It’s a puzzling dilemma all investors face.

Knowing when to sell or not sell a stock position.

We turned to two legendary investors —Li Lu and Chuck Akre — for advice.

Here’s what you need to know about the art of selling: 🧵⬇️ 1/19

Knowing when to sell or not sell a stock position.

We turned to two legendary investors —Li Lu and Chuck Akre — for advice.

Here’s what you need to know about the art of selling: 🧵⬇️ 1/19

2/ Our first advisor on when to sell has been called a “genius” by Charlie Munger.

Li Lu is also the only fund manager Munger ever placed his own funds with.

In a lecture to Columbia students, he discussed the 3 reasons that would cause him to sell a position in his portfolio:

Li Lu is also the only fund manager Munger ever placed his own funds with.

In a lecture to Columbia students, he discussed the 3 reasons that would cause him to sell a position in his portfolio:

3/ Lu says, “If you make a mistake, sell as fast as you can, even if it’s a correct mistake.

Investing is a probability game.

If you go into a situation with 90% confidence that things will work out well and a 10% chance they won’t — and that 10% event happens. You sell it."

Investing is a probability game.

If you go into a situation with 90% confidence that things will work out well and a 10% chance they won’t — and that 10% event happens. You sell it."

4/ The second time you want to sell is when the valuation swings way too much to the extreme.

Li Lu said, “I don’t sell a security because it’s a little overvalued, but if it is way overboard on the other side into euphoria, then I will sell it.”

Li Lu said, “I don’t sell a security because it’s a little overvalued, but if it is way overboard on the other side into euphoria, then I will sell it.”

5/ Third, you find a better opportunity.

He says, “Your job as an investor is to constantly improve your basket. You start with a high bar. You want to increase the bar higher and higher. You do that by constantly improving the opportunity costs. You find something better.”

He says, “Your job as an investor is to constantly improve your basket. You start with a high bar. You want to increase the bar higher and higher. You do that by constantly improving the opportunity costs. You find something better.”

6/ We now turn to our second legendary investor for thoughts on when to sell— Chuck Akre.

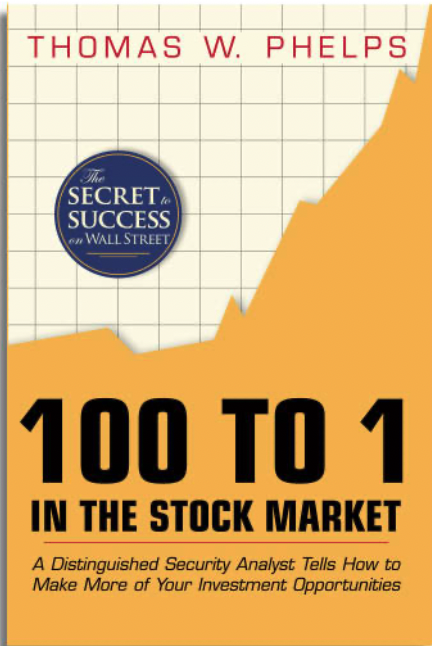

Akre was heavily influenced by Thomas Phelps book “100 to 1 in The Stock Market” and likes to invest in what he calls “compounding machines.”

Akre was heavily influenced by Thomas Phelps book “100 to 1 in The Stock Market” and likes to invest in what he calls “compounding machines.”

7/ A “compounding machine” is a business that is able to compound shareholder’s capital at high rates for long periods of time with little risk of permanent loss of capital.

Some of Akre's favorite compounders include Mastercard, Moody’s, and O’Reilly Automotive.

Some of Akre's favorite compounders include Mastercard, Moody’s, and O’Reilly Automotive.

8/ According to one of Akre’s partners, Chris Cerrone, the costliest mistakes have almost all been sell decisions.

The mistake, in most cases, has been selling TOO soon.

Cerrone has written a fantastic essay called “The Art of (Not) Selling.”

Read on: ⬇️

The mistake, in most cases, has been selling TOO soon.

Cerrone has written a fantastic essay called “The Art of (Not) Selling.”

Read on: ⬇️

9/ Cerrone says Akre’s investment philosophy is based on concentrating their capital in a small number of growing and competitively advantaged businesses.

These businesses are rare and only periodically available for purchase at attractive prices.

These businesses are rare and only periodically available for purchase at attractive prices.

10/ As Cerrone says, “Allowing our investments to compound uninterrupted is our North Star.”

He adds, “We believe these two ideas — (not) selling and compounding — are inextricably linked. Getting the first wrong makes the second impossible.”

He adds, “We believe these two ideas — (not) selling and compounding — are inextricably linked. Getting the first wrong makes the second impossible.”

11/ Many do not understand the power of compounding returns.

It was called the eighth wonder of the world by Einstein for good reason.

But, holding for the long term involves many temptations to sell.

How does Akre handle those temptations?

It was called the eighth wonder of the world by Einstein for good reason.

But, holding for the long term involves many temptations to sell.

How does Akre handle those temptations?

12/ First, they tune out politics and macroeconomics.

Cerrone says, “we are at our worst as investors when we allow concerns about these issues, including elections, trade wars, and Fed policy, to influence our investment decisions.”

Cerrone says, “we are at our worst as investors when we allow concerns about these issues, including elections, trade wars, and Fed policy, to influence our investment decisions.”

13/ Second, valuation plays no role in their sell decisions, and neither do price targets.

The idea that there will be an opportunity down the road to buy back in at lower prices seldom works out well in Akre’s experience.

Also, great businesses tend to exceed expectations.

The idea that there will be an opportunity down the road to buy back in at lower prices seldom works out well in Akre’s experience.

Also, great businesses tend to exceed expectations.

14/ There are 3 times, though, when Akre’s team will consider selling a position.

These include when a business is:

1. No longer growing at an above-average rate

2. Has had its competitive advantage impaired

3. Has had an adverse change in management

These include when a business is:

1. No longer growing at an above-average rate

2. Has had its competitive advantage impaired

3. Has had an adverse change in management

15/ Cerrone says, “In very rare instances, we might sell so we can free up capital to invest in what we believe is a better business. Beware, however. Selling something you know well to buy something new that seems better is a dangerous game.”

16/ For the investor determined to compound, tuning out the noise is essential.

Quarterly earnings, the financial press, and Wall Street analysts all contribute to the noise.

Keep in mind that the financial press and Wall Street live on eyeballs and transactions.

Quarterly earnings, the financial press, and Wall Street analysts all contribute to the noise.

Keep in mind that the financial press and Wall Street live on eyeballs and transactions.

17/ In his book “100 to 1 in the Stock Market,” Thomas Phelps advised:

“Never forget that people whose self-interest is diametrically opposed to your own are trying to persuade you to act every day.”

“Never forget that people whose self-interest is diametrically opposed to your own are trying to persuade you to act every day.”

18/ Phelps wrote that in 1972.

It is probably truer today than it was back then.

Wall Street trading desks do not earn commissions when you buy and hold, and the T.V. channels do not attract an audience by saying, “there is nothing new to report today.”

It is probably truer today than it was back then.

Wall Street trading desks do not earn commissions when you buy and hold, and the T.V. channels do not attract an audience by saying, “there is nothing new to report today.”

19/ We hope you find value in these ideas.

If you enjoyed this, you’d love our free daily newsletter, We Study Markets.

We explore the three biggest stories in markets, explained simply, in just five minutes each day.

Sign up here: ⬇️

If you enjoyed this, you’d love our free daily newsletter, We Study Markets.

We explore the three biggest stories in markets, explained simply, in just five minutes each day.

Sign up here: ⬇️

https://twitter.com/TIP_Network/status/1641869134605475862?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter