THREAD: How one of China's most notorious (and now jailed) financiers set up an offshore shell company to buy expensive art, including a $62m van Gogh, and how banks, brokerages and auction houses went along with it. FOLLOW ALONG. LOTS AND LOTS OF DOCUMENTS. (1/x)

The notorious financier: Xiao Jianhua, now jailed for bribery and serving a 13-year sentence. The public owner: movie producer Wang Zhongjun. Read all about it in this story, w/ @QianIsabelle @muyixiao @vwang3 (2/x) nytimes.com/2023/05/29/wor…

@QianIsabelle @muyixiao @vwang3 The NYT obtained a cache of thousands of documents detailing a vast offshore empire of shell companies that Xiao Jianhua oversaw. They were used to control companies in Hong Kong, move money offshore for a princeling and, in the case of Islandwide Holdings Ltd, to buy art. (3/x)

@QianIsabelle @muyixiao @vwang3 We counted up more than 130 of them, most, like Islandwide domiciled in the British Virgin Islands, but some as far afield as the Seychelles. In all they controlled more than $5 billion, but probably much more, since we couldn't track down the assets for many of them. (4/x)

@QianIsabelle @muyixiao @vwang3 Xiao Jianhua's name isn't on ANY of these companies, tho a few are owned by relatives. Mostly though, they are (on paper), owned by his employees or relatives of employees or business associates. One employee was an obscure man living in suburban Shanghai named Liu Hailong (5/x)

@QianIsabelle @muyixiao @vwang3 Liu Hailong was the director of four of these companies, including Islandwide Holdings Limited, a BVI shell company set up in 2008 in which he was also the sole owner. (6/x)

BVI shell companies can then be used to set up bank and brokerage accounts in global money centers. For Xiao Jianhua, that was almost always Hong Kong. Here's Islandwide's UBS account. (7/x)

And here's Standard Chartered. Both UBS and StanChart are huge, global banks. Islandwide is gaining a very legit footprint for anyone doing an anti-money laundering, know-your-customer check. (8/x)

So by the time 2014 rolls around, Islandwide Holdings, owned by the obscure Liu Hailong, is for anyone doing a CURSORY AML/KYC check a legit company. And does it have the money to buy a $62 million van Gogh? Why yes, yes it does! And we have the receipts. (9/x)

The bulk of the payment comes from Islandwide's China Construction Bank (Asia) account. This is the Hong Kong (read: offshore) branch of China's huge state-owned bank. Here's the wire transfer made to Sotheby's account at HSBC in Hong Kong. (10/x)

It was all to settle this invoice, which says payments are supposed to be made to Sotheby's account at JP Morgan in New York. Instead the payments went to Sotheby's in Hong Kong. (12/x)

So this guy Liu Hailong is not a wealthy man. Anyone who can afford to buy a van Gogh painting for $62 million pretty much has to be a billionaire (that would be 6.2% of the net worth of someone with $1 bln). Here's his front door. (13/x)

And while some rich Chinese people say in paperwork that they live in an ordinary place but really live like kings, this really is Liu's home. He answered the door for @vwang3 - after she asked him to verify the signatures on the wire transfer, he told her to leave. (14/x)

So how does a guy like this wind up with $62m in two overseas accounts, four BVI companies, and an account at a Swiss bank? It's because of his association with what was the Xiao's umbrella organization, the Tomorrow Group. (15/x)

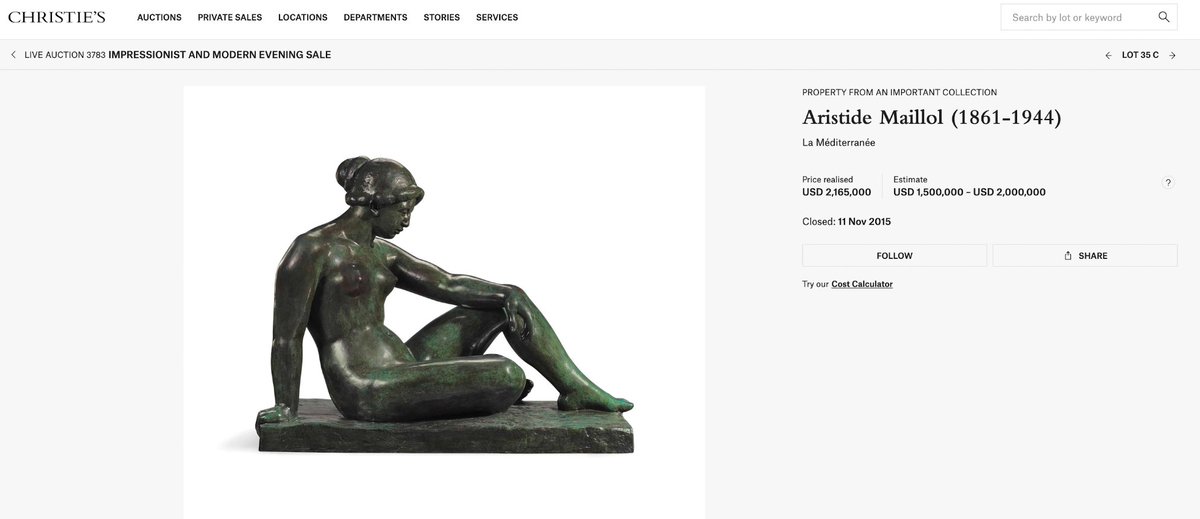

We asked lots of China art experts if they had ever heard of Liu Hailong. None of them had. This despite the fact that his doormat says, in English - nine times - "I am an art lover." This art lover goes on in 2015 to buy an Aristide Maillol sculpture at Christie's (16/x)

Dear readers, it takes a village to legitimize a sketchy shell company, one whose ultimate beneficial owner - in the eyes of Sotheby's - is a middle-class man living in Shanghai. Some REAL due diligence by banks (the front line here) would have been helpful (18/x)

But instead, banks, companies and brokerages continue this charade to this day, pretending that random people assigned as owners of shell companies with 10s of millions or 100s of millions of dollars are "investors." To start asking questions would be inconvenient. (19/x)

Consider this. After Xiao Jianhua's abduction, Liu Hailong was stripped of his ownership of Islandwide Holdings. It is now owned by an even more obscure person, described in company reports as an investor. If Xiao is in jail, WHO is pulling the strings now? END (20/20)

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter