0/n #GryphsisAcademyWeeklyCryptoDigest Turbulent Times in Crypto- BlackRock's ETF Move and Tether's Unexpected Shift (2023.06.12–2023.06.18)

medium.com/@gryphsisacade…

medium.com/@gryphsisacade…

3/n Contents - 1

1) Macro Overview: US Stock V.S. Crypto

2) Big Story: Blackrock BTC Spot ETF Application; USDT Depegging

3) Protocol Spotlight: Uniswap

4) Narrative Pick: LSD(Fi)

5) VC Funding Highlight

1) Macro Overview: US Stock V.S. Crypto

2) Big Story: Blackrock BTC Spot ETF Application; USDT Depegging

3) Protocol Spotlight: Uniswap

4) Narrative Pick: LSD(Fi)

5) VC Funding Highlight

4/n Contents - 2

6) Alpha Threads:

@TheDeFISaint’s analysis on Gain’s V6.3.2

@DeFiMinty’s tutourial on DeFiLlama

@louround’s thread on Swaap Finance V2

@viktor’s thread on $CRV flywheel

@Slappjakke’s token watchlist

7) Upcoming Events: Macro & Crypto

6) Alpha Threads:

@TheDeFISaint’s analysis on Gain’s V6.3.2

@DeFiMinty’s tutourial on DeFiLlama

@louround’s thread on Swaap Finance V2

@viktor’s thread on $CRV flywheel

@Slappjakke’s token watchlist

7) Upcoming Events: Macro & Crypto

5/n Macro Overview

CPI came in at 4%, slightly down from 4.1%. PPI dipped to -0.3% from prior 0.2%, while FOMC rate held steady at 5.25%. SPX and NQ have maintained upward momentum. Meanwhile, $BTC slightly outperforms $ETH, nearing 50% dominance rate.

CPI came in at 4%, slightly down from 4.1%. PPI dipped to -0.3% from prior 0.2%, while FOMC rate held steady at 5.25%. SPX and NQ have maintained upward momentum. Meanwhile, $BTC slightly outperforms $ETH, nearing 50% dominance rate.

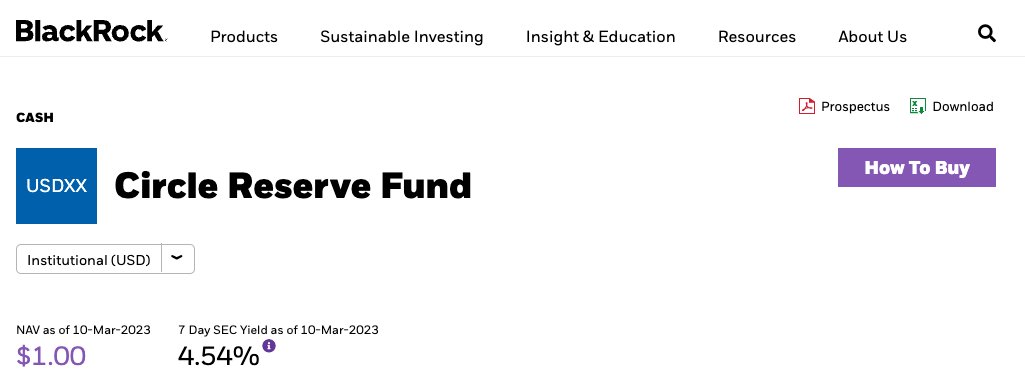

6/n Blackrock filing application for BTC spot ETF

BlackRock has applied to the SEC to launch a Bitcoin ETF, 'iShares Bitcoin Trust', using Bitcoin assets managed by Coinbase and benchmarked against Kraken's index.

BlackRock has applied to the SEC to launch a Bitcoin ETF, 'iShares Bitcoin Trust', using Bitcoin assets managed by Coinbase and benchmarked against Kraken's index.

7/n #GryphsisInsights

BlackRock's proposed Bitcoin ETF could be a game-changer, enhancing Bitcoin's accessibility, fostering adoption, reducing regulatory uncertainty, and leveraging BlackRock's prestige.

BlackRock's proposed Bitcoin ETF could be a game-changer, enhancing Bitcoin's accessibility, fostering adoption, reducing regulatory uncertainty, and leveraging BlackRock's prestige.

8/n USDT Depegging

USDT's value briefly fell below its standard 1:1 ratio with the USD due to an imbalance in Curve's 3Pool. Traders took advantage of the discrepancy, borrowing USDT to trade for DAI or USDC.

USDT's value briefly fell below its standard 1:1 ratio with the USD due to an imbalance in Curve's 3Pool. Traders took advantage of the discrepancy, borrowing USDT to trade for DAI or USDC.

9/n #GryphsisInsights

Amid USDT's recent price fluctuation, its market role suggests a full collapse is unlikely. Investors can hedge against potential USDT depegging using methods like swapping for other stablecoins, shorting USDC/USDT pair, or leveraging money markets.

Amid USDT's recent price fluctuation, its market role suggests a full collapse is unlikely. Investors can hedge against potential USDT depegging using methods like swapping for other stablecoins, shorting USDC/USDT pair, or leveraging money markets.

10/n Weekly Protocol Pick

Uniswap V4 introduces "hooks" for customizable pool interactions enabling innovative applications, and a "singleton" contract consolidating all pools into one to improve efficiency and reduce gas costs.

Uniswap V4 introduces "hooks" for customizable pool interactions enabling innovative applications, and a "singleton" contract consolidating all pools into one to improve efficiency and reduce gas costs.

11/n #GryphsisInsights

Uniswap V4's launch during heightened regulatory scrutiny on centralized exchanges could expedite the shift towards DEXs.

Uniswap V4's launch during heightened regulatory scrutiny on centralized exchanges could expedite the shift towards DEXs.

12/n #GryphsisInsights

However, despite its significant protocol upgrades, Uniswap's token price remains unaffected due to broader market conditions and its utility concerns. Continued monitoring for potential profit opportunities is advised.

However, despite its significant protocol upgrades, Uniswap's token price remains unaffected due to broader market conditions and its utility concerns. Continued monitoring for potential profit opportunities is advised.

13/n Trending Narrative: LSD(Fi)

DeFi's (LSD) market continues to grow with Ethereum staking platforms like Lido, Rocket, and Frax showing notable 30-day TVL growth. EigenLayer's mainnet launch is marking a significant step forward for the LSD market.

DeFi's (LSD) market continues to grow with Ethereum staking platforms like Lido, Rocket, and Frax showing notable 30-day TVL growth. EigenLayer's mainnet launch is marking a significant step forward for the LSD market.

14/n Trending Narrative: LSD(Fi)

EigenLayer's re-staking allows already staked capital to be staked again, providing additional security layers.

EigenLayer's re-staking allows already staked capital to be staked again, providing additional security layers.

15/n Trending Narrative: LSD(Fi)

It aids applications struggling to set up security networks on Ethereum by enabling the deployment of staked ETH or Liquid Staking Derivatives (LSDs), securing applications similar to the Ethereum network itself.

It aids applications struggling to set up security networks on Ethereum by enabling the deployment of staked ETH or Liquid Staking Derivatives (LSDs), securing applications similar to the Ethereum network itself.

16/n Trending Narrative: LSD(Fi)

In just 24 hours after launch, EigenLayer hit its deposit cap, indicating robust user interest. As of now, the platform supports the re-staking of stETH, rETH, cbETH, and Beacon Chain ETH, providing diverse opportunities for users.

In just 24 hours after launch, EigenLayer hit its deposit cap, indicating robust user interest. As of now, the platform supports the re-staking of stETH, rETH, cbETH, and Beacon Chain ETH, providing diverse opportunities for users.

17/n #GryphsisInsights

EigenLayer's re-staking addresses capital fragmentation in PoS chains and aids capital-needy applications, enhancing capital efficiency, user rewards, and application security.

EigenLayer's re-staking addresses capital fragmentation in PoS chains and aids capital-needy applications, enhancing capital efficiency, user rewards, and application security.

18/n #GryphsisInsights

With the growing LSD market cap and EigenLayer's mainnet launch, a further capital influx into the LSD market is expected, driving continued growth.

With the growing LSD market cap and EigenLayer's mainnet launch, a further capital influx into the LSD market is expected, driving continued growth.

19/n Top Funded Crypto Protocols This Week

Gensyn Protocol, a trustless layer-1 system, leverages blockchain technology to democratize machine learning training and reduce Web3 Dapps' reliance on Web2 infrastructure.

Gensyn Protocol, a trustless layer-1 system, leverages blockchain technology to democratize machine learning training and reduce Web3 Dapps' reliance on Web2 infrastructure.

20/n Top Funded Crypto Protocols This Week

After securing $43M funding from top institutions like a16z, it's currently the highest funded protocol this month.

After securing $43M funding from top institutions like a16z, it's currently the highest funded protocol this month.

21/n Top Funded Crypto Protocols This Week

Connext, a protocol enabling secure cross-chain transactions, addresses user experience fragmentation due to blockchain scalability issues.

Connext, a protocol enabling secure cross-chain transactions, addresses user experience fragmentation due to blockchain scalability issues.

22/n Top Funded Crypto Protocols This Week

Employing a hub-and-spoke architecture, automated off-chain actors, and simplified multi-chain contract interactions, it raised $7.5M on June 15 from investors like Poluchain Capital, Polygon, and NGC Venture.

Employing a hub-and-spoke architecture, automated off-chain actors, and simplified multi-chain contract interactions, it raised $7.5M on June 15 from investors like Poluchain Capital, Polygon, and NGC Venture.

23/n Alpha Threads

https://twitter.com/defiminty/status/1669083751077367810?s=61&t=umatWWTmNVA8V-B9f57Ryw

https://twitter.com/louround_/status/1669076962860736512?s=61&t=umatWWTmNVA8V-B9f57Ryw

https://twitter.com/viktordefi/status/1668653907512311808?s=61&t=Z3bxt8cNX7uyAjqCW1Pg8g

https://twitter.com/slappjakke/status/1668569706612269057?s=61&t=Z3bxt8cNX7uyAjqCW1Pg8g

https://twitter.com/1163177663831445508/status/1668998162877497344

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter