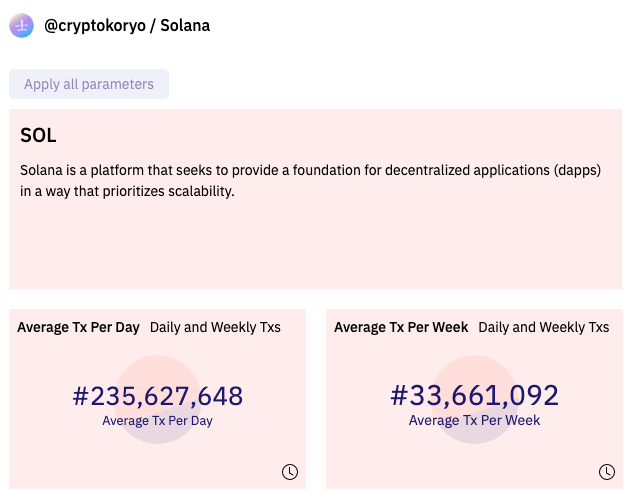

@DuneAnalytics recently released fully decoded Solana data.

I had previously never worked with Solana data.

So I made a Dune Solana dashboard to learn.

Let's look at the 'State of Solana' 🧵👇🏻

I had previously never worked with Solana data.

So I made a Dune Solana dashboard to learn.

Let's look at the 'State of Solana' 🧵👇🏻

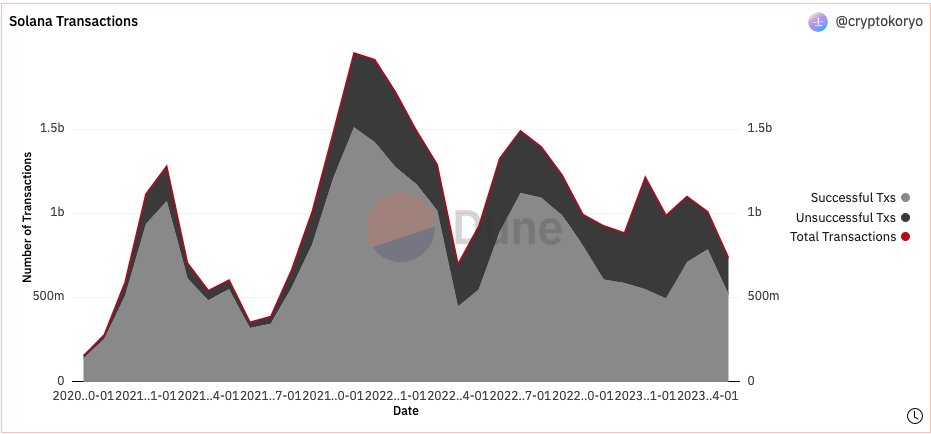

After the bull market, StepN and the NFT activity in 2022, number of transactions is in a decline. With no signs of recovery for now.

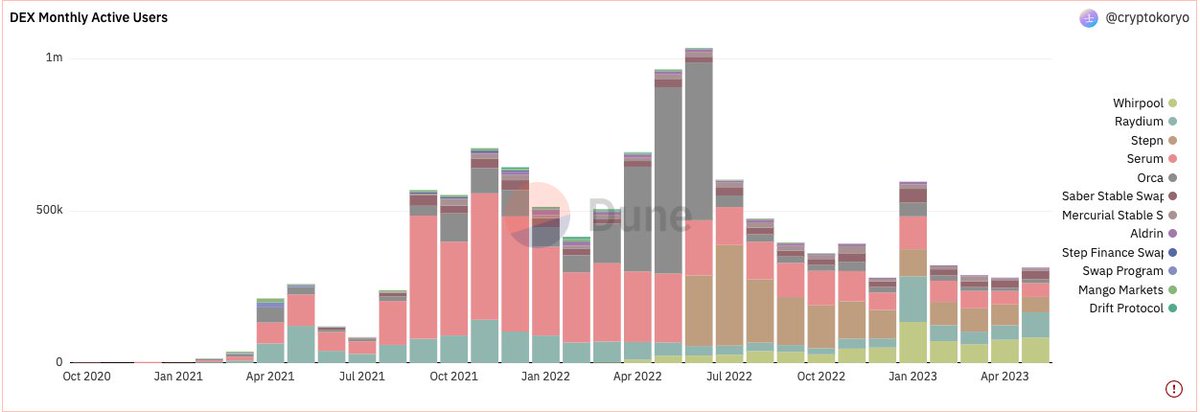

Number of active users on Dexes is also in a decline.

Serum lost almost all its market share.

Whirpool and Raydium dominate.

Serum lost almost all its market share.

Whirpool and Raydium dominate.

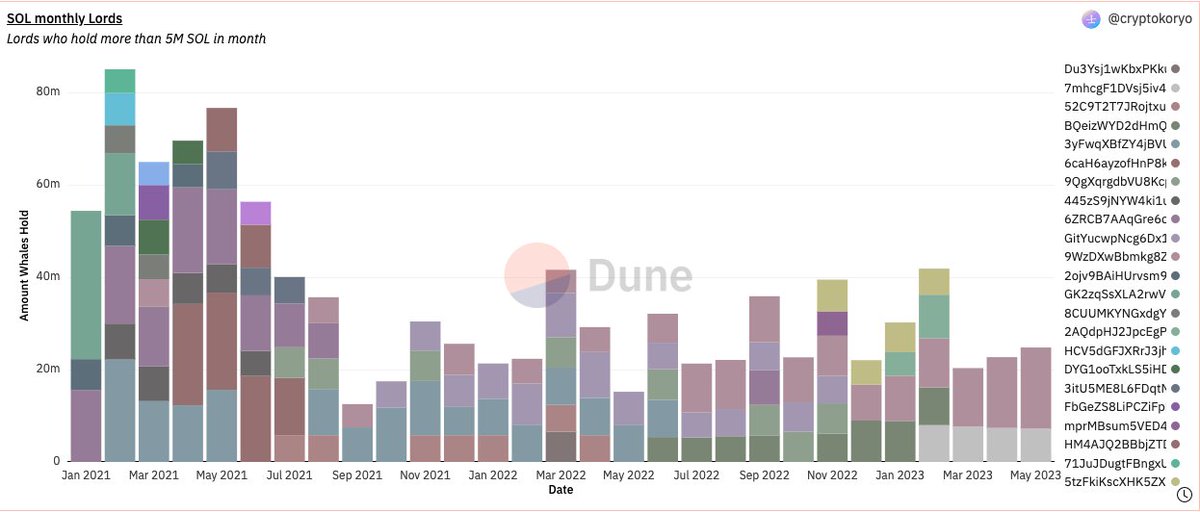

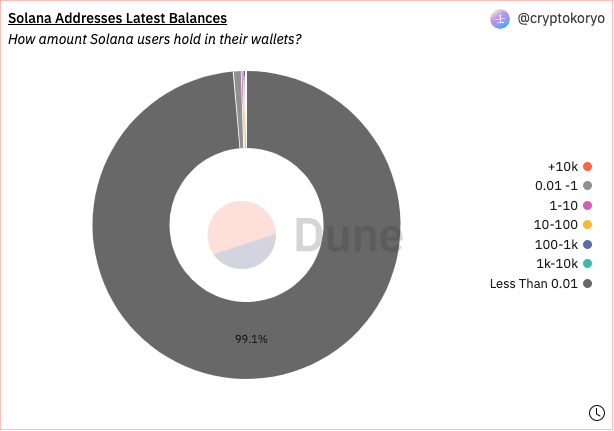

Surprisingly, it looks like 99% of Solana wallets hold less than 0.01 Solana.

Bots heavily dominating?

Bots heavily dominating?

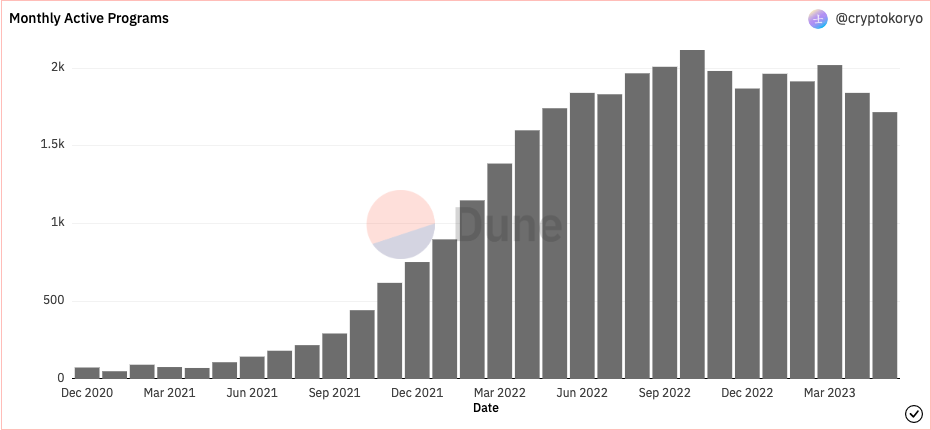

Number of active "Solana programs" still strong. No signs of decline for now.

"Solana Programs, often referred to as "smart contracts" on other blockchains, are the executable code that interprets the instructions sent inside of each transaction on the blockchain."

"Solana Programs, often referred to as "smart contracts" on other blockchains, are the executable code that interprets the instructions sent inside of each transaction on the blockchain."

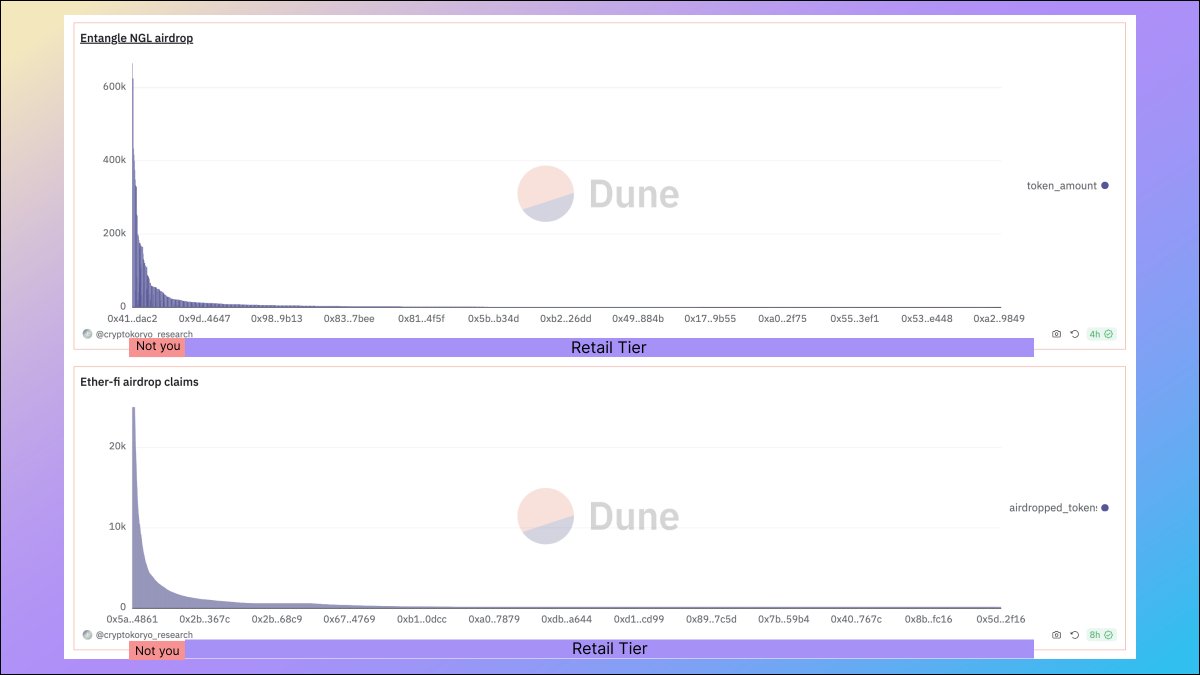

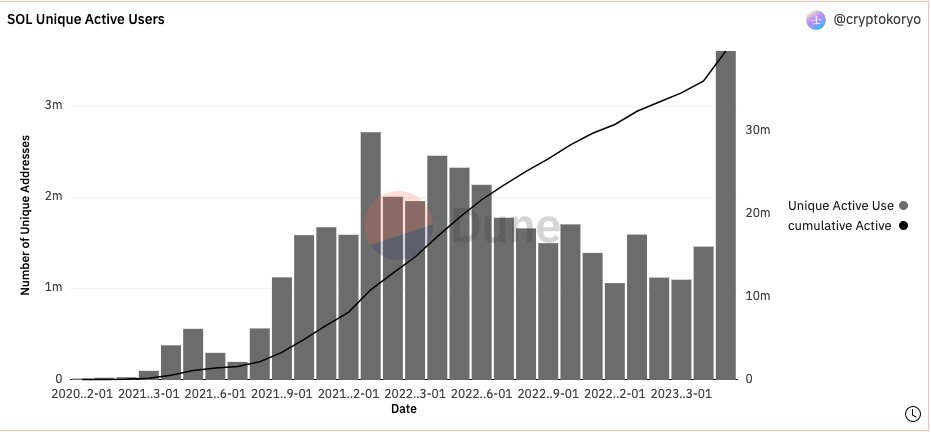

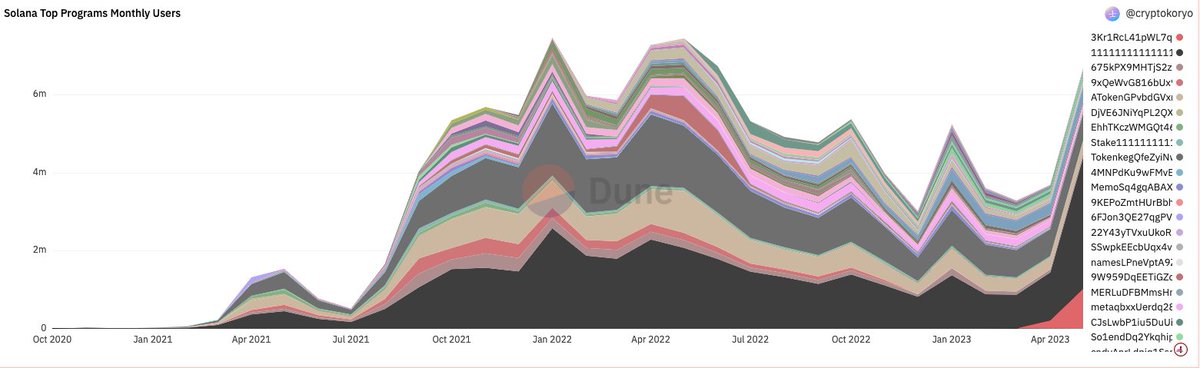

Number of unique active users was in a decline until last month.

A very strange spike in May surpassing bull market numbers.

A very strange spike in May surpassing bull market numbers.

I looked more closely to see what could explain it.

It looks like a jump in on '11111111111111111111111111111111' program, which allows to "'Create new accounts, allocate account data, assign accounts to owning programs and more"

Maybe a Solana expert could comment on that?

It looks like a jump in on '11111111111111111111111111111111' program, which allows to "'Create new accounts, allocate account data, assign accounts to owning programs and more"

Maybe a Solana expert could comment on that?

It wasn't straightforward to start working with Solana data. Solana generates 40x more data than Ethereum and queries are slow to run.

It was fun to learn about Solana and explore its data.

I haven't yet used Dune's IDL Decoded Tables.

Probably for a future dashboard.

It was fun to learn about Solana and explore its data.

I haven't yet used Dune's IDL Decoded Tables.

Probably for a future dashboard.

Special thanks to @DuneAnalytics team and @andrewhong5297 to bring Solana data on Dune.

Hope this was useful!

For more insightful content and daily curations, don't hesitate to follow me

@CryptoKoryo

If you found value in this thread, kindly support it by liking and retweeting the initial tweet linked below.

For more insightful content and daily curations, don't hesitate to follow me

@CryptoKoryo

If you found value in this thread, kindly support it by liking and retweeting the initial tweet linked below.

https://twitter.com/1453478721063620613/status/1660964084920070151

• • •

Missing some Tweet in this thread? You can try to

force a refresh