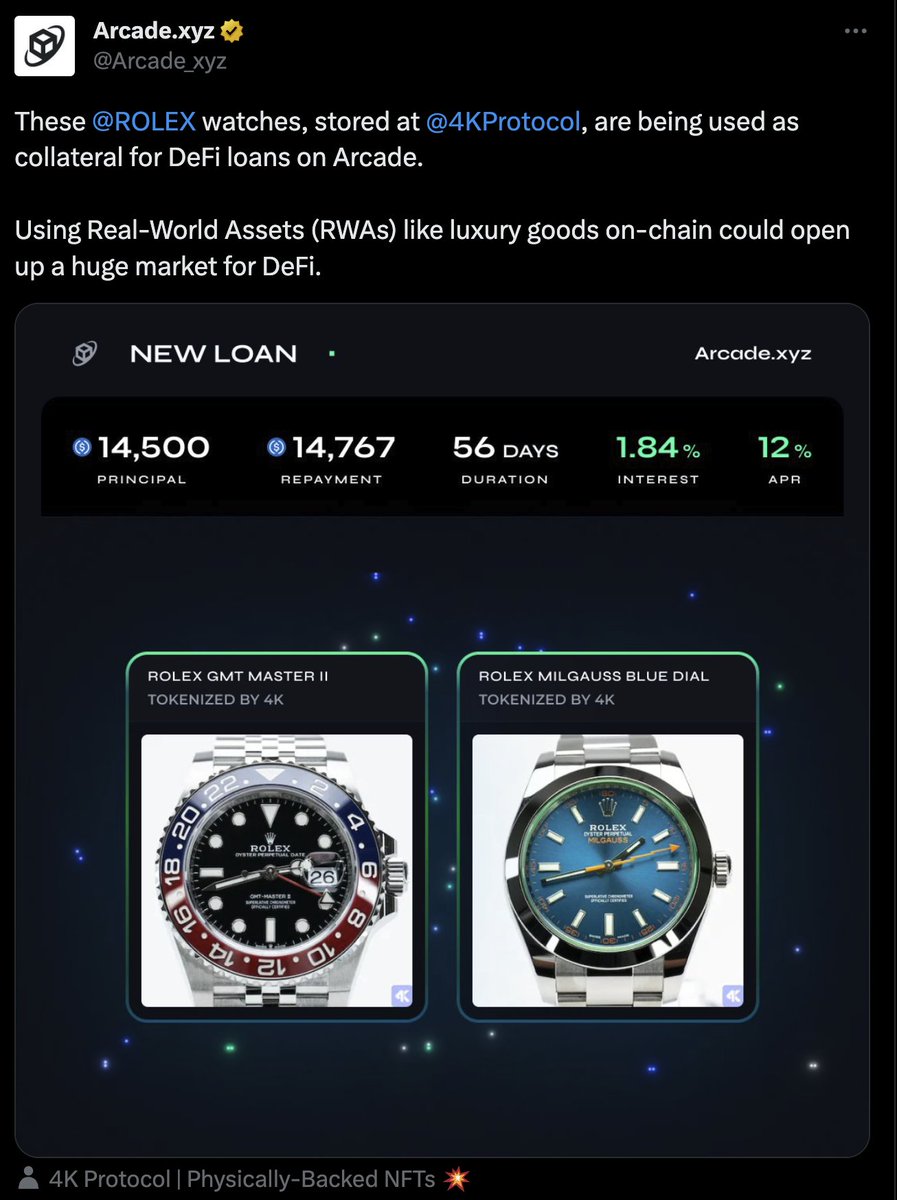

Someone just took a $14,500 loan on two Rolexes at 12% APR from a complete stranger all on-chain

The Rolexes were sent to an escrow company who then sent back NFTs representing ownership of the watches

The borrower can then use those NFTs to tap into global liquidity rather… twitter.com/i/web/status/1…

The Rolexes were sent to an escrow company who then sent back NFTs representing ownership of the watches

The borrower can then use those NFTs to tap into global liquidity rather… twitter.com/i/web/status/1…

All took place on @Arcade_xyz

We just passed $100m in (real) NFT lending volume and are just getting started

Highly suggest checking out the dApp and discord if this type of thing gets you excited

We just passed $100m in (real) NFT lending volume and are just getting started

Highly suggest checking out the dApp and discord if this type of thing gets you excited

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter