The MONTHLY ChartStorm - May 2023

$SPX $SPY $ES_F $VIX $STUDY

(thread)

$SPX $SPY $ES_F $VIX $STUDY

(thread)

Welcome to the inaugural MONTHLY ChartStorm — basically a digest of some of the most intriguing charts of the past month from the (now paywalled) Weekly S&P500 #ChartStorm

1. Allocations vs Sentiment

Despite some of the most bearish sentiment readings in recent history, investors only slightly reduced equity allocations. And now they're reassessing the situation...

h/t @topdowncharts

Despite some of the most bearish sentiment readings in recent history, investors only slightly reduced equity allocations. And now they're reassessing the situation...

h/t @topdowncharts

2. Soft Landing?

Wall Street analysts are basically predicting a soft landing for earnings, with consensus seeing a small dip and then strong recovery...

h/t @MikeZaccardi $SPX $SPY $MACRO

Wall Street analysts are basically predicting a soft landing for earnings, with consensus seeing a small dip and then strong recovery...

h/t @MikeZaccardi $SPX $SPY $MACRO

3. Recession Trading

Recessionary bear markets often see substantial rallies and periods of ranging/stalemate (...seem familiar?)

Stock prices can thus be very misleading in terms of false dawns and false hopes.

h/t @businesscycle $SPX $MACRO

Recessionary bear markets often see substantial rallies and periods of ranging/stalemate (...seem familiar?)

Stock prices can thus be very misleading in terms of false dawns and false hopes.

h/t @businesscycle $SPX $MACRO

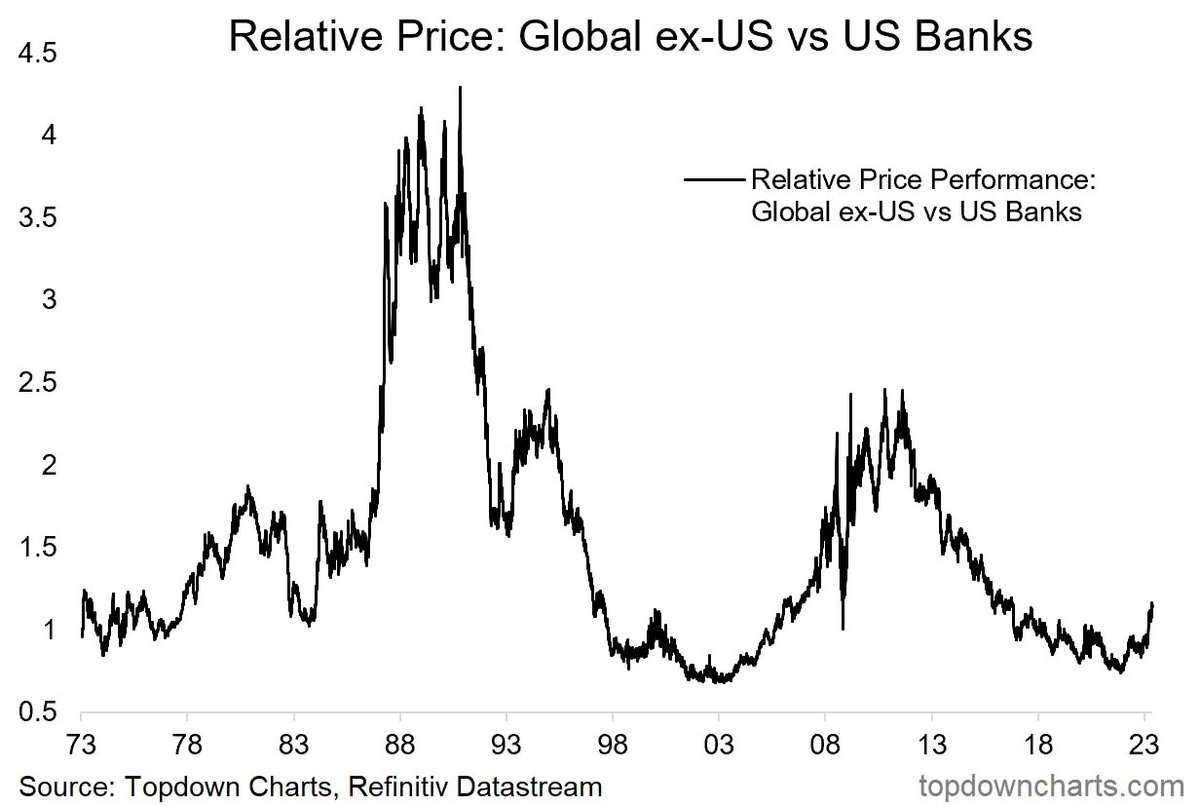

4. Global Banks Gain the Upper Hand

After a decade-long relative bear market, global banks are making a comeback (thanks to disastrous performance of US banks) — major turning point in progress?

h/t @topdowncharts $XLF $KRE $KBE

After a decade-long relative bear market, global banks are making a comeback (thanks to disastrous performance of US banks) — major turning point in progress?

h/t @topdowncharts $XLF $KRE $KBE

5. Tech vs The Rest: Peak or Plateau?

The dominance of tech relative performance can conclude with a bang (2000), a whimper (1970’s), or a plateau (1962)

h/t @Marlin_Capital $XLK $QQQ $NDX

The dominance of tech relative performance can conclude with a bang (2000), a whimper (1970’s), or a plateau (1962)

h/t @Marlin_Capital $XLK $QQQ $NDX

6. Lopsided Markets

Passive index-tracking investors are wildly concentrated in the top 10 stocks.

Will things like AI drive a rebalancing?

h/t @pkedrosky

Passive index-tracking investors are wildly concentrated in the top 10 stocks.

Will things like AI drive a rebalancing?

h/t @pkedrosky

7. Global Stockmarket Seasonality

This chart tracks the seasonal price patterns by month across a range of global equity indexes, and essentially goes to show that seasonality is a global thing.

And the seasons are changing…

h/t @laidler_ben

This chart tracks the seasonal price patterns by month across a range of global equity indexes, and essentially goes to show that seasonality is a global thing.

And the seasons are changing…

h/t @laidler_ben

8. It Was a Good Day

Would you believe me if I told you even-dated days historically outperformed odd-dated days?

h/t @buildalpha

Would you believe me if I told you even-dated days historically outperformed odd-dated days?

h/t @buildalpha

That's it for this month. 🤓

Check out the Weekly ChartStorm for more charts and timely updates on the market outlook: topdowncharts.com/chartstorm

Check out the Weekly ChartStorm for more charts and timely updates on the market outlook: topdowncharts.com/chartstorm

• • •

Missing some Tweet in this thread? You can try to

force a refresh