A thread with key quotes from Druckenmiller at #BloombergInvest:

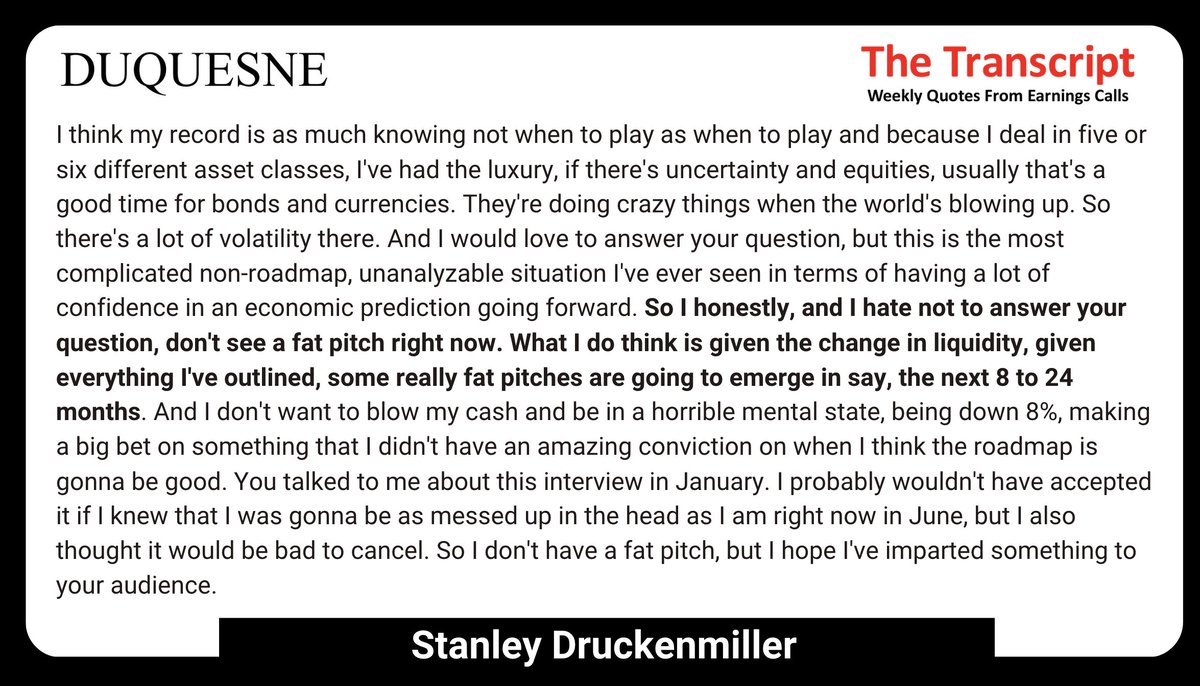

1. On his current fat pitch:

"So I honestly.. don't see a fat pitch right now. What I do think is...given everything I've outlined, some really fat pitches are going to emerge in say, the next 8 to 24 months"

1. On his current fat pitch:

"So I honestly.. don't see a fat pitch right now. What I do think is...given everything I've outlined, some really fat pitches are going to emerge in say, the next 8 to 24 months"

https://twitter.com/923687530045759488/status/1656021668022689841

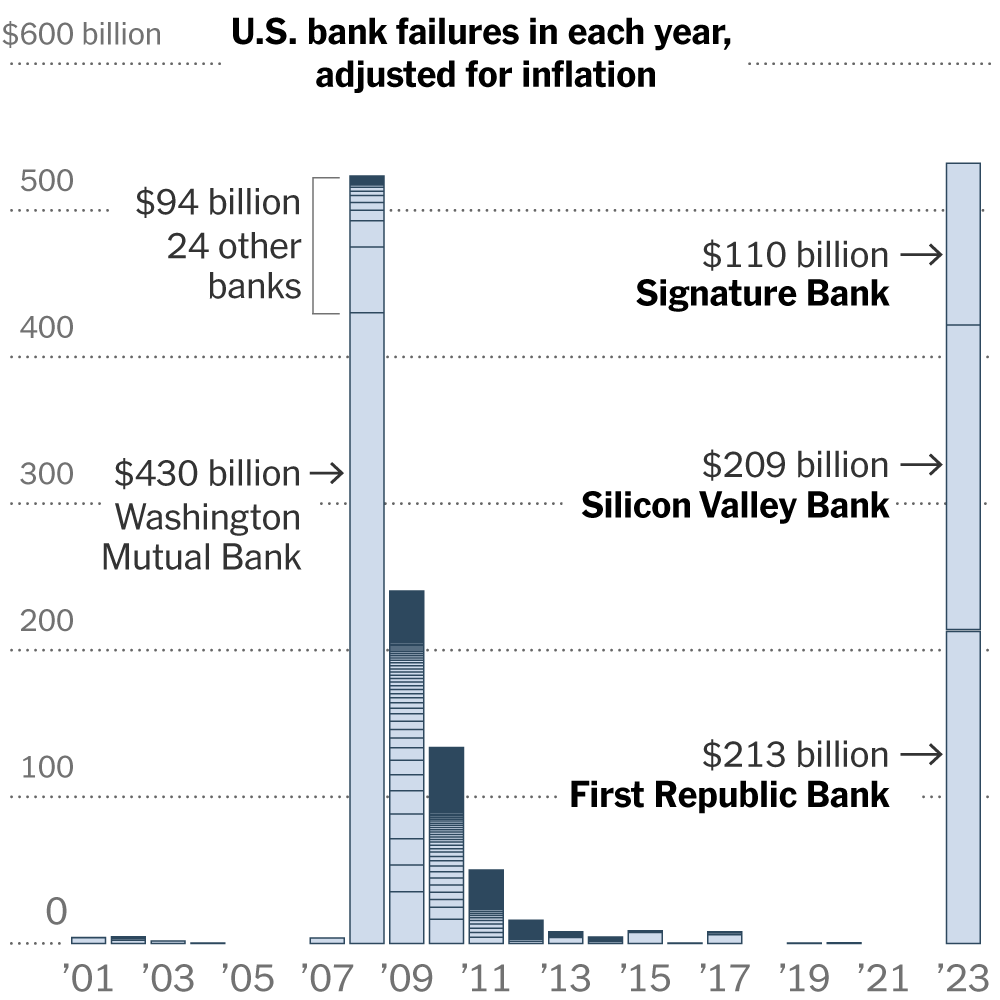

2. On when a recession will happen:

"I think I'm probably wrong and I'm gonna go back to the end of 23, but the real answer is, I don't know."

"I think I'm probably wrong and I'm gonna go back to the end of 23, but the real answer is, I don't know."

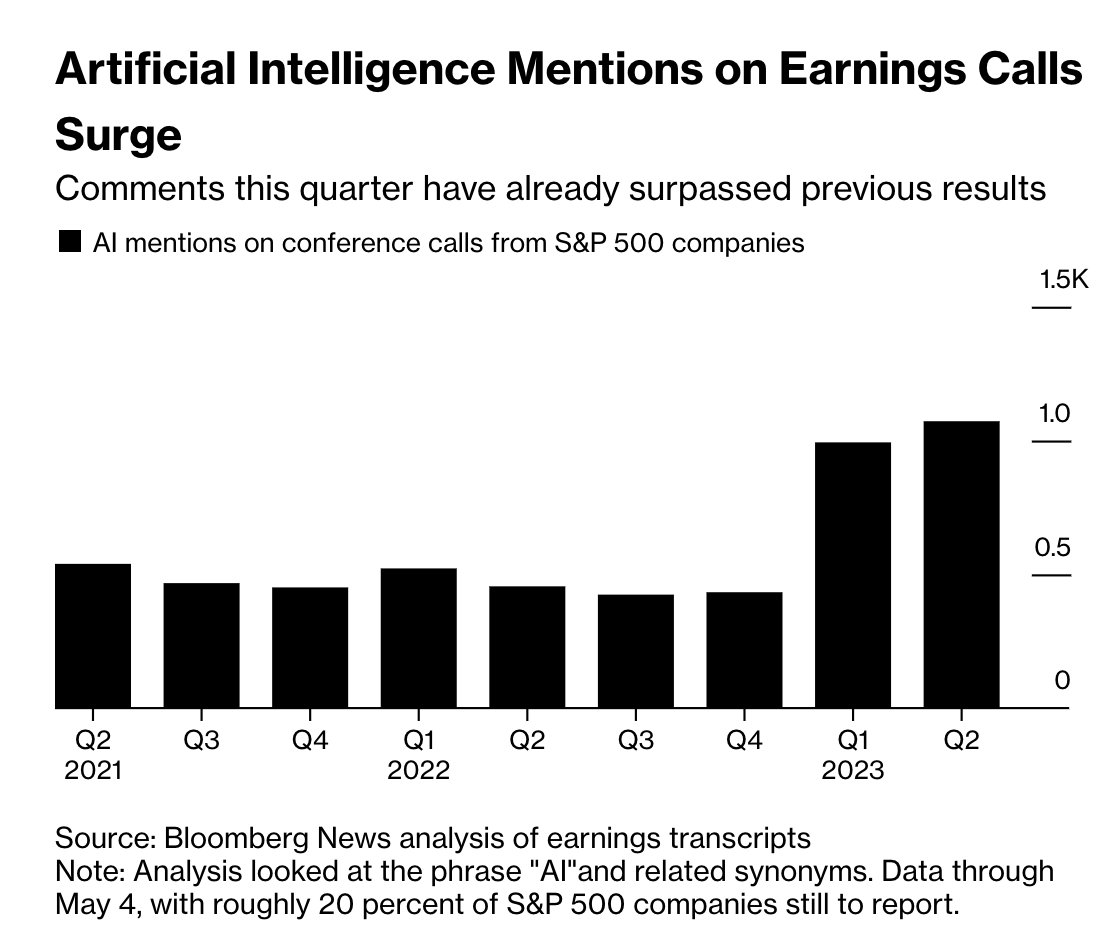

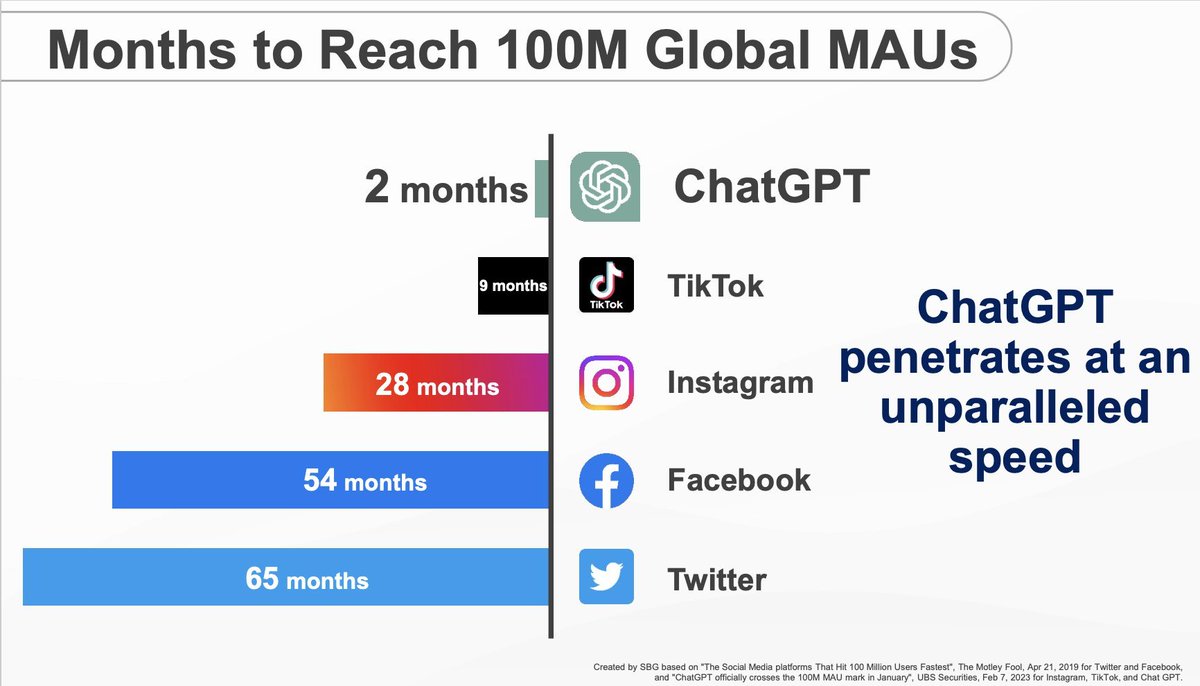

3. On how AI will perform in a recession:

"All of AI's not gonna make it through whether we have a recession or not, because they haven't separated the wheat from the chaff yet. But I do believe unlike crypto, I think AI is real"

"All of AI's not gonna make it through whether we have a recession or not, because they haven't separated the wheat from the chaff yet. But I do believe unlike crypto, I think AI is real"

4. On Nvidia:

"If [AI is] as big as I think it is, Nvidia is something we're gonna want to own for at least two or three years, not for 10 months and maybe longer"

"If [AI is] as big as I think it is, Nvidia is something we're gonna want to own for at least two or three years, not for 10 months and maybe longer"

5. On China:

"I was in love with China until about six or seven years ago...And then Xi Jinping did his thing...looking out, I do not look at them as a big challenge in the United States in terms of economic power and growth"

"I was in love with China until about six or seven years ago...And then Xi Jinping did his thing...looking out, I do not look at them as a big challenge in the United States in terms of economic power and growth"

6. On Japan:

"You have a couple of things going on. They look like they're solving deflation...They're really into the whole shareholder value thing. And then you got a guy running monetary policy and he sounds like Jerome Powell two years ago. inflation is taking off there"

"You have a couple of things going on. They look like they're solving deflation...They're really into the whole shareholder value thing. And then you got a guy running monetary policy and he sounds like Jerome Powell two years ago. inflation is taking off there"

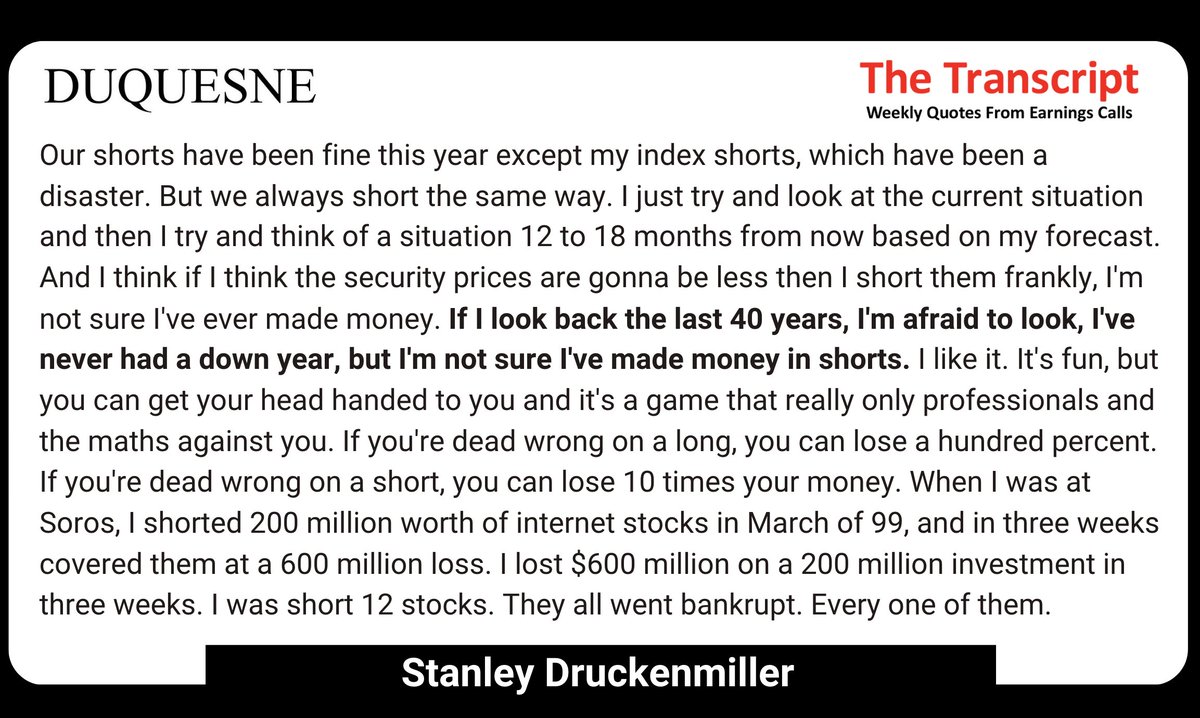

7. On his reflections on shorting:

"If I look back the last 40 years - I'm afraid to look- I've never had a down year, but I'm not sure I've made money in shorts"

"If I look back the last 40 years - I'm afraid to look- I've never had a down year, but I'm not sure I've made money in shorts"

8/8. Thanks for reading.

Here is the full interview:

Subscribe to our newsletter for more quotes like these: thetranscript.substack.com/subscribe

Here is the full interview:

Subscribe to our newsletter for more quotes like these: thetranscript.substack.com/subscribe

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter