CBN Governor, Mr. Godwin Emefiele, says the measures taken by the CBN MPC so far to rein in inflation have been potent and are yielding the expected outcome. #CBNMPC

#Emefiele restates optimism that Nigeria will attain the desired level of financial inclusion by 2024.

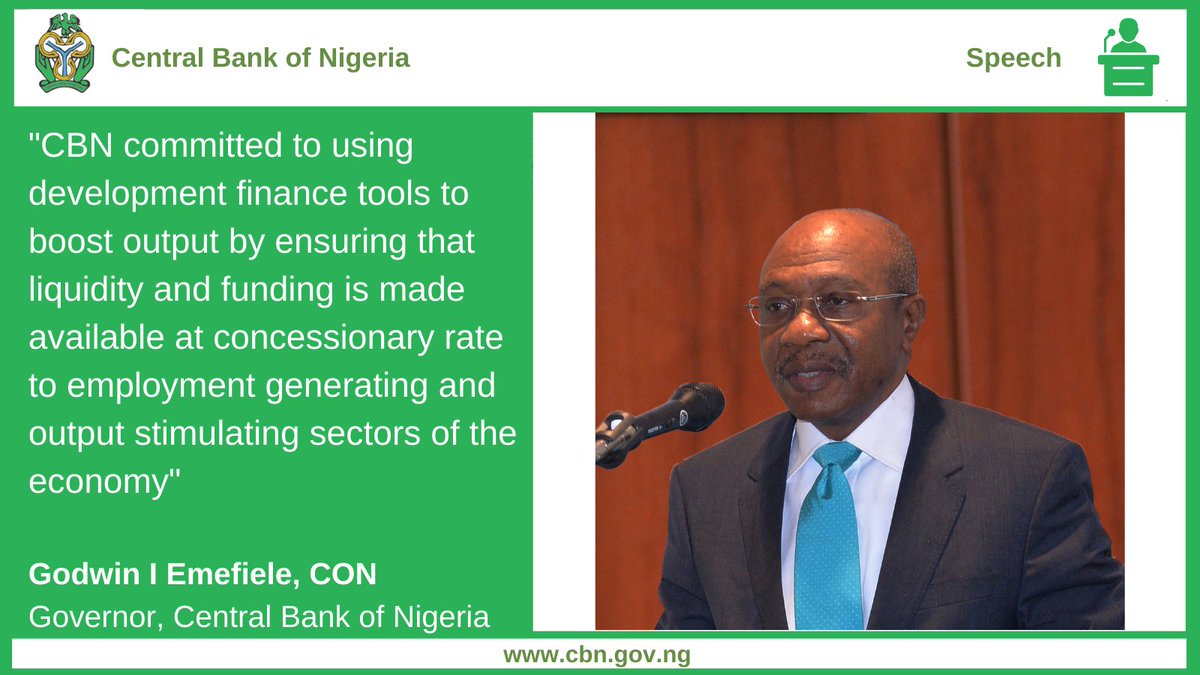

CBN Governor, Mr. Godwin Emefiele reiterates Bank’s decision to reduce aggressive intervention in quasi-fiscal activities.

CBN Governor, Emefiele stresses the need for all stakeholders to collaborate in ramping up crude oil production and to rely less on proceeds from the oil sector.

Central Bank of Nigeria Communiqué No. 148 of the 291st Meeting of Monetary Policy Committee held on Tuesday 23rd and Wednesday 24th May, 2023 cbn.gov.ng/Out/2023/CCD/C…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter