What are your trading problems?

After going through your replies, I have compiled the problems into these major categories:

- Capital

- Fear of losing

- Bad timing

- Where to sell

- Unable to ride the trend

- Struggle in pyramiding

- Addiction

- How to have a short watchlist

- Long only mindset

contd.

- Capital

- Fear of losing

- Bad timing

- Where to sell

- Unable to ride the trend

- Struggle in pyramiding

- Addiction

- How to have a short watchlist

- Long only mindset

contd.

- Where to set targets

- Bad mindset

Let's start with CAPITAL

Are you claiming that you possess a successful strategy and consistently generate profits with your small trading account, but the only hindrance is the lack of capital? If this statement is true,

contd.

- Bad mindset

Let's start with CAPITAL

Are you claiming that you possess a successful strategy and consistently generate profits with your small trading account, but the only hindrance is the lack of capital? If this statement is true,

contd.

I would argue that you might not be truly resourceful. With a proven winning system and confidence in your abilities, there are various avenues to secure additional funds, such as saving from your income or business profits, approaching proprietary trading firms

contd.

contd.

if you have maintained a track record or raise cash (I have done it and this is the least recommended option). To be frank, it seems that many individuals attribute their lack of success to insufficient capital,

contd.

contd.

when in reality, the root cause often lies in not having a reliable winning system.

You cannot really address a problem without first realizing what the problem is.

#BroTip

contd.

You cannot really address a problem without first realizing what the problem is.

#BroTip

contd.

Fear

Given the potential financial consequences of making mistakes in this field, it is natural to develop a sense of fear. However, the question arises: How can one overcome this fear? One approach is to take the next five trades with the sole purpose of challenging

contd.

Given the potential financial consequences of making mistakes in this field, it is natural to develop a sense of fear. However, the question arises: How can one overcome this fear? One approach is to take the next five trades with the sole purpose of challenging

contd.

and conquering your fear, rather than focusing on monetary gains. Start with smaller trade sizes and gradually increase them as you gain more confidence and improve your skills.

The objective is to shift the focus from the fear of losing money to the process of

contd.

The objective is to shift the focus from the fear of losing money to the process of

contd.

overcoming fear itself. By consciously practicing this method, you can gradually build up your abilities and develop a more resilient mindset.

contd.

contd.

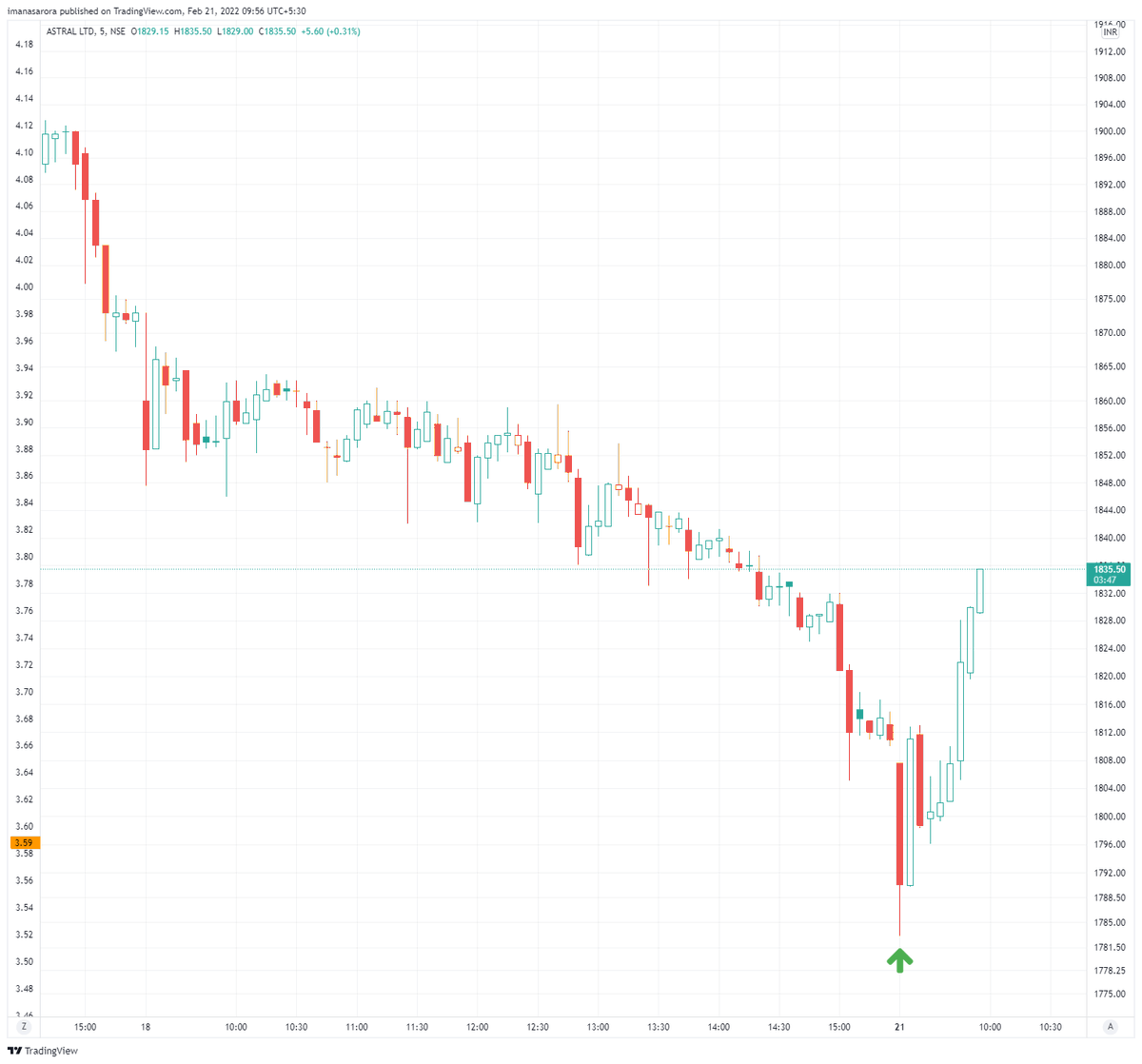

Bad timing

When you buy a stock, it often goes down, and when you sell, it tends to go up. To understand why this happens, look at what the stock did in the 2 to 3 bars before you made the trade. If the stock had already gone up a lot during that time, that's probably

contd.

When you buy a stock, it often goes down, and when you sell, it tends to go up. To understand why this happens, look at what the stock did in the 2 to 3 bars before you made the trade. If the stock had already gone up a lot during that time, that's probably

contd.

why you're having trouble.

Usually, stocks move in a pattern of 3 to 5 bars on average. The goal is to get in on the first or second bar of the pattern to catch the rest of the move. Some people make the mistake of entering on the fifth bar, and they end up losing

contd.

Usually, stocks move in a pattern of 3 to 5 bars on average. The goal is to get in on the first or second bar of the pattern to catch the rest of the move. Some people make the mistake of entering on the fifth bar, and they end up losing

contd.

money right away.

So, the important thing is to pay attention to the stock's movement in the previous bars before making a trade. By understanding the patterns and timing your entry better, you can increase your chances of making money instead of losing it right away.

contd.

So, the important thing is to pay attention to the stock's movement in the previous bars before making a trade. By understanding the patterns and timing your entry better, you can increase your chances of making money instead of losing it right away.

contd.

Where to sell

Selling can be the most challenging aspect of this business, and it's important to accept that you won't always achieve the best possible outcome in every trade. However, you can definitely improve your selling skills by being

contd.

Selling can be the most challenging aspect of this business, and it's important to accept that you won't always achieve the best possible outcome in every trade. However, you can definitely improve your selling skills by being

contd.

satisfied with your profits and moving on to the next trade. There are plenty of opportunities available, and I have never run out of them.

There are two situations where you would sell or close a trade:

When your trailing stop is hit: I use moving averages,

contd.

There are two situations where you would sell or close a trade:

When your trailing stop is hit: I use moving averages,

contd.

typically a 20-period moving average, to trail my stops. However, if the trend is exceptionally strong and has become extended, I may use a shorter-term moving average like a 10-period or even a 5-period moving average to trail my stops.

contd.

contd.

When you interfere and use your discretion to close at the market: I choose to sell at the market when I notice a significant change in the angle of the rise. If the stock price rapidly rises close to a 70 to 90-degree angle, it often kills the momentum of the move for

contd..

contd..

several days to come. In such cases, I see no benefit in trailing the stop and prefer to scale out gradually & avoid holding onto a stagnant investment.

In summary, I adapt my selling strategy by trailing stops with moving averages and close at the market when I observe

contd.

In summary, I adapt my selling strategy by trailing stops with moving averages and close at the market when I observe

contd.

a sharp and unsustainable rise in the stock price.

Contd.

Contd.

I will answer the rest of your questions in the coming days.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter