There’s a really important (and often overlooked) point here.

If, as rumoured, Tata builds a battery factory in the UK, actually it’s prob not Tata but another company - likely Envision AESC - which will actually be MAKING the batteries.

UK will be getting MORE reliant on China.

If, as rumoured, Tata builds a battery factory in the UK, actually it’s prob not Tata but another company - likely Envision AESC - which will actually be MAKING the batteries.

UK will be getting MORE reliant on China.

https://twitter.com/petercampbell1/status/1670873337000521741

This goes to a deeper point. For the most part, the car companies whose badges go on the vehicles we buy don’t make the batteries inside them.

They invariably outsource 🔋production to other firms you’ve probably never heard of, most of which are Asian. Many of which are Chinese.

They invariably outsource 🔋production to other firms you’ve probably never heard of, most of which are Asian. Many of which are Chinese.

This is something I write about at some length in #materialworld. Perhaps the most interesting thing about the world’s first “gigafactory” - the Tesla plant in Nevada - is that it’s NOT Tesla making the batteries - it’s Panasonic.

Now, Tesla, and for that matter other companies like GM, are starting to reach down the supply chain.

Tesla is starting to make some of its own batteries - albeit at smaller scale than Panasonic or CATL (which makes its Chinese batteries). GM is investing in lithium mines 👇

Tesla is starting to make some of its own batteries - albeit at smaller scale than Panasonic or CATL (which makes its Chinese batteries). GM is investing in lithium mines 👇

https://twitter.com/merrynsw/status/1671117782983884800

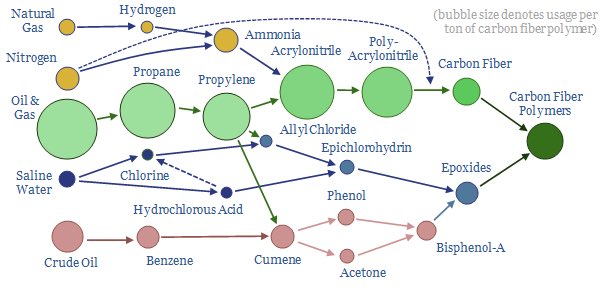

But it’s a reminder that the battery factories everyone’s obsessed with these days are really just the tip of the iceberg (see my recent blog for more). And the vast, VAST majority of that industrial iceberg is controlled by China edconway.substack.com/p/beyond-gigaf…

But, back to the UK, following the collapse of BritishVolt, Britain has no home-grown mass market EV battery player. The only major battery factory is the one for Nissan in Sunderland, which is run not by Nissan but by, guess who, Chinese-owned Envision AESC.

In other words, if Tata does as expected partner with Envision for its anticipated UK gigafactory Britain would not only be reliant on Chinese firms, but reliant on ONE Chinese firm for ALL its EV batteries.

The British CAR INDUSTRY would be reliant on ONE Chinese firm!

The British CAR INDUSTRY would be reliant on ONE Chinese firm!

China’s been thinking about this - how to dominate supply chains - for decades. UK has barely only just begun thinking about it. We spent years assuming we could just buy stuff from wherever would sell it for the cheapest price. Which made sense in a stable world. Less so today

We ALL need to start pondering the nuts & bolts of the world around us. Not just because it’s massively important for our economies and our future stability.

Also because it turns out to be fascinating.

I know - I’ve just written a book about it: amazon.co.uk/Material-World…

Also because it turns out to be fascinating.

I know - I’ve just written a book about it: amazon.co.uk/Material-World…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter