The wait is over.

@samkazemian just announced the design of frxETH v2.

With innovations such as market-based interest rate, @fraxfinance is taking frxETH to the next level in the LSD game 👑.

A thread breaking down the clever design of frxETH v2 🧵

@samkazemian just announced the design of frxETH v2.

With innovations such as market-based interest rate, @fraxfinance is taking frxETH to the next level in the LSD game 👑.

A thread breaking down the clever design of frxETH v2 🧵

1/

Background:

FrxETH is one of the fastest-growing LSD in the landscape, having accumulated over 233.4K ETH in > a year 🚀.

This exponential growth is largely attributed to the clever synergy between sfrxETH and the frxETH-ETH pool on Curve 🧠.

Background:

FrxETH is one of the fastest-growing LSD in the landscape, having accumulated over 233.4K ETH in > a year 🚀.

This exponential growth is largely attributed to the clever synergy between sfrxETH and the frxETH-ETH pool on Curve 🧠.

2/

However, to ensure the quality of early validators, Frax relies on in-house validators in V1.

To tackle this issue, frxETH V2 introduces innovations that promote decentralization in frxETH 🌐, while improving the efficiency of borrowing & lending in the staking market ✅.

However, to ensure the quality of early validators, Frax relies on in-house validators in V1.

To tackle this issue, frxETH V2 introduces innovations that promote decentralization in frxETH 🌐, while improving the efficiency of borrowing & lending in the staking market ✅.

3/

In this thread, I will cover:

1️⃣ The philosophy behind LSD.

2️⃣ Innovations of frxETH v2.

3️⃣ 🔑 The market-based interest rate.

4️⃣ ⚙️ The programmable lending market.

Without further ado, let's dive into the world of Frax 🏄.

In this thread, I will cover:

1️⃣ The philosophy behind LSD.

2️⃣ Innovations of frxETH v2.

3️⃣ 🔑 The market-based interest rate.

4️⃣ ⚙️ The programmable lending market.

Without further ado, let's dive into the world of Frax 🏄.

4/

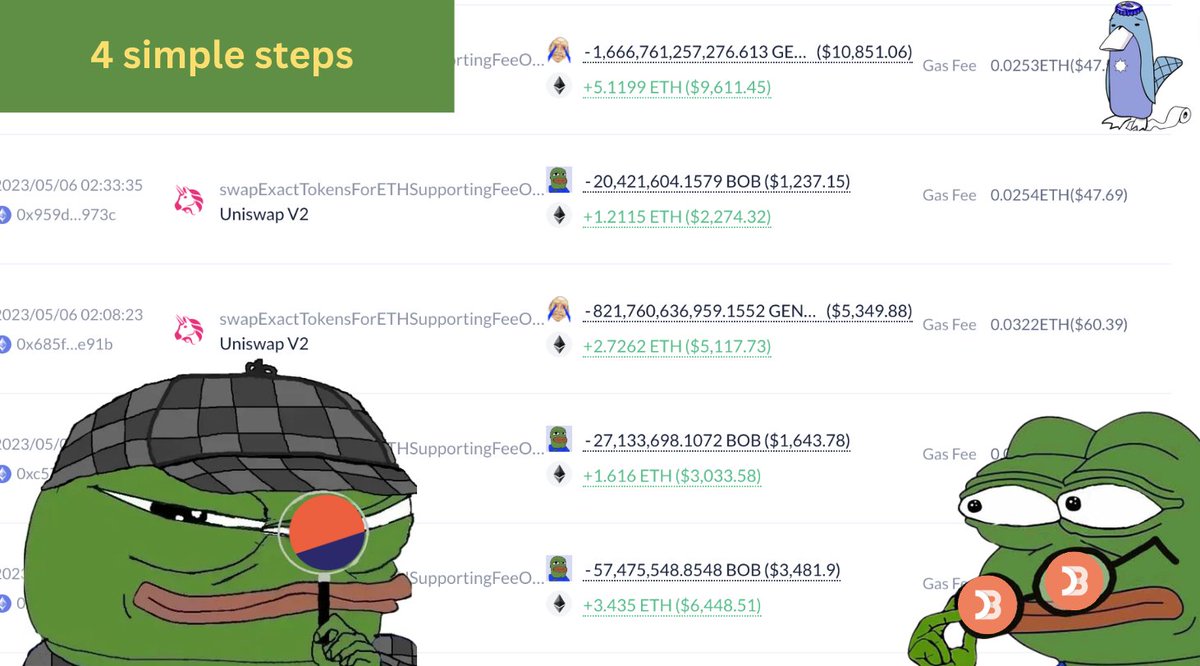

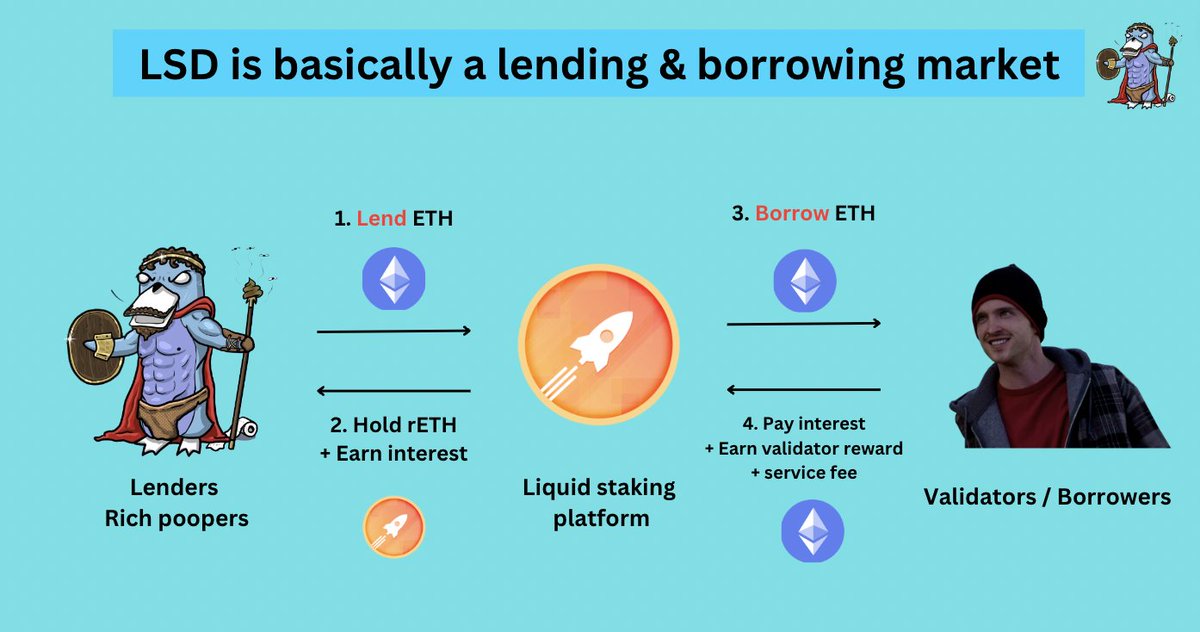

1️⃣ The philosophy behind LSD.

From Lido to Rocketpool, the underlaying concept behind all LSD is simply a lending & borrowing market.

Users lend ETH and receive rETH as a receipt, borrowers rent the right to operate validators for the project and pay interest to LSD holders.

1️⃣ The philosophy behind LSD.

From Lido to Rocketpool, the underlaying concept behind all LSD is simply a lending & borrowing market.

Users lend ETH and receive rETH as a receipt, borrowers rent the right to operate validators for the project and pay interest to LSD holders.

5/

Up to this point, it is clear that a peer-2-pool lending & borrowing staking market is by far the most efficient & decentralized model.

On the other hand, LSD like stETH and rETH essentially function as interest-bearing stablecoins that are pegged to ETH.

Up to this point, it is clear that a peer-2-pool lending & borrowing staking market is by far the most efficient & decentralized model.

On the other hand, LSD like stETH and rETH essentially function as interest-bearing stablecoins that are pegged to ETH.

6/

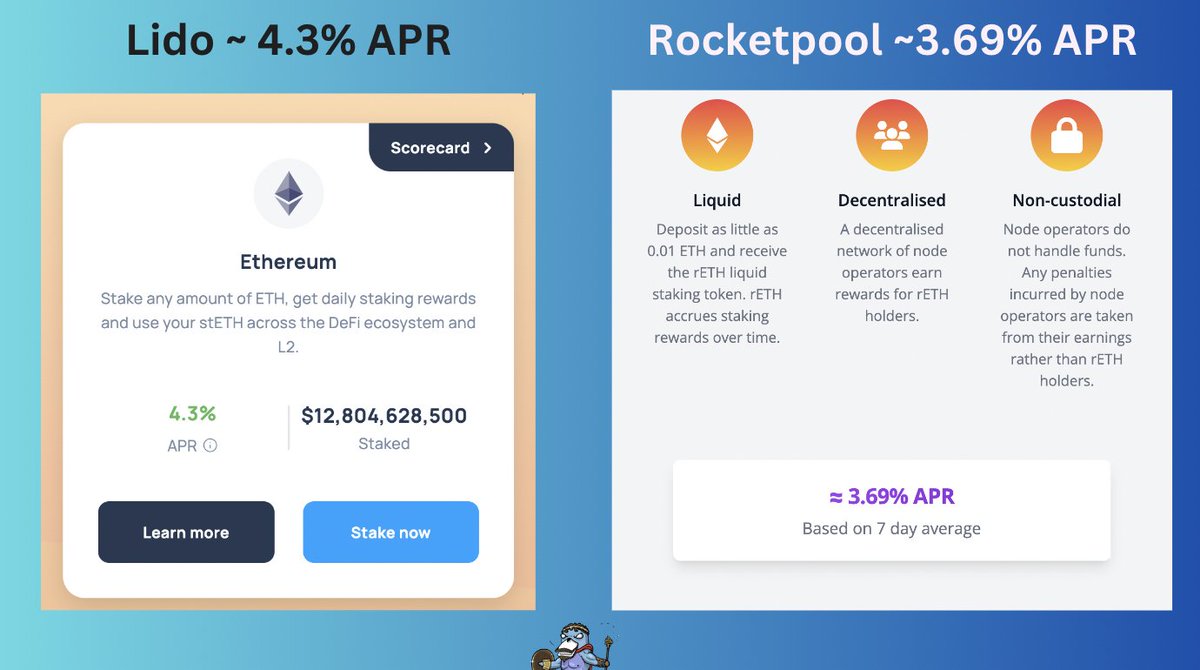

Yet, the LSD's APR is actually capped by the collateral costs.

@Rocket_Pool Liquid Staker has an APR of 3.69%, while @LidoFinance is slightly higher at 4.3%

This is because rewards must be distributed across a larger pool of capital before they allocated to the LSD holders.

Yet, the LSD's APR is actually capped by the collateral costs.

@Rocket_Pool Liquid Staker has an APR of 3.69%, while @LidoFinance is slightly higher at 4.3%

This is because rewards must be distributed across a larger pool of capital before they allocated to the LSD holders.

7/

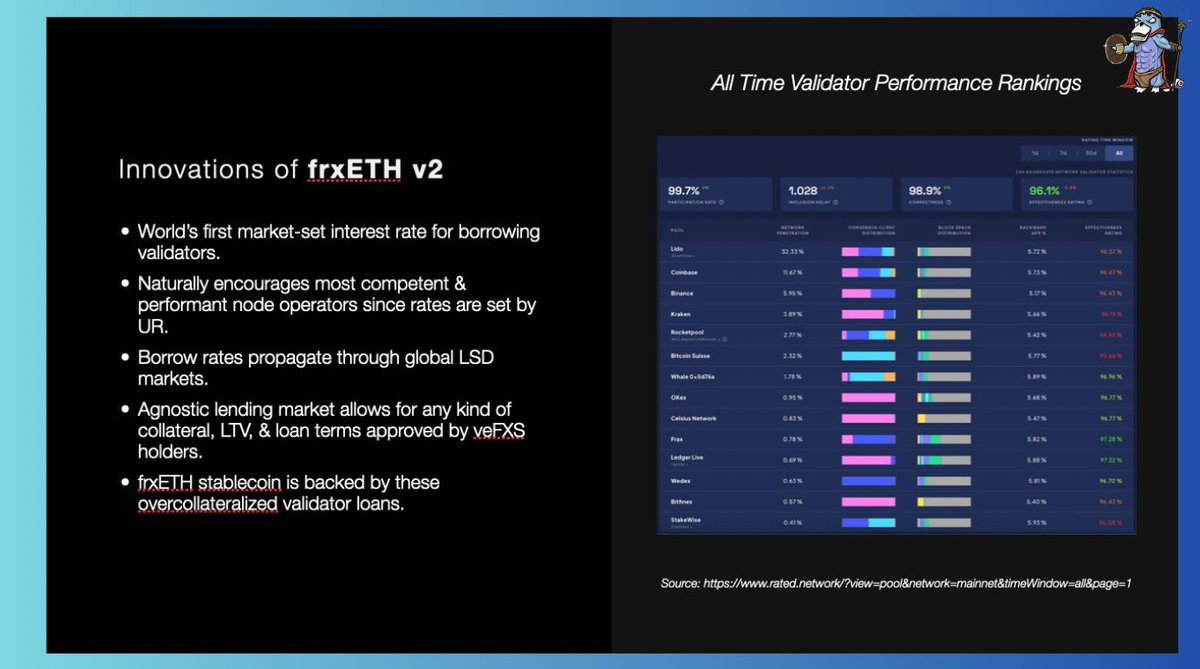

2️⃣ What are the innovations in frxETH v2 ?

To achieve the ultimate decentralised LSD project, frxETH v2 have introduced several innovations, most notably:

🔑 Market and utilization rate (UR) based interest rates

⚙️ Programmable lending market

2️⃣ What are the innovations in frxETH v2 ?

To achieve the ultimate decentralised LSD project, frxETH v2 have introduced several innovations, most notably:

🔑 Market and utilization rate (UR) based interest rates

⚙️ Programmable lending market

8/

A quick recap of frxETH v1 💭:

In Frax v1, users deposit ETH to redeem frxETH.

This frxETH can be staked for sfrxETH to earn staking rewards, or paired with ETH - frxETH on @CurveFinance to farm CRV emission.

Want to learn more? Check out my thread 👇

A quick recap of frxETH v1 💭:

In Frax v1, users deposit ETH to redeem frxETH.

This frxETH can be staked for sfrxETH to earn staking rewards, or paired with ETH - frxETH on @CurveFinance to farm CRV emission.

Want to learn more? Check out my thread 👇

https://twitter.com/poopmandefi/status/1643832960007716864

9/

In frxETH V2, users can borrow validators based on the Loan-to-Value (LTV) ratio.

To "borrow" a validator, users must first provide a minimal amount of ETH as collateral (Likely to > 8 ETH), which grants them the "right" to borrow and run a validator on @fraxfinance ✅.

In frxETH V2, users can borrow validators based on the Loan-to-Value (LTV) ratio.

To "borrow" a validator, users must first provide a minimal amount of ETH as collateral (Likely to > 8 ETH), which grants them the "right" to borrow and run a validator on @fraxfinance ✅.

10/

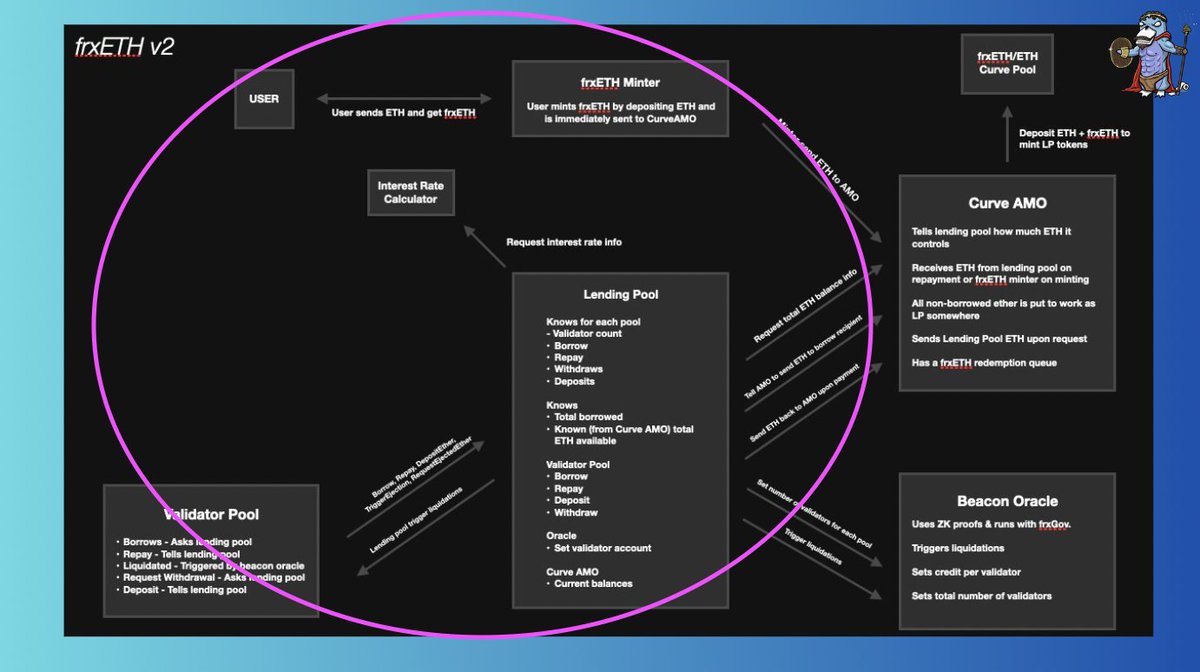

Meanwhile, the interest on borrowing is paid directly from the user's ETH and validator rewards 💵.

Below is an overview of the frxETH V2 architecture 👇.

To simplify the explanation, I will focus only on the circled area for the following threads.

Meanwhile, the interest on borrowing is paid directly from the user's ETH and validator rewards 💵.

Below is an overview of the frxETH V2 architecture 👇.

To simplify the explanation, I will focus only on the circled area for the following threads.

11/

2️⃣ frxETH v2 Innovations

FrxETH v2 doesn't use hardcoded fees.

Instead, it relies on a dynamic interest rate based on:

Utilization rate ⛏️

Market forces 🔑

Borrowers can check & trade based on open-interest in real-time, creating a more lucrative option for node operators

2️⃣ frxETH v2 Innovations

FrxETH v2 doesn't use hardcoded fees.

Instead, it relies on a dynamic interest rate based on:

Utilization rate ⛏️

Market forces 🔑

Borrowers can check & trade based on open-interest in real-time, creating a more lucrative option for node operators

12/

Let's use an example👇

If the borrowing fee is low 🆙 (Many lenders, or ETH stakers), users can borrow a validator, perform validation, and pay interest to the lender (which is sfrxETH) 🫴

Meanwhile, validators can keep all the bonuses, such as MEV, priority tips etc💰

Let's use an example👇

If the borrowing fee is low 🆙 (Many lenders, or ETH stakers), users can borrow a validator, perform validation, and pay interest to the lender (which is sfrxETH) 🫴

Meanwhile, validators can keep all the bonuses, such as MEV, priority tips etc💰

13/

On the other hand, if the interest rate spikes 🔻 (Too many demand for ETH, but not enough lender) to a point where it becomes unprofitable to run validator ❌.

Users might choose to:

1️⃣ Repay the debt

2️⃣ Eject the validator

and wait for a more favorable interest rate.

On the other hand, if the interest rate spikes 🔻 (Too many demand for ETH, but not enough lender) to a point where it becomes unprofitable to run validator ❌.

Users might choose to:

1️⃣ Repay the debt

2️⃣ Eject the validator

and wait for a more favorable interest rate.

14/

With the dynamic interest rate, it allows sophisticated node operators to execute their strategies based on the open market interest rate, enabling more flexible and lucrative choices for node operators 🚀.

With the dynamic interest rate, it allows sophisticated node operators to execute their strategies based on the open market interest rate, enabling more flexible and lucrative choices for node operators 🚀.

15/

Slashing 🪚

Slashing occurs when validators fail certain jobs, leading to an increase in the LTV for borrowers as the total value of the validator drop 🩸.

If LTV reaches an unhealthy level, the validator will be ejected in order to maintain the stability of the protocol.

Slashing 🪚

Slashing occurs when validators fail certain jobs, leading to an increase in the LTV for borrowers as the total value of the validator drop 🩸.

If LTV reaches an unhealthy level, the validator will be ejected in order to maintain the stability of the protocol.

16/

⚙️ Programmable lending market.

Fundamentally speaking, the collateral cost and type are usually agnostic (you can use RPL, fxs, or any token for collateral and their collateral costs are actually the same).

⚙️ Programmable lending market.

Fundamentally speaking, the collateral cost and type are usually agnostic (you can use RPL, fxs, or any token for collateral and their collateral costs are actually the same).

17/

With this in mind, frxETH v2 will be fully programmable, allowing vefxs holders to decide which token should be the new type of collateral and design new loan terms via governance.

This will also create a marketplace for ETH lenders and also borrowers on frxETH v2.

With this in mind, frxETH v2 will be fully programmable, allowing vefxs holders to decide which token should be the new type of collateral and design new loan terms via governance.

This will also create a marketplace for ETH lenders and also borrowers on frxETH v2.

18/

That's a wrap!

This is my superficial understanding of frxETHv 2 and I hope you all enjoyed the read!

I'm super bullish on the new frxETH v2 upgrades and I hope to learn more from it.

Please consider leaving a like and supporting me by retweeting!

That's a wrap!

This is my superficial understanding of frxETHv 2 and I hope you all enjoyed the read!

I'm super bullish on the new frxETH v2 upgrades and I hope to learn more from it.

Please consider leaving a like and supporting me by retweeting!

19/

Tagging Frax kings for the exciting v2 upgrades

@0xCha0s @Bitkevin1 @samkazemian @DeFiDave22 @napgener @rektdiomedes @cryptodetweiler @schizoxbt @Subli_Defi @thelearningpill @definapkin @CryptoDeFiGuy @0xJamesXXX @eek637 @charlie_defi @VoldiemortEth @NNovaDefi

Tagging Frax kings for the exciting v2 upgrades

@0xCha0s @Bitkevin1 @samkazemian @DeFiDave22 @napgener @rektdiomedes @cryptodetweiler @schizoxbt @Subli_Defi @thelearningpill @definapkin @CryptoDeFiGuy @0xJamesXXX @eek637 @charlie_defi @VoldiemortEth @NNovaDefi

20/

Tagging my CT frens for the alpha

@0xSalazar @DegenCamp @DeFi_Cheetah @2lambro @crypticdegen22

@OvrCldJonny @Deebs_DeFi @tomwanhh @Chinchillah_ @Hercules_Defi @ArbiAlpha @stacy_muur @0xkhan_ @ArsalanSartaj

@2lambro @hmalviya9 @francescoweb3 @ShivanshuMadan @jinglingcookies

Tagging my CT frens for the alpha

@0xSalazar @DegenCamp @DeFi_Cheetah @2lambro @crypticdegen22

@OvrCldJonny @Deebs_DeFi @tomwanhh @Chinchillah_ @Hercules_Defi @ArbiAlpha @stacy_muur @0xkhan_ @ArsalanSartaj

@2lambro @hmalviya9 @francescoweb3 @ShivanshuMadan @jinglingcookies

@0xSalazar @DegenCamp @DeFi_Cheetah @2lambro @crypticdegen22 @OvrCldJonny @Deebs_DeFi @tomwanhh @Chinchillah_ @Hercules_Defi @ArbiAlpha @stacy_muur @0xkhan_ @ArsalanSartaj @hmalviya9 @francescoweb3 @ShivanshuMadan @jinglingcookies Love the read?

Click the like button and spread it like a wild fire.

Click the like button and spread it like a wild fire.

https://twitter.com/poopmandefi/status/1665771114214338561?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter