💎Find the High & Low of the day

In this SERIES of threads, I'll cover everything about Standard Deviations

One of the most underappreciated ICT Concepts available, they are used to PINPOINT the HIGH and LOW of the day & More

Chapter 2 - Central Banks Dealers Range

In this SERIES of threads, I'll cover everything about Standard Deviations

One of the most underappreciated ICT Concepts available, they are used to PINPOINT the HIGH and LOW of the day & More

Chapter 2 - Central Banks Dealers Range

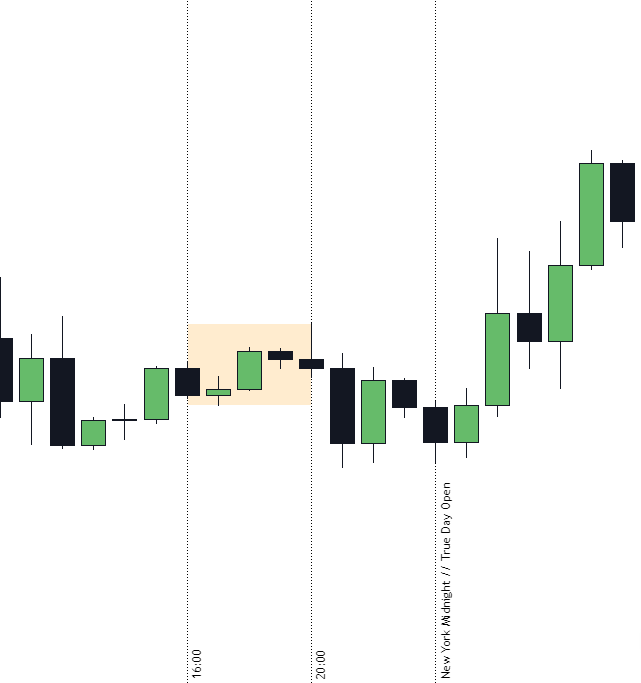

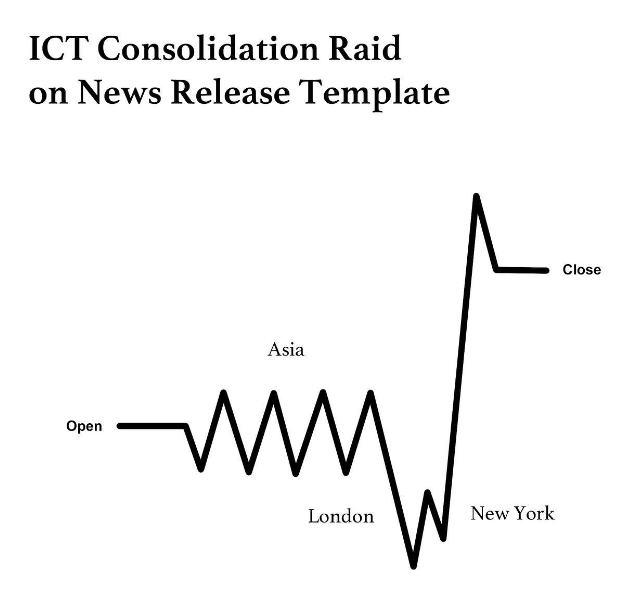

Central Banks Dealers Range is a small consolidation period between 16:00/4pm New York Time - 20:00/8pm New York Time

Every day you will see a consolidation from 16:00 –20:00 and it will continue into Asian session

During this time smart Money are analysing the market based on the open position to see what their next move will be

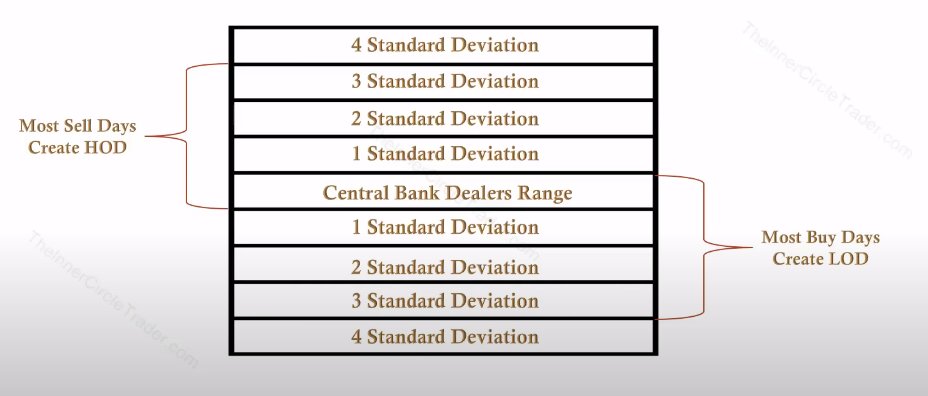

This will help us to know oversold/overbought areas without looking at indicators

The Deviations will help us to know where the high and low of the day will form

The Deviations will help us to know where the high and low of the day will form

Specifications:

Ideally, you want the range to be a consolidation mo more than 40 pip

Preferably 20-30 pips in total

Ideally, you want the range to be a consolidation mo more than 40 pip

Preferably 20-30 pips in total

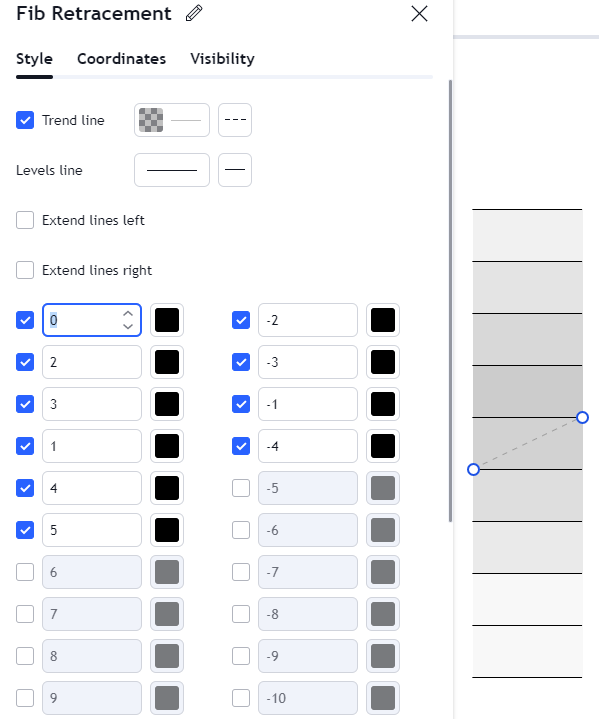

How to pull the fib:

You can either choose to pull it from

-Wick to Wick

-Body to Body

I prefer Wick to Wick as I measure the range from Wick to Wick as well

You can either choose to pull it from

-Wick to Wick

-Body to Body

I prefer Wick to Wick as I measure the range from Wick to Wick as well

DISCLAIMER (Burger Analogy)

Standard Deviations are a great ADDITION to your model

If you don't have a solid profitable base that works and you can find successfully adding Standard Deviations (And other core concepts remember the Burger Analogy) will only hurt you.

Standard Deviations are a great ADDITION to your model

If you don't have a solid profitable base that works and you can find successfully adding Standard Deviations (And other core concepts remember the Burger Analogy) will only hurt you.

Alignment

You want the Standard Deviations Levels to align with a PD Array

You want the Standard Deviations Levels to align with a PD Array

Its needles to say that for this model to work you will need to have mastered daily bias

Without knowing where we expect to expand for that day of the week the potency of this model falls of greatly.

If you want to learn daily bias read through my weekly profiles thread.

Without knowing where we expect to expand for that day of the week the potency of this model falls of greatly.

If you want to learn daily bias read through my weekly profiles thread.

Q: What if the CBDR isn't a consolidation or it isn't a 20-30 pip range?

A: You look for Standard Deviations of other ranges (Asian Range, Flout) which i will cover in future threads

A: You look for Standard Deviations of other ranges (Asian Range, Flout) which i will cover in future threads

End of thread

If you enjoyed this thread consider liking and retweeting

The goal is 300 Retweets and ill drop part 3

If you enjoyed this thread consider liking and retweeting

The goal is 300 Retweets and ill drop part 3

Special thanks to PrimeXBT

EARN UP TO 7000$ ON YOUR FIRST DEPOSIT WITH PROMOCODE: marketmaker

Extremely Low trade fees and no KYC??

Do you want to trade Forex, Indices, Commodities and Crypto?

go.primexbt.com/click?pid=1924…

EARN UP TO 7000$ ON YOUR FIRST DEPOSIT WITH PROMOCODE: marketmaker

Extremely Low trade fees and no KYC??

Do you want to trade Forex, Indices, Commodities and Crypto?

go.primexbt.com/click?pid=1924…

Just so i don't have to write it 100 times

Yes Core Content says 14:00-20:00

Charter Content says 16:00-20:00 and its more accurate

Yes Core Content says 14:00-20:00

Charter Content says 16:00-20:00 and its more accurate

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter