The S&P 500 seems stuck in this 3,800-4,200 range.

Earnings keep declining, now down 4% YoY.

So why isn't the stock market dropping further?

Are we still in a bull market or in another bear market rally?

Thread.

1/

Earnings keep declining, now down 4% YoY.

So why isn't the stock market dropping further?

Are we still in a bull market or in another bear market rally?

Thread.

1/

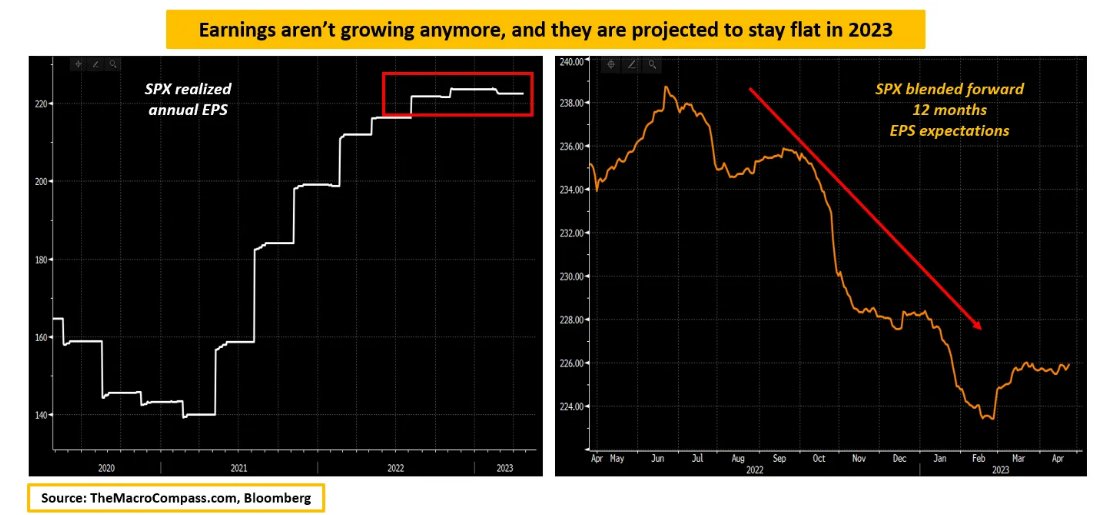

Earnings are not growing anymore in nominal terms, let alone in real terms.

Analysts also expect them SPX earnings to struggle throughout 2023 (right chart).

Why?

2/

Analysts also expect them SPX earnings to struggle throughout 2023 (right chart).

Why?

2/

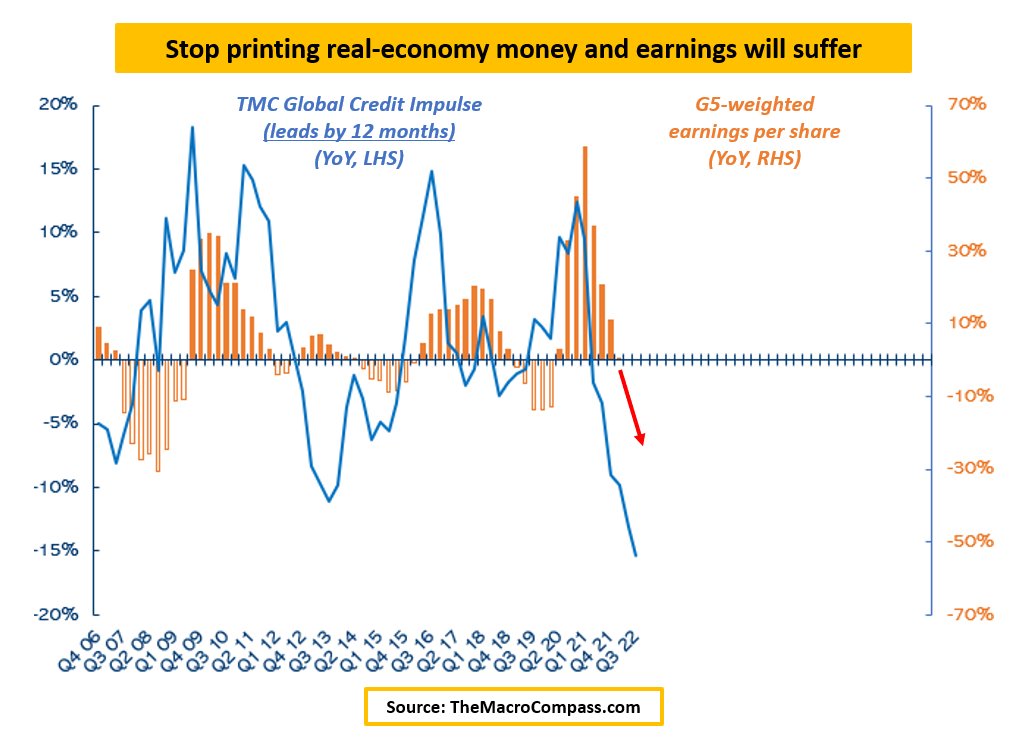

Cheap credit encourages leverage, and with it strong nominal spending and economic activity.

With a lag, earnings pick up.

We are now in the opposite process: credit creation has stalled at a global level, and that presents headwinds for earnings growth.

3/

With a lag, earnings pick up.

We are now in the opposite process: credit creation has stalled at a global level, and that presents headwinds for earnings growth.

3/

My flagship TMC Global Credit Impulse index leads rapid turns in the G5 earnings per share growth by 12 months.

It has been anticipating weaker earnings for quarters now, and looking ahead the situation doesn't seem great either.

4/

It has been anticipating weaker earnings for quarters now, and looking ahead the situation doesn't seem great either.

4/

When earnings don't grow anymore at a robust pace for a bit, companies are forced to rethink their core expenditures like labor.

Not a surprise that the mentions of ''job cuts'' in the SPX earnings calls are on the rise.

Claims are also picking up...tic toc.

5/

Not a surprise that the mentions of ''job cuts'' in the SPX earnings calls are on the rise.

Claims are also picking up...tic toc.

5/

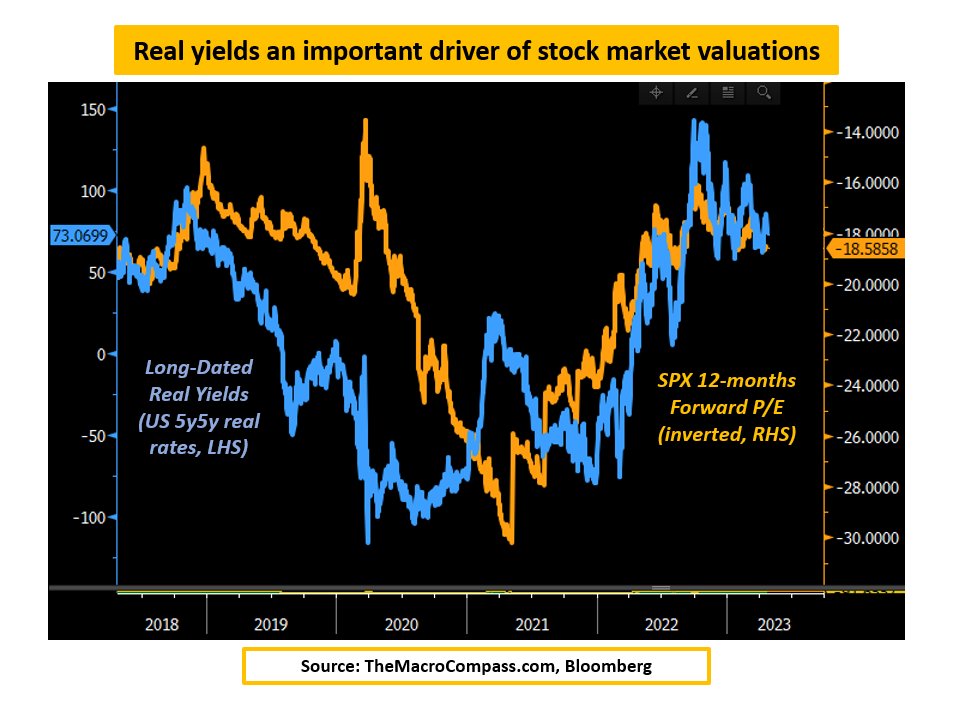

As earnings are not a tailwind anymore for equity markets, the only way to engineer a new healthy bull market would be through valuations expansion.

Valutions are driven by:

- Animal spirits

- Risk-free real yields (what's the alternative?)

6/

Valutions are driven by:

- Animal spirits

- Risk-free real yields (what's the alternative?)

6/

Long-dated real yields (blue) give us good clues about valuations: allow investors to earn a higher risk-free real rate, and they will be less willing (orange) to pay high multiples for equities.

And viceversa.

Today, real yields are pretty high...

7/

And viceversa.

Today, real yields are pretty high...

7/

...and as the Fed is focused on inflation, they are likely to remain high for a while.

Investors do have a good alternative, and so it's hard for valuations to expand a lot.

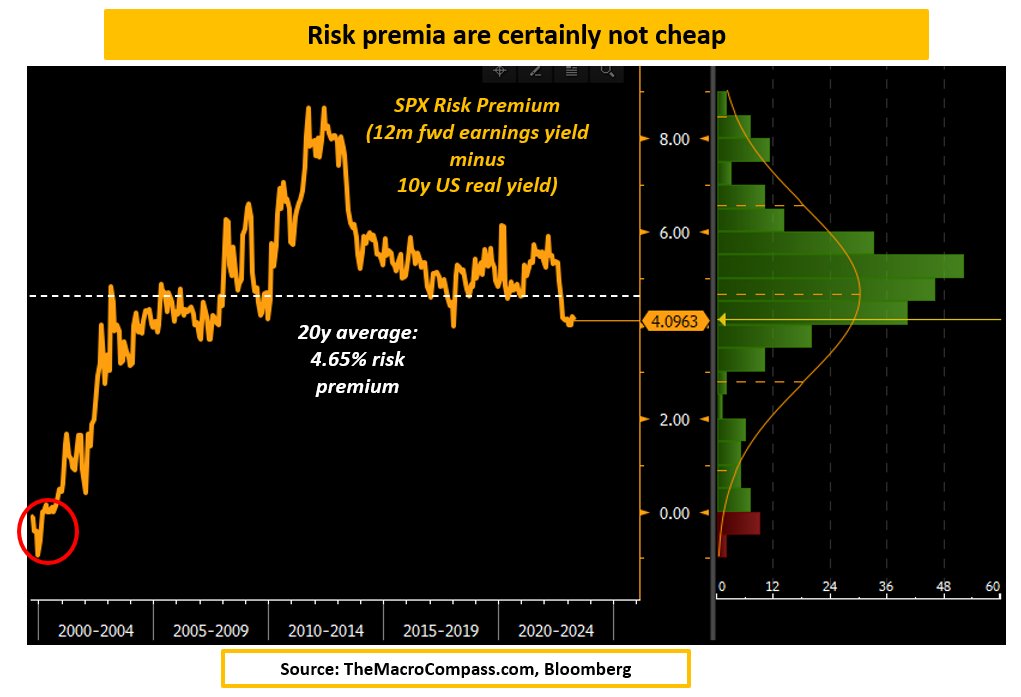

The starting point isn't cheap either, with compressed risk premia in US equities.

8/

Investors do have a good alternative, and so it's hard for valuations to expand a lot.

The starting point isn't cheap either, with compressed risk premia in US equities.

8/

For a healthy bull market to start you need strong earnings growth ahead and an accommodative Central Bank that allows valuations to freely expand.

Today, you got neither of the two.

That doesn't mean the SPX has to drop 20% from here, but it's hard to make the case...

9/

Today, you got neither of the two.

That doesn't mean the SPX has to drop 20% from here, but it's hard to make the case...

9/

...for a new bull market to start here.

Where could I be wrong?

If the economic engine would restart and surprise everybody on the upside together with inflation on a sustained decline: in other words, if a soft landing unfolds.

10/

Where could I be wrong?

If the economic engine would restart and surprise everybody on the upside together with inflation on a sustained decline: in other words, if a soft landing unfolds.

10/

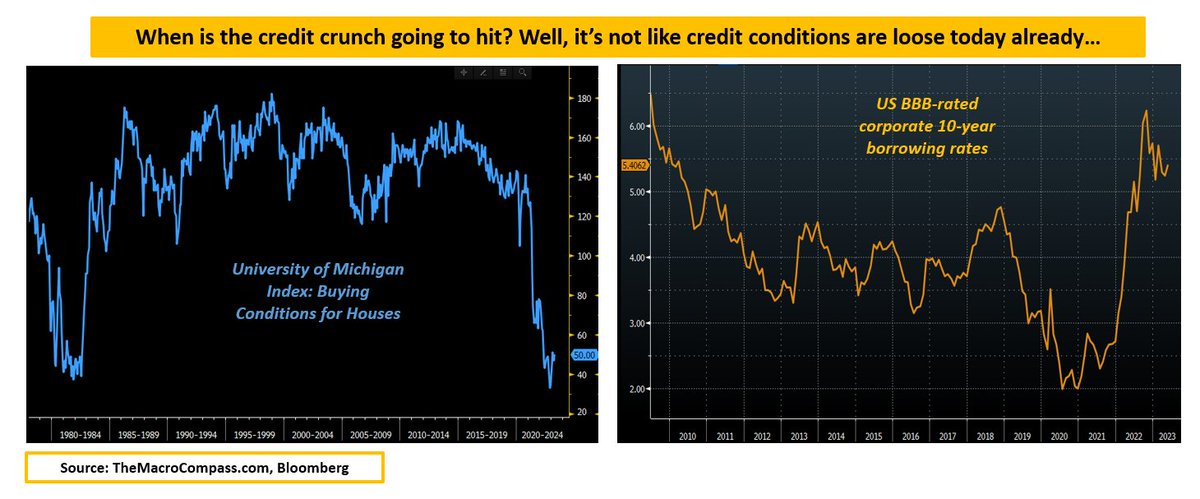

With the worst conditions in 40+ years to buy a house and US corporates forced to borrow at 5.5% interest rates, credit isn't cheap at all and I am not ready to endorse a soft landing here.

11/

11/

If you enjoyed this macro thread, consider subscribing to TheMacroCompass.com

We range from a FREE educational newsletter (new piece tomorrow, so sign up!) to premium products for thousands of worlwide clients including macro ETF portfolios and trade ideas.

12/

We range from a FREE educational newsletter (new piece tomorrow, so sign up!) to premium products for thousands of worlwide clients including macro ETF portfolios and trade ideas.

12/

Most importantly, always remember to be:

- Long macro education and insights

- Short ego

And to be nice to each others and enjoy yourselves and your loved ones more.

Have a nice evening!

13/13

- Long macro education and insights

- Short ego

And to be nice to each others and enjoy yourselves and your loved ones more.

Have a nice evening!

13/13

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter