Heavy last-minute lobbying in Brussels around the Sustainability Due Diligence Directive (#CSDDD) ahead of this Thursday's crucial @EUparliament vote.

Details matter. A 🧵of 10 somewhat more 'technical' or less debated features that will be critical in the vote & Trilogue. (1/x)

Details matter. A 🧵of 10 somewhat more 'technical' or less debated features that will be critical in the vote & Trilogue. (1/x)

*Single market clause*

Unlike Regulations, Directives do not automatically require "full harmonization" but allow MS to have stricter national rules. Businesses feared fragmentation &pushed for uniformity. But: Due diligence is evolving & needs stimuli from national level. (2/x)

Unlike Regulations, Directives do not automatically require "full harmonization" but allow MS to have stricter national rules. Businesses feared fragmentation &pushed for uniformity. But: Due diligence is evolving & needs stimuli from national level. (2/x)

*Targeting business models*

@eu_comission's proposal had no explicit reference to business models & sourcing squeeze that make human rights violations an in-built feature of value chains. This is a huge gap - luckily addressed in @EP_Legal report's mention of living wages. (3/x)

@eu_comission's proposal had no explicit reference to business models & sourcing squeeze that make human rights violations an in-built feature of value chains. This is a huge gap - luckily addressed in @EP_Legal report's mention of living wages. (3/x)

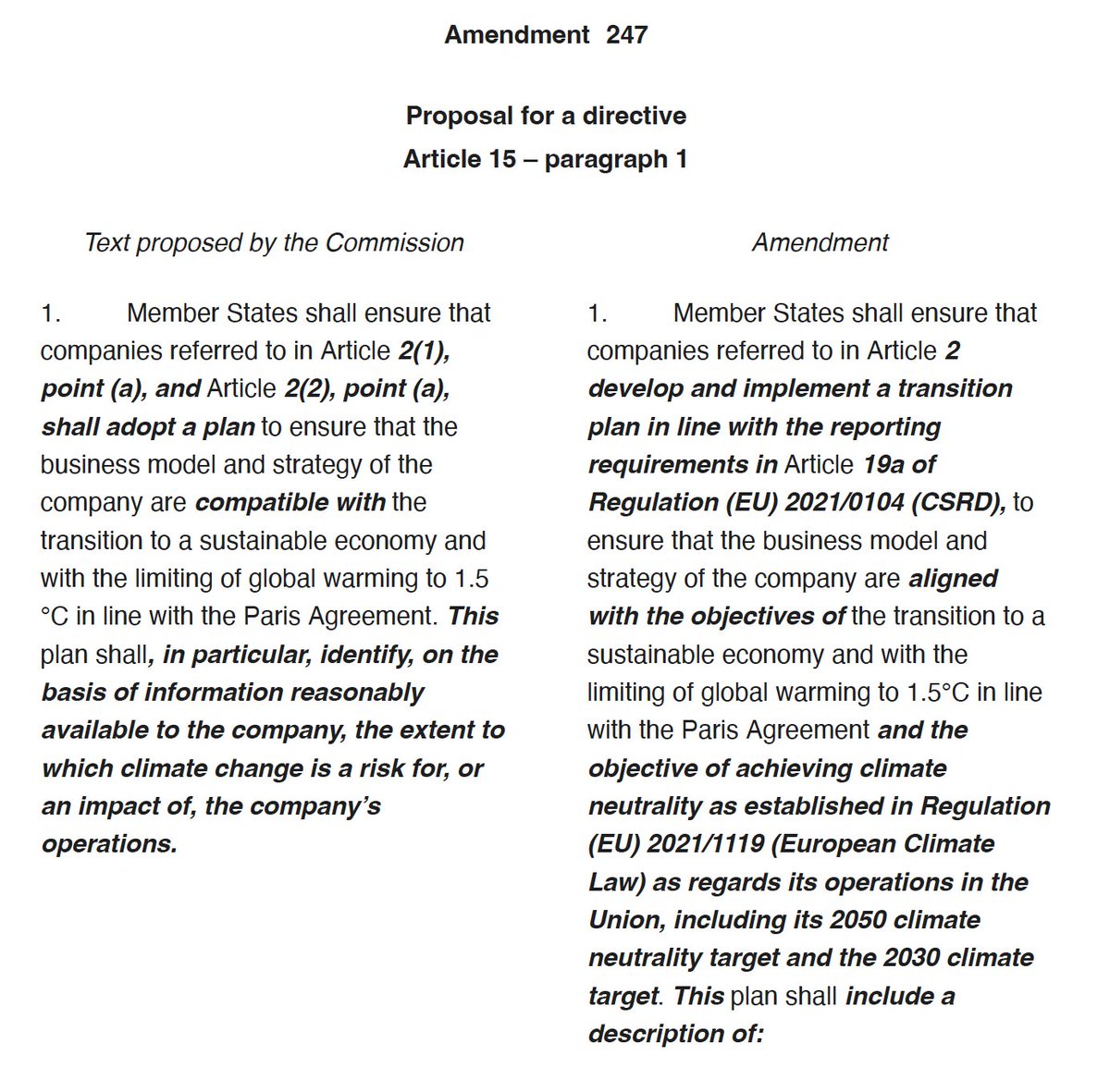

*Transition plan*

Environmental side of due diligence was underdeveloped in the initial proposal (few treaties included, no ref to Paris Agreement), but strengthened 'Transition plan' (tied to directors' remunerations) can be powerful decarbonizing instrument alongside DD. (4/x)

Environmental side of due diligence was underdeveloped in the initial proposal (few treaties included, no ref to Paris Agreement), but strengthened 'Transition plan' (tied to directors' remunerations) can be powerful decarbonizing instrument alongside DD. (4/x)

*Contractual provisions*

Effective due diligence needs to affect business contracts. But: (1.) Contractual provisions must exist not only on paper, but materialize betw parties, (2.) they must be fair for small suppliers; & (3.) may not push responsibility down the chain. (5/x)

Effective due diligence needs to affect business contracts. But: (1.) Contractual provisions must exist not only on paper, but materialize betw parties, (2.) they must be fair for small suppliers; & (3.) may not push responsibility down the chain. (5/x)

*Responsible disengagement*

For due diligence to facilitate long-term capability building rather than closing eyes to existing rights violations & exacerbate fragile supply relationships, provisions on 'responsible disengagement' are crucial. (6/x)

For due diligence to facilitate long-term capability building rather than closing eyes to existing rights violations & exacerbate fragile supply relationships, provisions on 'responsible disengagement' are crucial. (6/x)

*Digital due diligence tools*

Supply chain management IT will be in the future what social auditing was in the past. With tools sprouting up, from big and small IT developers and @eu_comission actively endorsing their use, we need to scrutinize their operations & code. (7/x)

Supply chain management IT will be in the future what social auditing was in the past. With tools sprouting up, from big and small IT developers and @eu_comission actively endorsing their use, we need to scrutinize their operations & code. (7/x)

*Limitation periods for civil liability*

Limitation periods are a key obstacle in liability proceedings (eg Jabir v Kik). Overcoming trauma, finding facts and legal complexity take time. Fear of limitation pushes plaintiffs into settlement. 10 years should be minimum. (8/x)

Limitation periods are a key obstacle in liability proceedings (eg Jabir v Kik). Overcoming trauma, finding facts and legal complexity take time. Fear of limitation pushes plaintiffs into settlement. 10 years should be minimum. (8/x)

*Accountability of third-party certifiers*

Due diligence will continue to build on many existing private governance instruments, but should mitigate their flaws. @EP_Legal's report sets the bar high for certification & sees a consultative role beyond conformity assessment. (9/x)

Due diligence will continue to build on many existing private governance instruments, but should mitigate their flaws. @EP_Legal's report sets the bar high for certification & sees a consultative role beyond conformity assessment. (9/x)

*Regular updates of the Annex*

Since updating the Directive once adopted is a tedious project, a simpler path is necessary to include future human rights and environmental treaties and keep the Annex dynamic. Delegated acts are a suitable instrument. (10/x)

Since updating the Directive once adopted is a tedious project, a simpler path is necessary to include future human rights and environmental treaties and keep the Annex dynamic. Delegated acts are a suitable instrument. (10/x)

*Integrating sustainability and resilience in value chains*

EU's value chain policies seem split between instruments pushing either 'sustainability' or 'resilience' (SMEI, Batteries Reg, Chips Act, ...). Integration is needed since only sustainable sourcing is resilient. (11/x)

EU's value chain policies seem split between instruments pushing either 'sustainability' or 'resilience' (SMEI, Batteries Reg, Chips Act, ...). Integration is needed since only sustainable sourcing is resilient. (11/x)

10 details that can make a difference - to watch out for in the @EUparliament vote & upcoming Trilogue.

All references taken from the 381 (!) overall amendments proposed in @EP_Legal's report by Rapporteur @larawoltersEU, available at europarl.europa.eu/doceo/document…. (12/x)

All references taken from the 381 (!) overall amendments proposed in @EP_Legal's report by Rapporteur @larawoltersEU, available at europarl.europa.eu/doceo/document…. (12/x)

• • •

Missing some Tweet in this thread? You can try to

force a refresh