EVERYTHING IS AN AD NETWORK: Back in 2021, I proposed that "Everything is an ad network" because foundational changes in digital privacy were "upending many of the fundamental precepts" of digital advertising. This trend has accelerated since. Thoughts in a thread (1/X).

2/ The Information reports that Instacart delivered perhaps 30% of its revenue in 2022 from advertising. Instacart operates a grocery marketplace; why does 1/3rd of its revenue derive from ads? Because Everything is an Ad Network. theinformation.com/articles/insta…

3/ Similarly, Walmart delivered $2.7BN in advertising revenue in 2022, up 30% from 2021. In March, the company declared that it expects to derive more profit from ads and services than from core retail sales going forward. money.usnews.com/investing/news…

4/ In my original post on the topic, titled Everything is an ad network, I identify a number of advertising initiatives from retailers (RMNs, or retail media networks) which were launched or enlarged in the wake of Apple's App Tracking Transparency (ATT) privacy policy. Why?

5/ ATT precipitated a tectonic upheaval in digital advertising. The IAB estimated in 2016 that, in combination, Facebook and Google captured 89% of all digital advertising spend growth. I wrote at the time that "Facebook and Google own our eyeballs." mobiledevmemo.com/facebook-googl…

6/ But ATT breaks the data feedback loop (on iOS) between large ad platforms and advertisers that facilitated behavioral profiling and user-level ad targeting. I describe this change and its consequences in The App Tracking Transparency Recession. mobiledevmemo.com/the-att-recess…

7/ Other, similar privacy restrictions will or have achieved the same: the DMA in Europe, Google's deprecation of third-party cookies in Chrome & the GAID on Android, etc. The tectonic upheaval will be universal. mobiledevmemo.com/rip-gaid-priva…

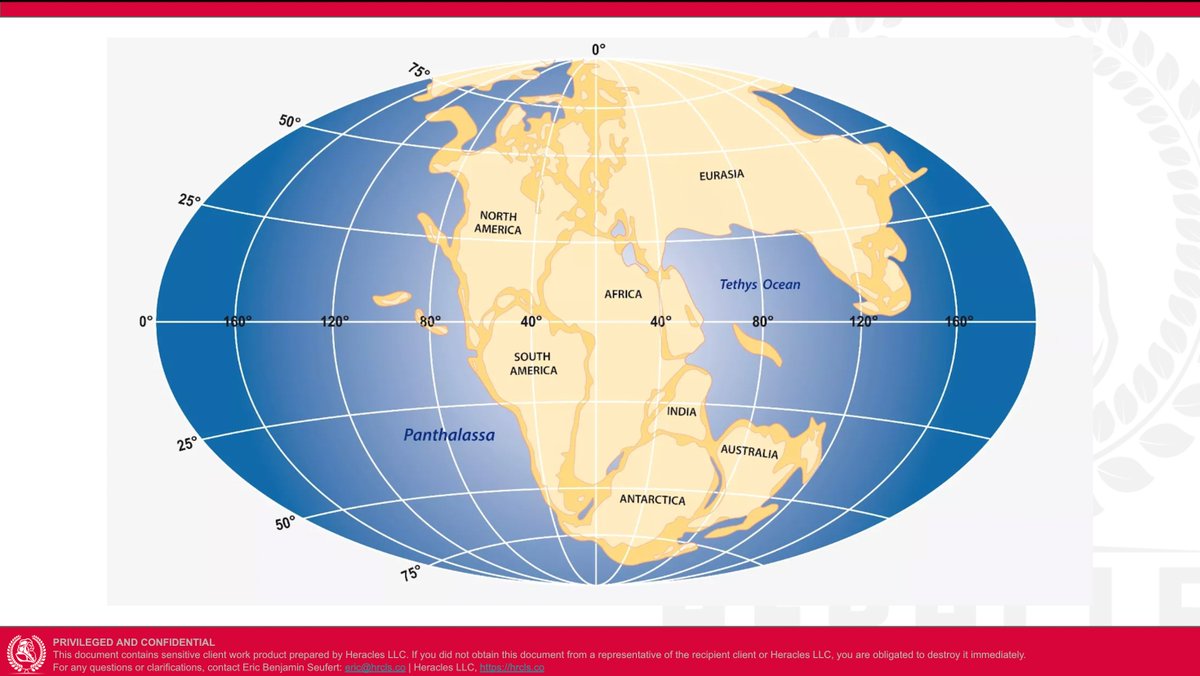

8/ Like Pangea, digital advertising's monolithic landmass of Google+FB is decomposing into a constellation of advertising platforms that don't rely (exclusively) on SDKs or pixels to pair user data with advertising outcomes. These new ad networks utilize first-party data (1PD).

9/ In the absence of a feedback loop of deterministically identifiable (through cookies or device identifiers) conversion data, 1PD aggregated through marketplace sales -- like Instacart's -- prevails. And that is playing out. From the original Everything is an ad network piece:

10/ Meta has adapted to this landscape disruption by utilizing AI to pursue two of the four opportunities for ad platform revenue growth I outline in this piece from July 2022: increase engagement (reels) and increase ad value (Advantage Plus). mobiledevmemo.com/unpacking-meta…

11/ Google has done the same with Shorts and its Performance Max (PMax) advertising product. But marketplace apps can simply conjure up advertising businesses because their 1PD (including simple contextual relevance) holds acute value now. mobiledevmemo.com/why-is-everyth…

12/ This is why Everything is an ad network: as @modestproposal1 pointed out in 2018, ad businesses are attractive, high-margin projects that can be derived from existing assets -- data. The tectonic upheaval in privacy has made them even more accessible.

https://twitter.com/modestproposal1/status/1002649360042283014

13/ Note that ATT didn't engender this dynamic. As I wrote in 2018, Amazon challenged the Facebook+Google stranglehold on digital advertising revenue growth long before ATT. But ATT and other policies have enlivened this contest dramatically. mobiledevmemo.com/can-amazon-ups…

14/ And Amazon is a primary beneficiary! Amazon's ads business grew by 19% in Q4 2022 versus -0.21% for Alphabet and 4% for Meta. mobiledevmemo.com/alphabet-q4-ea…

15/ Everything is an ad network, November 2021: mobiledevmemo.com/everything-is-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh