💎ICT POWER OF 3, OHLC/OHLC

This is one of the most important concepts as an ICT trader if you aren't utilizing this in your personal trading I strongly advise you to consider learning and adding it to your arsenal

Chapter 3 - CPE & STDIV

This is one of the most important concepts as an ICT trader if you aren't utilizing this in your personal trading I strongly advise you to consider learning and adding it to your arsenal

Chapter 3 - CPE & STDIV

Before getting into cool things we can do with OHLC we need to briefly go over everything I taught you so far in threads. So If this is your first thread from me I recommend going through other OHLC threads I made

https://t.co/s4IOlRNgst

https://t.co/s4IOlRNgst

https://twitter.com/silkyfx/status/1671594850641145857?s=20

https://twitter.com/silkyfx/status/1670134283569176578?s=20

One of the great tools to use in conjunction with OHLC is STANDARD DEVIATIONS

For OHLC we expect a judas against our bias above Opening price and then a move to the direction of our daily bias

So how are STDIV useful to OHLC?

STDIV can help us frame the day based on CBDR and Asian Range pip counts.

With OHLC we expect a judas below TDO

But what if it doesn't occur, how can we assume we will be getting a judas swing?

STDIV can help us frame the day based on CBDR and Asian Range pip counts.

With OHLC we expect a judas below TDO

But what if it doesn't occur, how can we assume we will be getting a judas swing?

Usually with STDIV we have a pip count measurement to qualify CBDR and AR / pick between them and determine which one should be used but these counts also help us to find "Intraday Profiles"

To simplify it there are 2 Intraday profiles

Normal Protraction

Late Protraction

Normal Protraction

Late Protraction

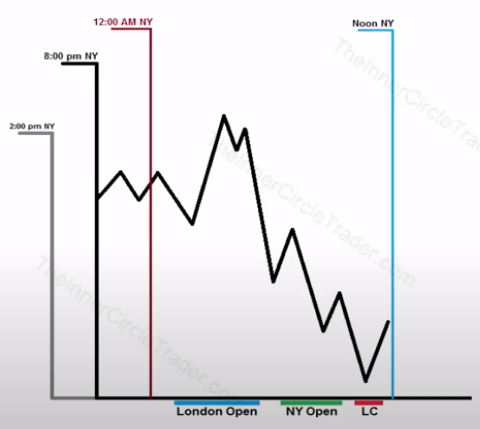

Normal Protraction is basically a Judas swing at around 2am and the parameters for it are

Consolidating CBDR and AR

Cbdr less than 40 pips

AR 20-3O pips

And it will be a judas into 1-2 STDIV on most days

Consolidating CBDR and AR

Cbdr less than 40 pips

AR 20-3O pips

And it will be a judas into 1-2 STDIV on most days

Late Protraction is basically when theres NO judas swing at around 2am but instead we just move in the direction of our draw/bias and the parameters for it are

NO Consolidating CBDR and AR

Cbdr more than 40 pips

AR more than 20-3O pips

NO Consolidating CBDR and AR

Cbdr more than 40 pips

AR more than 20-3O pips

So as I've mentioned this "tool" or way of viewing the market allows us to more accurately frame the day as instead of waiting for a "Judas Swing" to occur above midnight open and running Asia highs or something like that

If you want to learn more about it i recommend watching ICT core month 8 intraday profiles

Another great tool we can use are CPE / Close Proximity Entries. Something not a lot of ICT traders know about.

Before getting into CPE we need to remember how PO3 OHLC looks like i will be using the bearish example for this quick explanation

Accumulation Phase:

When price is trading at and above the Opening Price, Smart Money is accumulating a net short book.

When price is trading at and above the Opening Price, Smart Money is accumulating a net short book.

Manipulation Phase(Known as Judas swing):

The False Price Move caused at Market Openings or prior to news releases is a form of Manipulation.

The False Price Move is intended to lead Retail Traders on the wrong side of the Market.

The False Price Move caused at Market Openings or prior to news releases is a form of Manipulation.

The False Price Move is intended to lead Retail Traders on the wrong side of the Market.

Distribution Phase:

Distribution is where opposite side of the Candle forms into the closing of the Candle.

This is where Smart Money distributes their accumulation of Shorts. // This is the move that takes ous to our target draw/delivers according to our daily bias

Distribution is where opposite side of the Candle forms into the closing of the Candle.

This is where Smart Money distributes their accumulation of Shorts. // This is the move that takes ous to our target draw/delivers according to our daily bias

So where does "CPE" come into this

Above the Opening Price or at "Close Proximity Entries" is where Smart Money is looking to go short.

Above the Opening Price or at "Close Proximity Entries" is where Smart Money is looking to go short.

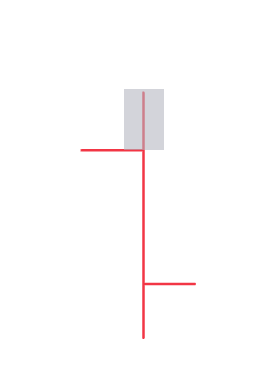

Close Proximity Entries are areas 1:1 deviated away from the "judas swing" / manipulation and opening price together

Another way i can explain it is [Opening price ] +[ Range from Open to HOD ] would be the "Opening Range" this "Opening Range" We want to move 1:1 deviation below

Another way i can explain it is [Opening price ] +[ Range from Open to HOD ] would be the "Opening Range" this "Opening Range" We want to move 1:1 deviation below

In this "CPE" Areas every potential short in a daily range is found.

This is where FVG's, Imbalances, Raids occur. and this is an area in which you would ideally like to take trades.

This is where FVG's, Imbalances, Raids occur. and this is an area in which you would ideally like to take trades.

This only works if we get a Judas Swing therefore using "STDIV" and CPE would prove beneficial as we need to know if there is going to be a judas or not.

Disclaimer you dont need these to make money these are just little cool tricks if youre learning stick to the basics

Shout out to the sponsor of this thread BYBIT I will be doing a 50,000 USD tourney and a MacBook giveaway with them SOON and for those you will need to have an account created as a part of my community to join. If you're interested sign up : partner.bybit.com/b/57020

Also if you signed up and deposited at least 100USDT with my link feel free to send me a DM for a free and complete trade model. Next free funded account giveaway is TOMORROW so turn on your notifications!

@InnerAlgoTrader How is combining 4 separate concepts from which 2 of arent core into a model rehashing anything get a grip

@i_Regera Ngl theres much more but ill see if i want to bring charter into this

@ChrisDanny911 I know you wont listen but you really really shouldn't be taking advice from "inner circle reddit" or reddit in general

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter