The #LSDfi narrative has a new player in town, @raft_fi.

Its TVL has risen to $30M less than a week after launch!

We have created a @DuneAnalytics dashboard to help you follow their development.

Let's dive in🧵

Its TVL has risen to $30M less than a week after launch!

We have created a @DuneAnalytics dashboard to help you follow their development.

Let's dive in🧵

1/

This thread will include:

• Raft's protocol

• $R stablecoin

• Remarkable launch results

This thread will include:

• Raft's protocol

• $R stablecoin

• Remarkable launch results

2/

What is Raft?

Raft allows people to generate $R stablecoin by depositing $stETH and $wstETH with:

• Capital efficiency

• Robust incentive & stable peg mechanism

• Deep and instant liquidity across numerous trading pairs

What is Raft?

Raft allows people to generate $R stablecoin by depositing $stETH and $wstETH with:

• Capital efficiency

• Robust incentive & stable peg mechanism

• Deep and instant liquidity across numerous trading pairs

3/

Users are required to borrow at least 3K $R with a minimum collateral ratio of 110% for each $R.

The borrowing rate is the sum of the Base Rate and Borrowing Spread and is capped at 5%.

The current borrowing rate is 0.01% (borrow 3K $R, the fee is 0.3 $R.

Users are required to borrow at least 3K $R with a minimum collateral ratio of 110% for each $R.

The borrowing rate is the sum of the Base Rate and Borrowing Spread and is capped at 5%.

The current borrowing rate is 0.01% (borrow 3K $R, the fee is 0.3 $R.

4/

There are 3 methods of returning minted $R:

• Repayment: Repay your borrowed $R tokens in Raft and gets $wstETH

collateral

• Redemption: Redeem $R for other borrowers for $wsETH collateral

• Liquidation: Recieve $wstETH + Liquidation Reward from Liquidators

There are 3 methods of returning minted $R:

• Repayment: Repay your borrowed $R tokens in Raft and gets $wstETH

collateral

• Redemption: Redeem $R for other borrowers for $wsETH collateral

• Liquidation: Recieve $wstETH + Liquidation Reward from Liquidators

5/ Peg mechanism

R uses both Hard Peg & Soft Peg to maintain its peg value of 1 USD.

Hard Peg: Use redemptions & over-collateralization to facilitate arbitrage opportunities

Soft Peg: Incentivizes users to act based on the expectation that the peg will be kept in the future

R uses both Hard Peg & Soft Peg to maintain its peg value of 1 USD.

Hard Peg: Use redemptions & over-collateralization to facilitate arbitrage opportunities

Soft Peg: Incentivizes users to act based on the expectation that the peg will be kept in the future

6/

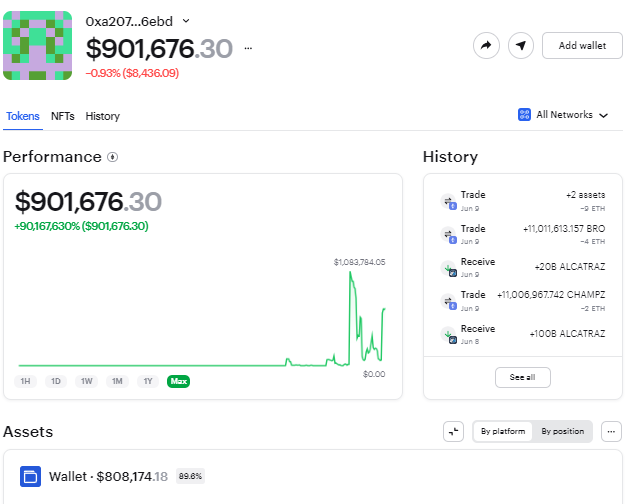

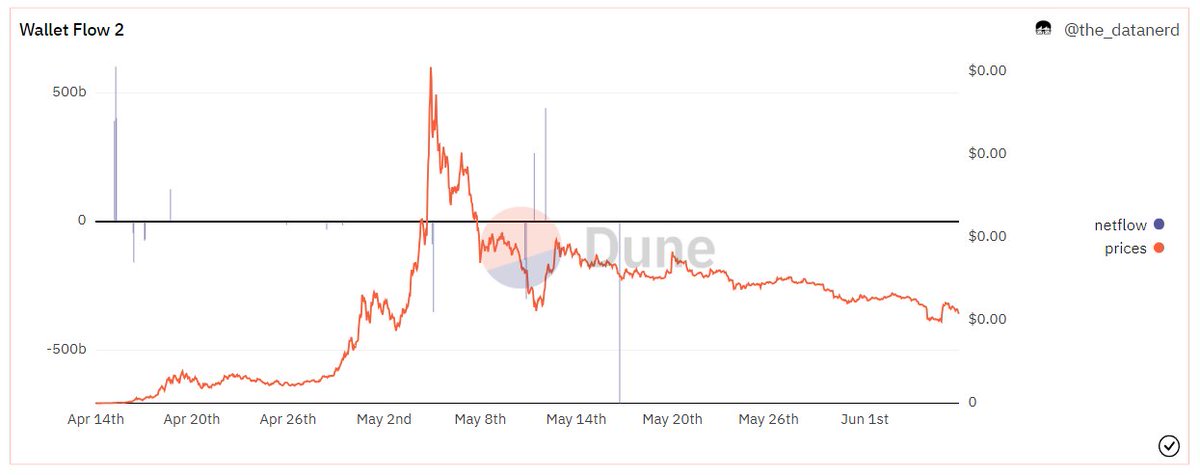

Let's analyze the performance of Raft in more detail using our new Raft Dashboard.

The $R dex trading volume continues to increase with the current volume of $3.5M.

The 3 main pools remain highly liquid, with R-wstETH leading the charge (worth $17M).

Let's analyze the performance of Raft in more detail using our new Raft Dashboard.

The $R dex trading volume continues to increase with the current volume of $3.5M.

The 3 main pools remain highly liquid, with R-wstETH leading the charge (worth $17M).

7/

In less than a week, their TVL has reached $30M (15K $wstETH).

Their stablecoin supply is on a tear also, reaching $17M in total.

In less than a week, their TVL has reached $30M (15K $wstETH).

Their stablecoin supply is on a tear also, reaching $17M in total.

7/

With the outstanding launch and innovative features of Raft, the $R stablecoin has taken the #LSDfi market by storm.

Can it reach the top soon?

Track Raft's performance with our Dashboard here: dune.com/the_datanerd/r…

With the outstanding launch and innovative features of Raft, the $R stablecoin has taken the #LSDfi market by storm.

Can it reach the top soon?

Track Raft's performance with our Dashboard here: dune.com/the_datanerd/r…

Hope you have found the thread helpful.

Follow me @OnchainDataNerd for more.

Like/Retweet the first tweet below to support my work:

Follow me @OnchainDataNerd for more.

Like/Retweet the first tweet below to support my work:

https://twitter.com/OnchainDataNerd/status/1667162644653162497

Calling all on-chain enthusiasts!

The Data Nerd's Telegram group is a treasure trove of quality insights and information.

Don't miss out on the action. Join us today!

t.me/OnchainSignal_…

The Data Nerd's Telegram group is a treasure trove of quality insights and information.

Don't miss out on the action. Join us today!

t.me/OnchainSignal_…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter