Yield trading can be incredibly profitable if done correctly📊

@pendle_fi offers this on a variety of assets like GLP, gDAI, ETH LSDs & more.

The ultimate beginners/intermediates guide to yield trading and outperforming classic DeFi strategies📈

@pendle_fi offers this on a variety of assets like GLP, gDAI, ETH LSDs & more.

The ultimate beginners/intermediates guide to yield trading and outperforming classic DeFi strategies📈

Content covered:

• Pendle

• Tokenized yield

• Shorting yield

• Longing yield

• Active yield trading

Let's dive in👇

• Pendle

• Tokenized yield

• Shorting yield

• Longing yield

• Active yield trading

Let's dive in👇

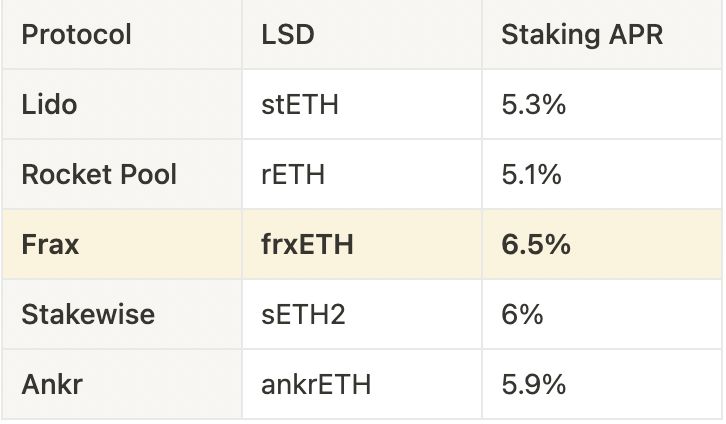

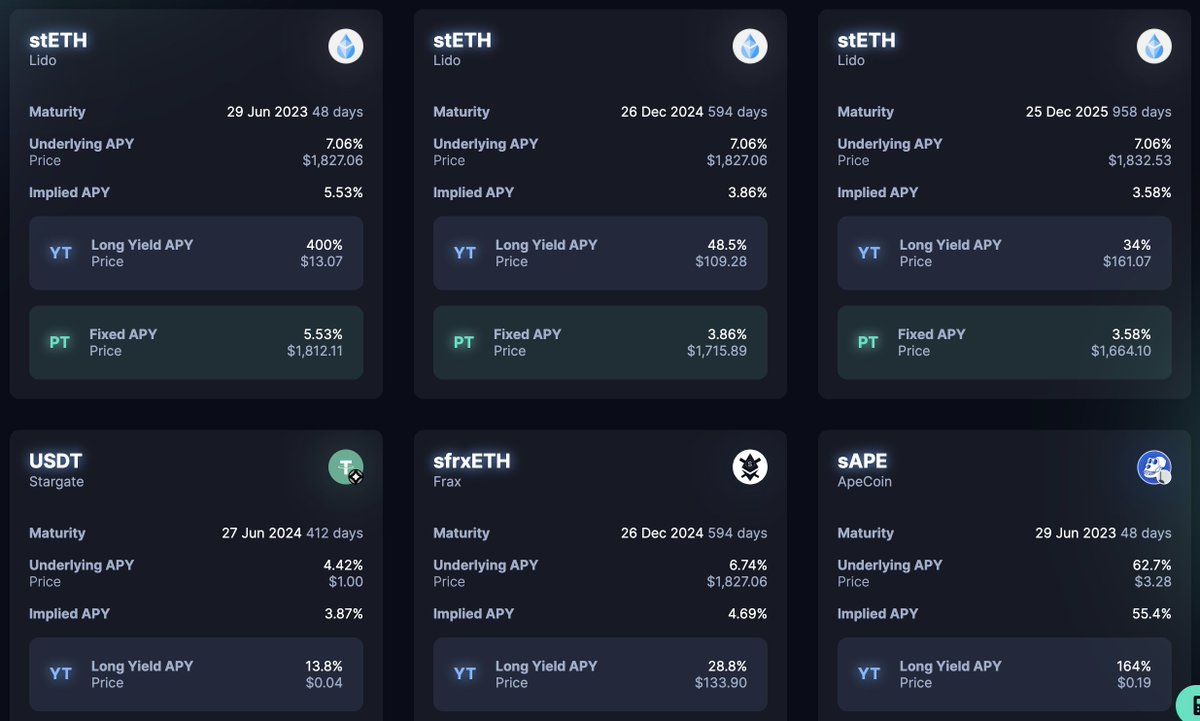

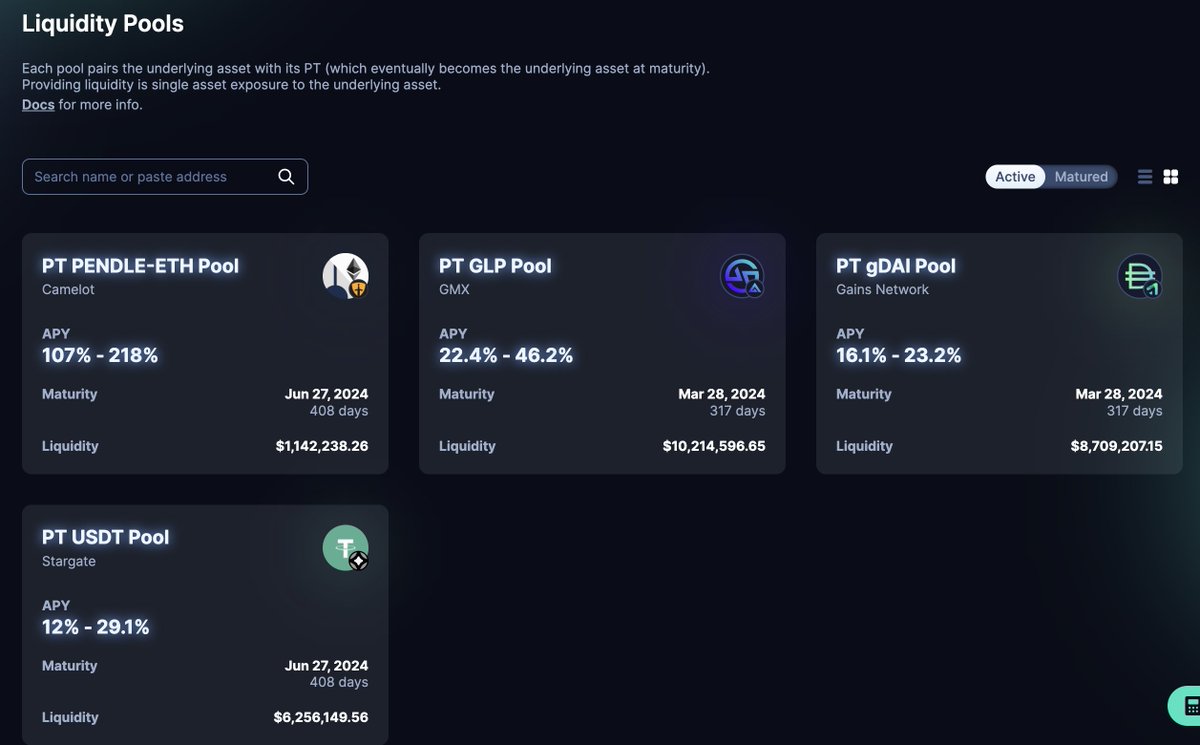

1/ Users on Pendle can earn high yield on a variety if yield bearing assets like:

• ETH LSD's such as stETH, sfrxETH & rETH

• GLP, gDAI, Stargate USDT

• Liquidity pools like PENDLE/ETH

The protocol is live on Ethereum and Arbitrum and is constantly updated with new features.

• ETH LSD's such as stETH, sfrxETH & rETH

• GLP, gDAI, Stargate USDT

• Liquidity pools like PENDLE/ETH

The protocol is live on Ethereum and Arbitrum and is constantly updated with new features.

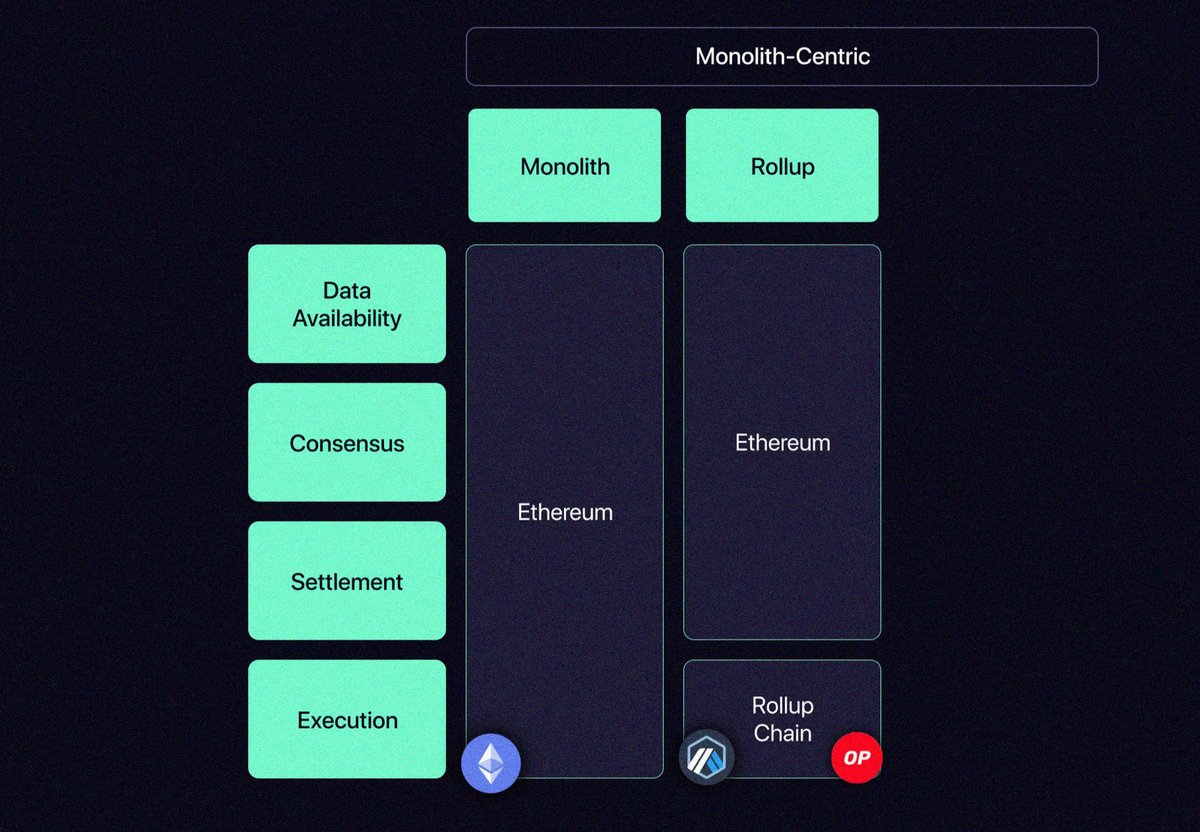

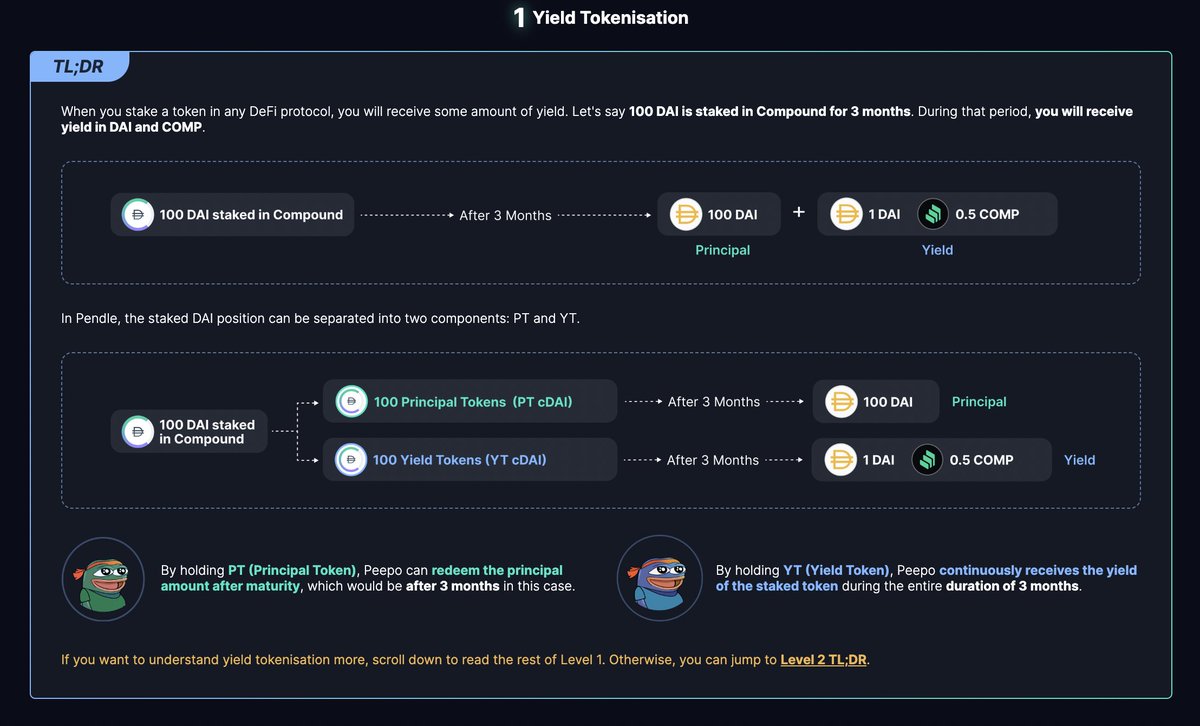

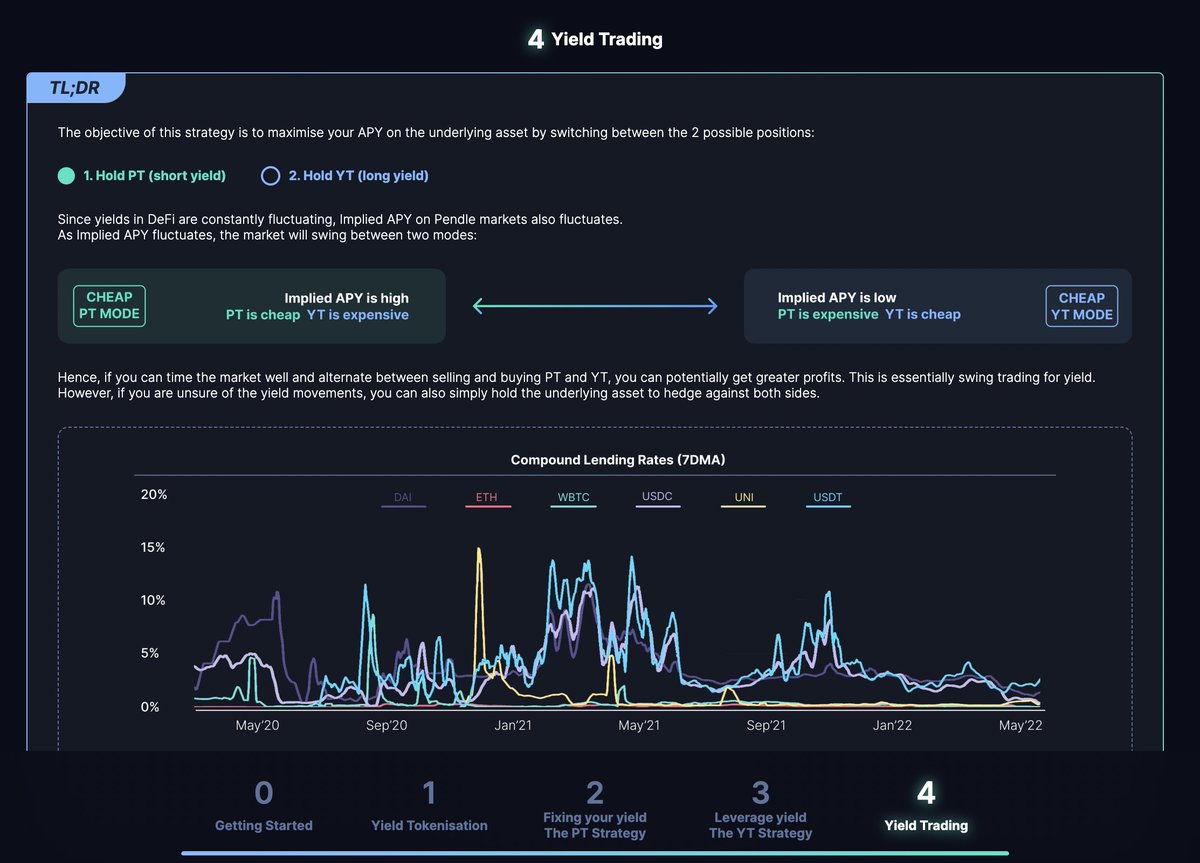

2/ - Tokenized yield -

On Pendle Finance, yield bearing assets like GLP or ETH LSDs are split up into:

• A principal token (the asset itself)

• A yield token (the yield generated by the asset)

Study the image for a deeper understanding👇

On Pendle Finance, yield bearing assets like GLP or ETH LSDs are split up into:

• A principal token (the asset itself)

• A yield token (the yield generated by the asset)

Study the image for a deeper understanding👇

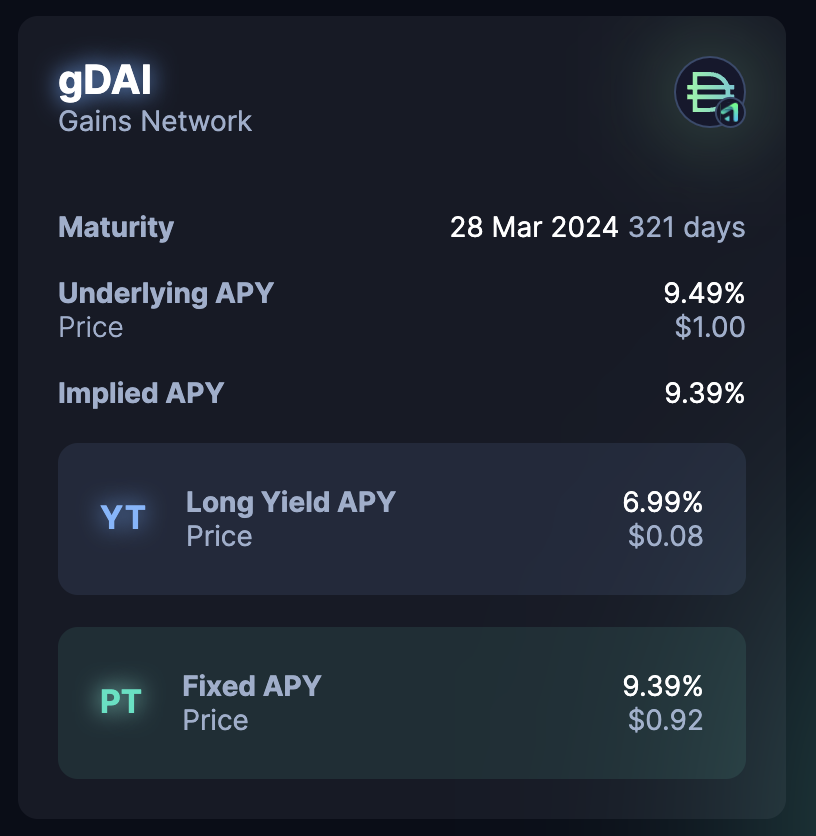

3/ The principle token (PT) appreciates in value until it reaches the full price of the underlying asset at maturity.

E.g. PTgDAI is currently trading at $0.92 and will reach the underlying price of gDAI ($1) in 323 days (maturity).

The PT tokens therefore offer a fixed yield.

E.g. PTgDAI is currently trading at $0.92 and will reach the underlying price of gDAI ($1) in 323 days (maturity).

The PT tokens therefore offer a fixed yield.

4/ Holding the yield token (YT) grants you all the yield on the underlying token.

Choosing to buy the YT instead of locking in the fixed yield with the principle tokens signals that you believe the future yield will increase.

Let's look at this more closely👇

Choosing to buy the YT instead of locking in the fixed yield with the principle tokens signals that you believe the future yield will increase.

Let's look at this more closely👇

5/ The price of the YT + the price of the PT = price of the underlying asset.

E.g for gDAI:

PTgDAI ($0.92) + YTgDAI ($0.08) = gDAI ($1.00).

What else is the price of the YT and PT determined by?

Market sentiment. More specifically buy and sell pressure of the YT & PT.

E.g for gDAI:

PTgDAI ($0.92) + YTgDAI ($0.08) = gDAI ($1.00).

What else is the price of the YT and PT determined by?

Market sentiment. More specifically buy and sell pressure of the YT & PT.

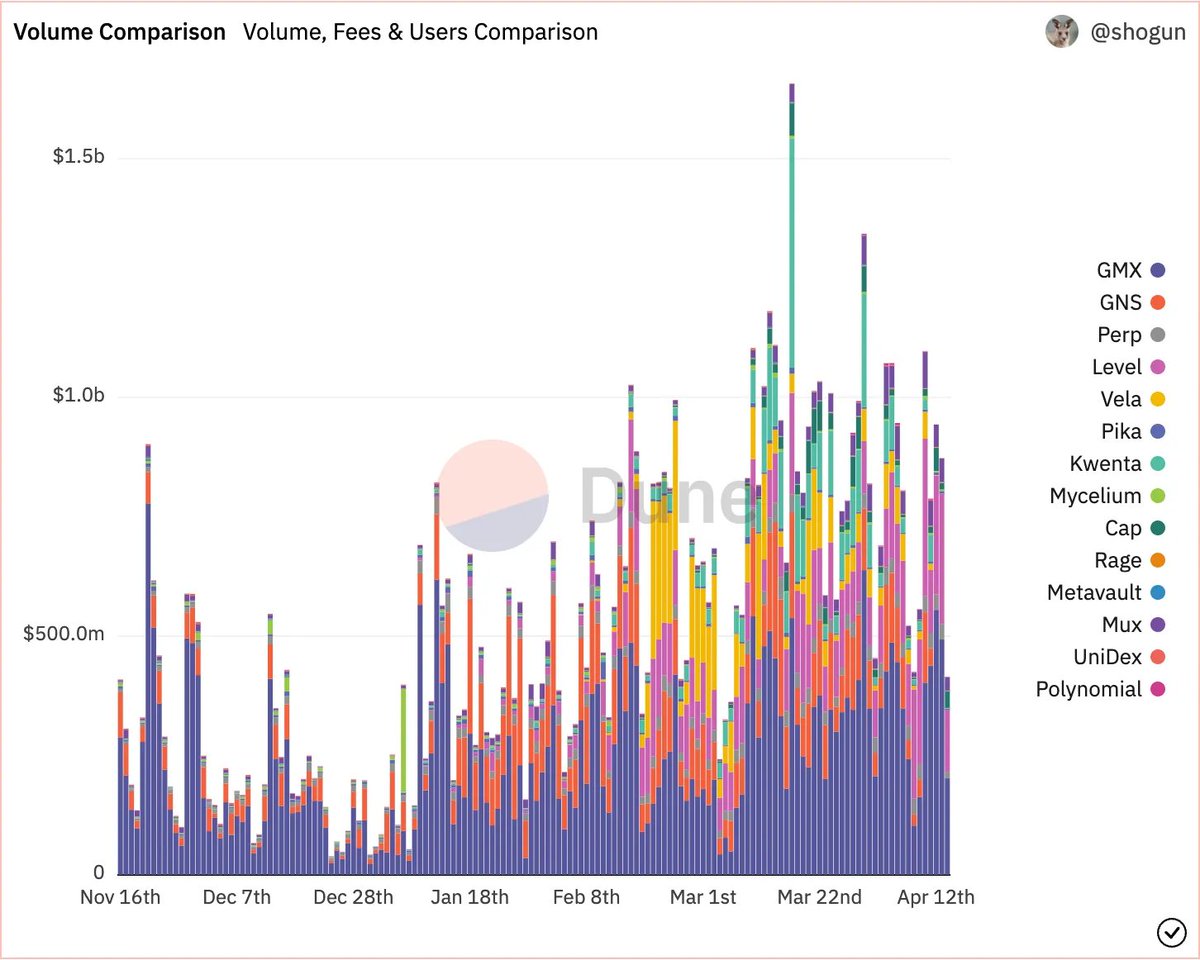

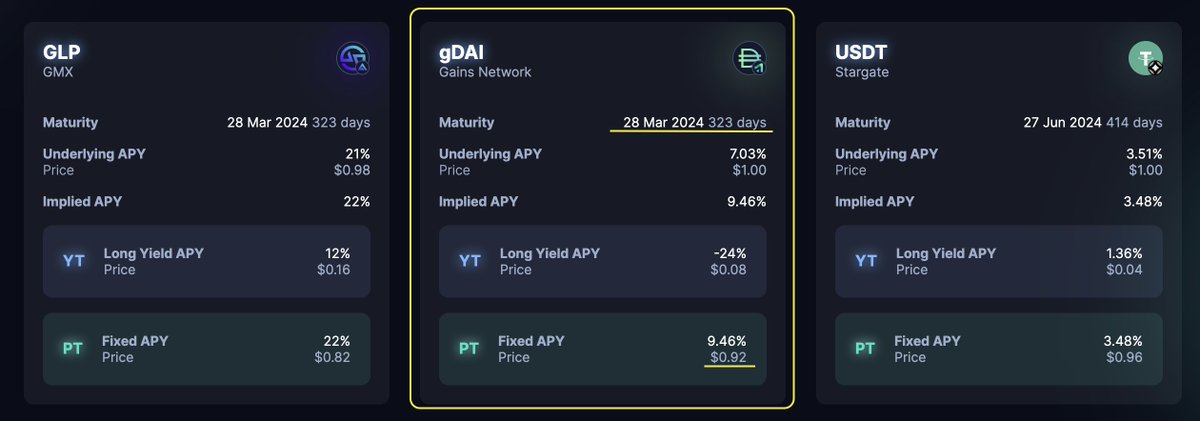

6/ - Shorting yield -

Terminology 📒

Underlying APY: GLP APY on @GMX_IO

Implied APY: GLP APY on Pendle which is determined by the traders on Pendle.

Buying the PTGLP token currently locks in a 20.2% APY which is pretty good considering GLP only yields 12.7% on GMX itself.

Terminology 📒

Underlying APY: GLP APY on @GMX_IO

Implied APY: GLP APY on Pendle which is determined by the traders on Pendle.

Buying the PTGLP token currently locks in a 20.2% APY which is pretty good considering GLP only yields 12.7% on GMX itself.

7/ As seen from the image above, the PTGLP token appreciates from $0.83 to $0.97 in 321 days which is the 20.2% APY.

If many traders decide to lock in the fixed yield by buying the PT token ->

PTGLP price increases 🔼

A higher ptGLP price = lower fixed yield for future buyers.

If many traders decide to lock in the fixed yield by buying the PT token ->

PTGLP price increases 🔼

A higher ptGLP price = lower fixed yield for future buyers.

8/ - Longing yield -

When the PTGLP token appreciates in price the YTGLP token depreciates and vice versa as PTGLP + YTGLP = GLP.

Buying and holding YT = longing yield

Profits = future yield - YT cost

Let's break this down:

When the PTGLP token appreciates in price the YTGLP token depreciates and vice versa as PTGLP + YTGLP = GLP.

Buying and holding YT = longing yield

Profits = future yield - YT cost

Let's break this down:

9/ Let's say you buy the YTGLP token at $0.15 with an underlying APY on GMX at 20% and an implied yield on Pendle at 18%.

You might have noticed that fees have been very high on GMX the past week so when the weekly APY updates on GMX, the yield is likely to increase.

You might have noticed that fees have been very high on GMX the past week so when the weekly APY updates on GMX, the yield is likely to increase.

10/ Let's say this turned out to be true and the underlying APY shoots up to 35%.

Traders on Pendle are now more likely to buy the YTGLP as they want the high yield more easily accessible.

As more traders buy the YT than PT, YTGLP appreciates and you can sell at a profit.

Traders on Pendle are now more likely to buy the YTGLP as they want the high yield more easily accessible.

As more traders buy the YT than PT, YTGLP appreciates and you can sell at a profit.

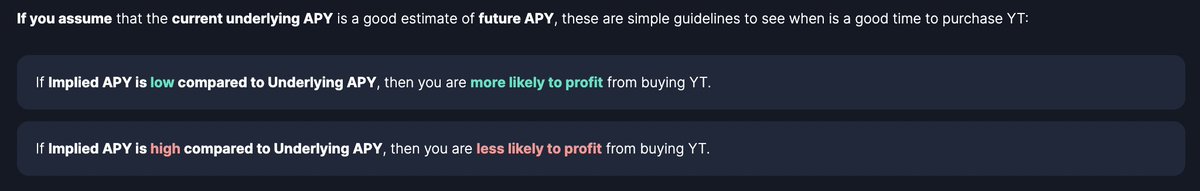

11/ In general:

If implied APY > underlying APY

• You are more likely to profit from buying the PT token

If implied APY < underlying APY

• You are more likely to profit from buying the YT token

If implied APY > underlying APY

• You are more likely to profit from buying the PT token

If implied APY < underlying APY

• You are more likely to profit from buying the YT token

12/ At the end of the day it depends on the supply and demand for both the PT and YT.

Being able to predict where the underlying yield on the native protocol itself is moving is the best way to yield trade on Pendle.

An example of this from @gabavineb👇

Being able to predict where the underlying yield on the native protocol itself is moving is the best way to yield trade on Pendle.

An example of this from @gabavineb👇

https://twitter.com/gabavineb/status/1632756061424988160

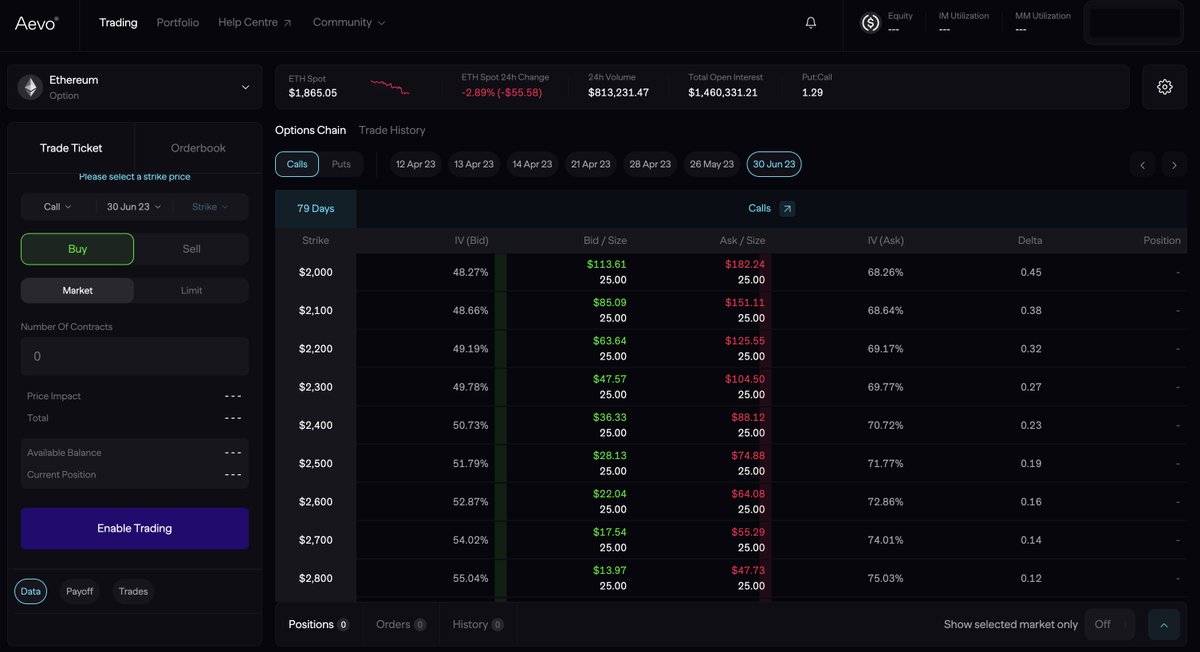

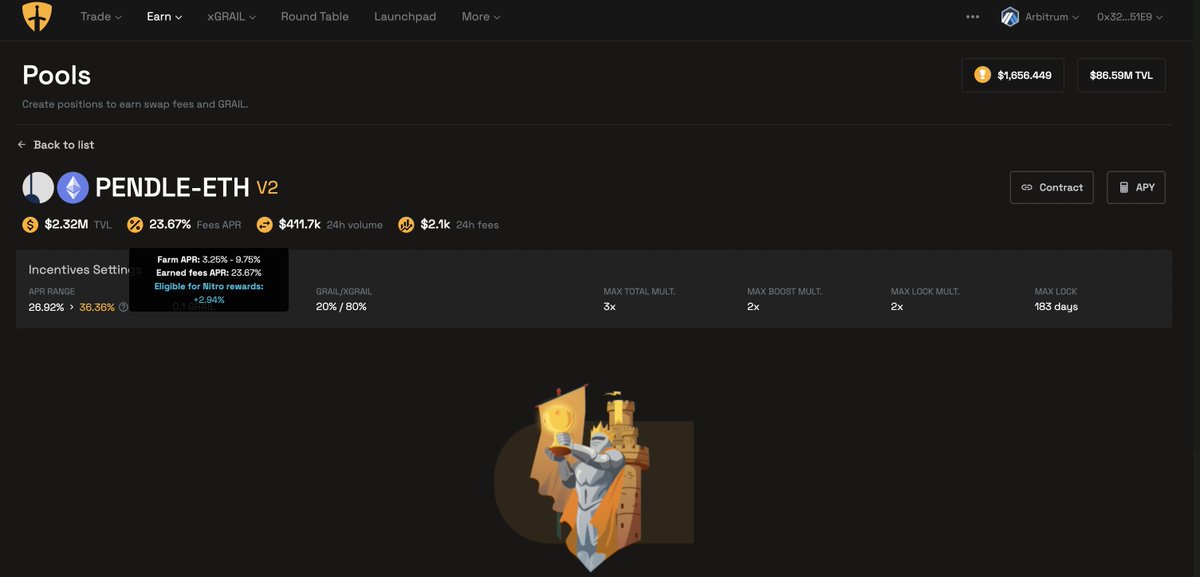

13/ Pool 三

@pendle_fi recently added a new asset on Arbitrum:

PENDLE/ETH

This brings another dimension to yield trading and brings a new level liquidity and volatility to yield trading.

@pendle_fi recently added a new asset on Arbitrum:

PENDLE/ETH

This brings another dimension to yield trading and brings a new level liquidity and volatility to yield trading.

14/ The pool comes from @CamelotDEX where the yield is being generated by $GRAIL emissions and swap fees.

As seen from the image before the underlying APY on Camelot is 33% whereas the fixed (implied) APY on Pendle is 23.9%.

As seen from the image before the underlying APY on Camelot is 33% whereas the fixed (implied) APY on Pendle is 23.9%.

15/ If you believe that the high yield on Camelot will continue, you might want to buy the yield token (YTPENDLE/ETH) as it will appreciate in value if the implied yield on Pendle increases.

16/ As with all assets on Pendle, you can also provide liquidity to the market by depositing into the liquidity pools made up of the asset itself and the principle token (PT).

Exact same impermanent loss on this LP as on Camelot itself so a no-brainer providing liquidity here.

Exact same impermanent loss on this LP as on Camelot itself so a no-brainer providing liquidity here.

17/ With these types of markets (PENDLE/ETH) there is deeper liquidity as the underlying liquidity pool position from Camelot can be used for yield trading.

Further, Camelot LP's might as well deposit their liquidity into Pendle for higher rewards (Pendle fees + emissions).

Further, Camelot LP's might as well deposit their liquidity into Pendle for higher rewards (Pendle fees + emissions).

So, if you want to become a yield trading master I recommend studying the 'Learn' page on Pendle.

It covers everything from the basic mechanics of the principle and yield tokens to more advanced yield trading.

Took me a few reads to fully grasp the concepts.

It covers everything from the basic mechanics of the principle and yield tokens to more advanced yield trading.

Took me a few reads to fully grasp the concepts.

Keep in mind that nothing in this thread should be construed as financial advice!

I am a proud partner of @pendle_fi as I strongly believe in their product hence the thread is sponsored.

I am a proud partner of @pendle_fi as I strongly believe in their product hence the thread is sponsored.

I also did a video on YT covering the basics of Pendle (yield token, principal token, liquidity pools, vePENDLE etc).

You can check it out here:

You can check it out here:

Linking back to the first post. Leave a like/retweet if you enjoyed the research⚡️

https://twitter.com/ThorHartvigsen/status/1658843524823937024

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter