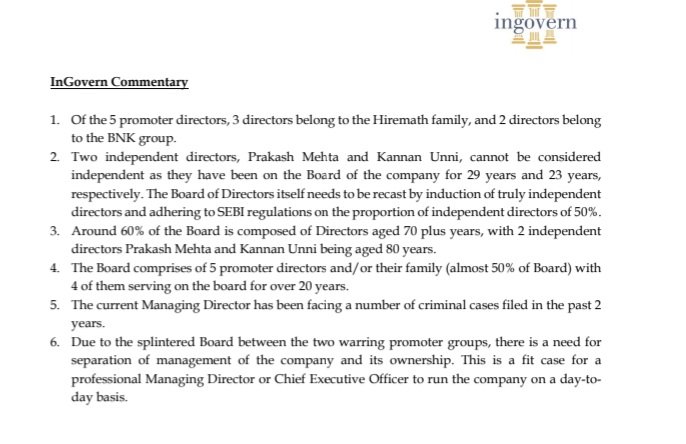

Masterclass on Corporate Governance

Case Study: Hikal Ltd

Great insights provided by @reachShriram Sir & his team @InGovern

Full report available on their website.

Key snippets here.

A must-read for any student of investing.

1/3

Case Study: Hikal Ltd

Great insights provided by @reachShriram Sir & his team @InGovern

Full report available on their website.

Key snippets here.

A must-read for any student of investing.

1/3

If you do a Twitter search on #StandwithHIKAL you will get to see so many tweets in favour of the management.

All you need to do is a random check on a few profiles.

You will get the story.

Disc: No Holding, No Reco

3/3

All you need to do is a random check on a few profiles.

You will get the story.

Disc: No Holding, No Reco

3/3

Hikal has given a detailed answer to all the points raised by Ingovern.

What is interesting to note is that the 4.43 Cr salary amount which the management categorically denied, can be easily found in the Annual Report.

bseindia.com/xml-data/corpf…

What is interesting to note is that the 4.43 Cr salary amount which the management categorically denied, can be easily found in the Annual Report.

bseindia.com/xml-data/corpf…

This was just a trailer.

Watch the full movie of @reachShriram Sir & @InGovern in the link below. :)

Watch the full movie of @reachShriram Sir & @InGovern in the link below. :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh