Analyzing the competitive landscape of an industry is essential to understand the business🧵

Using Porter's Five Forces, we will analyze Costco's competitive position $COST 📊

Let's dive in 🧵👇

=THREAD=

Using Porter's Five Forces, we will analyze Costco's competitive position $COST 📊

Let's dive in 🧵👇

=THREAD=

Porter's five forces were constructed by Micheal Porter in 1979.

Porter is a professor at Harvard BS and is a legend in strategy and business competition.

We will use his framework to understand the competitive dynamics surrounding Costco and its position in the market.

Porter is a professor at Harvard BS and is a legend in strategy and business competition.

We will use his framework to understand the competitive dynamics surrounding Costco and its position in the market.

•Threat of new entrants

Costco operates in a highly competitive retail industry, but its business model presents significant barriers to entry.

Its membership-based model, bulk purchasing power, and distribution network make it challenging for new entrants to replicate.

Costco operates in a highly competitive retail industry, but its business model presents significant barriers to entry.

Its membership-based model, bulk purchasing power, and distribution network make it challenging for new entrants to replicate.

•Bargaining power of suppliers

Costco has a unique advantage.

With its large-scale operations and purchasing volumes, Costco can negotiate favorable deals with suppliers.

This allows them to offer competitive prices to customers while maintaining healthy profit margins.

Costco has a unique advantage.

With its large-scale operations and purchasing volumes, Costco can negotiate favorable deals with suppliers.

This allows them to offer competitive prices to customers while maintaining healthy profit margins.

The concept of sharing its scale economics benefits with its customers is called "scale economics shared", a concept popularized by Nick Sleep

This business model is extremely resilient because it is very hard to compete with, and low prices will never go out of style

This business model is extremely resilient because it is very hard to compete with, and low prices will never go out of style

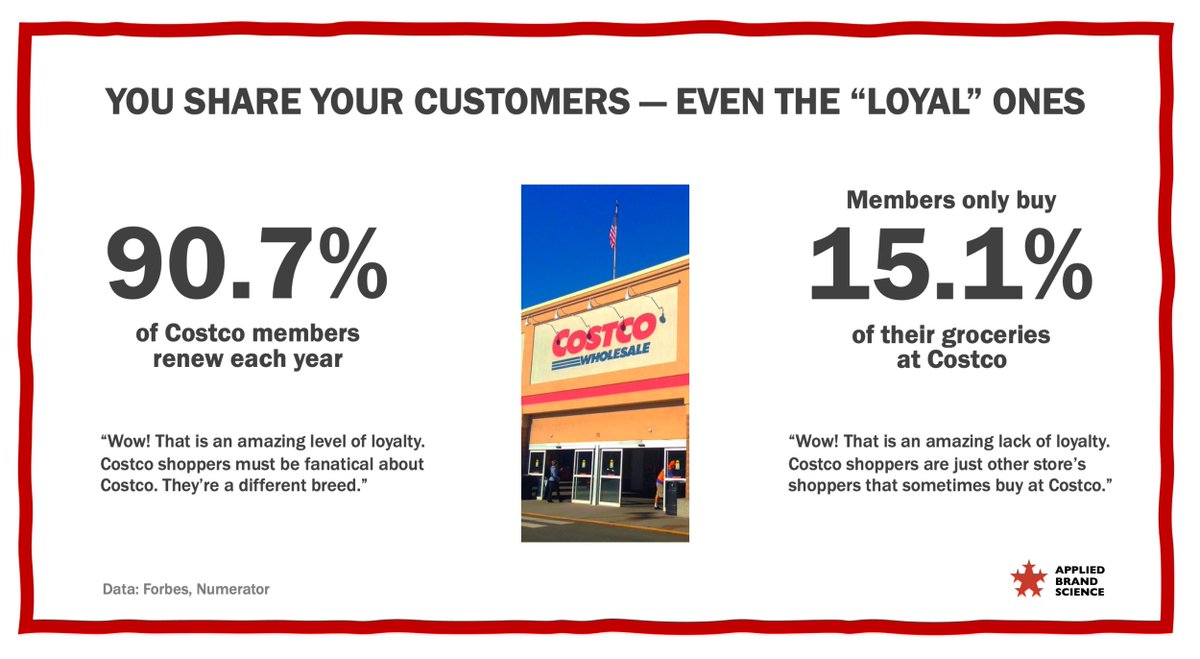

•Bargaining power of buyers

Costco's customers are primarily B2C and small businesses.

While buyers have some power due to the availability, Costco's low prices, wide product selection, and exclusive membership benefits create strong customer loyalty.

Costco's customers are primarily B2C and small businesses.

While buyers have some power due to the availability, Costco's low prices, wide product selection, and exclusive membership benefits create strong customer loyalty.

•Threat of substitute products or services

Costco faces competition from both traditional B&M retailers and online platforms.

However, Costco's value proposition of bulk purchases, and discounted prices mitigate the threat of substitutes to a large extent.

Costco faces competition from both traditional B&M retailers and online platforms.

However, Costco's value proposition of bulk purchases, and discounted prices mitigate the threat of substitutes to a large extent.

•Intensity of competitive rivalry within the industry

Costco competes with major retailers like Walmart, Target, and Amazon.

Costco has managed to differentiate itself from its competitors. This is reflected in their continued success over decades:

Costco competes with major retailers like Walmart, Target, and Amazon.

Costco has managed to differentiate itself from its competitors. This is reflected in their continued success over decades:

• Conclusion: Costco has a strong competitive position compared to its peers.

The barriers to entry, strong supplier relationships, loyal customer base, limited threat of substitutes, and differentiated positioning help sustain Costco's competitive advantage.

The barriers to entry, strong supplier relationships, loyal customer base, limited threat of substitutes, and differentiated positioning help sustain Costco's competitive advantage.

Costco's ability to drive down costs through economies of scale enables them to offer competitive pricing, attracting and retaining customers.

This creates a virtuous cycle, as more members join, Costco's purchasing power increases, leading to better deals with suppliers.

This creates a virtuous cycle, as more members join, Costco's purchasing power increases, leading to better deals with suppliers.

If you enjoyed this thread:

1. Follow me (@InvestInAssets) for more

2. Retweet the 1st tweet below to share this thread

3. Subscribe to my Newsletter and free resources: linktr.ee/investinassets

I write about my journey as an investor focusing on quality businesses

1. Follow me (@InvestInAssets) for more

2. Retweet the 1st tweet below to share this thread

3. Subscribe to my Newsletter and free resources: linktr.ee/investinassets

I write about my journey as an investor focusing on quality businesses

https://twitter.com/1558861445902786560/status/1667470543979970560

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter