Thames Water are on the verge of being taken back into public ownership because of their £14bn "unsustainable" debt - but where did it come from?

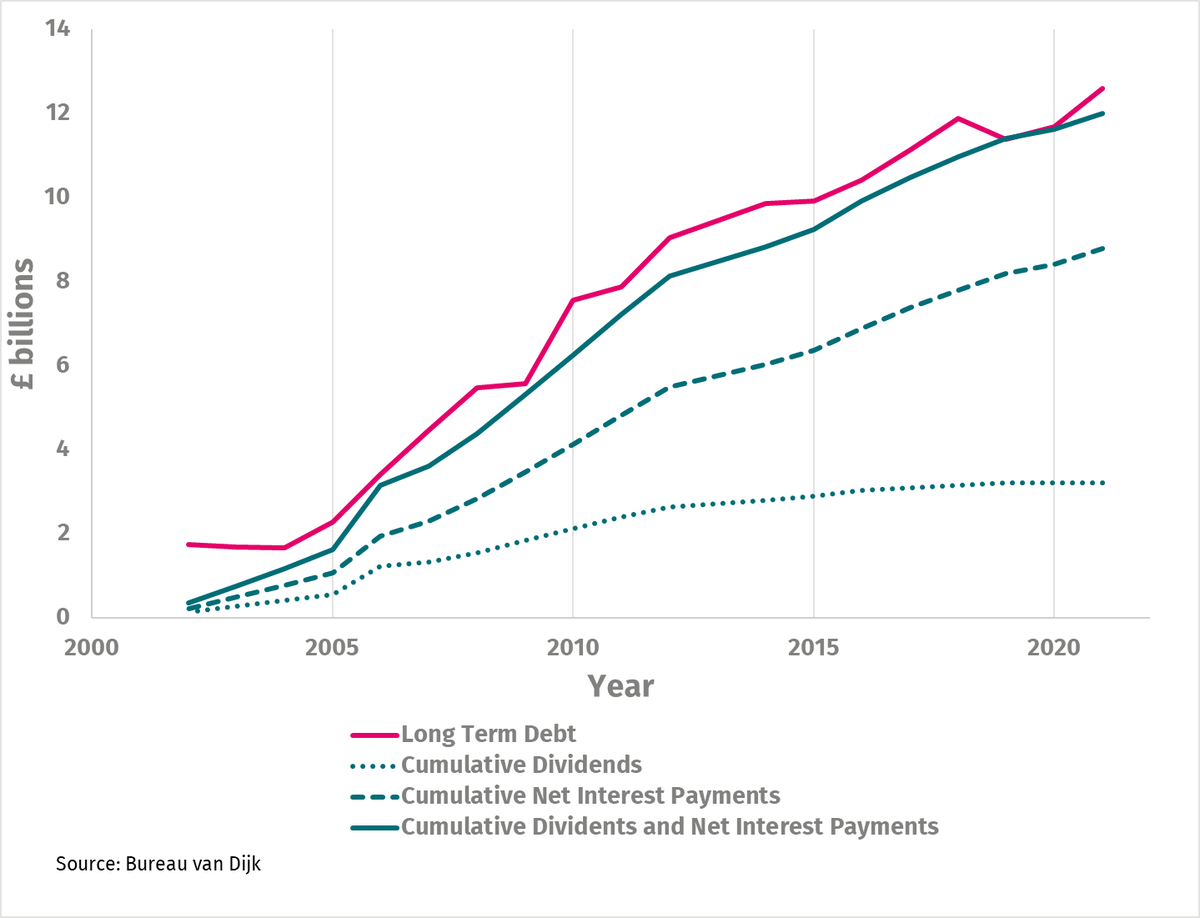

I looked at the last 20yrs of accounts and their long-term debt tracks their dividend and net interest payments over the period https://t.co/FPnXxogAHa

I looked at the last 20yrs of accounts and their long-term debt tracks their dividend and net interest payments over the period https://t.co/FPnXxogAHa

https://twitter.com/SkyNews/status/1674062000735887360

Since 2002 Thames Water have paid:

💰£3.2 billion in dividends

💸£8.8 billion in net interest payments

💰£3.2 billion in dividends

💸£8.8 billion in net interest payments

But interest on what? In this Guardian piece David Hall argues that very little of this debt went to support investment, but rather to finance dividends to shareholders

This looks like a textbook case of privatisation of profit and socialisation of risk

https://t.co/LIiT5jQXiItheguardian.com/environment/ng…

This looks like a textbook case of privatisation of profit and socialisation of risk

https://t.co/LIiT5jQXiItheguardian.com/environment/ng…

Regulated natural monopolies should be governed in the public interest

Seeing billions of pounds of payments going to shareholders, while sewage spills into rivers, with the taxpayer now potentially having to pick up the bill is the exact opposite of that

Seeing billions of pounds of payments going to shareholders, while sewage spills into rivers, with the taxpayer now potentially having to pick up the bill is the exact opposite of that

Thames Water claims "Our external shareholders have not been paid a dividend for the last five years"

But as Hall shows here that really isn't the full story. Dividends are paid to a holding company that then distributes those to external stakeholders.

https://t.co/MI1eSKafh7gala.gre.ac.uk/id/eprint/3427…

But as Hall shows here that really isn't the full story. Dividends are paid to a holding company that then distributes those to external stakeholders.

https://t.co/MI1eSKafh7gala.gre.ac.uk/id/eprint/3427…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter