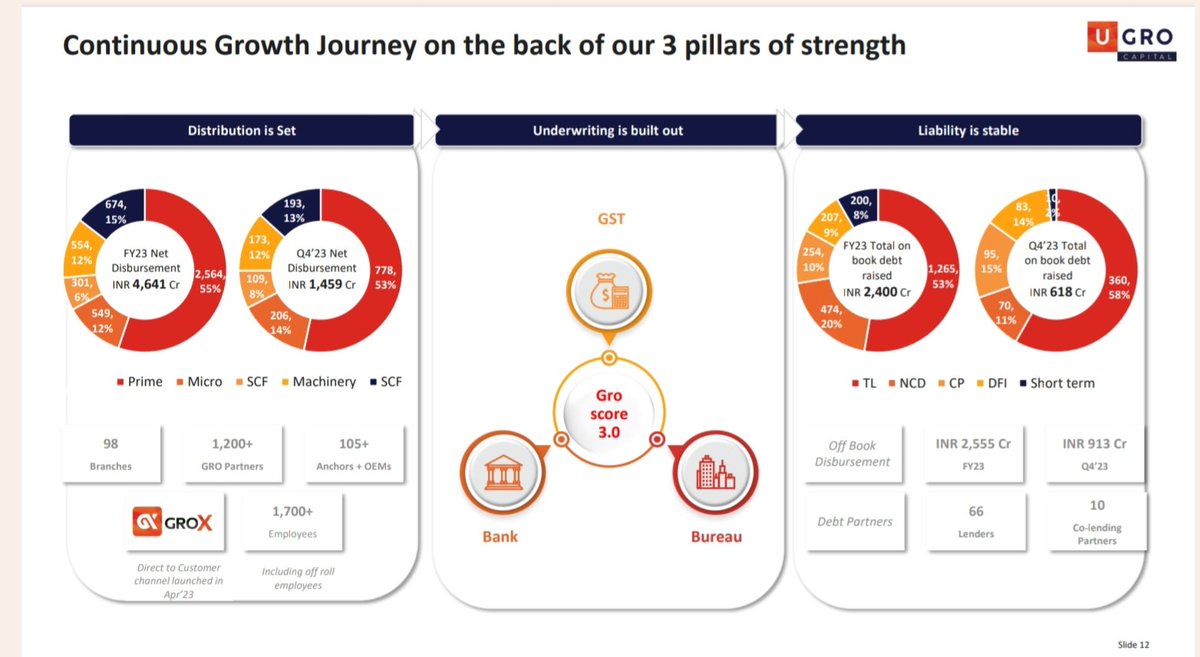

#UgroCapital Shaping up nicely as the Data & Machine Learning backed MSME lender on focused sectoral lending. Have steered well through the difficult times of past few years in the NBFC/lending space

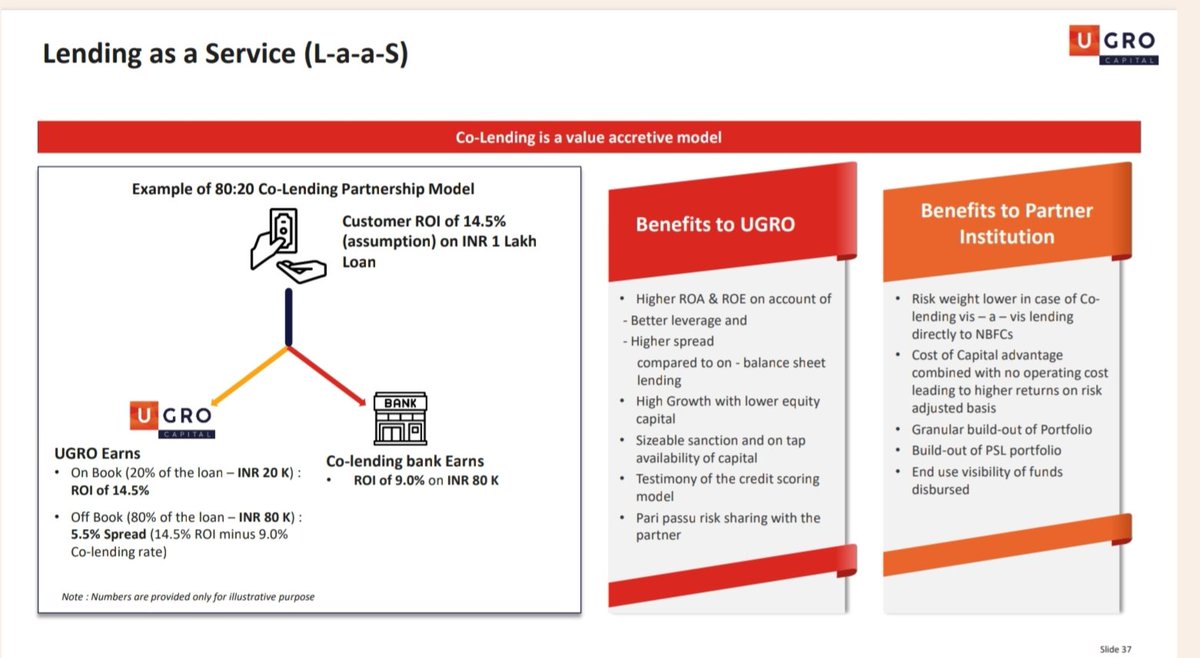

The off-book AUM mix ramped up to 40% significantly de-risking own capital, supported by premiere financial institutions

• • •

Missing some Tweet in this thread? You can try to

force a refresh