HASHKEY 🧵🧩🧩🧩🧵 1/22

Hashkey is an important piece to this Prometheum and Wanxiang puzzle. Not only did they fund Prometheum, Hashey Digital Asset Group is a Wanxiang Partner and have a technology agreement with Wanxiang and Prometheum.

Let’s look at some interesting facts… twitter.com/i/web/status/1…

Hashkey is an important piece to this Prometheum and Wanxiang puzzle. Not only did they fund Prometheum, Hashey Digital Asset Group is a Wanxiang Partner and have a technology agreement with Wanxiang and Prometheum.

Let’s look at some interesting facts… twitter.com/i/web/status/1…

HashKey hired ex JPMorgan Managing Director, David Leahy, as the COO of HashKey and also attended MIT for Cybersecurity. Same MIT Gary Gensler taught his Blockchain course.

3/22

3/22

👀 Fenbushi Capital 👀

*Bill Hinamn was in-house lawyer for the Brooklyn Project.

6/22

*Bill Hinamn was in-house lawyer for the Brooklyn Project.

6/22

https://twitter.com/nerdnationunbox/status/1669226886185078785

“SEBA Bank Partners w/ Hashkey for Institutional Crypto Adoption”

*Alameda and FTX investors amongst others.

7/22

*Alameda and FTX investors amongst others.

7/22

https://twitter.com/michael63140627/status/1600067343039594496

ZA Bank in efforts with Boston Consulting Group, & HKT Payments Secured Lending Application

*Boston Consulting Group is a BAKKT investor!!! See 3rd and 4th pic for Bakkt info. 👀

8/22

*Boston Consulting Group is a BAKKT investor!!! See 3rd and 4th pic for Bakkt info. 👀

8/22

https://twitter.com/michael63140627/status/1646424872111702016

💨 🔥 9/22

Early Ethereum backer HashKey Capital has raised $500 million to create one of Asia’s biggest crypto investment pools.

Early Ethereum backer HashKey Capital has raised $500 million to create one of Asia’s biggest crypto investment pools.

https://twitter.com/crypto/status/1615908749822009349

🚨🚨🚨🚨🚨🚨🚨🚨🚨🚨10/22

Evertas raises $14M which Hashkey participated in.

*Evertas President & Founder is ex Enterprise Ethereum Alliance #EEA

Evertas raises $14M which Hashkey participated in.

*Evertas President & Founder is ex Enterprise Ethereum Alliance #EEA

https://twitter.com/coindesk/status/1602303513941479425

💰💰💰💰11/22

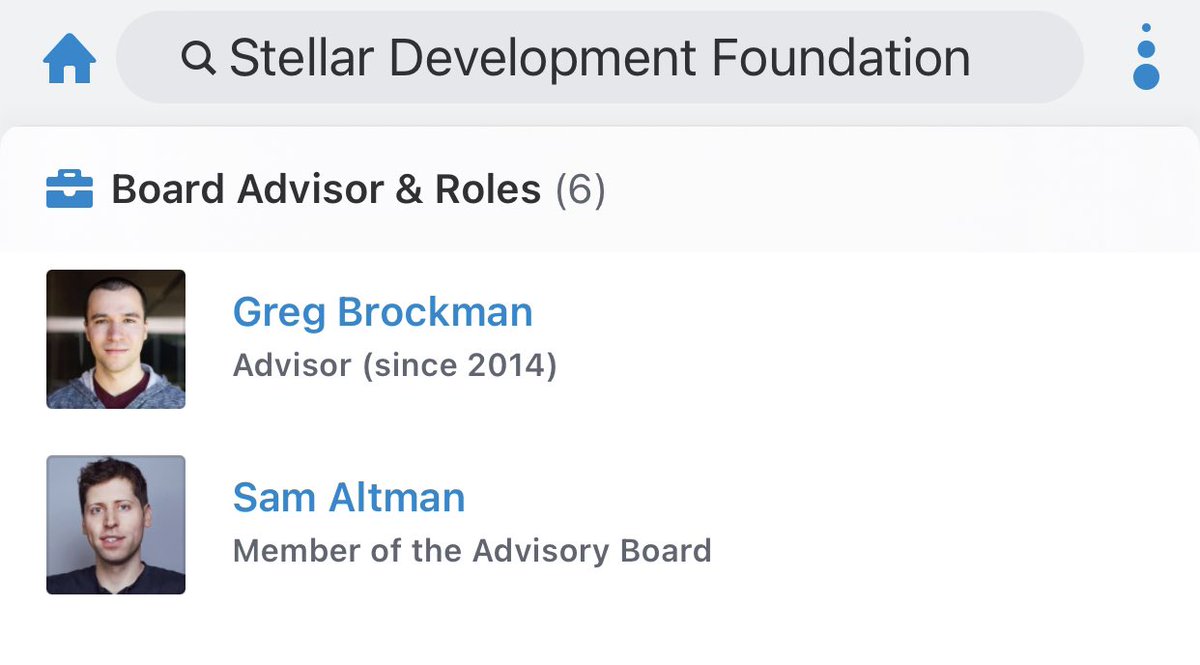

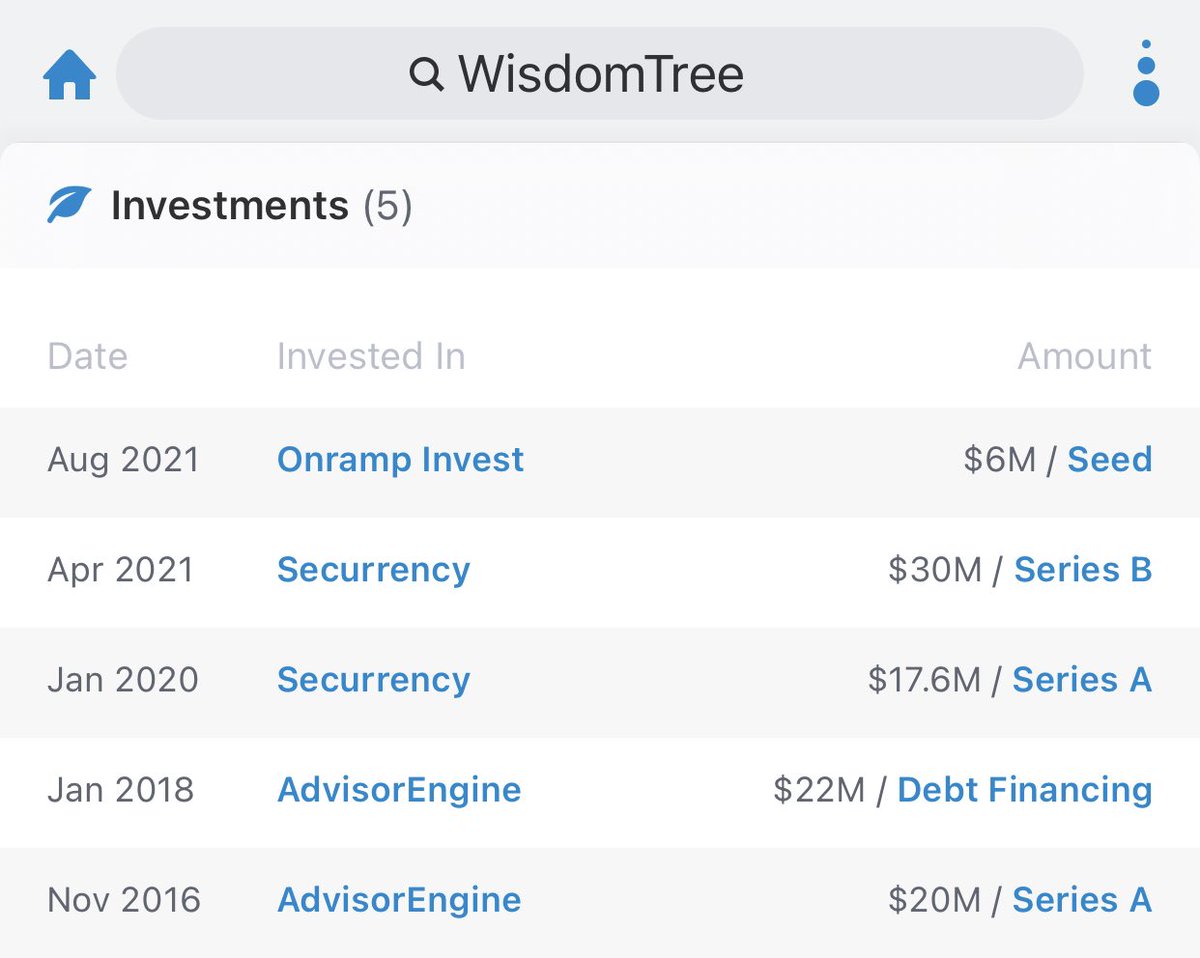

Let’s now take a look into some of Hashkey’s Investments and players involved.

👇🏼👇🏼👇🏼👇🏼👇🏼

Let’s now take a look into some of Hashkey’s Investments and players involved.

👇🏼👇🏼👇🏼👇🏼👇🏼

Joe Lubin’s SKLAE Labs 13/22

Key Investors:

ConsenSys Ventures

Galaxy Digital (Mike Novogratz)

Hashkey

MultiCoin (Kyle Samani)

Key Investors:

ConsenSys Ventures

Galaxy Digital (Mike Novogratz)

Hashkey

MultiCoin (Kyle Samani)

Hashkey is also invested in Custodia Bank. PJT Partners is an investor in Custodia as their only listed investment. PJT Partners is the same company Bill Hinman was flagged for holding when he joined the SEC and their only investment listed is Custodia Bank.

👀👀👀

14/22

👀👀👀

14/22

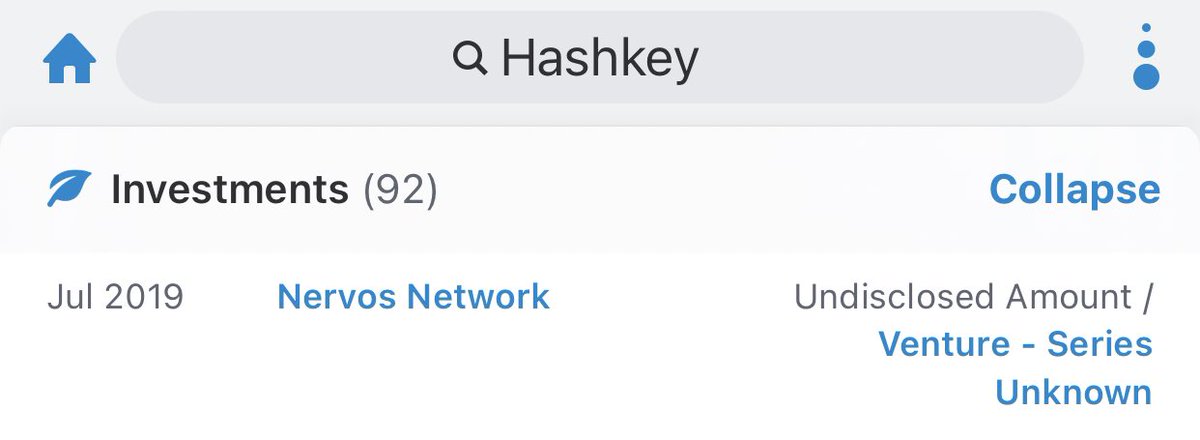

Nervous Network 15/22

Key Investors:

Dragonfly (ConsenSys & Paradigm)

Hashkey

Multicoin Capital (Kyle Samani)

Sequoia Capital 🇨🇳

Wanxiang

Key Investors:

Dragonfly (ConsenSys & Paradigm)

Hashkey

Multicoin Capital (Kyle Samani)

Sequoia Capital 🇨🇳

Wanxiang

Blockfolio 16/22

Key Investors:

COIND (Alibaba / Goldman Sachs)

Founders Fund (Peter Thiel)

Hashkey

Pantera (Jed McCaleb Partner)

Key Investors:

COIND (Alibaba / Goldman Sachs)

Founders Fund (Peter Thiel)

Hashkey

Pantera (Jed McCaleb Partner)

Terra 17/22

Key Investors:

Binance

Coinbase

COIND (Alibaba / Goldman Sachs)

Galaxy (Mike Novogratz)

Hashkey

Pantera (Jed McCaleb Partner)

Key Investors:

Binance

Coinbase

COIND (Alibaba / Goldman Sachs)

Galaxy (Mike Novogratz)

Hashkey

Pantera (Jed McCaleb Partner)

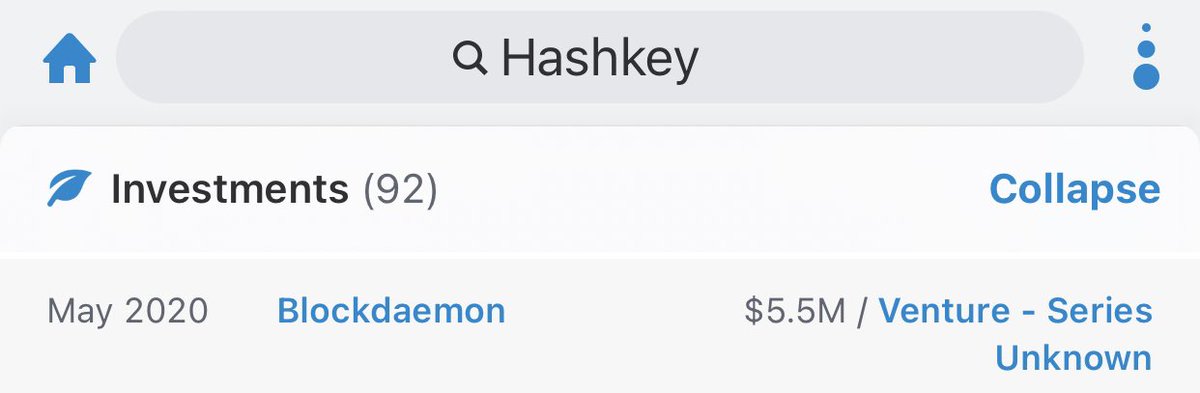

Blockdaemon 18/22

Key Investors:

BlockFi (ConsenSys Investor)

Citi

Fenbushi Capital*

Galaxy (Mike Novogratz)

Goldman Sachs

Hashkey

Morgan Creek (Custodia Investor)

SoftBank (Jack Ma on Board 🇨🇳)

Warburg Serres

Key Investors:

BlockFi (ConsenSys Investor)

Citi

Fenbushi Capital*

Galaxy (Mike Novogratz)

Goldman Sachs

Hashkey

Morgan Creek (Custodia Investor)

SoftBank (Jack Ma on Board 🇨🇳)

Warburg Serres

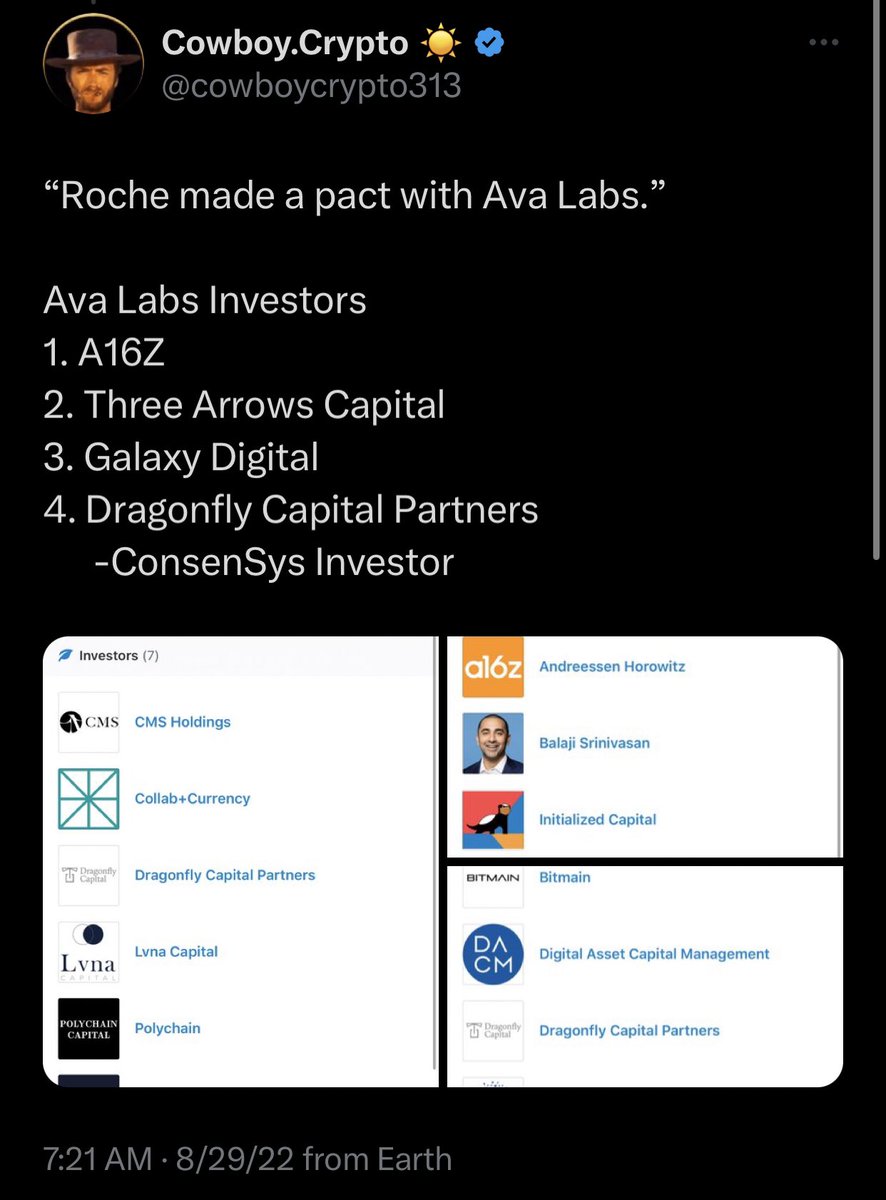

🔥 Ava Labs 🔥 19/22

Key Investors:

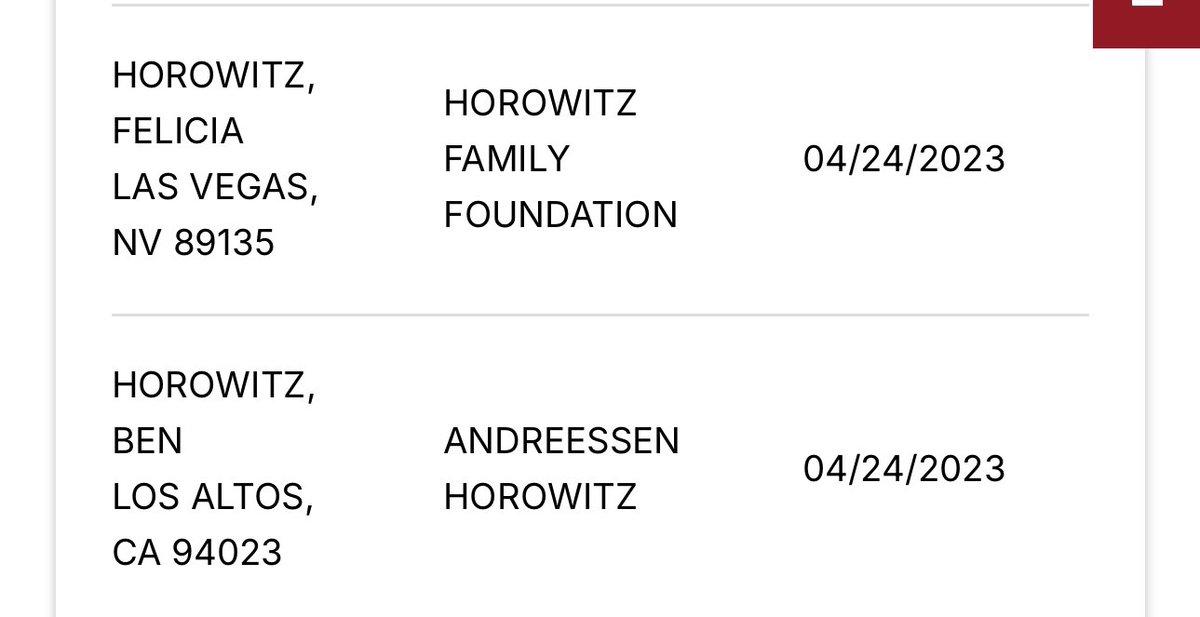

A16Z

Dragonfly (ConsenSys Investor)

Galaxy (Mike Novogratz)

Hashkey

Three Arrows Capital

@bgarlinghouse false accusations

Key Investors:

A16Z

Dragonfly (ConsenSys Investor)

Galaxy (Mike Novogratz)

Hashkey

Three Arrows Capital

@bgarlinghouse false accusations

ETHSign 20/22

Key Investors:

COIND (Alibaba / Goldman Sachs)

Hashkey

Sequoia Capital 🇨🇳

Sequoia Capital China 🇨🇳

Key Investors:

COIND (Alibaba / Goldman Sachs)

Hashkey

Sequoia Capital 🇨🇳

Sequoia Capital China 🇨🇳

Burnt Finance 21/22

Key Investors:

Alameda Research (SBF)

Do Kwon

Hashkey

Multicoin (Kyle Samani)

Terra

Key Investors:

Alameda Research (SBF)

Do Kwon

Hashkey

Multicoin (Kyle Samani)

Terra

These are the key players I found involved with Hashkey and associate with them on a regular basis. There’s more to be found, but it’s quite clear China 🇨🇳 has a grip on US crypto markets as well as the SEC. #XRPArmy

22/22

22/22

• • •

Missing some Tweet in this thread? You can try to

force a refresh