Thread on #HBLPower

Recall this thrilling scene in the movie, "Uri" with those jaw-dropping night vision goggles, leaving you on the edge of your seat.

Recall this thrilling scene in the movie, "Uri" with those jaw-dropping night vision goggles, leaving you on the edge of your seat.

Introducing India's Tony Stark / Iron Man, Arvind Lakshmikumar, the CEO of Tonbo Imaging, who's making our armed forces cooler and powerful.

So Iron Man revealed

All of night vision gadgets in Uri were from Tonbo

90% of India's night vision gadgets (2020-2023) are Tonbo-made

All of night vision gadgets in Uri were from Tonbo

90% of India's night vision gadgets (2020-2023) are Tonbo-made

Before we delve into Tonbo, let's first explore what makes HBL Power an intriguing company worth discussing.

Before we proceed, if you find our research helpful, please help other investor friends by retweeting this thread & support our efforts because It took over 50 hours to simplify HBL Power for you.

This would also encourage us to post more of such research for you, in the future.

This would also encourage us to post more of such research for you, in the future.

I love researching small businesses run by first generation entrepreneurs.

Shivalik

RACL

Airtel

The list is long.

Shivalik

RACL

Airtel

The list is long.

These tech-savvy businessmen prioritize innovation over money, try to bridge tech gaps in society, and money just becomes a byproduct.

Started in 1986, by Dr. Aluru Jagadish Prasad, HBL Power Systems has always tried to stay ahead of the curve through extensive R&D.

87% of HBL's FY2023 revenues were from industrial and defence batteries and 13% from other segments.

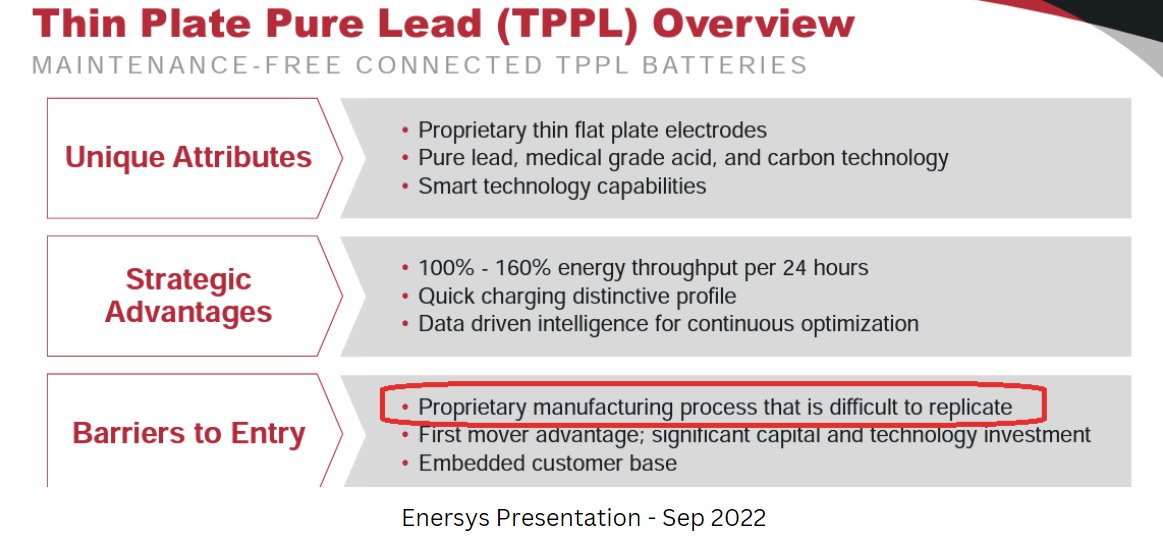

TPPL/PLT Market leader, Enersys, with sales of 3.7 billion USD (30k+ Crs), explains the differences between TPPL & conventional batteries.

HBL's 2022 Annual Report showcases PLT battery customers.

ST Telemedia

COLT & other large Data Centers

Reliance

Indian Army

ST Telemedia

COLT & other large Data Centers

Reliance

Indian Army

A bit about some of HBL's PLT customers.

ST Telemedia is a global data center player with group revenues exceeding $4 Billion.

ST Telemedia is a global data center player with group revenues exceeding $4 Billion.

HBL's extensive R&D has led to creation of multiple businesses.

Each business needs exploration, but for now, let's focus on TCAS (Kavach).

Each business needs exploration, but for now, let's focus on TCAS (Kavach).

TCAS, invented in the 1970s, is a radar for planes. It warns pilots if other planes are too close, keeping everyone safe in the sky.

ETCS, introduced in 2002, made Belgian trains safer, like TCAS for planes. It prevented collisions and improved cooperation.

Given the valuable human lives at stake, these are complex safety systems with defect rates, almost nil, perhaps.

(Start at 16 seconds to save time)

(Start at 16 seconds to save time)

But these cost a bomb. About 2 Crs per kilometer.

So Indian co's developed similar in-house technologies which costed just 50 Lacs per Km.

So Indian co's developed similar in-house technologies which costed just 50 Lacs per Km.

Indian Railways' Research Designs & Standards Organization (RDSO) collaborated with 3 companies for TCAS (Train Collision Avoidance System).

The 3 Indian co's certified by Indian Railways are

Medha Servo Drives

HBL Power Systems

Kernex Microsystems

Medha Servo Drives

HBL Power Systems

Kernex Microsystems

2 competitors yet to be certified and will need 2-3 years for product development, trials, and certification.

1. Quadrant Future Tek

1. Quadrant Future Tek

In the 2022 budget, the Indian Finance Minister announced that 2000 kms of Indian railways would join TCAS (rebranded as Kavach).

India's Railway Minister, Ashwini Vaishnav, demonstrated courage & faith by personally testing the Kavach system on board in Mar 2022.

So from demo trial in 2012 to final testing in 2022.

That's 10 years of R&D!!

Let that number sink in for a sec.

A few years is what it'll take a new player to enter TCAS.

That's 10 years of R&D!!

Let that number sink in for a sec.

A few years is what it'll take a new player to enter TCAS.

Wait.

Inter... What???

Interoperability is like puzzle pieces fitting perfectly together to create a complete picture.

Inter... What???

Interoperability is like puzzle pieces fitting perfectly together to create a complete picture.

And if ABC Ltd also joins the race for TCAS, then they need to ensure compatibility with all 3 as well as XYZ.

A moat that keeps widening !

A moat that keeps widening !

TCAS is an area where skilled players hold the reins with expertise and patience, while HBL's 20+ years of R&D set them apart.

A large opportunity

A vast 35000 Crs potential with 3 players & seamless interoperability

Add it all up & you'll see what cud be coming

A vast 35000 Crs potential with 3 players & seamless interoperability

Add it all up & you'll see what cud be coming

Even if HBL captures just 20% of 35k Crs in this 3 player market, it's a whopping 7000 Crs, 5 times their 2023 revenues.

Maybe HBL will get less than 20%, but you get the idea.

Maybe HBL will get less than 20%, but you get the idea.

Now TCAS is potentially, a high growth segment.

As per HBL's estimates, Sales in Electronics for Rail & Defence could go up at 164% CAGR.

As per HBL's estimates, Sales in Electronics for Rail & Defence could go up at 164% CAGR.

The kind of opportunity in TCAS sounds better when it comes from the horse's mouth.

Here's our Railway Minister at 01:54 saying Kavach went from 3000 Kms to 5000 Kms.

youtube.com/v/kJSGZ9WyETc

Here's our Railway Minister at 01:54 saying Kavach went from 3000 Kms to 5000 Kms.

youtube.com/v/kJSGZ9WyETc

As per HBL EBITDA margins could potentially grow at 45% CAGR until 2026!

Margins are estimated to go up from 13% in 2023 to 18% in 2026.

And they are saying that because?

Because R&D of 300 Crs has already been expensed out over the last 10+ years.

Because R&D of 300 Crs has already been expensed out over the last 10+ years.

This means HBL's current PAT & market cap could've been higher had they included R&D as an asset on the balance sheet.

Instead they deducted it as an expense from their P&L, deferring gratification.

Instead they deducted it as an expense from their P&L, deferring gratification.

Expensing R&D reveals corporate governance and the management's patience for delayed rewards, just like Mr. Bachchan's advice.

In their investor PPT mgmt said

Future R&D exp & Capex would be lower

&

Working capital higher.

These mean higher future Cash Flows.

Future R&D exp & Capex would be lower

&

Working capital higher.

These mean higher future Cash Flows.

Defence opportunity - This is a Digital Control Harness developed by HBL in 2017, under technical license from Elbit Systems, Israel.

Indigenous: Defence's new trend

It means India develops & makes her own weapons, tech & manpower and reduce dependency on other countries.

It means India develops & makes her own weapons, tech & manpower and reduce dependency on other countries.

For eg, India's choice of Spike ATGMs from Israel in 2021 was driven by technology transfer & local production, aligning with Make in India.

Rico's concall tells us PSUs & Rico are still NOT indigenous.

Maybe they'll take a while. Maybe they won't.

We'll know as time passes.

Maybe they'll take a while. Maybe they won't.

We'll know as time passes.

Technology transfer is like baking a cake from a recipe book while inventing your own tech is like baking your own cake recipe from scratch.

HFCL may need Physics/Electronics/Mechanics experts for further in-house development, while HBL is less likely to face this issue.

Among 5 players, 2 import, Rico aims for indigenization, HFCL collaborates. What about HBL?

Some advice from one of my favorite finance authors.

Some advice from one of my favorite finance authors.

Here's something Rico indicated about a competitor's own technology - My bet is they were talking about HBL.

HFCL's Dec 2022 investor presentation shows a massive $2.1 Billion opportunity size for Electronic Fuses & $20 Billion for Electro Optics

Returning to Electro Optics & Tonbo - It develops cutting-edge tech that enhances India's armed forces, boosting their coolness & power.

Rephrasing an ex-NATO commander from a paid news article.

"Based on my experience, I've seen night vision technology comparable to Tonbo's only in select classified U.S. labs."

Wow!

"Based on my experience, I've seen night vision technology comparable to Tonbo's only in select classified U.S. labs."

Wow!

Tonbo's projected Sales, sourced from multiple websites. Keep in mind these figures may not be entirely accurate.

Applications of some of Tonbo's products.

In Sep 2019, drones attacked Saudi Arabia's Aramco oil fields, impacting the world's largest oil producer.

Aramco suffered daily losses to the tune of 2500 Crs due to drone attacks, while also impacting 5% of global oil production.

In Sep 2019, drones attacked Saudi Arabia's Aramco oil fields, impacting the world's largest oil producer.

Aramco suffered daily losses to the tune of 2500 Crs due to drone attacks, while also impacting 5% of global oil production.

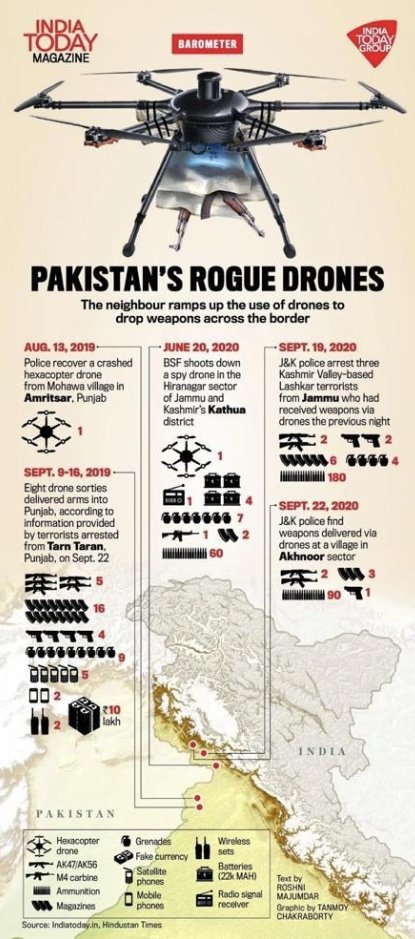

In 2019, the skies above Jammu Airport witnessed a hostile display of our rogue enemy's drones which unleashed a disgraceful attack.

Tonbo's ingenious AI systems defend airports, oil fields, and vital assets from such malicious rogue drones.

More applications of Tonbo's products. All optionalities - Less likely to play out than TCAS / Defence opportunities, in my opinion.

Moving on to risks in the HBL Power / Tonbo Imaging story.

Risk 1- Actions of govt employees differ from Central govt's words, creating a disconnect in their alignment.

Risk 1- Actions of govt employees differ from Central govt's words, creating a disconnect in their alignment.

The other concern raised by Tonbo was a delay in getting back the money that the govt. owed them.

The good thing is that Tonbo has many customers other than Govt of India.

Here are some:

The good thing is that Tonbo has many customers other than Govt of India.

Here are some:

The outcome of Tonbo's growth, with the leverage of HBL's experience, remains to be seen as time unfolds.

Risk 2 - Indian government's commitment to implement TCAS on high-density networks by 2020, as stated in a 2017 tweet, remains unfulfilled.

Railway budget of 2016-17 aimed for TCAS implementation on high-density networks by 2020, but progress has been disappointing.

The railway ministry's 2022 pledge: 6000 Route KMs on Golden Quadrilateral. A 3000 Crs opportunity for 3 players (6000 Kms * 50 Lacs).

The recent train accident in Orissa in which precious lives were lost is expected to speed up TCAS rollout.

Indian Railways also aims to export TCAS/Kavach worldwide, boasting a price tag one-fourth that of developed nations.

Indian Railways also aims to export TCAS/Kavach worldwide, boasting a price tag one-fourth that of developed nations.

Risk # 3 - Despite HBL's remarkable R&D capabilities, they seem to have missed the opportunity to fully scale up Lead Acid batteries.

Exide and Amaron achieved brand recognition in the lead-acid battery space, but HBL didn't.

Jack of all trades, master of none, perhaps?

Exide and Amaron achieved brand recognition in the lead-acid battery space, but HBL didn't.

Jack of all trades, master of none, perhaps?

Their R&D prowess seems to be overshadowing their sales capabilities, highlighting a potential imbalance in strengths.

This is somewhat reflected in their aspiration to be a Mittelstand firm.

This is somewhat reflected in their aspiration to be a Mittelstand firm.

Mittelstand firms in Germany are family-owned small businesses that specialize in technology, emphasizing quality and long-term success.

HBL's lead acid battery business is contracting, and their other ventures face potential lumpiness and delays.

Margins have shrunk due to capacities exceeding demand.

Margins have shrunk due to capacities exceeding demand.

Risk #5: Govt. Babus' delays impede HBL's cash flow, leaving it short of future working capital needs.

Further rise anticipated in working capital in the future.

Hopefully, it grows at a slower pace than their sales.

Hopefully, it grows at a slower pace than their sales.

To be fair, HBL seems to be getting smarter at managing this piece.

Risk # 6 - Dr. Prasad, the mastermind of HBL at 77, poses a crucial key man risk for the company, due to his age.

Risk # 7 - In the TCAS tendering system, only the L1 player (lowest bidder) secures orders, leaving others without guaranteed orders.

Risk # 8 - More of a market related risk. HBL stock trades at 42x earnings, possibly reflecting high expectations for future growth.

That's it from me folks.

Please consider retweeting this thread

Please consider retweeting this thread

https://twitter.com/barathmukhi/status/1671094929928654849

We post a lot of text and video content on our Telegram channel.

If you'd like to stay up to date, then here's the link

t.me/barathmukhi

If you'd like to stay up to date, then here's the link

t.me/barathmukhi

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter