$MMTLP @nbhydrocarbons

I've been getting a little tired of hearing our investment being called a meme.

I'm also tired of hearing people bashing NBH. I truly don't think people are grasping the magnitude of the asset.

I understand you're suffering, but heal through knowledge.

I've been getting a little tired of hearing our investment being called a meme.

I'm also tired of hearing people bashing NBH. I truly don't think people are grasping the magnitude of the asset.

I understand you're suffering, but heal through knowledge.

If you do your research you will find quite a bit of these disingenuous articles.

Sure.. there will be less demand for O&G for transportation purposes (not really, but ok) but it will just be replaced with O&G for OTHER purposes.

gep.com/blog/mind/how-…

Sure.. there will be less demand for O&G for transportation purposes (not really, but ok) but it will just be replaced with O&G for OTHER purposes.

gep.com/blog/mind/how-…

Secondly, and more importantly, that demand will simply shift from one use case to another. visualcapitalist.com/how-much-oil-e…

Let's look at some graphs. 😎O&G is here to stay, my friends. It's not an obsolete industry by any stretch of the imagination; it is simply shifting.

And these days, O&G is a lot cleaner than most people think; technology has advanced significantly. By comparison of greenhouse gas emissions, the mining & refining process of rare earth metals for current EV batteries & other electronics is far more hazardous to the environment.

You HAVE to think big picture. O&G will reduce the amount of coal emissions. That's indirectly GREEN in itself!

A lot of the information I received came from this video. Great watch! I think everyone should. api.org/oil-and-natura…

strausscenter.org/energy-and-sec…

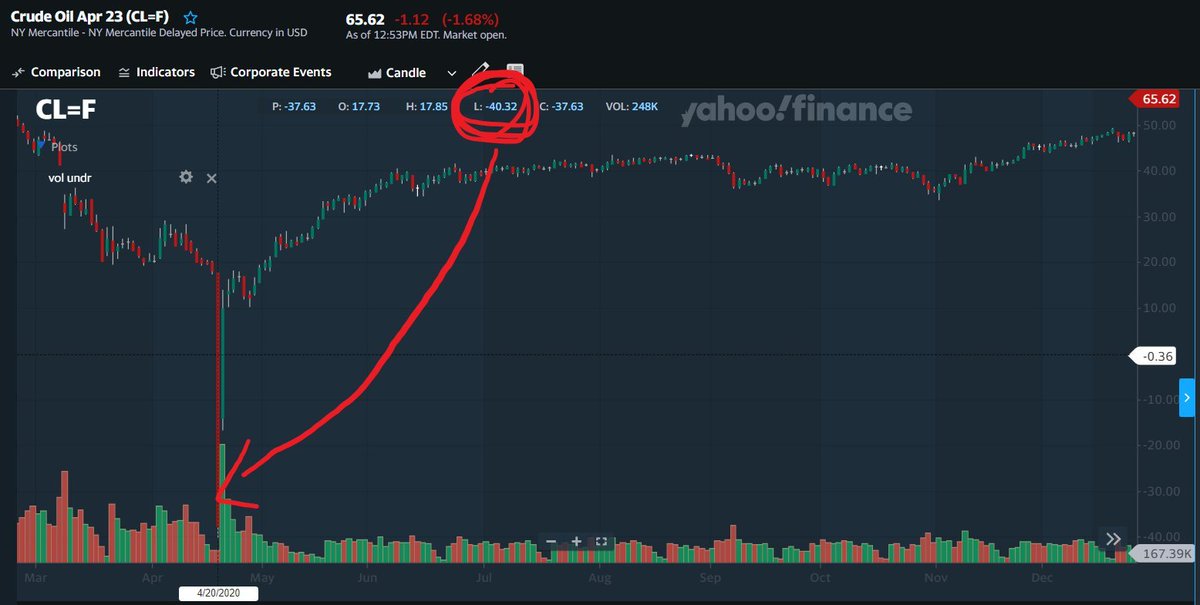

If you were unaware of the "US Shale Revolution", I suggest you take a good, hard look at what is happening in the Energy industry in 2023. The pandemic offered the buying opportunity of a lifetime & they scared many people away by twisting the narrative.

If you were unaware of the "US Shale Revolution", I suggest you take a good, hard look at what is happening in the Energy industry in 2023. The pandemic offered the buying opportunity of a lifetime & they scared many people away by twisting the narrative.

Historically, the US has been a leading importer but we are about to make a massive shift. The US is in the perfect position to become completely energy independant.

Last year, the US out produced Russia by 184bcm (billion cubic metres) at a staggering 975bcm.

Last year, the US out produced Russia by 184bcm (billion cubic metres) at a staggering 975bcm.

Last week, @Pecos_Bill_1962 & @FernandoOil had a great space call (Thanks again, gentlemen!)

Fernando said something that peaked my interest. He mentioned West Texas is typically being 'gassier' and we have a gas pipeline running right passed the property.😎

Fernando said something that peaked my interest. He mentioned West Texas is typically being 'gassier' and we have a gas pipeline running right passed the property.😎

He also mentioned the issue with drilling too close together and how it can affect the pressure from other wells. Thankfully these days there are new drilling advancements to help mitigate these problems.

And at this point, NBH has realistically got through the most difficult part of the business. They aren't far off from production.

We all know the Permian is still hot! You can't ignore the sentiment!

Chevron has a $14B budget for 2023 and has already allocated 28.5% of that ALONE for the Permian.

And just more recently, Vital Energy just dropped $540M!

"large undeveloped areas" 😎

Chevron has a $14B budget for 2023 and has already allocated 28.5% of that ALONE for the Permian.

And just more recently, Vital Energy just dropped $540M!

"large undeveloped areas" 😎

I'll end this thread with this.

Just take a look at who is involved, know who's at the helm, and for G-d's sake follow the money. You are holding the🦄

(White - Torchlight, Black - NextBridge)

Just take a look at who is involved, know who's at the helm, and for G-d's sake follow the money. You are holding the🦄

(White - Torchlight, Black - NextBridge)

So just remember, when someone questions your investment, and calls it a meme, school their ass. #Facts 🎤✋😎

And now you see why I am bullish on the indirect synergy between @nbhydrocarbons and @Metamaterialtec

Thank you for reading! 🙏💛

And now you see why I am bullish on the indirect synergy between @nbhydrocarbons and @Metamaterialtec

Thank you for reading! 🙏💛

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter