What is the fair market value of XRP?

This question is more complex than it sounds, and led a small group of people on a nearly 2 year journey, picking up more along the way to support the effort.

🧵 A thread about our whitepaper to determine the Fair Market Value of XRP.

This question is more complex than it sounds, and led a small group of people on a nearly 2 year journey, picking up more along the way to support the effort.

🧵 A thread about our whitepaper to determine the Fair Market Value of XRP.

1. In December of 2020, the SEC filed a lawsuit against Ripple that led to a sell off of XRP and subsequent decrease in market price.

In the months that followed, @jvallee2000 noticed unusual details in the case that led him to wonder what was really going on. 🤔

In the months that followed, @jvallee2000 noticed unusual details in the case that led him to wonder what was really going on. 🤔

2. In Q3 of 2021, Jimmy and the team at Valhil Capital decided to send a proposal to the US Central Bank (The Fed), offering to sell their XRP (and that of others who wanted to participate) at a substantially higher price than available on the exchanges.

3. The point was to bring attention to the appearance of “regulatory capture” and a discussion around the implications.

Logical questions then arose. ❓❓❓

If the SEC had harmed retail holders through their lawsuit, how could one calculate the financial damages?

Logical questions then arose. ❓❓❓

If the SEC had harmed retail holders through their lawsuit, how could one calculate the financial damages?

4. How much did the lawsuit hinder adoption of the XRPL from its ability to realize its intended use case?

If the potential use case had been reached, what would the value of XRP have been?

If the potential use case had been reached, what would the value of XRP have been?

5. This is when the concept of Fair Market Value entered the discussion, and how it differs from Market Value.

Shortly after, Valhil Capital invited a larger group of people to come together (the Confidential Committee).

Shortly after, Valhil Capital invited a larger group of people to come together (the Confidential Committee).

6. The goal was to unite and to create a plan to address the collusion and harm caused by the SEC.

In the fall of 2022, The Confidential Committee formed a smaller Valuation Committee of people experienced in quantitative and financial valuations.

In the fall of 2022, The Confidential Committee formed a smaller Valuation Committee of people experienced in quantitative and financial valuations.

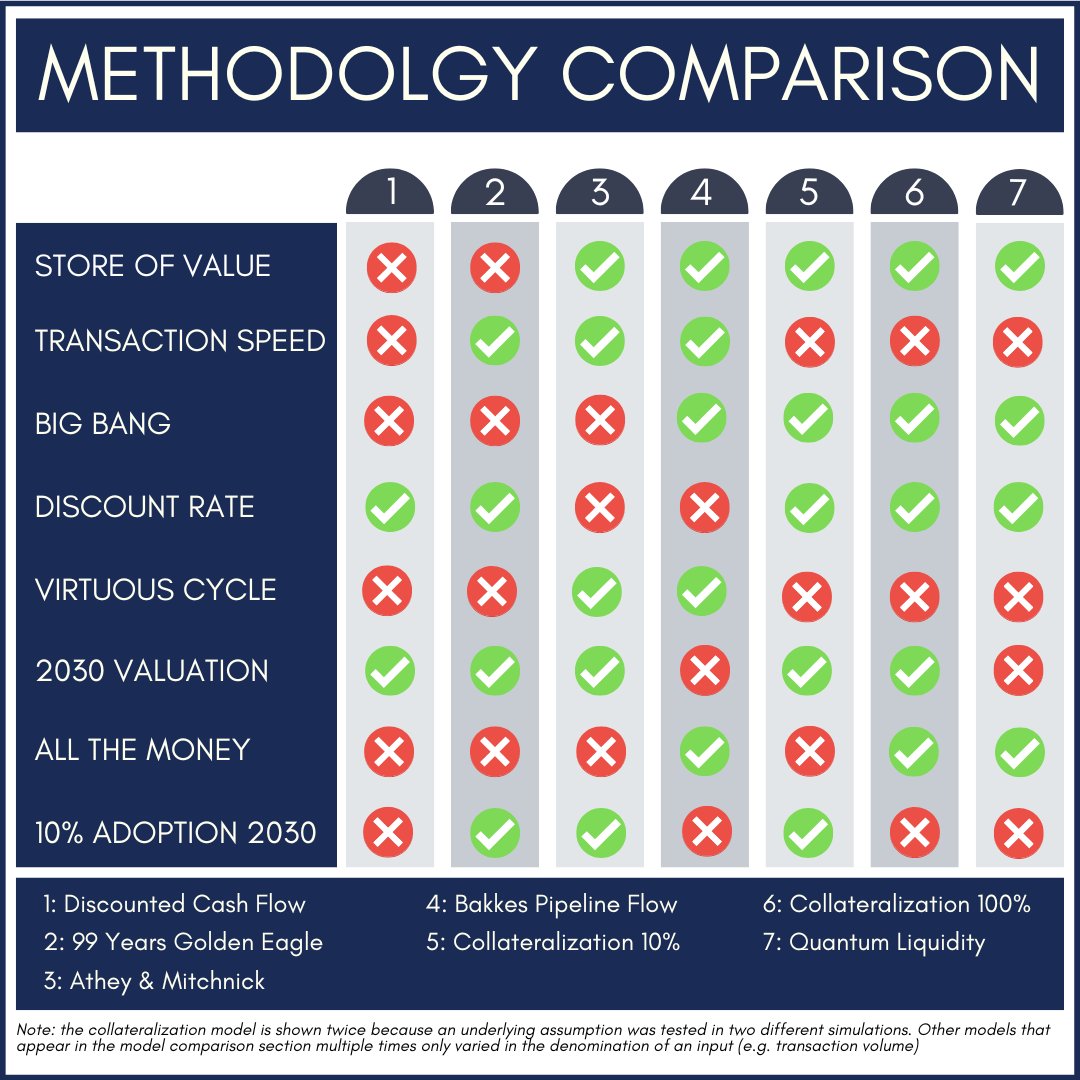

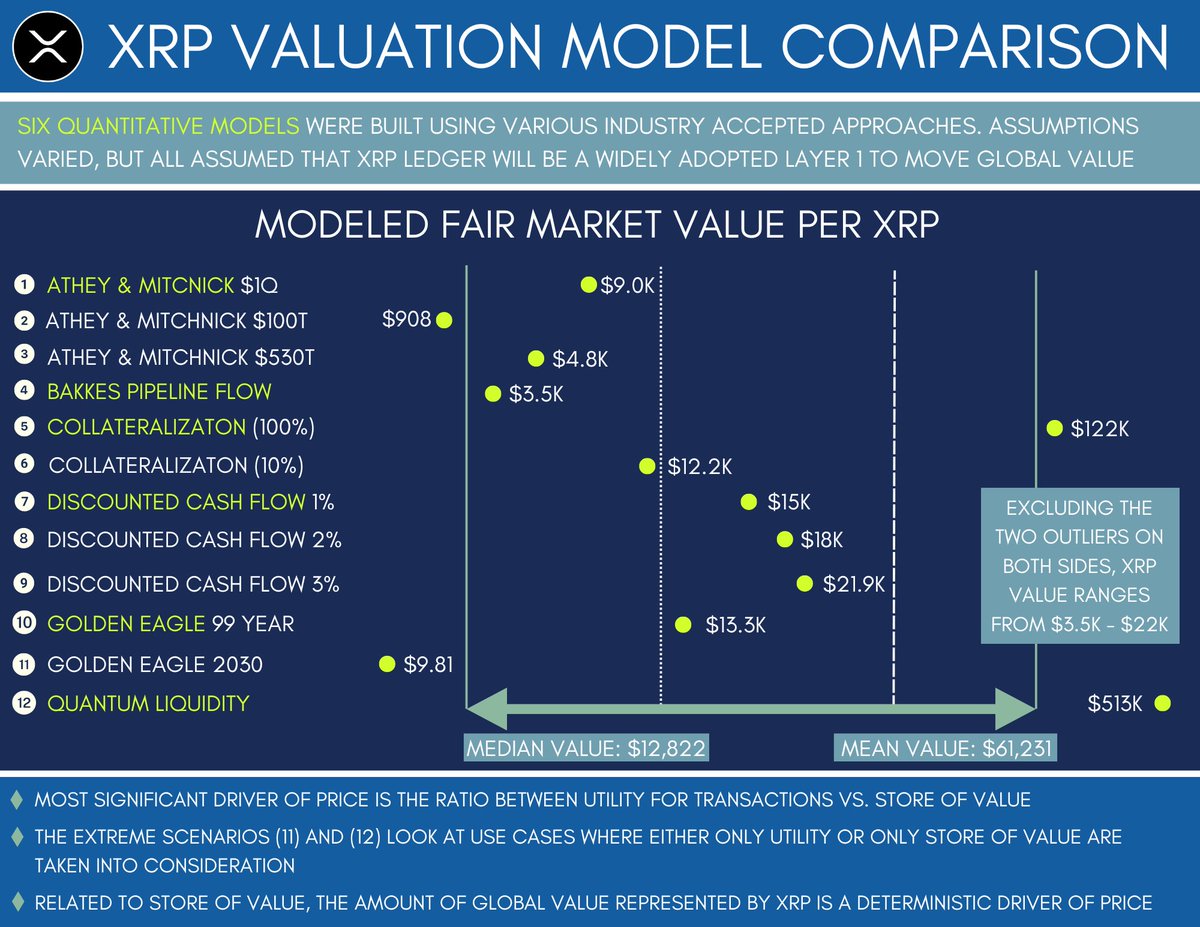

7. Six different valuation models were built over the span of several months.

The Valuation Committee made the decision to share our findings along the way.

This was because not all of models were completed at the same time.

The Valuation Committee made the decision to share our findings along the way.

This was because not all of models were completed at the same time.

8. Oddly, this decision brought substantial criticism.

We were learning, and publishing what we were learning, on Twitter & YouTube, as we went along.

Some critics felt that we should have waited until we were done. ⏰

We were learning, and publishing what we were learning, on Twitter & YouTube, as we went along.

Some critics felt that we should have waited until we were done. ⏰

9. Much to our surprise, the results of the first set of models led new people to step up and contribute additional models.

10. This confirmed we made the right decision, contrasting the transparency of our process to “build in public” to the secretive “back smoky room” process being undertaken by our public servants at the SEC.

The effort was expanding.

The effort was expanding.

11. The paper we have released today would have been quite different if we had waited to share what we learned.

One misperception around this effort was that the models are price forecasts designed to mislead people or give retail holders a dose of “hopium”.

One misperception around this effort was that the models are price forecasts designed to mislead people or give retail holders a dose of “hopium”.

12. However, among the people who took the time to really understand the output from the models, the opposite conclusion became evident.

(the lawsuit cost a LOT of people a LOT of money)

(the lawsuit cost a LOT of people a LOT of money)

13. The six models, which cover a range of specific scenarios, all show that the value of XRP would have been SUBSTANTIALLY higher than it is now (had the lawsuit never happened).

14. In that timeline of events, the XRPL would have been unencumbered by the stigma and confusion around the classification of XRP.

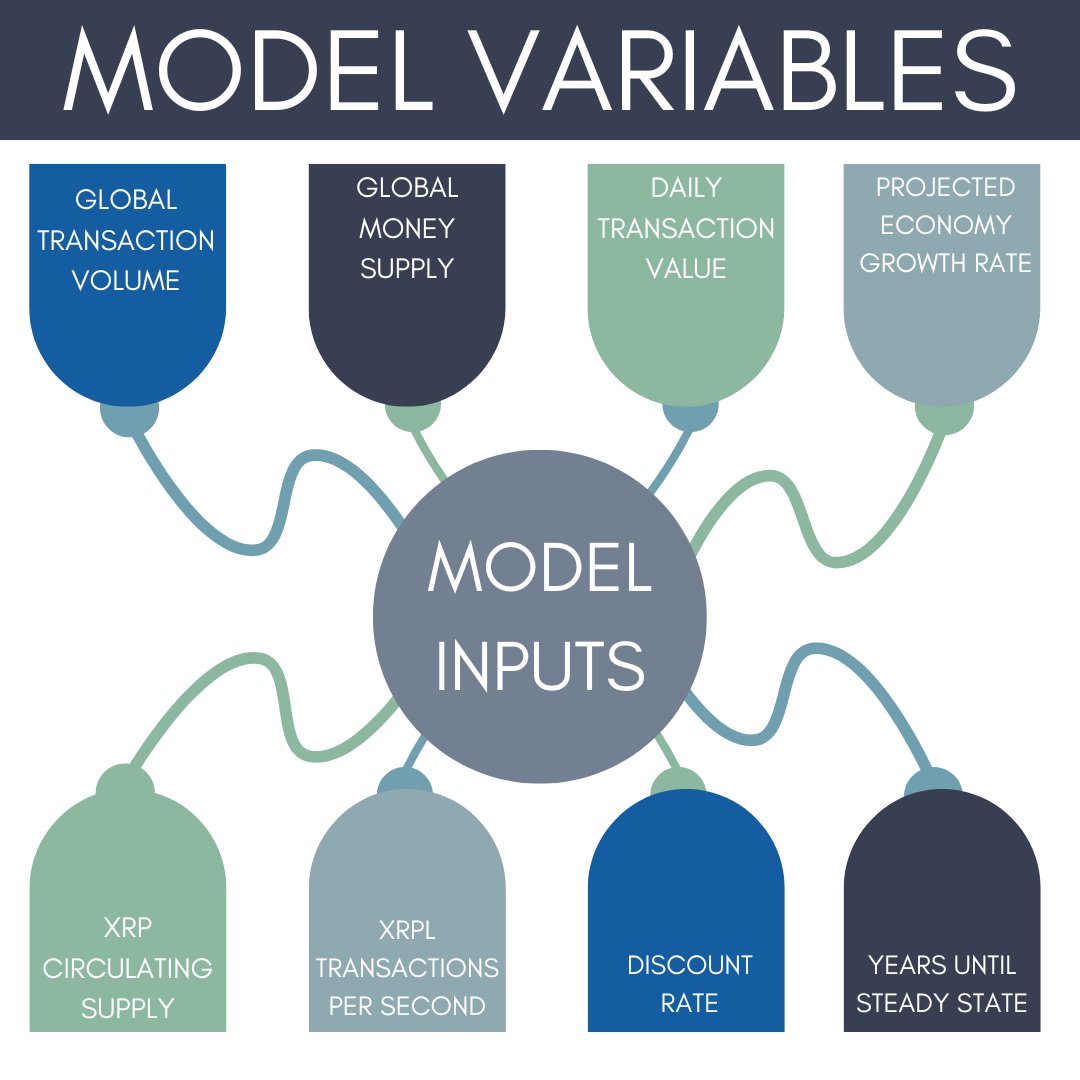

The range of simulated output values from the 6 models is very wide.

Two dominant and connected variables have a powerful influence on the price.

The range of simulated output values from the 6 models is very wide.

Two dominant and connected variables have a powerful influence on the price.

15. We refer to those variables as "transaction value" and "store of value".

Both are addressed in great detail throughout the paper, as is the concept of the Virtuous Cycle (the dynamic relationship between those two variables).

Both are addressed in great detail throughout the paper, as is the concept of the Virtuous Cycle (the dynamic relationship between those two variables).

16. To our knowledge, no other analysis of this scope has been done in the digital assets space.

A diverse team (w/a variety of professional backgrounds) came together as volunteers to build a series of quantitive models to understand the value drivers for a digital currency.

A diverse team (w/a variety of professional backgrounds) came together as volunteers to build a series of quantitive models to understand the value drivers for a digital currency.

17. The initial response to the model output was remarkable.

The majority of people were appreciative and commended our efforts, while a small minority reacted quite viciously.

The critics made false assumptions and drew incorrect conclusions about our motives.

The majority of people were appreciative and commended our efforts, while a small minority reacted quite viciously.

The critics made false assumptions and drew incorrect conclusions about our motives.

18. This was quite surprising considering our transparency throughout the process, again, contrasted to the SEC’s secretive “deliberative process.”

Multiple podcast interviews were held that addressed the backstory and goals.

Multiple podcast interviews were held that addressed the backstory and goals.

19. Regardless of what the various models simulate in terms of potential value, one fact remains unchanged.

The YEARS that the XRPL has been under the dark cloud of the lawsuit cannot be recovered.

The YEARS that the XRPL has been under the dark cloud of the lawsuit cannot be recovered.

20. Humans are resilient and can overcome setbacks, but nearly three years of lost innovation on the XRPL are gone.

21. After months of analysis, discussion and internal review, The Confidential Committee is pleased to release our paper titled “A Comprehensive Approach to Determining the Fair Market Value of XRP”.

22. Please read and share widely to help the industry learn more about valuing the new asset class that will play a big role in our upcoming financial system.

heyzine.com/flip-book/Valu…

heyzine.com/flip-book/Valu…

If anyone has an issue with the link - try this one heyzine.com/flip-book/valu…

• • •

Missing some Tweet in this thread? You can try to

force a refresh