Famous for "The Big Short"

The move that netted him $800 million.

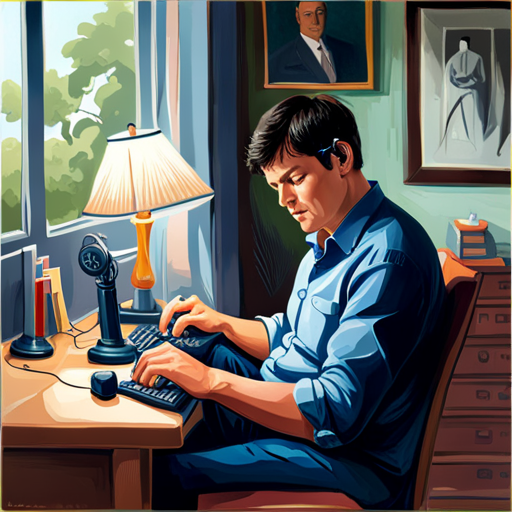

Diagnosed with Asperger's Syndrome at a young age.

He overcame this adversity - generating an 890% return over an 8-year period for his investors.

The Story Of Michael Burry & His Investments:

🧵

The move that netted him $800 million.

Diagnosed with Asperger's Syndrome at a young age.

He overcame this adversity - generating an 890% return over an 8-year period for his investors.

The Story Of Michael Burry & His Investments:

🧵

1/

Asperger's Syndrome symptoms include:

- Unusual behaviors & difficulty interacting with others

However, it can also cause:

- An all-absorbing interest in a specific topic

Fortunately for Burry, this interest was directed at finding value where others weren't looking.

Asperger's Syndrome symptoms include:

- Unusual behaviors & difficulty interacting with others

However, it can also cause:

- An all-absorbing interest in a specific topic

Fortunately for Burry, this interest was directed at finding value where others weren't looking.

2/

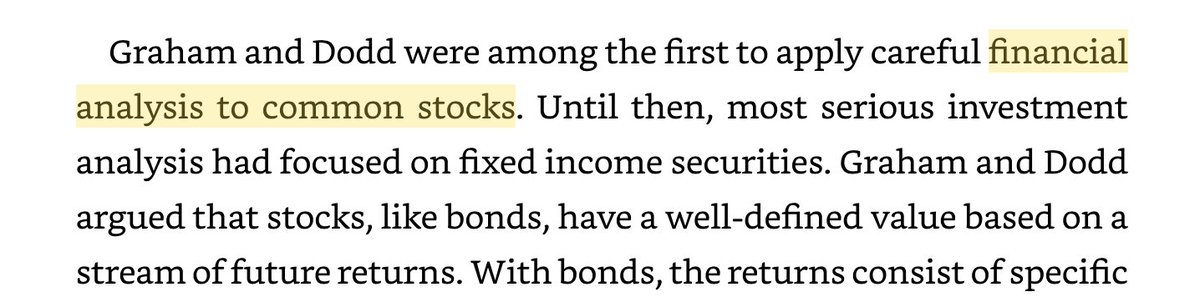

Burry earned an MD degree from the Vanderbilt University School of Medicine.

But had an extreme interest in investing, particularly value investing, which he worked on at night.

Burry earned an MD degree from the Vanderbilt University School of Medicine.

But had an extreme interest in investing, particularly value investing, which he worked on at night.

3/

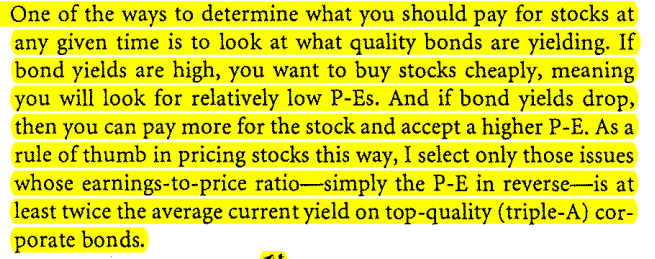

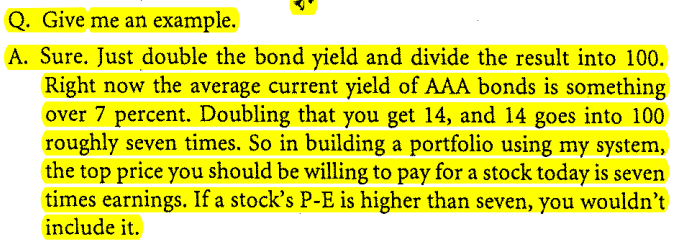

He wrote about his value picks on the stock discussion site Silicon Investor.

He gained a very strong following and reputation on the back of his success, attracting interest from world class investors such as Joel Greenblatt.

He wrote about his value picks on the stock discussion site Silicon Investor.

He gained a very strong following and reputation on the back of his success, attracting interest from world class investors such as Joel Greenblatt.

4/

So in the year 2000, with some inheritance money he started his own hedge fund.

Scion Capital.

Which deliverred explosive results in a declining market.

So in the year 2000, with some inheritance money he started his own hedge fund.

Scion Capital.

Which deliverred explosive results in a declining market.

5/

2001

S&P 500 fell -11.88%

Scion up +55%

2002

S&P 500 fell -22.1%

Scion up +16%

2003

S&P 500 up +28.69%

Scion up +50%!

2001

S&P 500 fell -11.88%

Scion up +55%

2002

S&P 500 fell -22.1%

Scion up +16%

2003

S&P 500 up +28.69%

Scion up +50%!

7/

His research on the values of residential real estate convinced him that subprime mortgages, especially those with "teaser" rates & the bonds based on these mortgages, would begin losing value.

When the original rates are replaced by much higher rates.

His research on the values of residential real estate convinced him that subprime mortgages, especially those with "teaser" rates & the bonds based on these mortgages, would begin losing value.

When the original rates are replaced by much higher rates.

8/

This conclusion led him to short the market.

He did this by persuading Goldman Sachs and other investment firms to sell him "credit default swaps" against subprime deals he saw as vulnerable.

This conclusion led him to short the market.

He did this by persuading Goldman Sachs and other investment firms to sell him "credit default swaps" against subprime deals he saw as vulnerable.

9/

He went to the bank to issue him the instrument to short the housing market.

Banks laughed at him. Because "no one ever bets against the housing market."

He went to the bank to issue him the instrument to short the housing market.

Banks laughed at him. Because "no one ever bets against the housing market."

10/

The banks saw this as easy money. So they did it.

The instrument he got the bank to create was a “credit default swap”.

The banks saw this as easy money. So they did it.

The instrument he got the bank to create was a “credit default swap”.

11/

A credit default swap (CDS) is a financial derivative that allows an investor to swap or offset their credit risk with that of another investor.

He went to several different banks to create him credit default swaps, to build a large enough position.

A credit default swap (CDS) is a financial derivative that allows an investor to swap or offset their credit risk with that of another investor.

He went to several different banks to create him credit default swaps, to build a large enough position.

12/

Goldman Sachs offers to sell him $5 million in credit default swaps.

Burry says "how about $100 million".

He does another $200 million with Deutsche Bank.

When he’s done, he informs his partners he bought $1.3 B in credit default swaps.

Goldman Sachs offers to sell him $5 million in credit default swaps.

Burry says "how about $100 million".

He does another $200 million with Deutsche Bank.

When he’s done, he informs his partners he bought $1.3 B in credit default swaps.

13/

At the same time, Burry began to tell his investors of the enormous risks to the system.

His investors were mostly institutions, they did not want to hear his theory.

Their other investments were built upon the concept of a sound system, with no subprime mortgage risk.

At the same time, Burry began to tell his investors of the enormous risks to the system.

His investors were mostly institutions, they did not want to hear his theory.

Their other investments were built upon the concept of a sound system, with no subprime mortgage risk.

14/

Burry suffered an investor revolt.

Some investors in his fund worried his predictions were inaccurate and demanded their money back.

Burry suffered an investor revolt.

Some investors in his fund worried his predictions were inaccurate and demanded their money back.

15/

Unfortunately, it was too late.

Burry positions were illiquid.

If he got out of the trades early, he would suffer a huge loss.

So Burry simply refused the investors requests.

Unfortunately, it was too late.

Burry positions were illiquid.

If he got out of the trades early, he would suffer a huge loss.

So Burry simply refused the investors requests.

16/

2007

His early prediction starts to play out.

The dominoes begin to fall.

First with Bear Stearns, then with Lehman Brothers, AIG, and the rest of the financial system.

2007

His early prediction starts to play out.

The dominoes begin to fall.

First with Bear Stearns, then with Lehman Brothers, AIG, and the rest of the financial system.

17/

Burry’s investment paid off handsomely.

He made $100 million for himself and $700 million for his investors.

Burry’s investment paid off handsomely.

He made $100 million for himself and $700 million for his investors.

18/

Scion Capital recorded returns of:

+489.34% (net of fees and expenses) from 2000 to 2008.

The S&P 500, returned just under 3%, including dividends over the same period.

Scion Capital recorded returns of:

+489.34% (net of fees and expenses) from 2000 to 2008.

The S&P 500, returned just under 3%, including dividends over the same period.

19/

Burry is a contrarian by nature and is willing to look at companies and society differently than other people.

His Next Big Moves:

Burry is a contrarian by nature and is willing to look at companies and society differently than other people.

His Next Big Moves:

20/

2013

Burry targets water-rich farmland, away from large governmental & infrastructural limitations.

"I believe that Agriculture land with water on site will be very valuable in the future and i've put a good amount of money into that."

- Michael Burry

2013

Burry targets water-rich farmland, away from large governmental & infrastructural limitations.

"I believe that Agriculture land with water on site will be very valuable in the future and i've put a good amount of money into that."

- Michael Burry

21/

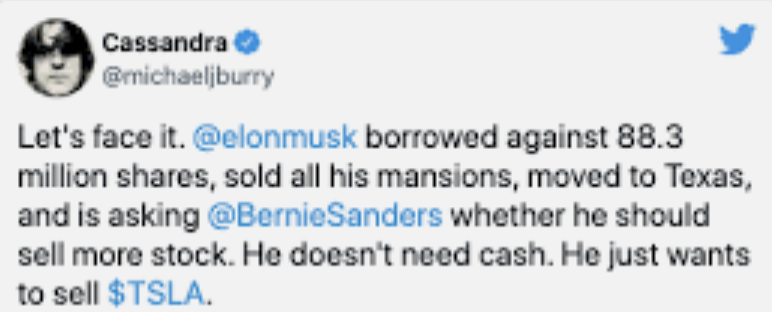

The Tesla Short:

Burry initiated a $500 million short position on Tesla around December 2020.

Burry predicted Tesla stock would collapse like the housing bubble, saying that:

The Tesla Short:

Burry initiated a $500 million short position on Tesla around December 2020.

Burry predicted Tesla stock would collapse like the housing bubble, saying that:

22/

"My last Big Short got bigger and Bigger and BIGGER"

and taunted Tesla bulls to "enjoy it while it lasts."

October 2021, after a 100% rise in Tesla's stock value, he revealed he was no longer shorting it.

Even the best get it wrong.

"My last Big Short got bigger and Bigger and BIGGER"

and taunted Tesla bulls to "enjoy it while it lasts."

October 2021, after a 100% rise in Tesla's stock value, he revealed he was no longer shorting it.

Even the best get it wrong.

23/

More Recently:

Burry has suggested that the current surge in stocks resembles the dot-com bubble & could end in a similarly devastating crash.

He predicted the 2008 financial crisis and now warns of a recession in the U.S. this year, along with further inflation peaks.

More Recently:

Burry has suggested that the current surge in stocks resembles the dot-com bubble & could end in a similarly devastating crash.

He predicted the 2008 financial crisis and now warns of a recession in the U.S. this year, along with further inflation peaks.

24/

Notably, Burry has made significant bets on private prison stocks like GEO Group and CoreCivic, which now make up over 50% of his hedge fund's portfolio.

Notably, Burry has made significant bets on private prison stocks like GEO Group and CoreCivic, which now make up over 50% of his hedge fund's portfolio.

25/

"My thinking is probably summarized by the word “Ick.” Taking a special analytical interest in stocks that inspire a first reaction of “ick.” I tend to become interested in stocks that by their very names or circumstances inspire an unwillingness – and an “ick”

- Burry

"My thinking is probably summarized by the word “Ick.” Taking a special analytical interest in stocks that inspire a first reaction of “ick.” I tend to become interested in stocks that by their very names or circumstances inspire an unwillingness – and an “ick”

- Burry

26/

Want to know what stocks Buffett, Munger or Dalio are buying?

There's a tool for that in my "Toolkit For the Value Investor".

Also - valuation tool, stock screener tool and more.

Get a FREE copy here:

valueinvestoracademy.com

Want to know what stocks Buffett, Munger or Dalio are buying?

There's a tool for that in my "Toolkit For the Value Investor".

Also - valuation tool, stock screener tool and more.

Get a FREE copy here:

valueinvestoracademy.com

27/

Want to see Burry's current investment portfolio?

Follow me below & click the alert button, I'll post it tomorrow.

@ValueInvestorAc

Enjoyed this? Please help us reach a greater audience, retweet the 1st tweet of this thread. Thanks!

Want to see Burry's current investment portfolio?

Follow me below & click the alert button, I'll post it tomorrow.

@ValueInvestorAc

Enjoyed this? Please help us reach a greater audience, retweet the 1st tweet of this thread. Thanks!

https://twitter.com/ValueInvestorAc/status/1667864782538432513

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter