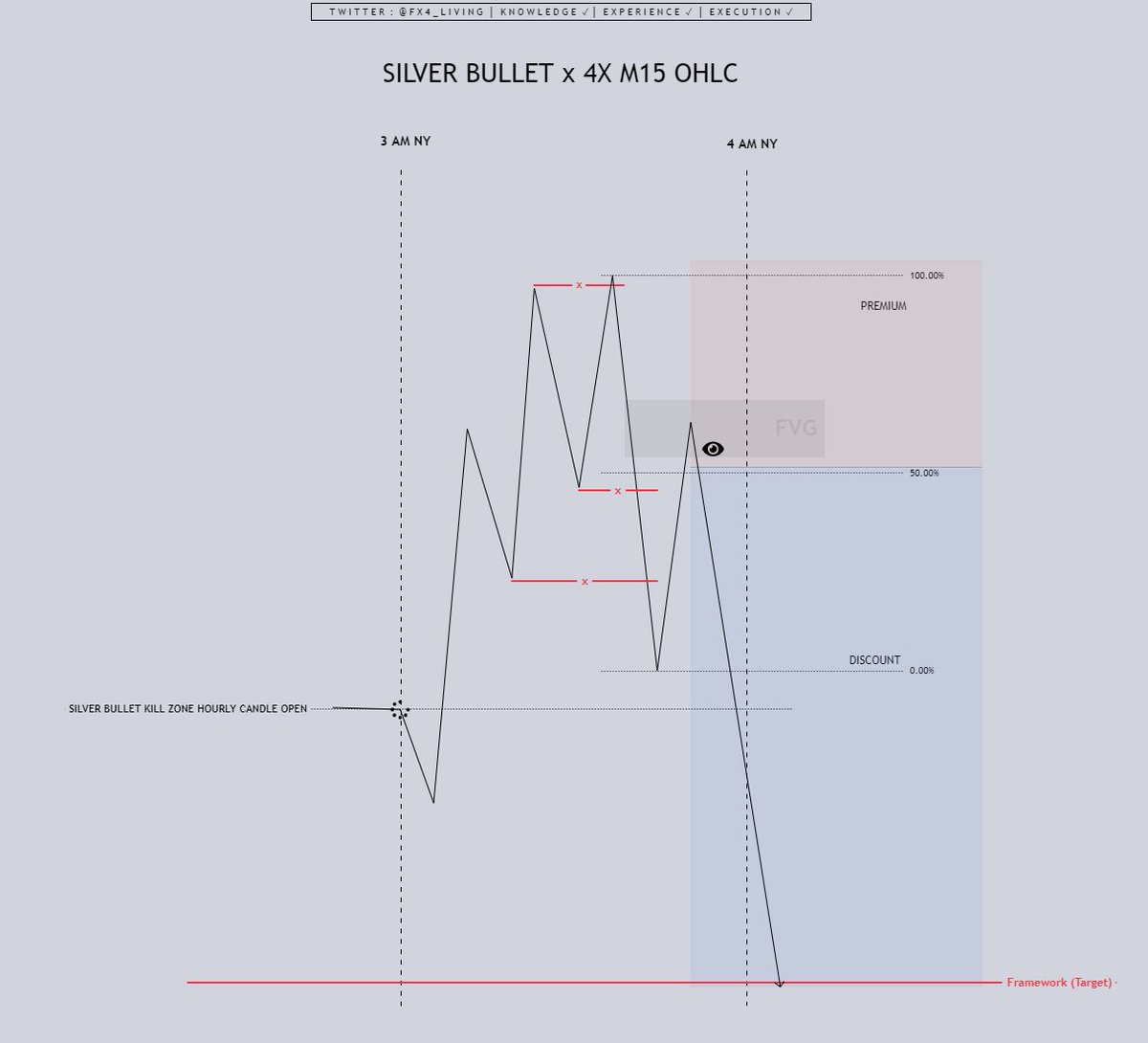

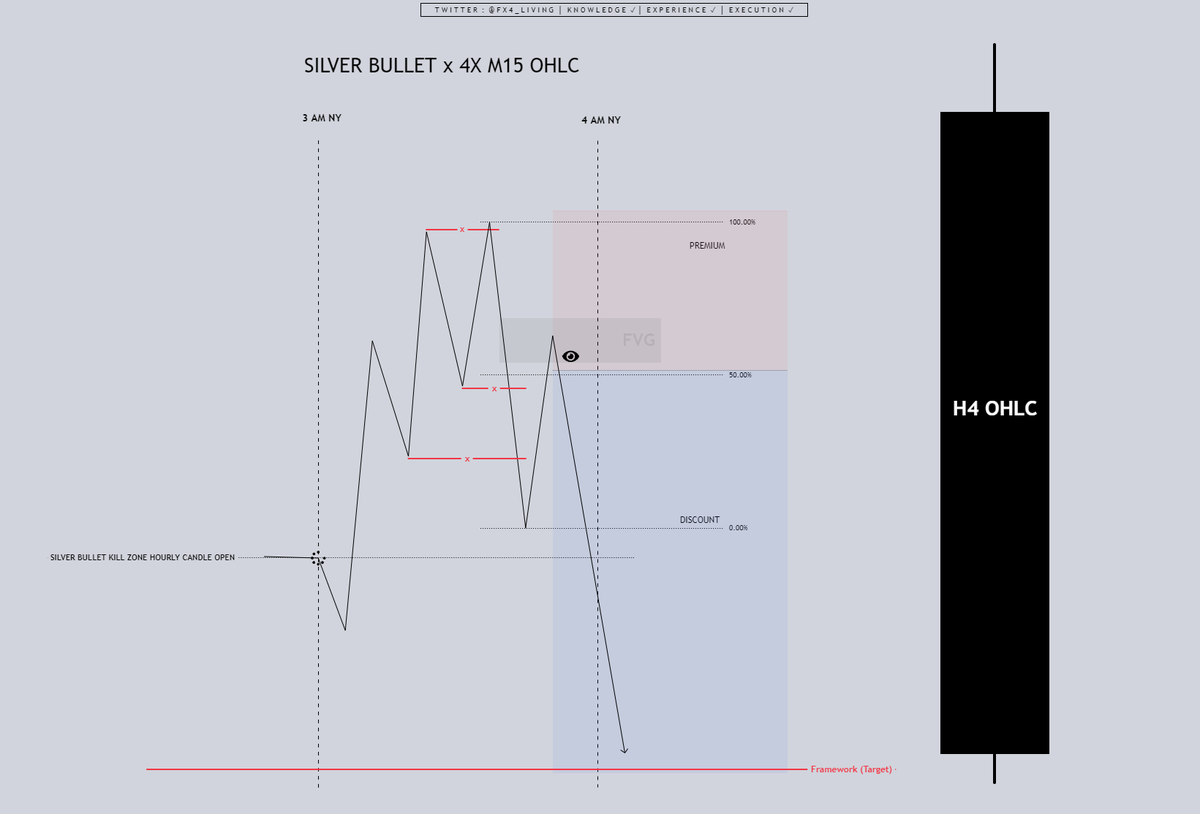

ICT Silver Bullet x X4 M15 OHLC 💡

Using the Silver Bullet Framework (Time Based)

And Anticipating the last M15 candle from the H1 close.

Thread🧵

Like, Retweet, Bookmark 💾 twitter.com/i/web/status/1…

Using the Silver Bullet Framework (Time Based)

And Anticipating the last M15 candle from the H1 close.

Thread🧵

Like, Retweet, Bookmark 💾 twitter.com/i/web/status/1…

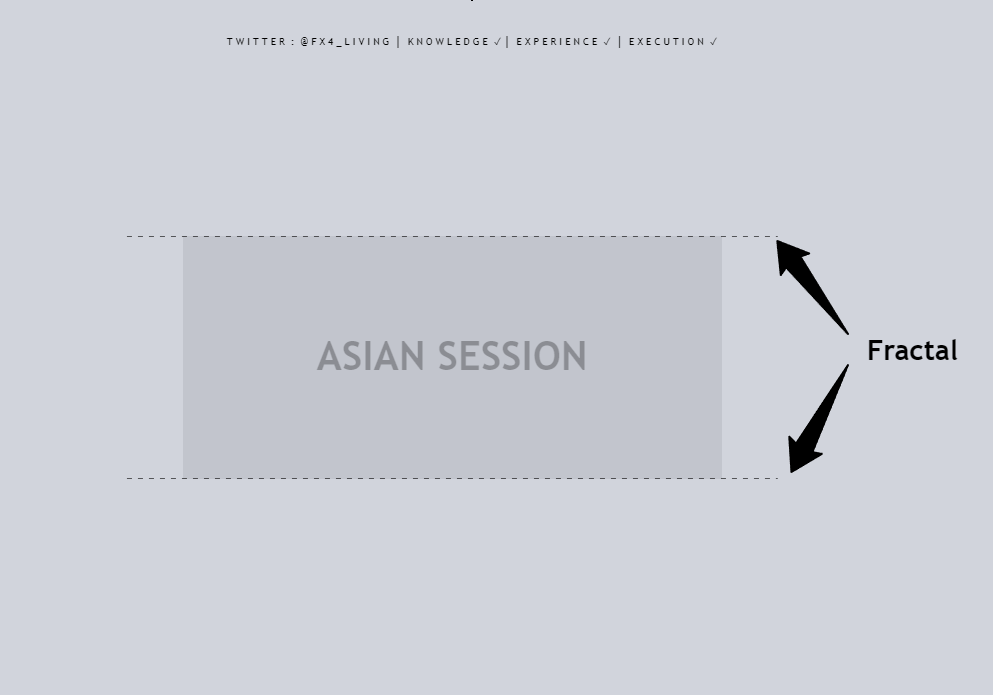

H1 (Silver Bullet Time Based) =

X2 M30 OHLC candles. ✅

X4 M15 OHLC candles. ✅

X12 M5 OHLC candles. ✅

Follow @fx4_living for more content💎

X2 M30 OHLC candles. ✅

X4 M15 OHLC candles. ✅

X12 M5 OHLC candles. ✅

Follow @fx4_living for more content💎

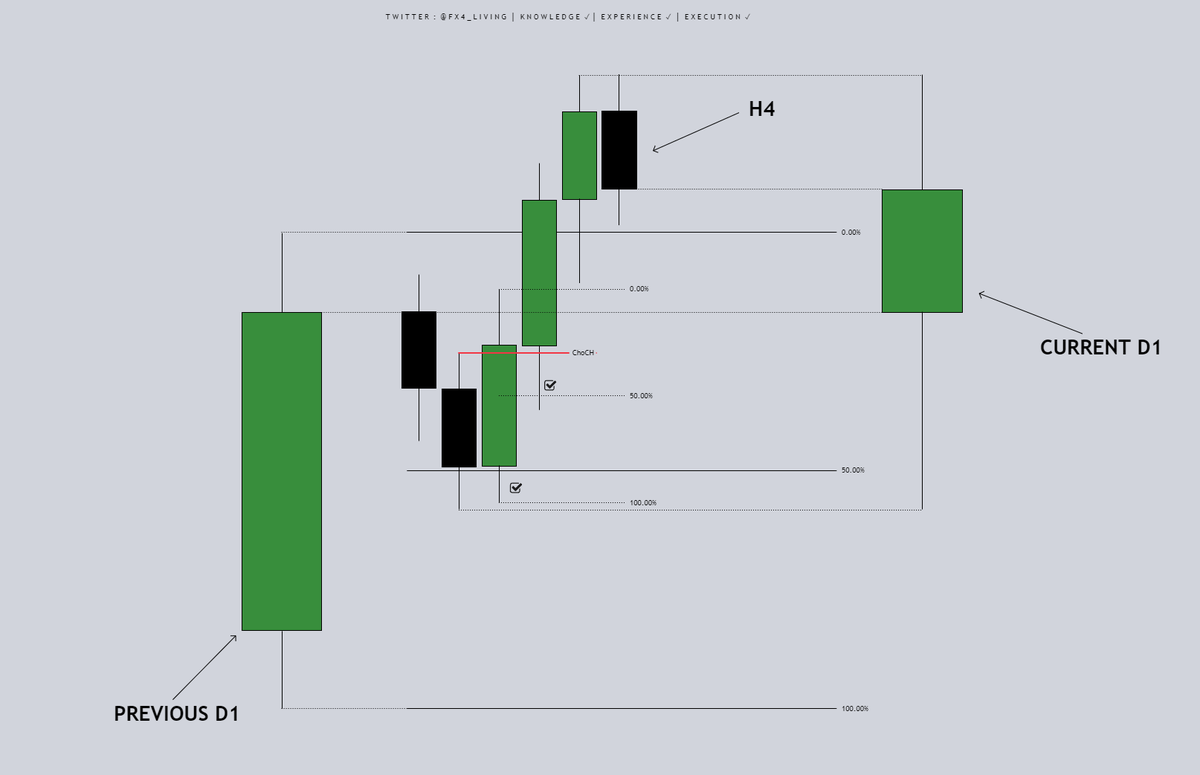

Here the narrative :

First M15 Closed Bullish OHLC. ✅

Second M15 Closed Bullish respecting the previous M15 low. ✅

Third M15 Closed Bearish under the previous M15 low. ✅

Fourth M15 Retraced into Premium of the previous M15 and rejecting in lower timeframe. ✅

First M15 Closed Bullish OHLC. ✅

Second M15 Closed Bullish respecting the previous M15 low. ✅

Third M15 Closed Bearish under the previous M15 low. ✅

Fourth M15 Retraced into Premium of the previous M15 and rejecting in lower timeframe. ✅

Anticipating the Last M15 to be a bearish candle, respecting the previous M15 high (Stoploss) Invalidation.

- Target is your next internal or external liquidity.

- Target is your next internal or external liquidity.

Always take partials if you are in profit, because the 4 to 5 AM candle can retrace and wipe some of your profits.

If you can read the M15, you don't really need to go in M5, M3, M1 candles to get your "perfect entry" all you need is some probabilities.

Also, if the trade respect the H4 direction, higher probability for a winning trade.

Also, if the trade respect the H4 direction, higher probability for a winning trade.

Are you implementing ICT Silver Bullet in your trading?

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter