The Story of VIX

As Options traders, we all look at VIX or at some point realise its importance. But have you ever wondered where did it come from? Who were the brains behind it?

I did, and here’s the back story. Sit back and read on. ↘️

As Options traders, we all look at VIX or at some point realise its importance. But have you ever wondered where did it come from? Who were the brains behind it?

I did, and here’s the back story. Sit back and read on. ↘️

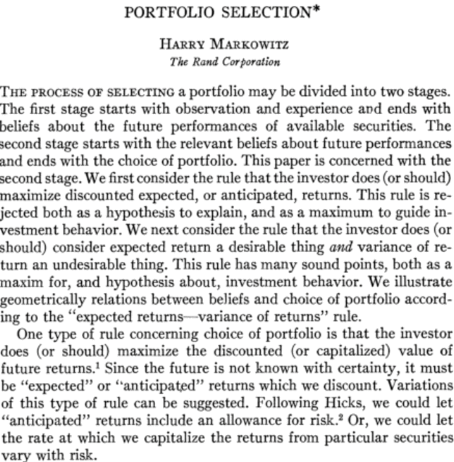

Till the 1950's fund managers were judged based on absolute performance. If you gave them 100 and they turned it to 112, you would say they did 12% on it. Things changed after Harry Markowitz published a groundbreaking paper titled “ Portfolio Selection”.

He was the first to argue that a fund’s performance should be judged not just only on returns but also on the risk it takes to generate that return.

He used the concept of ‘variance’ to mean volatility or risk.

He used the concept of ‘variance’ to mean volatility or risk.

The logic was simple, if an asset is more volatile you should expect more return from it. Compare stocks with bonds here. Stocks are more volatile so expect more from them.

In other words, Markowitz developed an academic model with which investors could measure the trade-offs they faced between risk and return. And in the process, volatility became the reigning proxy for risk.

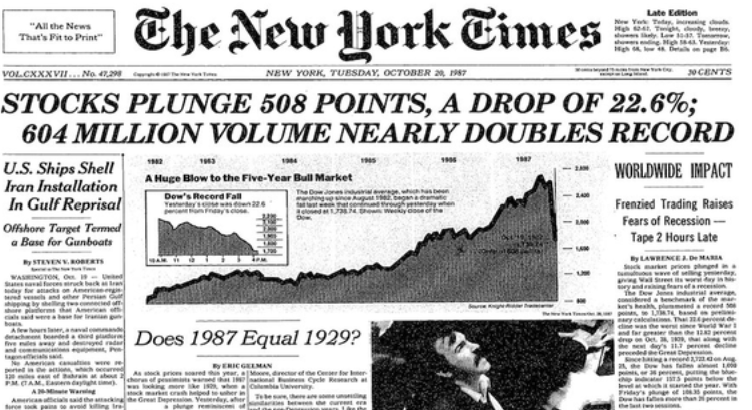

Next comes VAR (Value at Risk) Till about 1980’s past 30-day average market movement was used as a proxy for volatility. Similar to a rolling 30-day rate of change.

Black Monday's crash of 1987, pushed JP Morgan's then-CEO to devise a daily measure of risk. Till Guldimann who was at JP Morgan created VaR that used the historical volatility of markets to calculate the maximum the bank could lose on any given day, with 95 percent certainty.

By 1990s JP Morgan made VAR open for others to use.

By now volatility had become the most accepted way to measure financial risk, around this time other academics and practitioners started laying the groundwork to create products to eventually trade volatility itself.

By now volatility had become the most accepted way to measure financial risk, around this time other academics and practitioners started laying the groundwork to create products to eventually trade volatility itself.

Enter, Options.

Options in a way are very similar to insurance. They help us hedge against any pre-defined future outcomes.

For e.g., you can hedge your portfolio against a crash, by buying Put options. You pay a premium and it would cover your risk in the event of a crash.

Options in a way are very similar to insurance. They help us hedge against any pre-defined future outcomes.

For e.g., you can hedge your portfolio against a crash, by buying Put options. You pay a premium and it would cover your risk in the event of a crash.

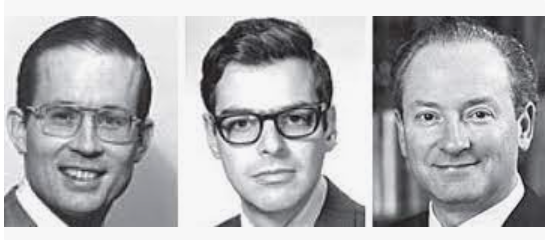

The way to price these options was invented by three academics - Fisher Black, Robert Merton and Myron Scholes.

In 1973, they created a model to calculate the price of these options, volatility was an input in it. This became popularly known as the Black & Scholes Model.

In 1973, they created a model to calculate the price of these options, volatility was an input in it. This became popularly known as the Black & Scholes Model.

But options by themselves weren't quite enough to truly turn volatility into an asset class so that one could trade it.

This is where two academics called Menachem Brenner and Dan Galai come in.

This is where two academics called Menachem Brenner and Dan Galai come in.

By mid-1980 the duo started working on frameworks that used option prices to create an actual index of stock-market volatility, which they called “ Sigma Index”.

They pitched the idea to various exchanges, but at the time no one wanted it. They were ahead of their time.

They pitched the idea to various exchanges, but at the time no one wanted it. They were ahead of their time.

The idea languished until 1992, when the Chicago Board Options Exchange (CBOE) hired another academic Robert Whaley to turn the idea of an options-based volatility index into reality.

He took six months and by 1993, the CBOE Volatility Index – popularly called VIX – was born.

He took six months and by 1993, the CBOE Volatility Index – popularly called VIX – was born.

Though the purpose of creating VIX was actually to create a derivative on it, that path is a long story by itself, maybe for another day.

References:

a) How India VIX works - zerodha.com/z-connect/quer…

b) Wikipedia on VIX - en.wikipedia.org/wiki/VIX

a) How India VIX works - zerodha.com/z-connect/quer…

b) Wikipedia on VIX - en.wikipedia.org/wiki/VIX

If you liked this story and the research, do follow me or better still re-tweet it to those who you think would like it.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter