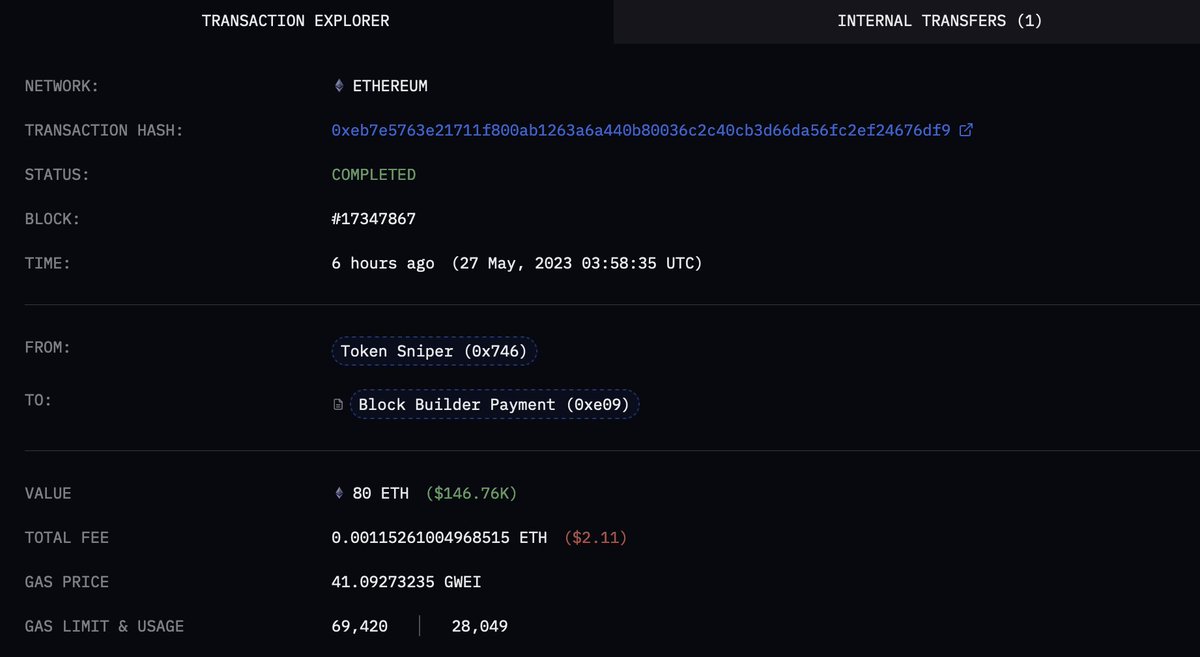

This morning, $200M worth of DAI was minted and burned by MakerDAO in the same block.

It was part of an arbitrage transaction with a net profit of... $3?

Why did this happen - and what does this mean?

Details below 👇

It was part of an arbitrage transaction with a net profit of... $3?

Why did this happen - and what does this mean?

Details below 👇

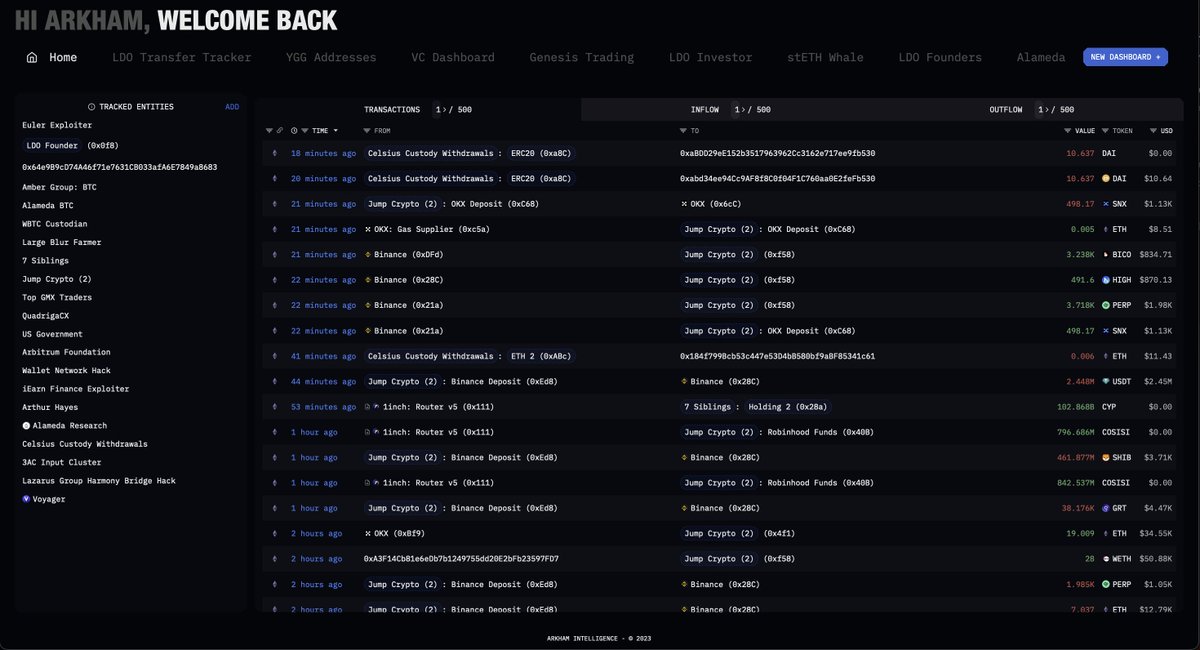

This transaction was performed by an arbitrage bot that used Flashloans in order to supply the capital for its transaction.

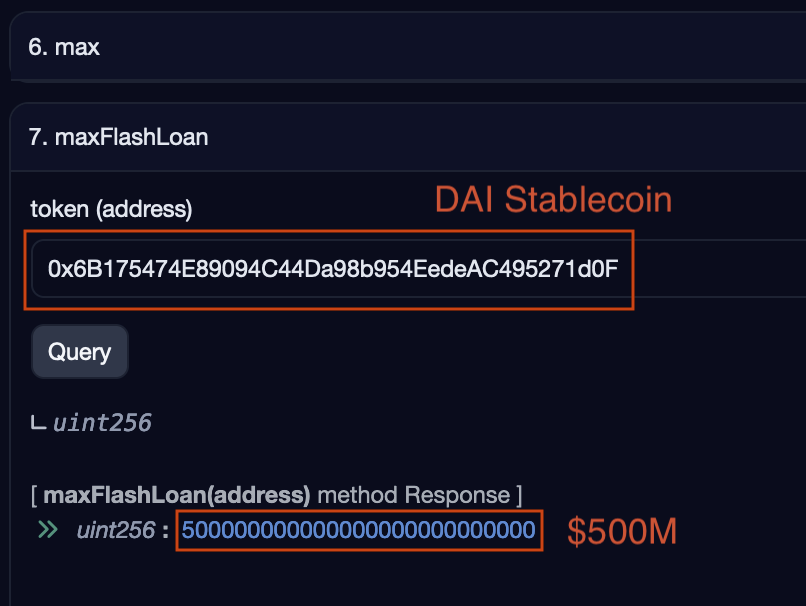

The reason that the DAI amount is so high is due to MakerDAO's 'DssFlash' contract, which allows zero-fee borrowing on any amount of DAI.

The reason that the DAI amount is so high is due to MakerDAO's 'DssFlash' contract, which allows zero-fee borrowing on any amount of DAI.

In fact, this bot is only constrained by the actual debt ceiling set by MakerDAO, which currently stands at $500M DAI.

This means that any user can borrow and return up to $500M DAI, as long as they perform the two actions in the same block.

This means that any user can borrow and return up to $500M DAI, as long as they perform the two actions in the same block.

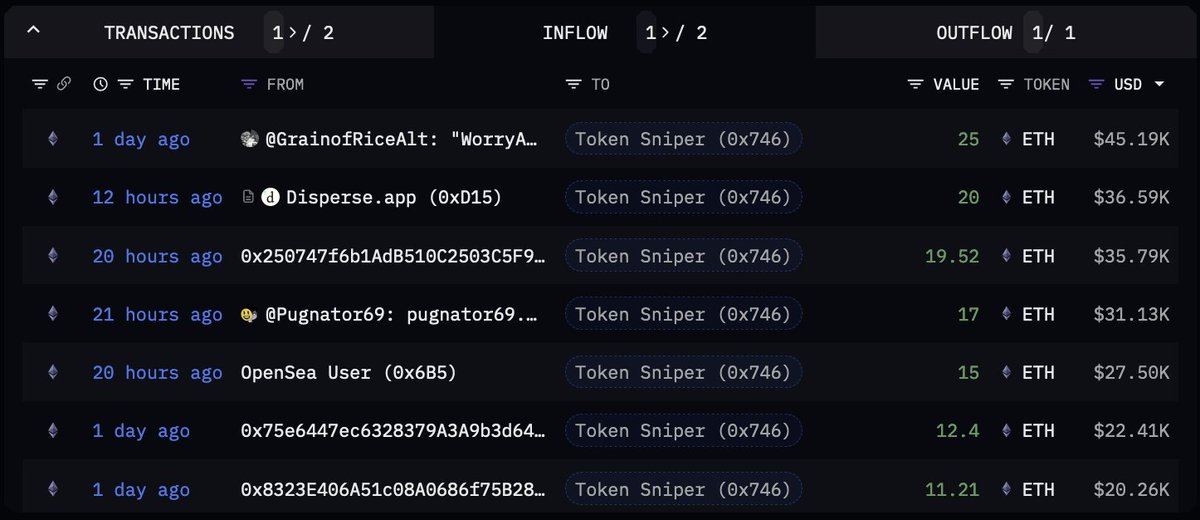

Using a Flashloan means that the bot doesn't need to hold any capital itself.

It can simply Flashloan DAI from MakerDAO, and then borrow the relevant assets from AAVE.

See below, the bot borrows and returns WETH, to AAVE V2.

It can simply Flashloan DAI from MakerDAO, and then borrow the relevant assets from AAVE.

See below, the bot borrows and returns WETH, to AAVE V2.

In this case, the 200M DAI was borrowed from MakerDAO, supplied to the AAVE DAI Market, and $2.35K in WETH was borrowed against this.

The WETH was used to buy Threshold Network (T) on Curve and sell it on Balancer, making a total profit of 0.019 ETH ($33)

The WETH was used to buy Threshold Network (T) on Curve and sell it on Balancer, making a total profit of 0.019 ETH ($33)

However, transaction fees for this arbitrage cost $28.76, and additionally $1 was sent to the block builder.

This makes the bot's revenue a grand total of: $3.24.

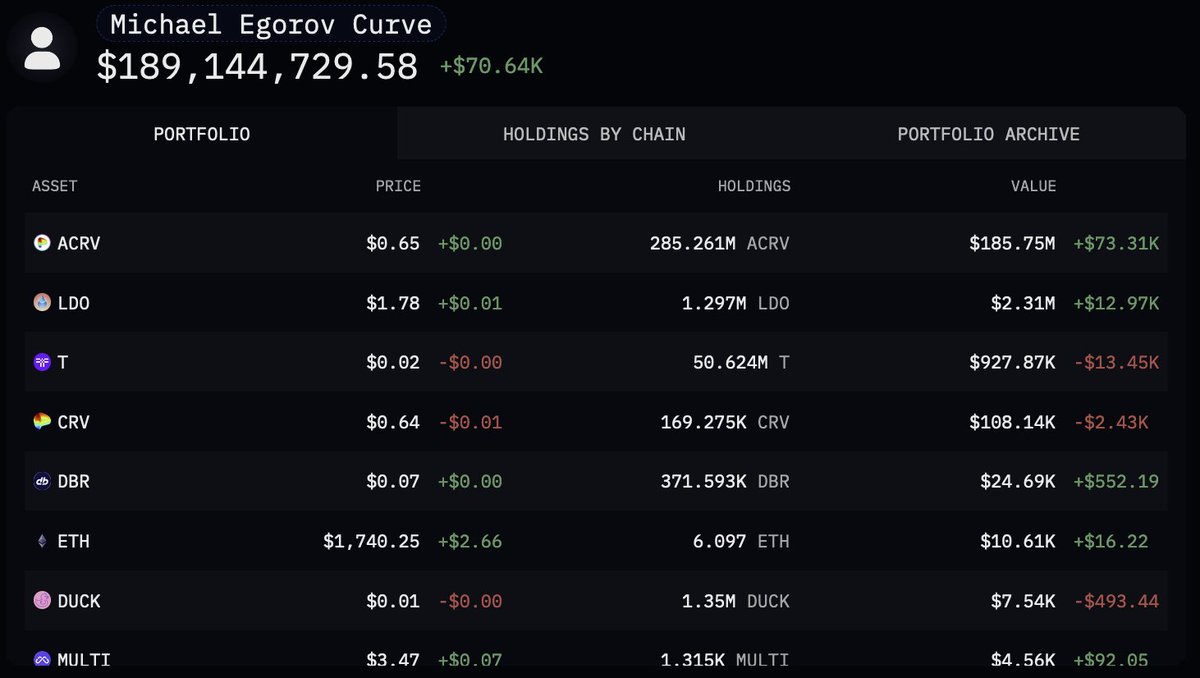

Check out this entity on Arkham, using the link below:

platform.arkhamintelligence.com/explorer/entit…

This makes the bot's revenue a grand total of: $3.24.

Check out this entity on Arkham, using the link below:

platform.arkhamintelligence.com/explorer/entit…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter