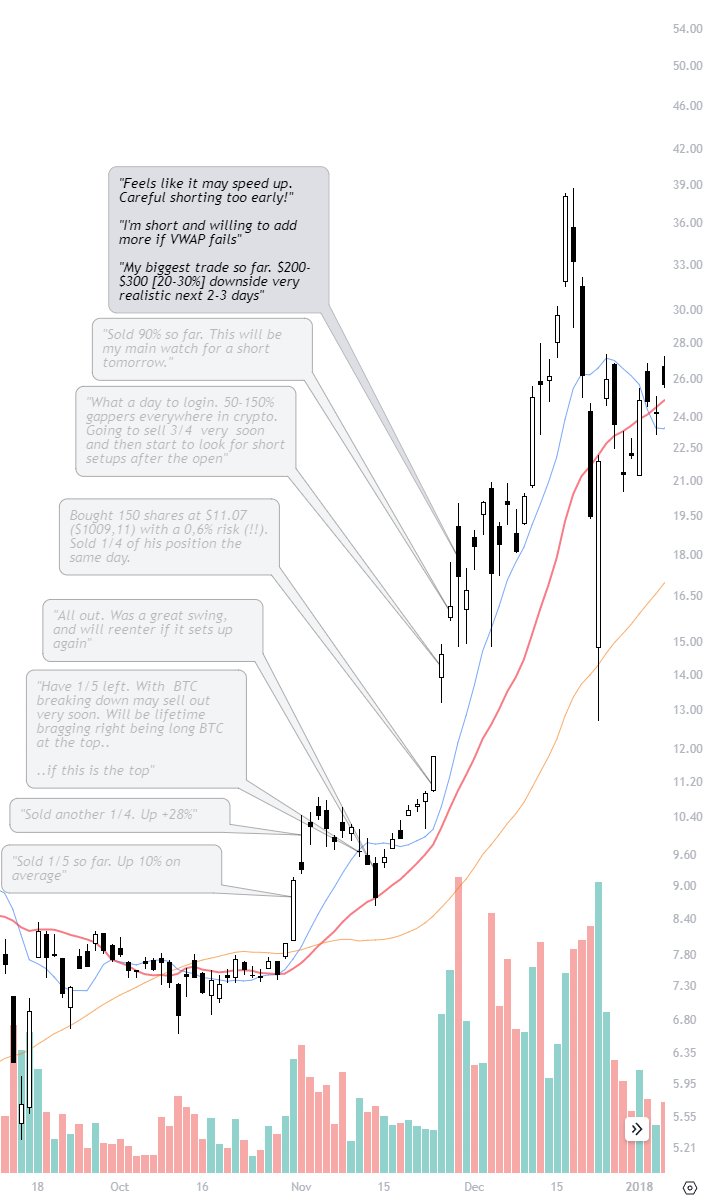

LESSON #17

Finding the best entries and exits when looking at a chart in retrospect is easy

Being able to do it when the trade is developing is hard

Don't become a hindsight trader 👀

Finding the best entries and exits when looking at a chart in retrospect is easy

Being able to do it when the trade is developing is hard

Don't become a hindsight trader 👀

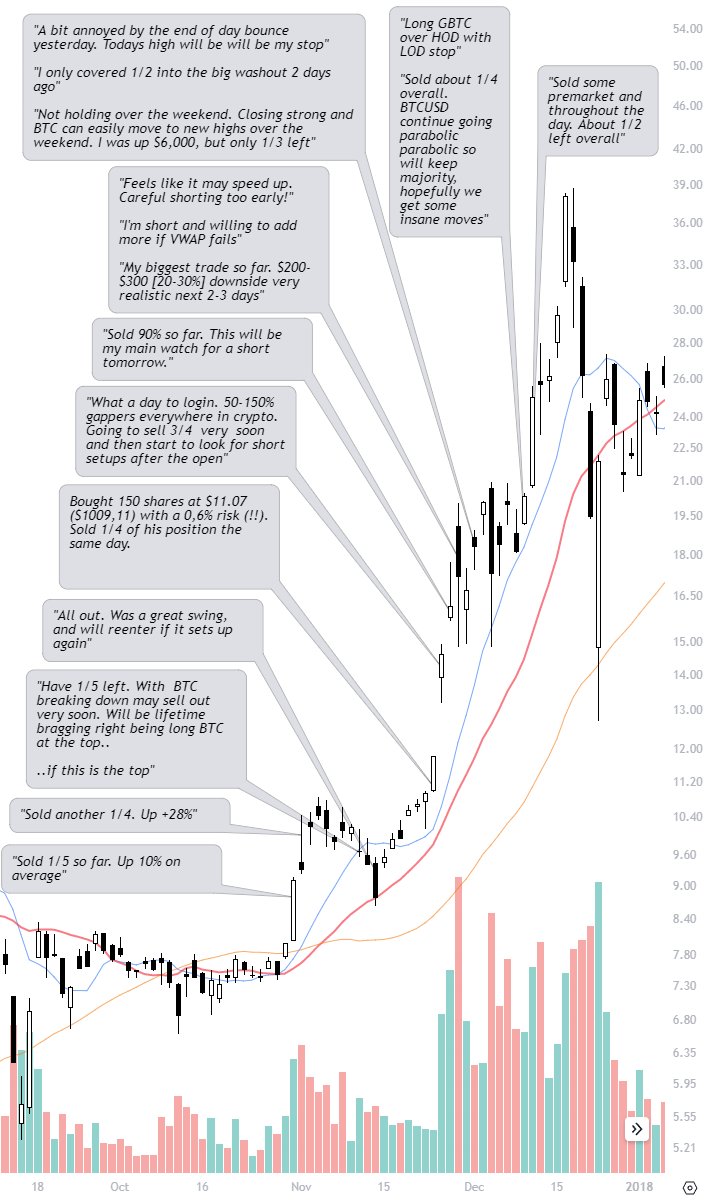

QULLAMAGGIES REVIEW

Here's Qullamggies own review of the trade

Here's Qullamggies own review of the trade

You can do the same study 🧑🎓

I spent several hundred hours studying Qullamaggie. I curated some of my findings in a presentation and share all the data with anyone willing to do the work

👇

I spent several hundred hours studying Qullamaggie. I curated some of my findings in a presentation and share all the data with anyone willing to do the work

👇

https://twitter.com/inninuM/status/1653035579313889280?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh