1/Months in the making, here's the final cut of my story on the long-awaited wealth transfer, no longer in the future tense:

We're closer to 2053 than 1992.

Elites are already disbursing to heirs while alive.

The masses likely need luck or a paradigm shift

nytimes.com/2023/05/14/bus…

We're closer to 2053 than 1992.

Elites are already disbursing to heirs while alive.

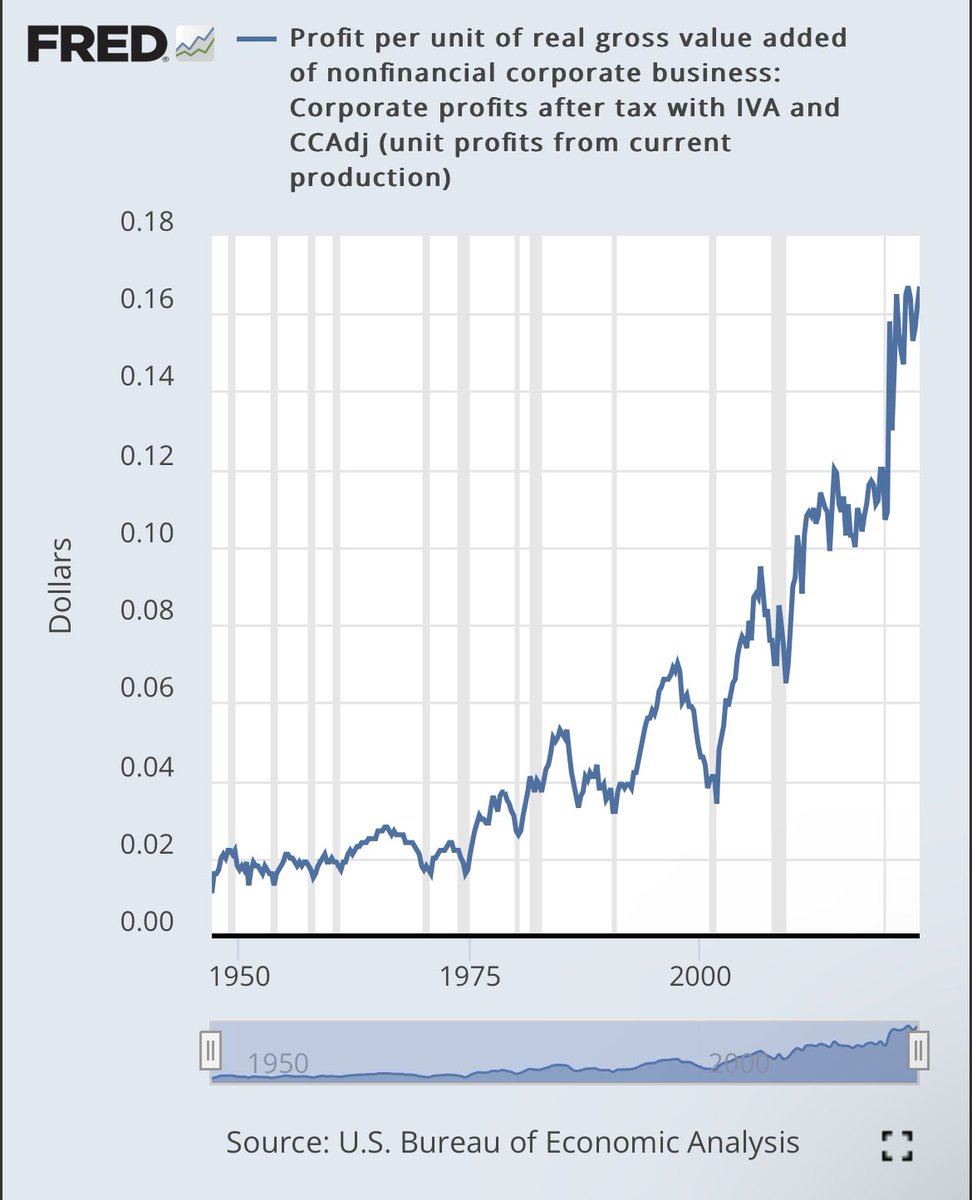

The masses likely need luck or a paradigm shift

nytimes.com/2023/05/14/bus…

2/i've already heard from some saying "but what about___!?"

& yes...there's a 'directors cut' version noting___. but algos show ppl aren't reading features in full so we have to TLDR topics. read to the end to change that media trend :)

for now, here's a companion story thread:

& yes...there's a 'directors cut' version noting___. but algos show ppl aren't reading features in full so we have to TLDR topics. read to the end to change that media trend :)

for now, here's a companion story thread:

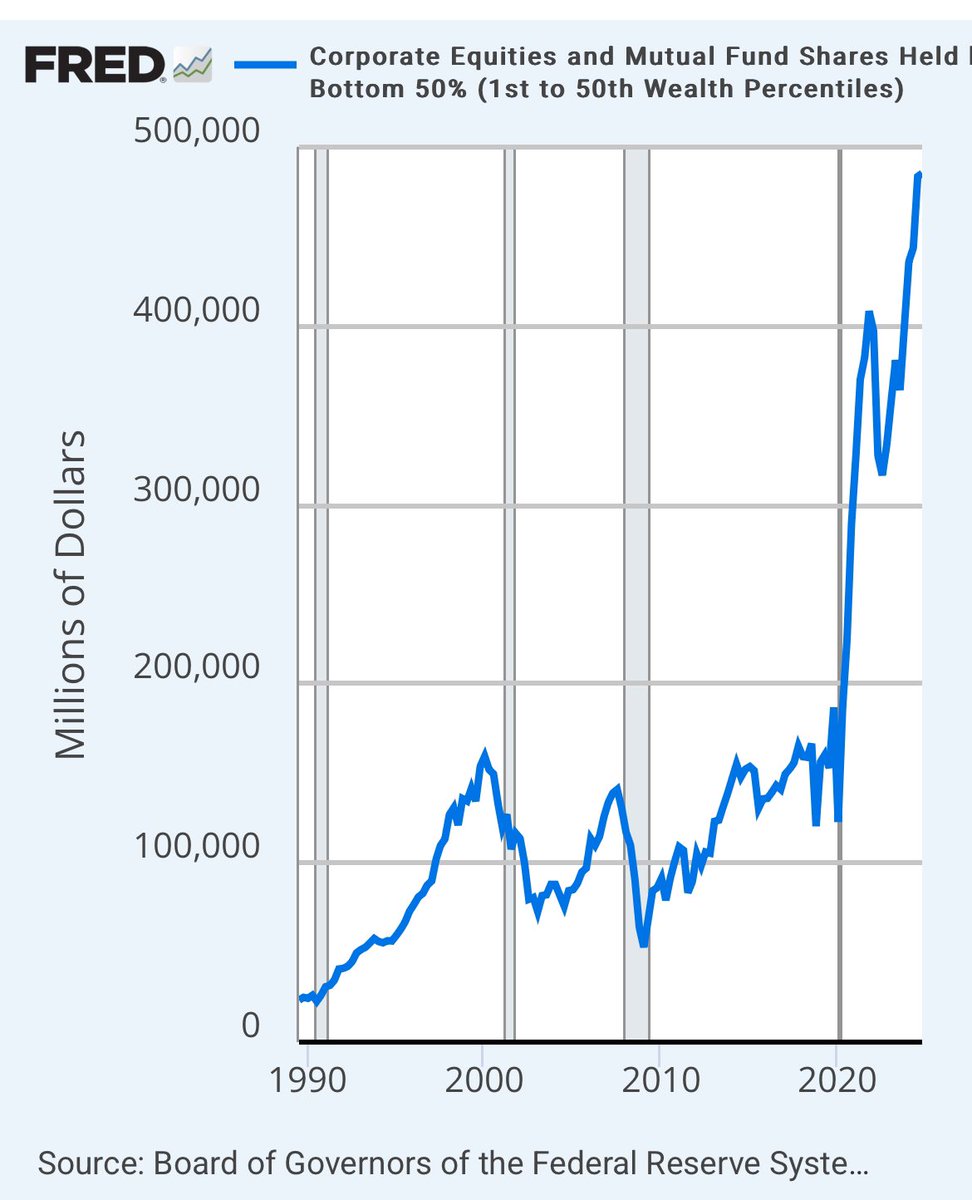

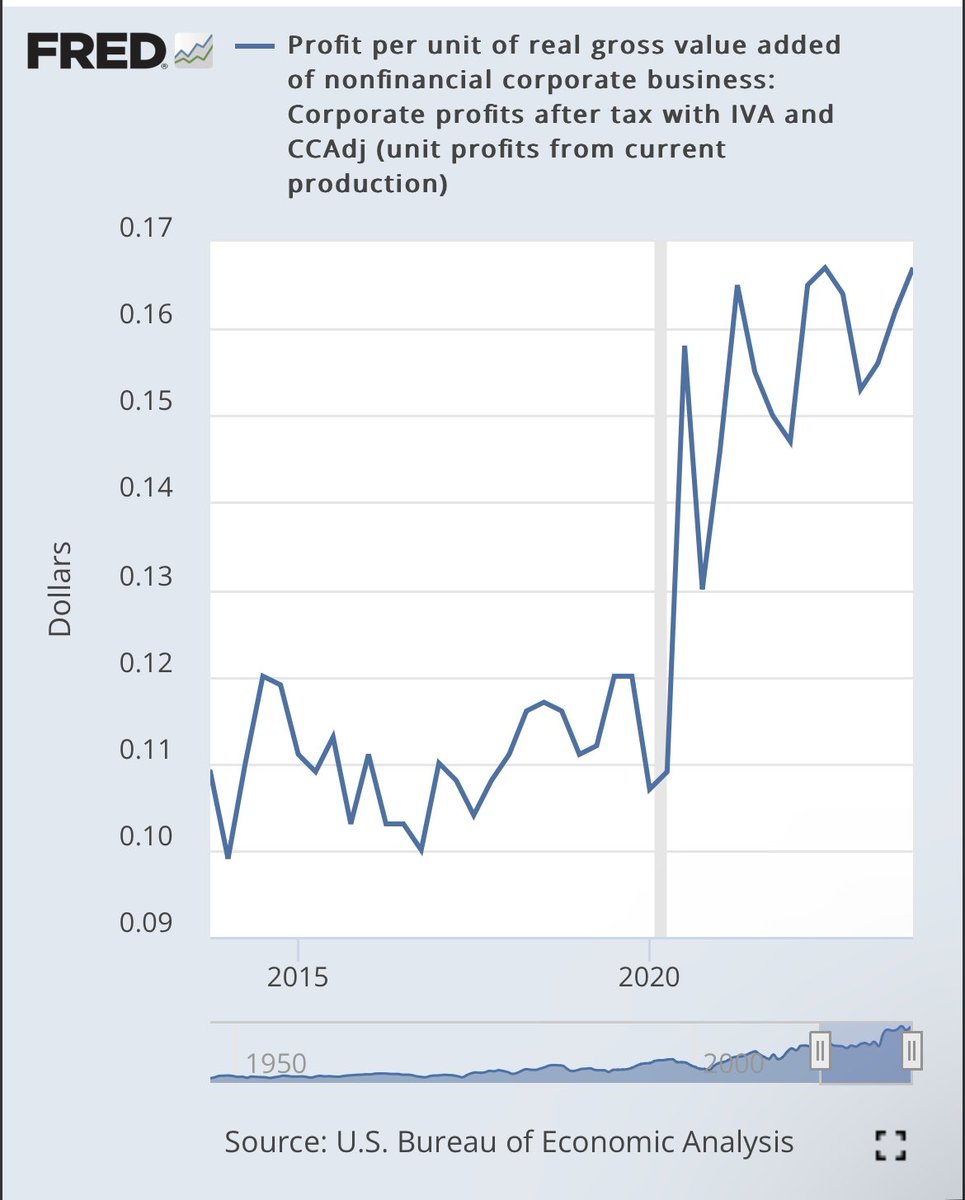

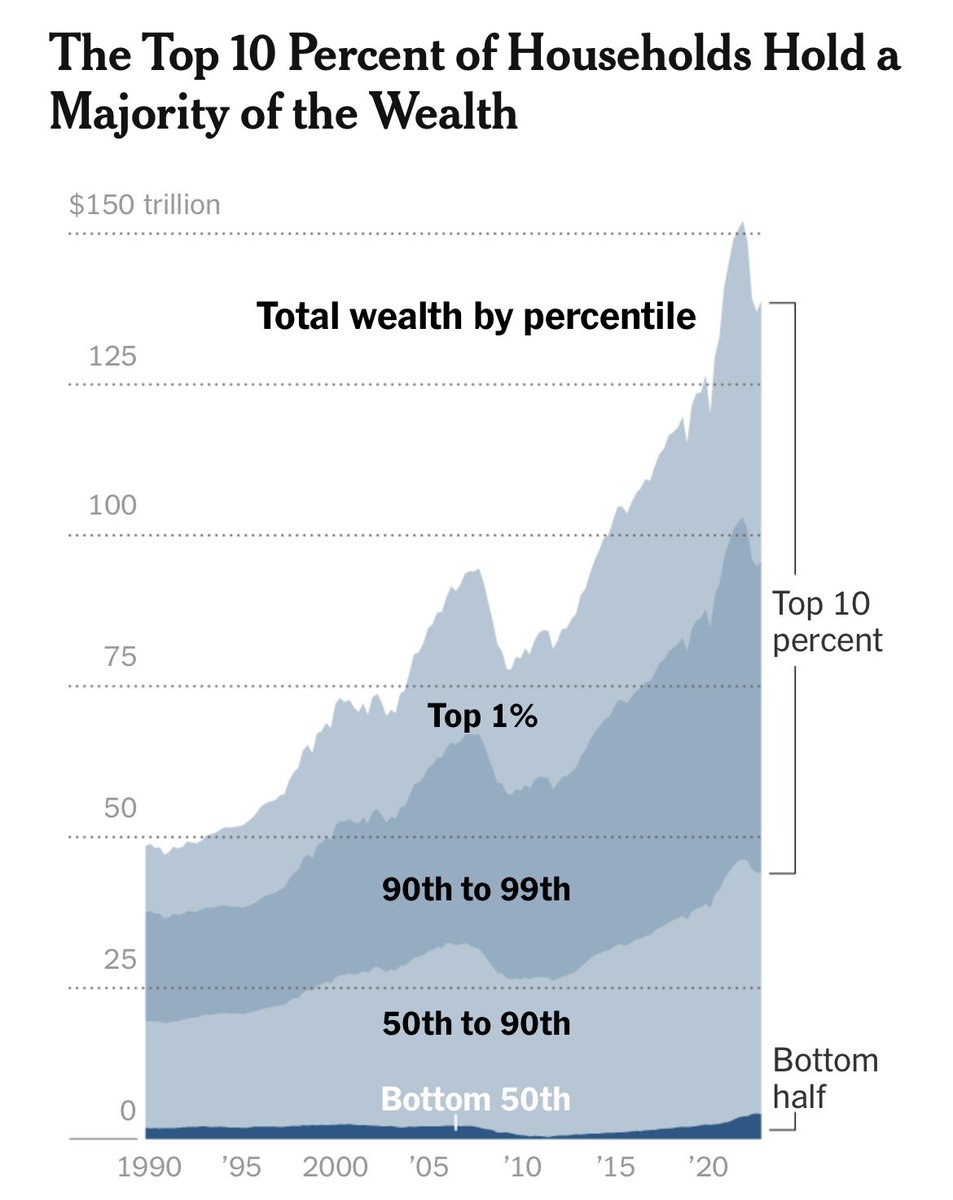

3/ *intergenerational* wealth disparities are shrinking as millennials, as a whole, catch up to Gen X & Boomers in wealth accrual. but *intragenerational* disparities may worsen. those rich millennials/zoomers envied on TikTok/IG will absorb more, as 50+% of their peers struggle:

4/...as i discussed with @dougboneparth, there are broadly 3 buckets in this Great Transfer:

-Managerial Elite/Successionesque owners of capital

-the banal-but-wide-band of normie affluence: tony homes & hefty portfolios etc

-the humble pie of the "bottom" 50%: see that sliver?

-Managerial Elite/Successionesque owners of capital

-the banal-but-wide-band of normie affluence: tony homes & hefty portfolios etc

-the humble pie of the "bottom" 50%: see that sliver?

5a/ in '89, total US family wealth was ~$38 trillion. now? $140 trillion. $84 trillion will be inherited by 2045, $16 trillion of it in a few years. "The amounts are just staggering," James Jack, a managing director at UBS, largest wealth manager in the world, told me

he added...

he added...

5b/ for those in wealth mgmt, Succession (minus the raunchy satire) is real life.

HighNetWorth & ultra-HNW individuals form 1.5% of households. they constitute 42% of the almost $100 trillion expected to be passed down.

funnily, Jack says the show has truly boosted business...

HighNetWorth & ultra-HNW individuals form 1.5% of households. they constitute 42% of the almost $100 trillion expected to be passed down.

funnily, Jack says the show has truly boosted business...

6/naturally, there’s no data on the impact Succession had on his or other firms client growth, Mr Jack said, but "an amazing outcome of the show," he told me, is "ever since it entered pop culture succession planning has become a much bigger topic among families"

onto normies...

onto normies...

7/to be "set" you can also just be the grandson of a family of lawyers. average price of a house is up ~500% since 1983. The stock market (per S&P 500 index) is up 2,800% since 1983. simply owning vanilla stocks + a "nice" neighborhood = crazy ROI.

not so simple for everyone...

not so simple for everyone...

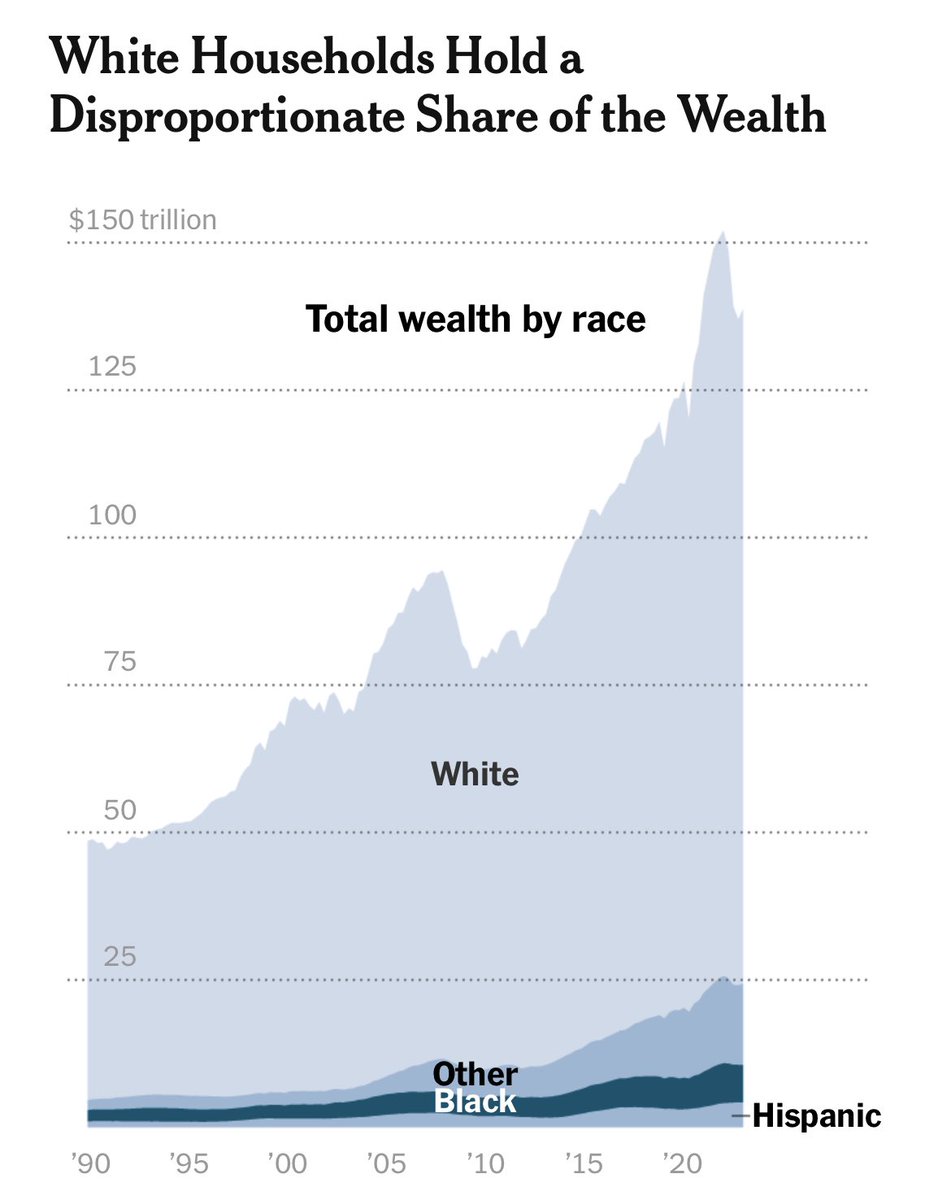

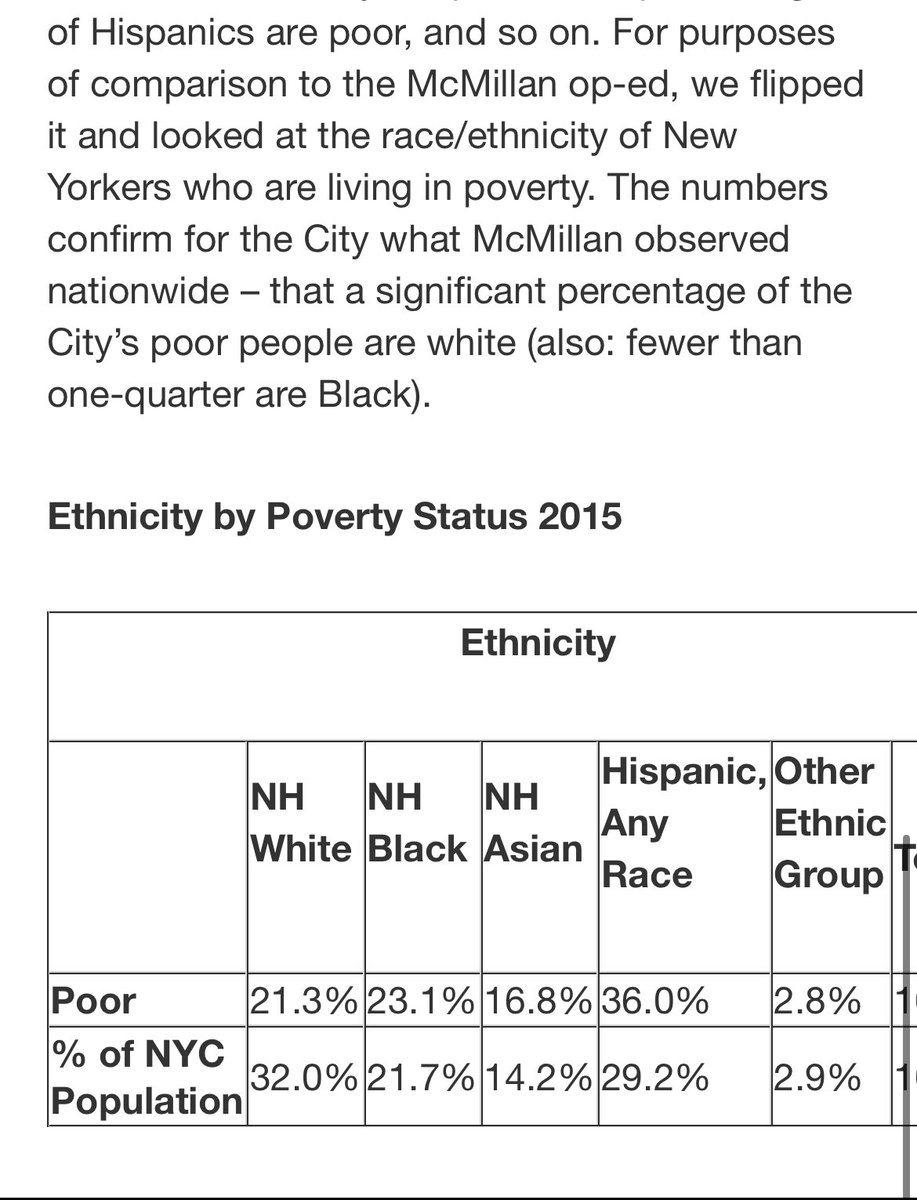

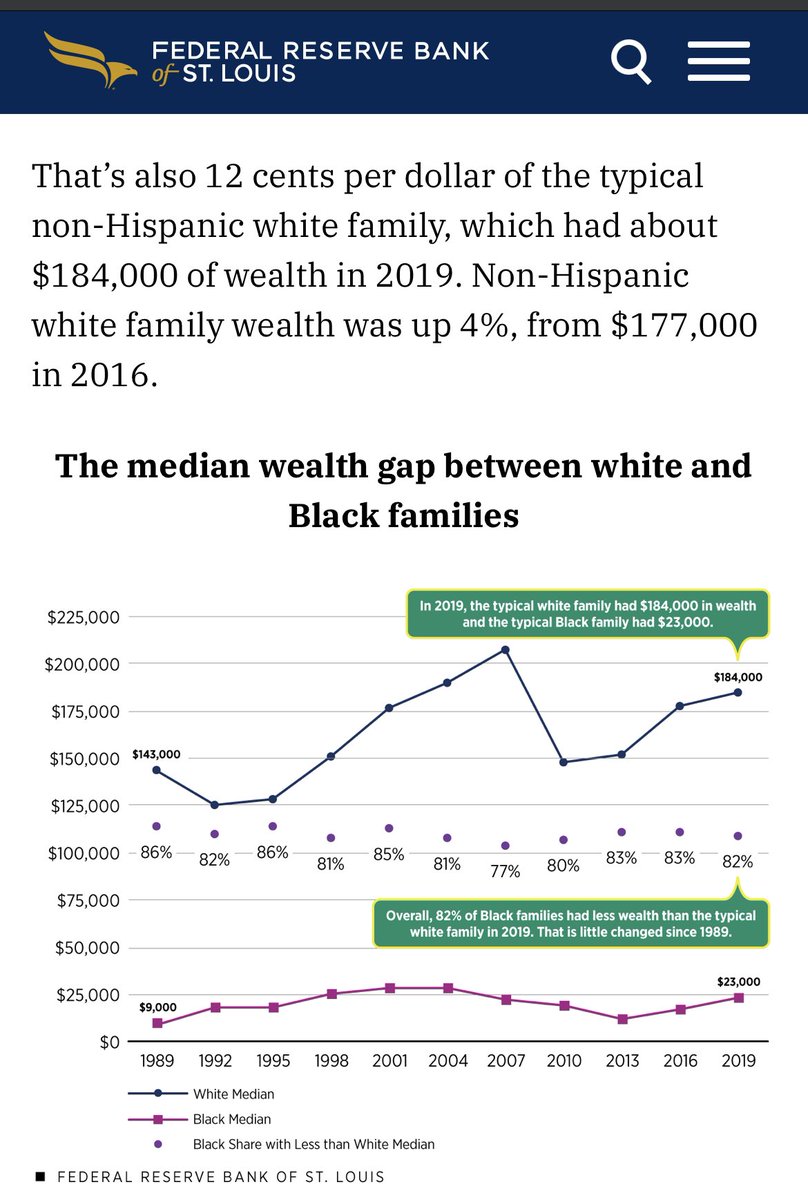

8/typically, convos about inequity quickly pivot to race inequity & then it's just a class/race food fight. so lets just parse the data...

Nearly half of ppl in poverty are white. Most US fams are white. Most fams aren't rich

yet. the top 1 & 10% are uber-white

so you get this:

Nearly half of ppl in poverty are white. Most US fams are white. Most fams aren't rich

yet. the top 1 & 10% are uber-white

so you get this:

9/if you split the US economy into halves, the Haves are way whiter (benefitting from years of...well, everything). also crucial is a focus on the non-heirs - the 'bottom' 50% - which have an avg. annual income of *~$28,000*

politics can belie how they are people of all colors...

politics can belie how they are people of all colors...

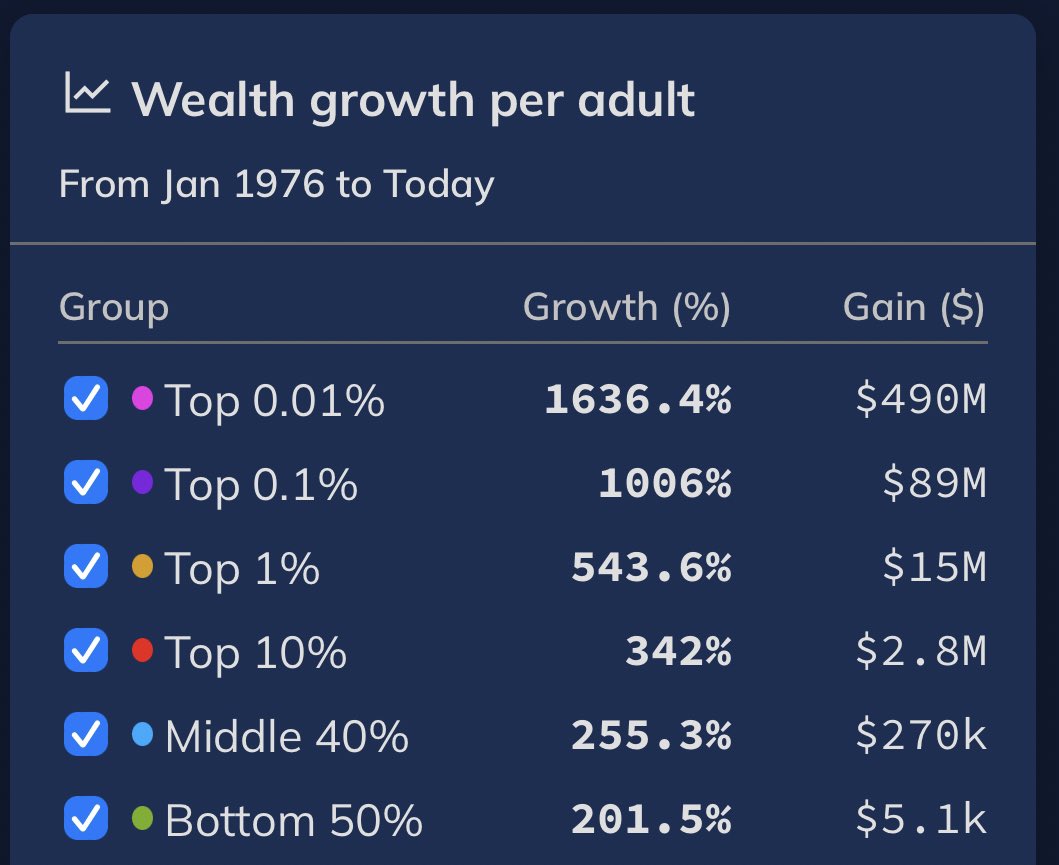

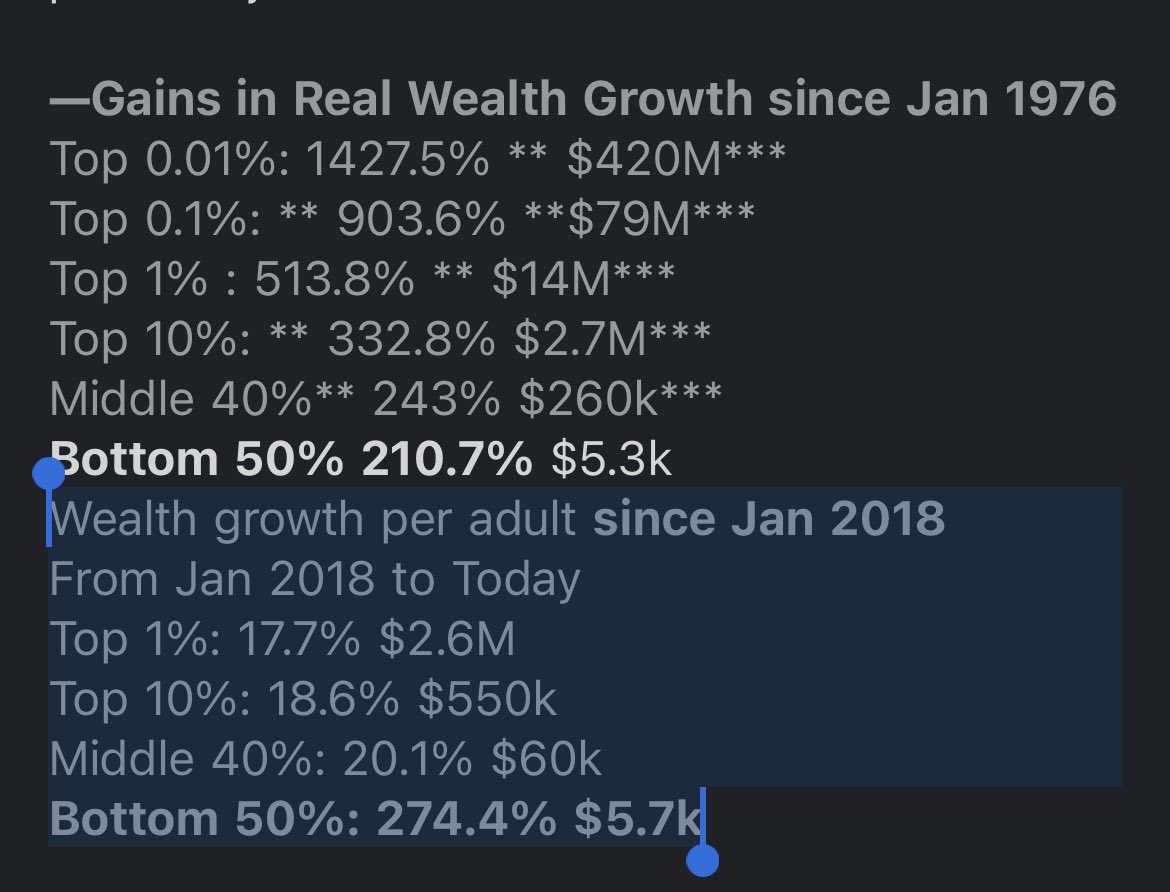

10/as @gabriel_zucman & co. show with their data tracker and as @keds_economist told me there’s a "huge difference between augmenting existing wealth vs generating wealth. The latter is so, so, so much harder"

$5k(!) in real wealth growth for the Bottom 50% since both '76 & 2018

$5k(!) in real wealth growth for the Bottom 50% since both '76 & 2018

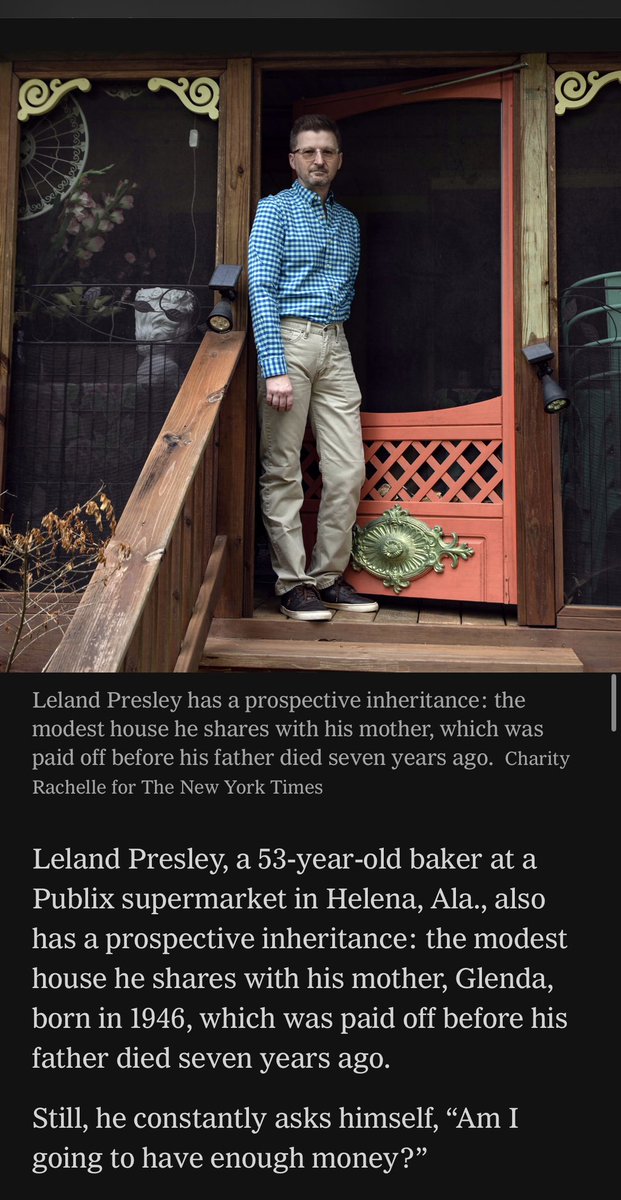

11/This is my guy Leland Presley, a 53 yr old baker from Alabama. slow drawl. quick wit. He began at Publix (where median salary is $24k as of '22) at 13/hr in 2013.

He's clawed up to $20/hr now but half-jokes he isn't sure how he'll afford full retirement unless he dies early

He's clawed up to $20/hr now but half-jokes he isn't sure how he'll afford full retirement unless he dies early

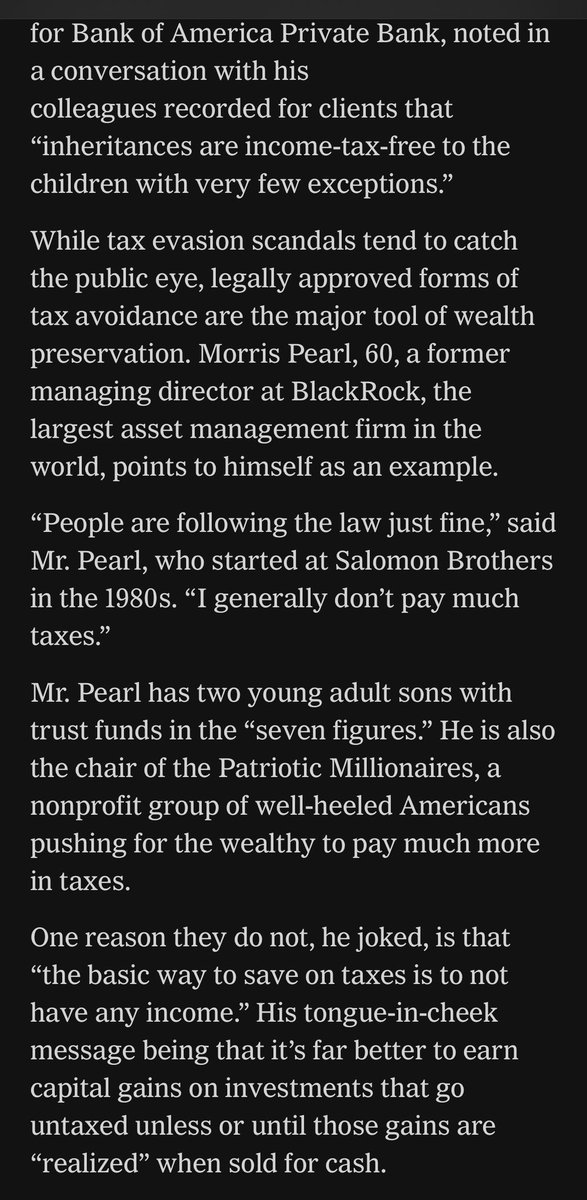

12/compare him with Morris Pearl, only a few years older, a $ stratosphere away. Pearl, a real mensch, got his start on Wall St in the 'Liars Poker' 80s era & made millions over the yrs he says "he's pretty smart, mostly lucky."

that fortune, like all others, is set to compound

that fortune, like all others, is set to compound

13/...Despite the mega trillions going to heirs, HNW households (those with $5 mill+ in assets) are projected to pay a mere $4.2 trillion in taxes on estates and transfers in the next 25 yrs, per @cerulli_assoc

tax evasion=headlines

the boring legal stuff is the main story...

tax evasion=headlines

the boring legal stuff is the main story...

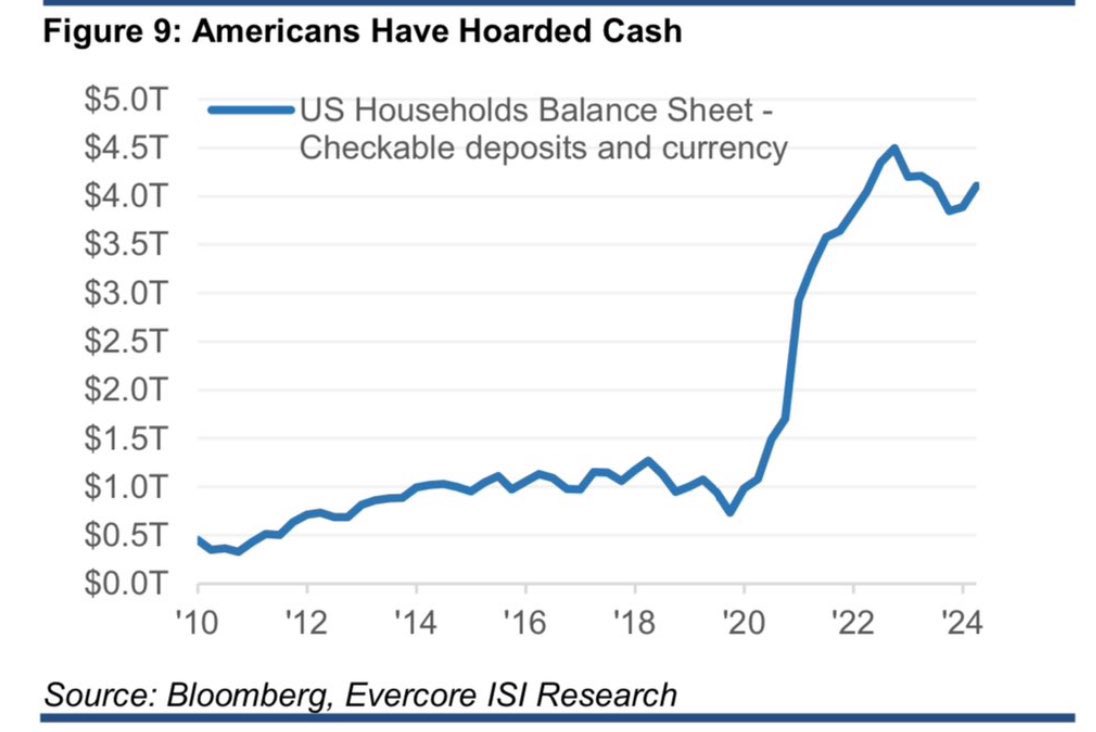

14/There's a lot of handwringing about the credit spending & borrowing habits of the working and middle class masses. but as James Jack from UBS told me: "The biggest borrowers are the rich" and with low risk loan terms, “it's basically free money"

(portfolio ROI > loan rate)🥹

(portfolio ROI > loan rate)🥹

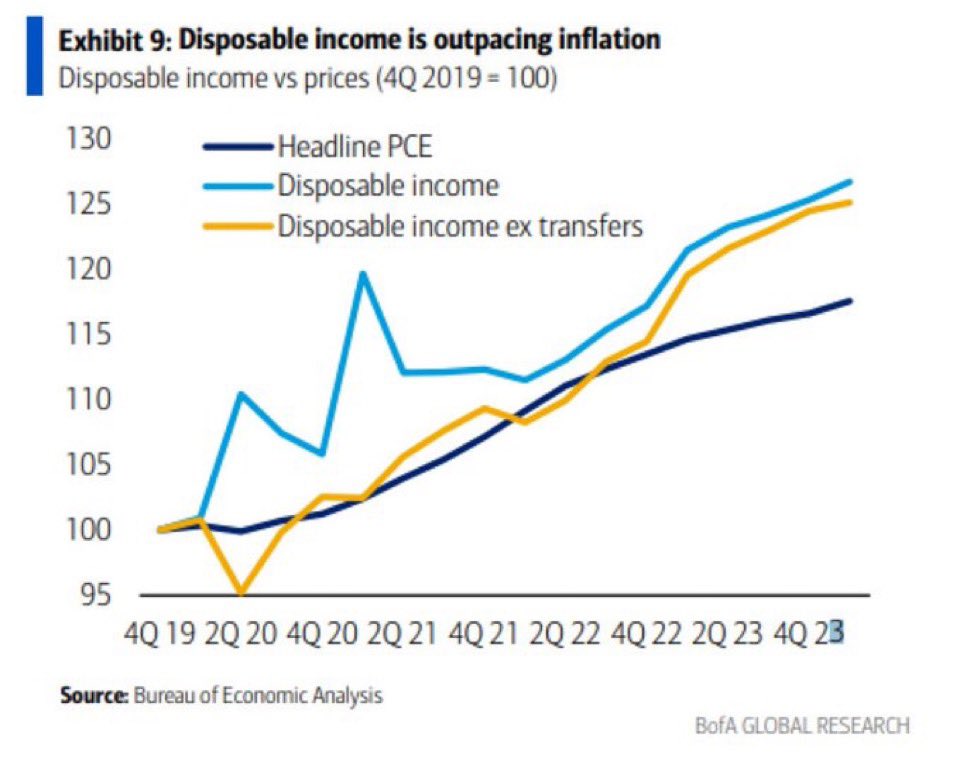

15/a paper by Carter C. Price & @keds_economist found that if "income growth since 1975 remained as equitable" as it was total annual income of Americans outside the top 10% wouldve been $2.5 trillion higher in the year 2018: enough to 2x median income / $1k more in monthly pay

16/the data is not all doom & gloom. financial success stories of immigrant & nonimmigrant POC get cloaked by pervasive stories & shocking data detailing years of ongoing disadvantage. but the generational green shoots of 60-80s immigration & integration laws are finally here...

17/the generation of Black&Brown people that were finally first let into Corporate America, the Ivies, flagship colleges (albeit on uneven ground) are now often family matriarchs & patriarchs.

but: by a recent *govt count, the typical Black family still had a mere $23k in wealth

but: by a recent *govt count, the typical Black family still had a mere $23k in wealth

18/there are also many nuances regarding the White 'Winners' of this wealth transfer

a) parental longevity/health/planning means many will get *only*/mostly a house upon a death in the fam, years away b) the upperishmiddleclass of all colors feels "sandwiched" by kids/elders...

a) parental longevity/health/planning means many will get *only*/mostly a house upon a death in the fam, years away b) the upperishmiddleclass of all colors feels "sandwiched" by kids/elders...

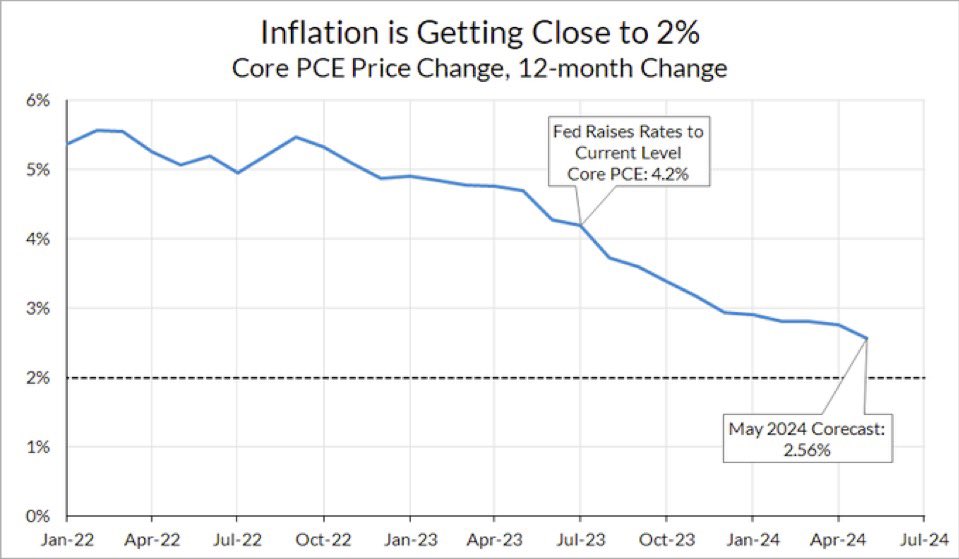

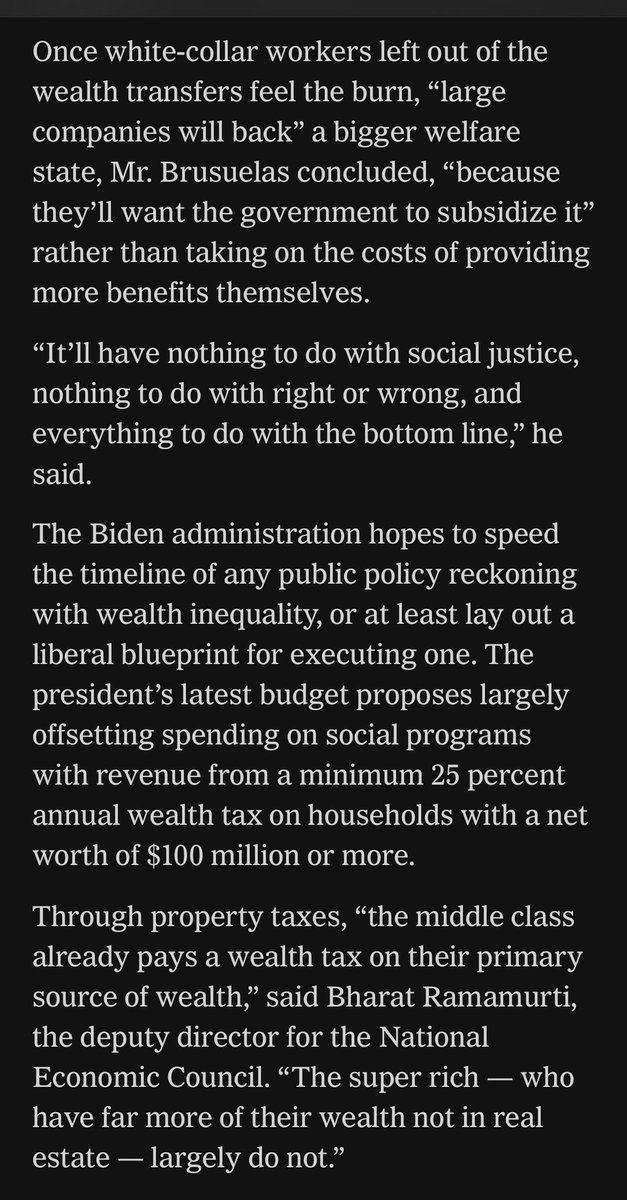

19/that brings me to my final point: the rich getting richer, the poor poorer (in real terms) & the middle scrapping to get ahead looks deeply unsustainable on a macroeconomic basis. amid this inequity, could we rly cut social benefits? keep stifling wage gains for avg workers?

20/@joebrusuelas a stalwart economist, thinks change will come — but only when higher-income salary workers, still sort of managing, can no longer rly afford kids+housing+elder care+leisure <<with pricing for all that showing little relief, are we that far off?

time will tell.

time will tell.

• • •

Missing some Tweet in this thread? You can try to

force a refresh