NEW FROM US:

Tingo Group: Fake Farmers, Phones, and Financials—The Nigerian Empire That Isn’t

hindenburgresearch.com/tingo

(1/n)

Tingo Group: Fake Farmers, Phones, and Financials—The Nigerian Empire That Isn’t

hindenburgresearch.com/tingo

(1/n)

We are short Tingo Group $TIO because we believe the company is an exceptionally obvious scam with completely fabricated financials.

(2/n)

(2/n)

$TIO headquartered in New Jersey, claims to have several business segments focused on providing mobile phones, food processing and an online food marketplace for farmers primarily located in Nigeria.

(3/n)

(3/n)

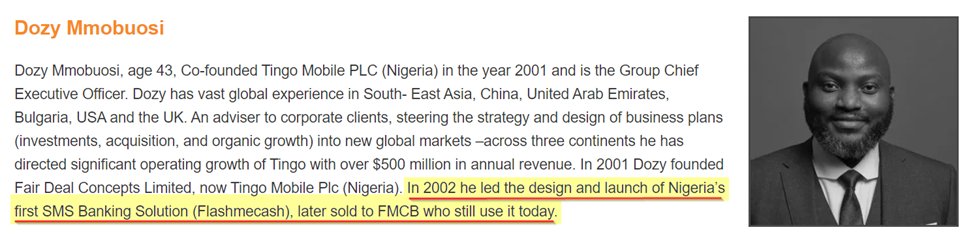

$TIO was founded and is spearheaded by “Dozy” Mmobuosi, CEO of the key holding company entity.

Dozy is regularly described by the media as a billionaire and made waves earlier this year when he attempted to acquire now-Premier League soccer team Sheffield United. (4/n)

Dozy is regularly described by the media as a billionaire and made waves earlier this year when he attempted to acquire now-Premier League soccer team Sheffield United. (4/n)

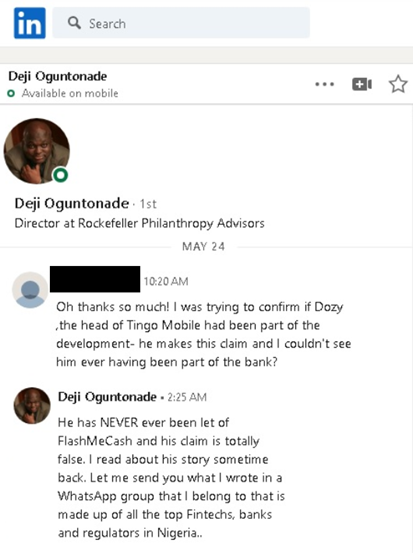

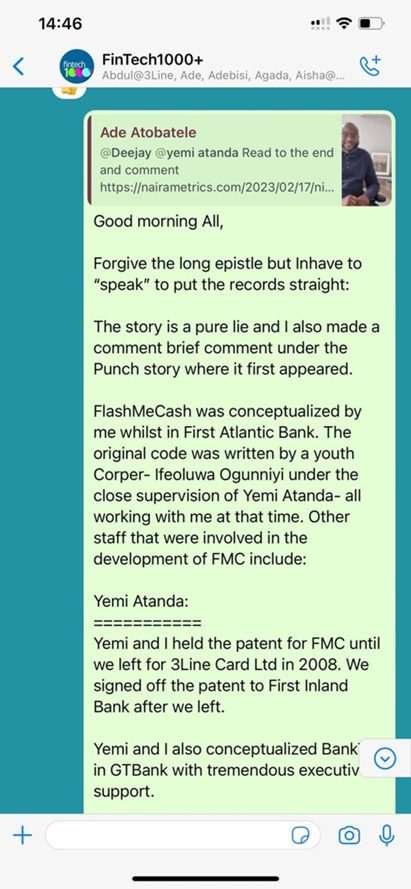

We’ve identified major red flags with Dozy’s background.

He appears to have fabricated his biographical claim to have developed the first mobile payment app in Nigeria.

We contacted the app’s actual creator, who called Dozy’s claims “totally false” & a “pure lie”.

(5/n)

He appears to have fabricated his biographical claim to have developed the first mobile payment app in Nigeria.

We contacted the app’s actual creator, who called Dozy’s claims “totally false” & a “pure lie”.

(5/n)

Dozy claimed in his biography to have received a PhD in rural advancement from Malaysian university UPM in 2007.

We contacted UPM to verify the degree. They wrote back saying no one by his name was found in their verification system. (6/n)

We contacted UPM to verify the degree. They wrote back saying no one by his name was found in their verification system. (6/n)

In 2017, Dozy was arrested and faced an 8-count indictment over issuance of bad checks, according to the Nigerian Economic and Financial Crimes Commission.

He later settled the case in arbitration.

(7/n)

He later settled the case in arbitration.

(7/n)

In 2019, Dozy claimed to have launched “Tingo Airlines” & posted social media messages encouraging customers to “fly with Tingo Airlines today”.

Media later uncovered Tingo photoshopped its logo onto pictures of airplanes. Dozy later admitted to never owning any aircraft.

(8/n)

Media later uncovered Tingo photoshopped its logo onto pictures of airplanes. Dozy later admitted to never owning any aircraft.

(8/n)

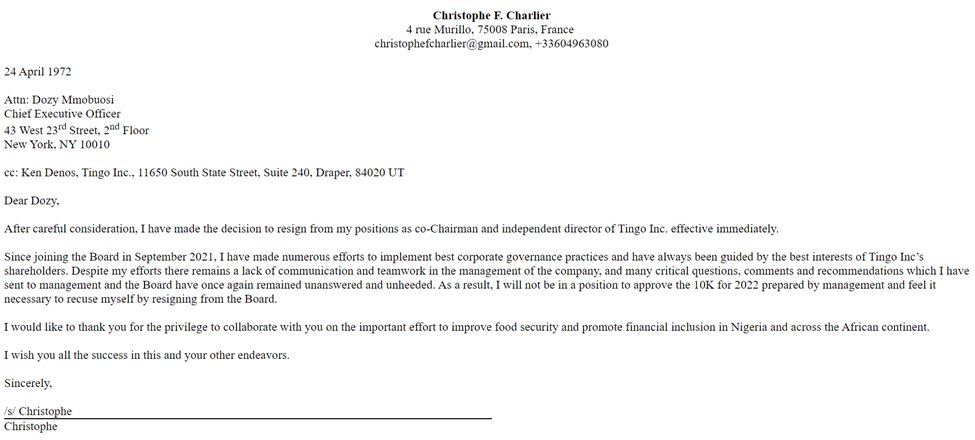

In April 2023, Tingo’s Co-Chair wrote a public letter to Dozy, filed with the SEC, saying he could not approve the company’s annual report & felt it “necessary" to "resign" due to “many critical questions, comments and recommendations” that went “unanswered and unheeded”.

(9/n)

(9/n)

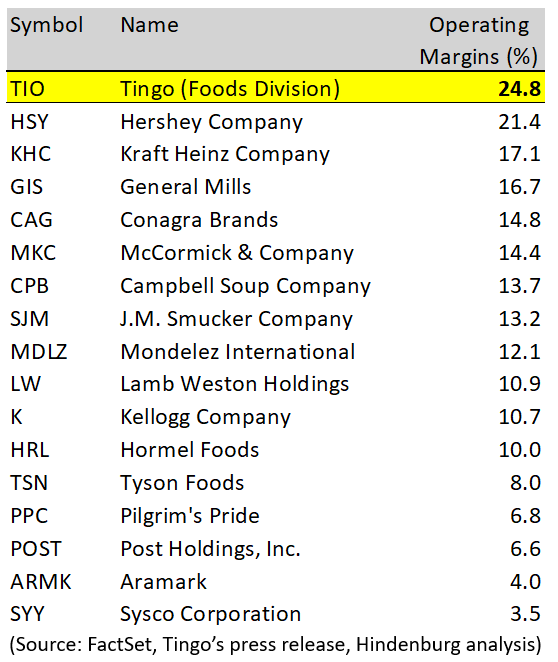

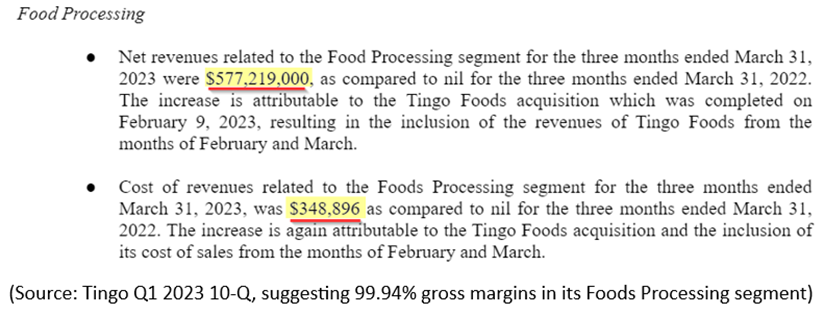

$TIO's food division is 7 months old, yet claimed to generate $577.2 million in revenue last quarter alone, representing 68% of total reported revenue.

If accurate, its claimed 24.8% operating margins would exceed those of every major comparable food company.

(10/n)

If accurate, its claimed 24.8% operating margins would exceed those of every major comparable food company.

(10/n)

Yet, Tingo has no food processing facility of its own.

Rather, it claims its explosive revenue and profitability is derived from acting as a middleman between Nigerian farmers and an unnamed third-party food processor.

(11/n)

Rather, it claims its explosive revenue and profitability is derived from acting as a middleman between Nigerian farmers and an unnamed third-party food processor.

(11/n)

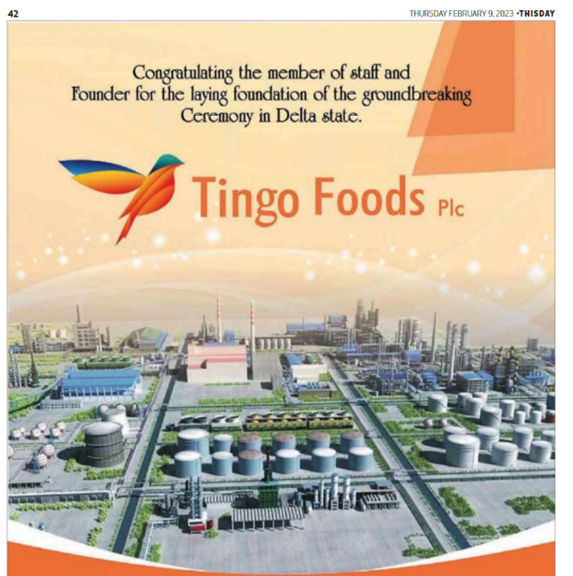

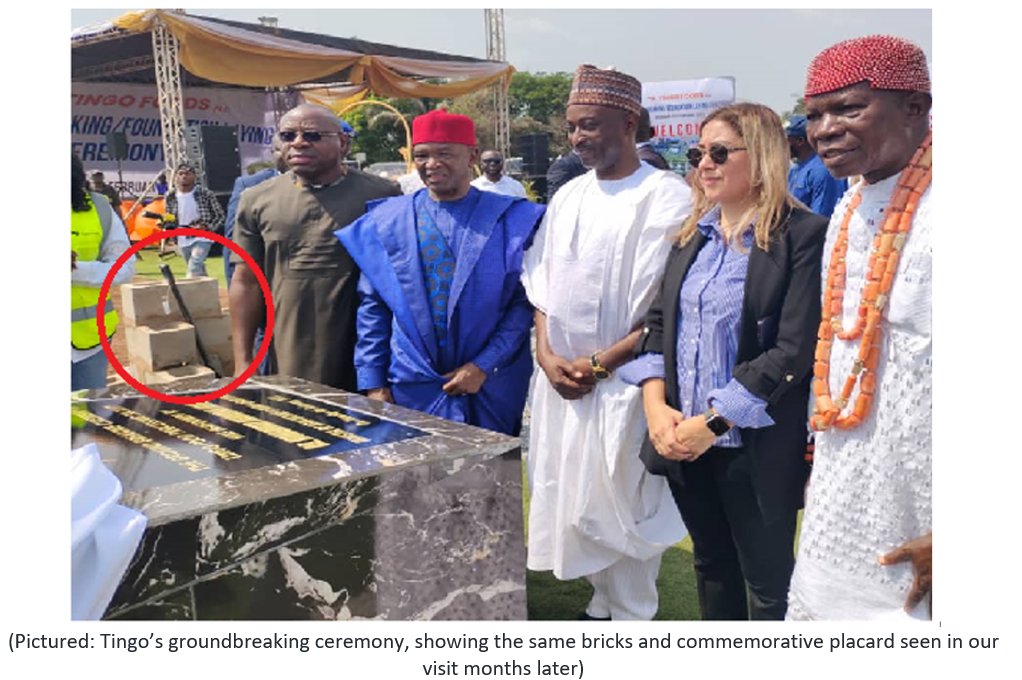

In February 2023, the company held a groundbreaking ceremony for a planned $1.6 billion Nigerian food processing facility, attended by the country’s agriculture minister and other political luminaries.

(12/n)

(12/n)

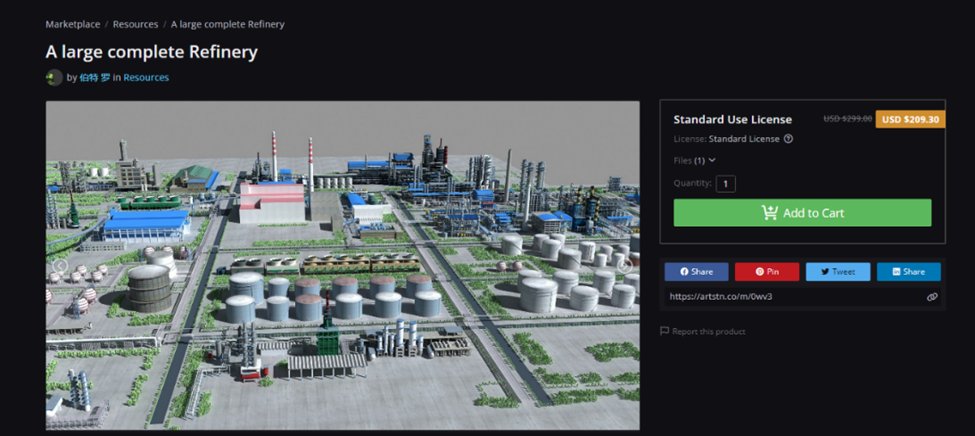

We found that the rendering of the planned facility, featured in Tingo’s investor materials and on a billboard at the ceremony, is actually a rendering of an oil refinery from a stock photo website. (13/n)

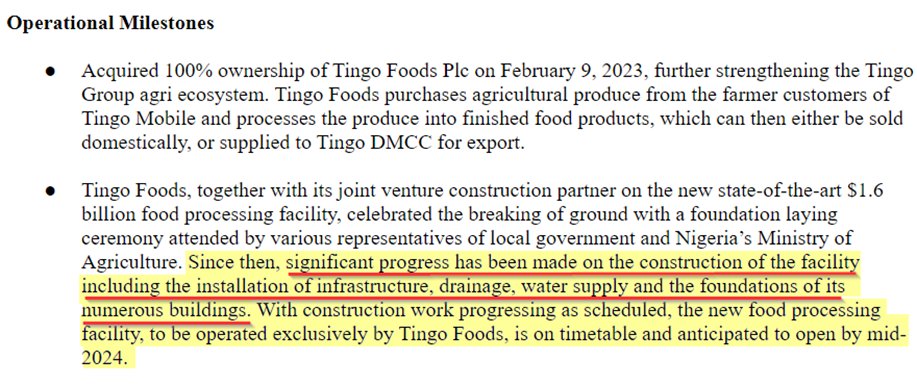

Following its groundbreaking, Tingo reported in a May 2023 SEC filing that it made “significant progress” on the facility, including laying “the foundations of its numerous buildings”. (14/n)

We visited the site a week later and found zero signs of progress; it was empty except for the plaque and billboard commemorating the groundbreaking ceremony, surrounded by weeds.

youtube.com/shorts/XE92we6…

(15/n)

youtube.com/shorts/XE92we6…

(15/n)

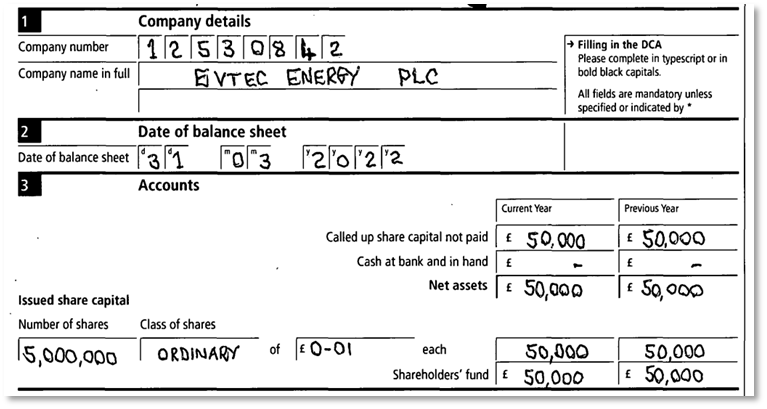

Subsequent to the “groundbreaking”, $TIO announced a $150M agreement with a UK entity called Evtec Energy to build solar panels for its non-existent facility.

Funding is slated to be provided through Evtec, but UK filings show Evtec was “Dormant” and held zero cash.

(16/n)

Funding is slated to be provided through Evtec, but UK filings show Evtec was “Dormant” and held zero cash.

(16/n)

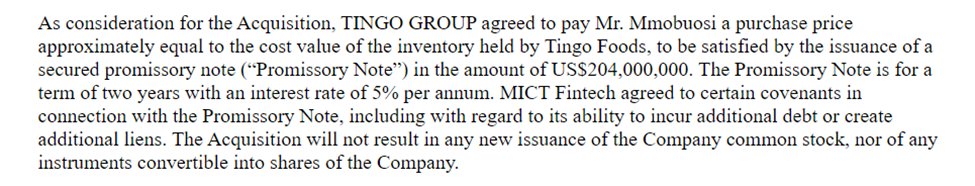

Tingo Group bought Tingo Foods from Dozy in February 2023 for $204 million, a price “approximately equal to the cost value of the inventory held by Tingo Foods”.

(17/n)

(17/n)

The inventory, which was reported in year-end financials, completely vanished from Tingo’s Q1 2023 accounts without explanation.

In our experience, $204 million in inventory doesn’t just disappear at companies with internal controls and genuine financial reporting. (18/n)

In our experience, $204 million in inventory doesn’t just disappear at companies with internal controls and genuine financial reporting. (18/n)

Tingo claimed its mobile handset leasing, call and data segments generated $128 million in revenue last quarter (~15% of total).

(19/n)

(19/n)

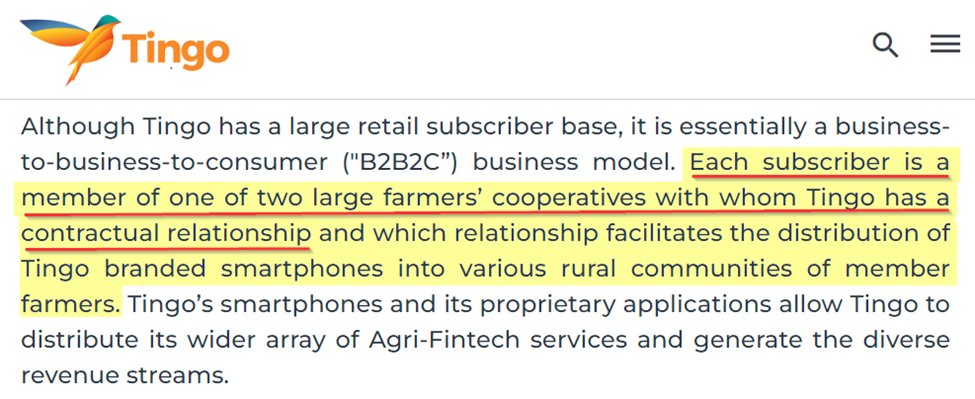

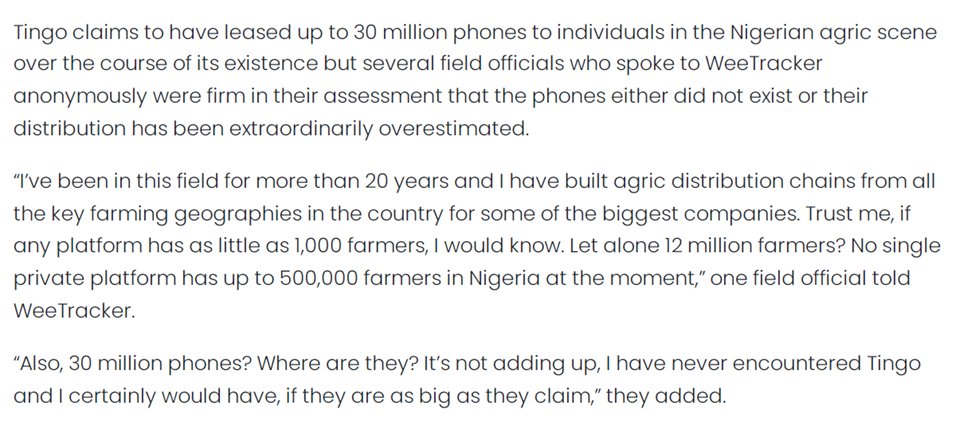

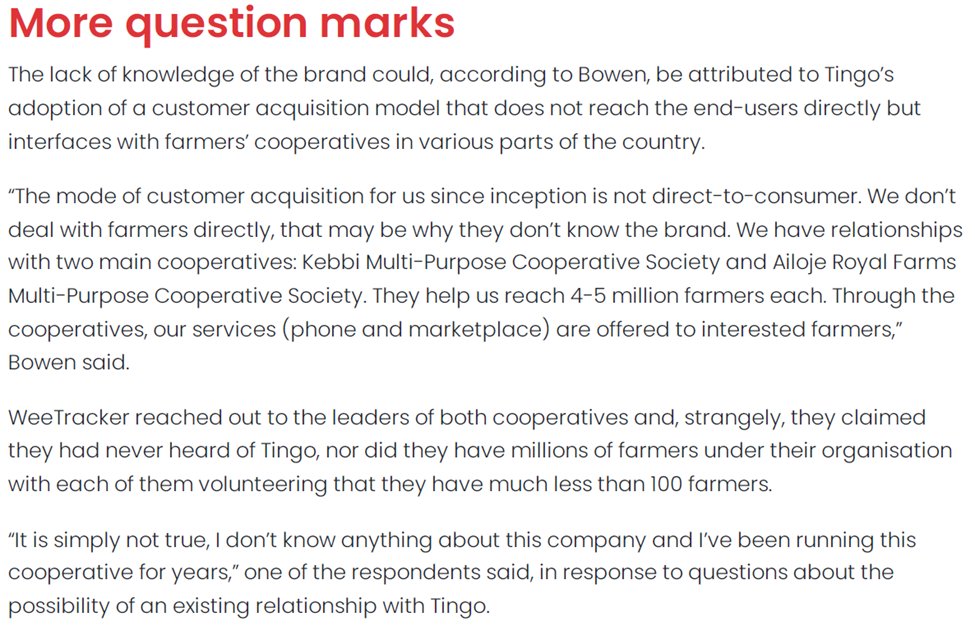

$TIO claims members of 2 unnamed farming co-ops supply the majority of its then ~9M userbase, consisting of local Nigerian farmers.

These farmers supposedly form the core of company’s phone customers & provide ag products used in TIO's food & trading businesses.

(20/n)

These farmers supposedly form the core of company’s phone customers & provide ag products used in TIO's food & trading businesses.

(20/n)

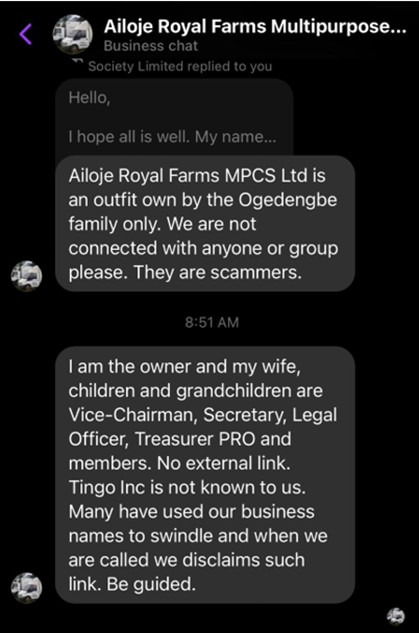

Local media outlet @weetracker identified and contacted the cooperatives.

Both said they had never heard of Tingo and had fewer than 100 farmers in each cooperative. (21/n)

Both said they had never heard of Tingo and had fewer than 100 farmers in each cooperative. (21/n)

We were able to make contact with one of the cooperatives.

Its owner reiterated having no relationship with Tingo and flat out told us “they are scammers”.

(22/n)

Its owner reiterated having no relationship with Tingo and flat out told us “they are scammers”.

(22/n)

Our checks with the Nigerian Communications Commission showed it has no record of Tingo being a mobile licensee at all, despite licensing requirements and the company's claim to have 12+ million mobile customers. (23/n)

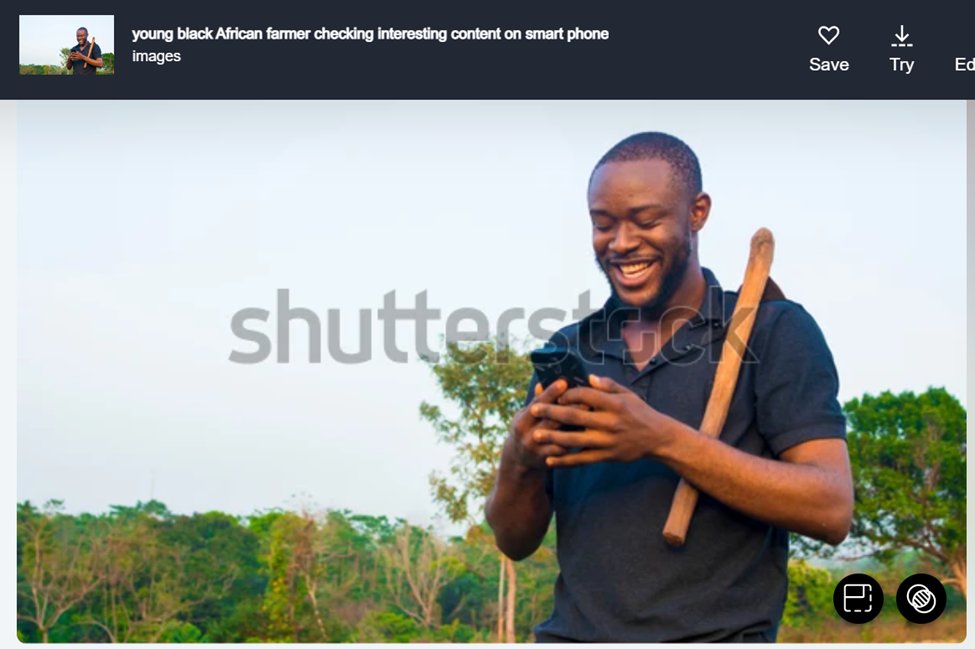

Despite claiming to have millions of farmers using its phones, Tingo Mobile’s corporate presentation and webpage use stock photos of farmers using phones. (24/n)

We visited Tingo Mobile’s office in Nigeria and found only a handful of employees and a sign posted on its door by federal tax authorities stating that the company is delinquent on its tax obligations.

(25/n)

(25/n)

Tingo Mobile claimed its Ghana expansion efforts would enroll 2-4M members by February 2023. This would represent ~9%-18% market share in the country within months.

We found zero records pertaining to Tingo Mobile through Ghana’s communication regulator.

(26/n)

We found zero records pertaining to Tingo Mobile through Ghana’s communication regulator.

(26/n)

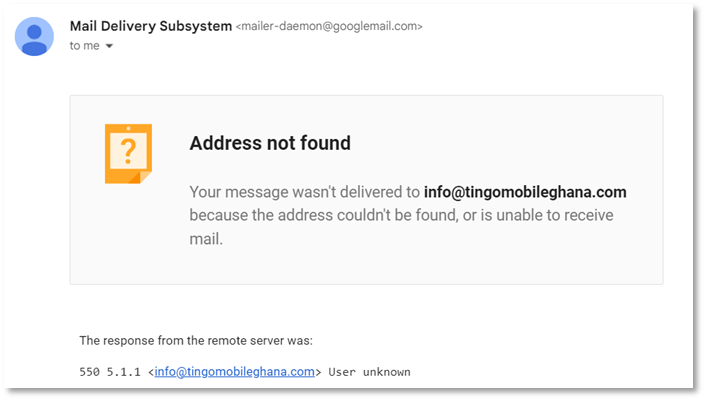

We tried to contact Tingo’s Ghana support in late May to buy a phone.

The email bounced back and no one picked up the phone despite numerous attempts.

(27/n)

The email bounced back and no one picked up the phone despite numerous attempts.

(27/n)

We visited Tingo’s Ghana office location in late May 2023. We saw 2 cars in the parking lot and no customers.

When we tried to enroll in a plan and buy a phone we were told the location wasn’t operational yet.

(28/n)

When we tried to enroll in a plan and buy a phone we were told the location wasn’t operational yet.

(28/n)

TingoPay (part of Tingo Mobile) claimed in 2021 to have launched a partnership with a major local bank.

(29/n)

(29/n)

Two days after Tingo’s blockbuster announcement, the bank put out a statement calling Tingo’s claim false and that it had “NOT concluded any agreement with Tingo International in respect of any payment system whatsoever”. (30/n)

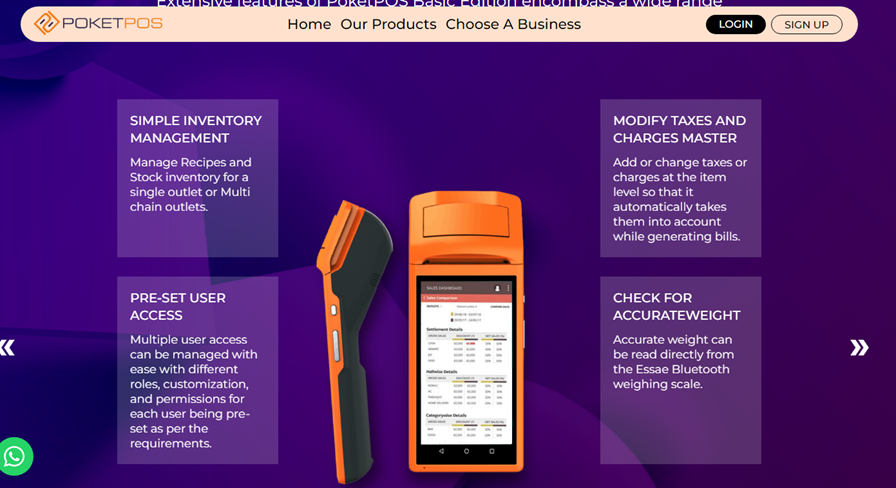

$TIO now claims its payment group has a point of sale (PoS) system and other merchant products. (31/n)

We found that pictures of Tingo’s claimed PoS system were taken from different PoS operator’s website, with a Tingo logo photoshopped over them. (32/n)

$TIO claims its “seed to sale” online marketplace called NWASSA generated $125.3 million in revenue last quarter or ~15% of its total revenue, yet the website has been “under maintenance” and inoperable for months. (33/n)

$TIO claims it has launched its NWASSA platform in Ghana.

The Ghana website also doesn’t work and just says “Updating…” without ever going anywhere. (34/n)

The Ghana website also doesn’t work and just says “Updating…” without ever going anywhere. (34/n)

In a May 2023 press release, Tingo claimed its brand-new agricultural export business, Tingo DMCC, was on track to deliver over U.S. $1.34 billion in exports by Q3.

(35/n)

(35/n)

$TIO's sales projections for that business are higher than the entire nation of Nigeria’s annual 2022 agricultural exports, which totaled about U.S. $1.15 billion, per government data. (36/n)

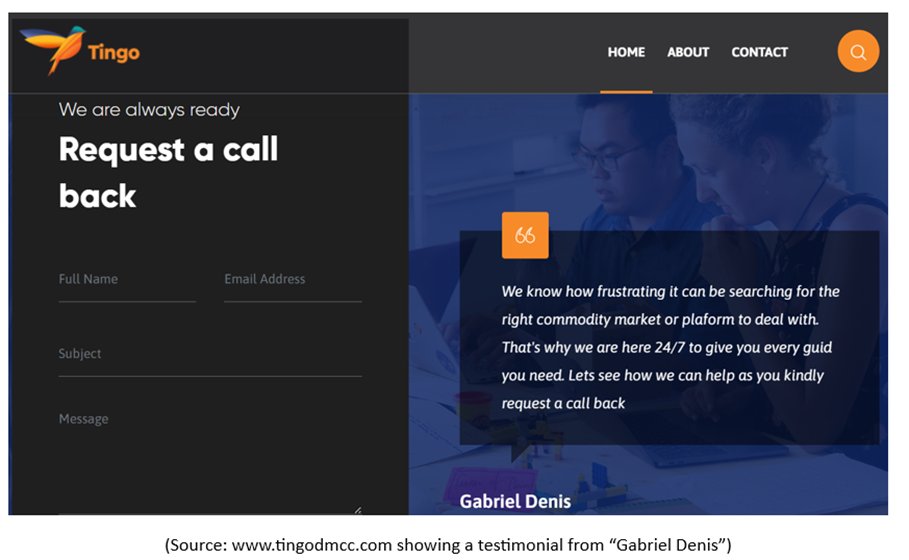

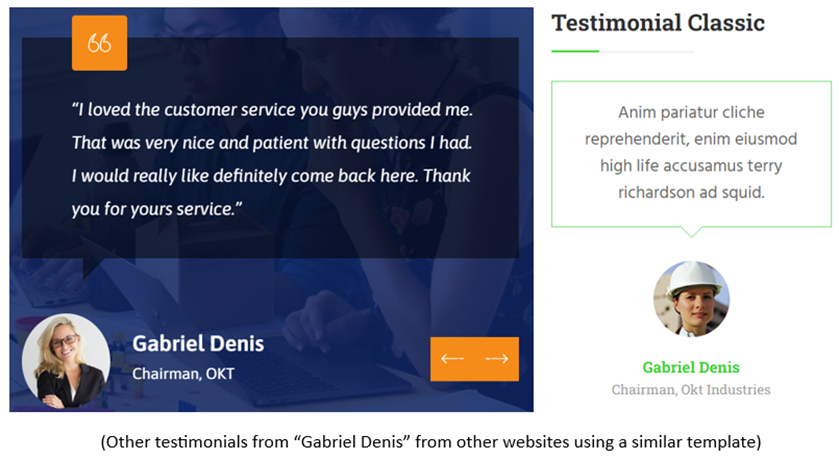

Tingo DMCC’s website has numerous non-functioning links and includes a fake testimonial that appears leftover from the website template.

(37/n)

(37/n)

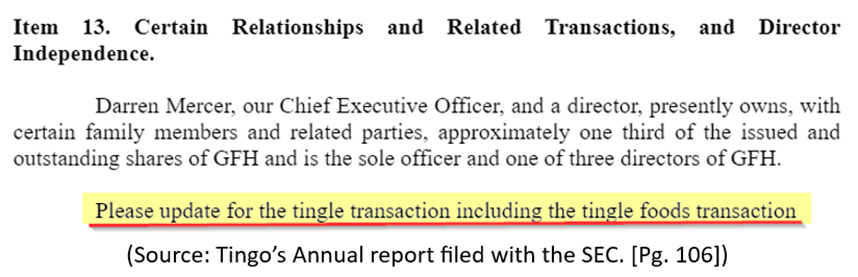

$TIO's financial statements are riddled with errors and typos, including a note to itself that it apparently forgot to delete, saying “please update for the tingle (sic) transaction including the tingle (sic) foods transaction”.

(38/n)

(38/n)

Its financials include other basic errors like incorrect math and leaving zeroes off key metrics. (39/n)

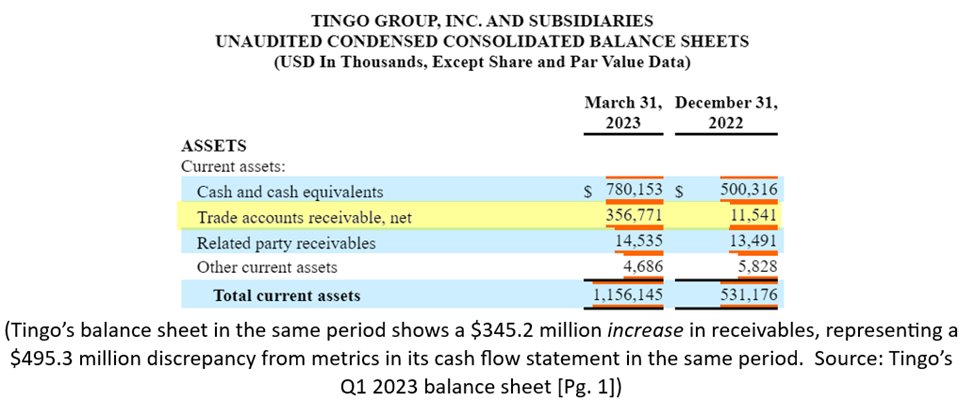

More troublingly, Tingo’s cash flow and balance sheet statements do not reconcile and show major errors indicating a complete lack of financial controls.

Its cash flow statements regularly subtract items from cash that should be added and vice versa.

(40/n)

Its cash flow statements regularly subtract items from cash that should be added and vice versa.

(40/n)

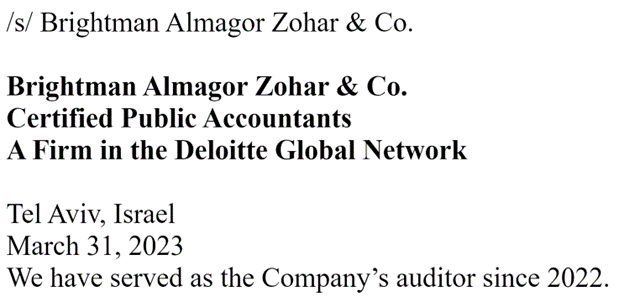

The apparent errors seem to also apply to Tingo’s audited annual financial statements, which were recently given an unqualified audit opinion by Deloitte Israel (a strange choice given the company lacks substantive operations in Israel).

(41/n)

(41/n)

We strongly suspect Tingo’s cash balance, which it conveniently claims is held in Nigeria, is fake.

The company collected only ~12% of the interest income one would expect from its claimed cash balances.

(42/n)

The company collected only ~12% of the interest income one would expect from its claimed cash balances.

(42/n)

Tingo is a word in the Pascuense language of Easter Island meaning, “to borrow objects from a friend's house, one by one, until there's nothing left.”

For a company that did an otherwise terrible job pretending to be a real business, it landed on an absolutely perfect name.

For a company that did an otherwise terrible job pretending to be a real business, it landed on an absolutely perfect name.

Overall, we think Tingo is a worthless and brazen fraud that should serve as a humiliating embarrassment for all involved.

We do not expect the company will be long for this world. $TIO

hindenburgresearch.com/tingo

(44/n)

We do not expect the company will be long for this world. $TIO

hindenburgresearch.com/tingo

(44/n)

• • •

Missing some Tweet in this thread? You can try to

force a refresh