A sophisticated trader has been showing impressive activity on @HyperliquidX

After a meticulous on-chain investigation, I've made some compelling discoveries.

1/ 🧵 🫧

After a meticulous on-chain investigation, I've made some compelling discoveries.

1/ 🧵 🫧

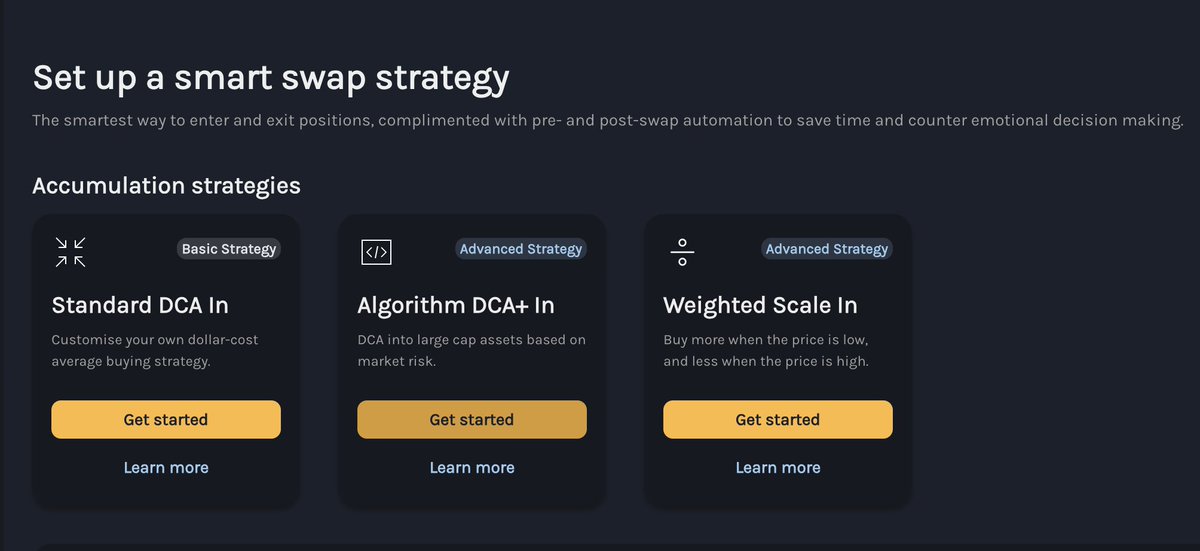

2/ Hyperliquid, for those uninitiated, is an advanced decentralized exchange that’s revolutionizing the blockchain space with CEX-like trading experiences and groundbreaking trading tools.

https://twitter.com/KingJulianIAm/status/1663992760683360257?s=20

3/ 🔍 Over the past week, a proficient trader has been making substantial movements on the platform, racking up around 66M in volume on just one account.

By tracking their deposits, I've embarked on an odyssey to unearth the origin of these transactions.

By tracking their deposits, I've embarked on an odyssey to unearth the origin of these transactions.

4/ These aren't ordinary transactions. The sophisticated strategies at play here suggest a significant player with a profound understanding of the crypto market dynamics.

They've done more than 20k transactions on the platform across multiple wallets since onboarding.

They've done more than 20k transactions on the platform across multiple wallets since onboarding.

5/ Notably, this influx of activity didn't spring from any outreach by a Hyperliquid core contributor.

This entity seemed to have independently perceived the benefits and potential of the Hyperliquid platform an onboarded on their own.

This entity seemed to have independently perceived the benefits and potential of the Hyperliquid platform an onboarded on their own.

6/ 🕵️♀️ Unraveling the depositing wallets led me to a wallet with a track record of market-making activities - a key player maneuvering substantial liquidity in the crypto markets.

7/ The trace led me across multiple platforms and contracts where the wallets interact with, notably many exchange wallets.

Continuing the lead, we traveled across different routers and bridges ending with the ETH mainnet wallet, which then led us to the head multisig.

Continuing the lead, we traveled across different routers and bridges ending with the ETH mainnet wallet, which then led us to the head multisig.

8/ 🧩 This sophisticated trader engaging in the Hyperliquid ecosystem is none other than @wintermute_t

Indeed, the renowned global heavyweight in algorithmic trading has independently onboarded Hyperliquid.

Indeed, the renowned global heavyweight in algorithmic trading has independently onboarded Hyperliquid.

9/ 🌊 This revelation adds a fascinating layer of complexity to the Hyperliquid platform. It'll be intriguing to watch how this influential presence will impact the platform's market dynamics.

Stay tuned for more. Or go try it out yourself at app.hyperliquid.xyz/join/XULIAN

Stay tuned for more. Or go try it out yourself at app.hyperliquid.xyz/join/XULIAN

11/ Bonus points if someone can tell me who lovebnb.eth is, so much tracks back to this address too.

• • •

Missing some Tweet in this thread? You can try to

force a refresh